Unless otherwise noted, the source for all data in this report is Pitchbook Data, Inc/LCD. Pitchbook Data/LCD does not make any representations or warranties as to the completeness, accuracy or sufficiency of the data in this report.

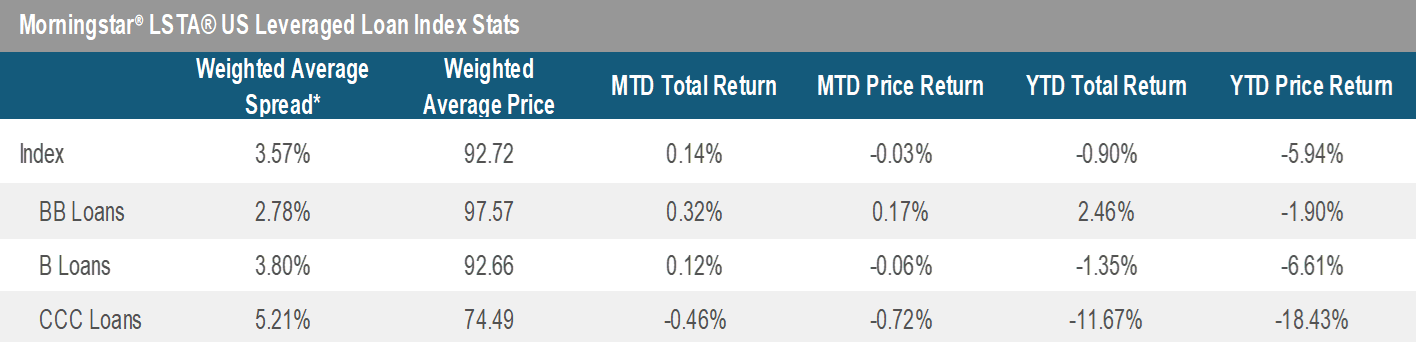

1. Assumes 3 Year Maturity. Three-year maturity assumption: (i) all loans pay off at par in 3 years, (ii) discount from par is amortized evenly over the 3 years as additional spread, and (iii) no other principal payments during the 3 years. Discounted spread is calculated based upon the current bid price, not on par. Please note that Index yield data is only available on a lagging basis, thus the data demonstrated is as of December 2, 2022.

2. Excludes facilities that are currently in default.

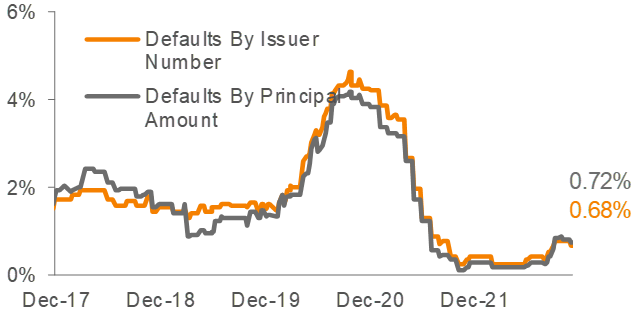

3. Issuer default rate is calculated as the number of defaults over the last twelve months divided by the number of issuers in the Index at the beginning of the twelve-month period. Principal default rate is calculated as the amount defaulted over the last twelve months divided by the amount outstanding at the beginning of the twelve-month period.

General Risks for Floating Rate Senior Loans: Floating rate senior loans involve certain risks. Below investment grade assets carry a higher than normal risk that borrowers may default in the timely payment of principal and interest on their loans, which would likely cause the value of the investment to decrease. Changes in short-term market interest rates will directly affect the yield on investments in floating rate senior loans. If such rates fall, the investment’s yield will also fall. If interest rate spreads on loans decline in general, the yield on such loans will fall and the value of such loans may decrease. When short-term market interest rates rise, because of the lag between changes in such short-term rates and the resetting of the floating rates on senior loans, the impact of rising rates will be delayed to the extent of such lag. Because of the limited secondary market for floating rate senior loans, the ability to sell these loans in a timely fashion and/or at a favorable price may be limited. An increase or decrease in the demand for loans may adversely affect the loans.

This commentary has been prepared by Voya Investment Management for informational purposes. Nothing contained herein should be construed as (i) an offer to sell or solicitation of an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Any opinions expressed herein reflect our judgment and are subject to change. Certain of the statements contained herein are statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation, (1) general economic conditions, (2) performance of financial markets, (3) changes in laws and regulations and (4) changes in the policies of governments and/or regulatory authorities. The opinions, views and information expressed in this commentary regarding holdings are subject to change without notice. The information provided regarding holdings is not a recommendation to buy or sell any security. Fund holdings are fluid and are subject to daily change based on market conditions and other factors.

Voya Investment Management Co. LLC (“Voya”) is exempt from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (“Act”) in respect of the financial services it provides in Australia. Voya is regulated by the SEC under US laws, which differ from Australian laws. This document or communication is being provided to you on the basis of your representation that you are a wholesale client (within the meaning of section 761G of the Act), and must not be provided to any other person without the written consent of Voya, which may be withheld in its absolute discretion.