Key Takeaways

Consumer companies that effectively use big data can improve their customer experience and boost their bottom lines.

The most “digitally mature” companies have fully digitalized their businesses, using advanced AI and machine learning to anticipate customer needs.

Once a company falls behind in the data race, it’s hard to catch up, which is why we make digital maturity a primary consideration in picking stocks.

Consumer companies that are adept at turning mountains of customer data into actionable intelligence are boosting sales and gaining market share, creating opportunities for investors.

Why does big data matter?

Companies of every stripe have long sought to know exactly who their customers are, what they want to buy and when they want to buy it. This is particularly true in the consumer sector, where in-depth customer knowledge can help firms increase loyalty and capture a greater share of spending power. But truly knowing your customer is easier said than done: Success depends not just on the quality of customer data, but on what companies can do with it.

Consumer companies in particular have known the potential value of the data sitting right under their noses, but a host of issues prevented many firms from using it to the fullest:

- Companies need a direct relationship with their customers so they can own their customer data, rather than access it through a wholesale model.

- These firms need to capture data on who customers are and attach it to what customers buy across all channels.

- They also need to figure out how to analyze this data and use it in an effective way to target customers and drive sales.

The companies that have solved these issues have seen profound shifts in their businesses as a result. For example, firms that can factor in demographic profiles, geographic locations and purchase histories are able to highlight other items their customers may be interested in buying. Even better is knowing what similar types of customers have purchased, what items may need to be replaced or what the customers’ next purchase is likely to be based on prior purchases.

In a recent article, we explored some of the innovations — including cloud computing, parallel processing and advanced software — that are propelling companies into the age of big data. In this installment, we’ll illustrate how consumer companies are using these innovations to expand their customer knowledge, deepen the customer experience and boost their bottom lines.

Digital maturity is a key consideration in our stock analysis, because once a company has fallen behind, it’s often difficult for them to catch up.

Big data usage evolves through its own life stages

Using big data effectively is less about reaching a destination than maximizing every phase of the journey. The technology itself is constantly evolving. There’s always a new way to handle more data faster and more accurately. One way to quantify this evolution is to categorize retailers into four stages of digital maturity, ranging from old-school siloed structures to fully data-integrated, artificial intelligence–optimized operations (Exhibit 1). We find this to be a helpful way to think about the big data journey for the retail industry overall.

Source: Voya Investment Management.

Siloed retail

In this phase, companies have started incorporating big data into their operations, but they aren’t tapping its full potential — for example, they keep information segregated rather than sharing it across departments. Public consumer companies have almost entirely moved beyond this stage over the last decade. Consider the time when e-commerce businesses were in their infancy and had separate infrastructures for their physical stores and online presences — including separate customer databases, buying teams and supply chains. This prevented them from building a comprehensive view of customers and their spending behaviors.

Connected retail

This phase is table stakes for consumer companies today. To compete on a level playing field, companies need to connect their siloed data sources into a single customer view and inventory pool. This enables greater consumer insights and more efficient inventory management. Granted, for companies in this stage of their tech journeys, specifics about customer knowledge can vary widely. But, at a minimum, companies can divide their customers into broad demographic groups and target them using both owned and third-party data.

Analytics-driven retail

Companies in this phase have established a big data architecture — using tools such as cloud computing, the Internet of Things and AI — to drive innovation across their businesses. Loyalty programs with high customer sales penetration can help firms capture their own customer data. That data can then be integrated into marketing plans using AI, which may provide multiple benefits:

- Personalized recommendations and targeted offers for customers.

- Data-driven pricing decisions.

- Optimized supply chains, with inventory held at its highest profit point.

Smart retail

These organizations are the most mature on the data spectrum. They have fully digitalized their businesses and are using advanced AI and machine learning capabilities to anticipate their customers’ wants and needs. The ability to process millions of data points and apply learnings quickly makes these companies extremely nimble in an ever-changing consumer landscape.

In the consumer sector, we look to invest in best-in-class companies that are winning the tech race within their industries.

Winning with big data

Best-in-class consumer companies are those that own their customer data, have progressed across the big data continuum and are now using big data tools effectively to maximize sales. We’ve found two compelling examples: a beauty retailer and an online marketplace.

Big data beautifies a beauty chain’s loyalty program

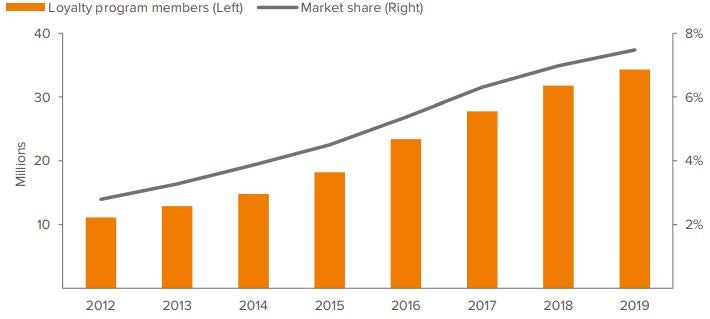

Consider the example of a large beauty specialty retailer with a strong loyalty program that encompasses 95% of total sales. The company has been able drive its business forward by using the data captured through the program’s many facets (Exhibit 2). The power of this loyalty data is evident in the relationship between growth in loyalty members and the company’s market-share progression (Exhibit 3).

Source: Company reports, Voya Investment Management.

Source: Company reports, Voya Investment Management.

An online marketplace mines big data to help sellers find buyers

Big data helps companies handle vast quantities of data and apply it in new ways. One online retail marketplace, with tens of millions of sellers, lists hundreds of millions of unique items. Its business model depends on being able to accurately classify the listings and have them appear in search queries to likely buyers.

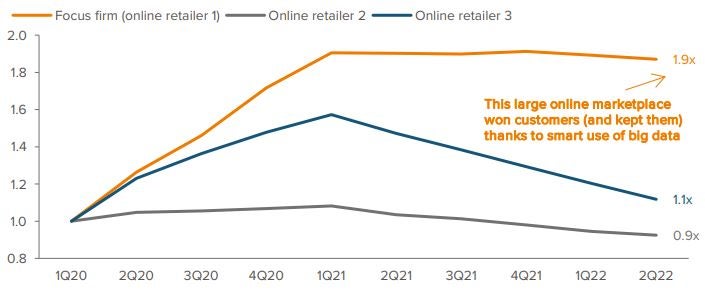

Activity between buyers and sellers generates 1.3 billion data events per day. Putting the right item at the top of search results for the right buyer is crucial: a single search might generate over 10,000 results. Using big data and machine learning, the company provides personalized search results to each buyer, accounting for variables such as location, demographics, season, hobbies and shipping times (Exhibit 4). By getting the right results in front of the right buyer at the right time, the company is able to maximize conversion and customer satisfaction.

The efforts are paying off: 83% of purchases now come from clicks on the first page of search results, and the company has been able to retain active buyers gained during the pandemic at a much greater level than online peers (Exhibit 5).

Source: Company reports, Voya Investment Management.

Source: Company reports, Voya Investment Management

We actively seek companies that have put the big data building blocks in place and are able to drive tangible results in their businesses.

Big data can be a big boost to growth

In the equity universe, consumer companies are particularly well positioned to benefit from the insights hidden in their customer data — in large part because they can capture, analyze and act on so many points of information. With the right approach to big data, companies can react quickly to changing consumer preferences, gain market share and grow faster than their peers. That’s why we place such importance on a company’s big data prowess when assessing growth potential.

The consumer sector is just one area feeling the effects of the big data microtrend. We’ve previously discussed the technology enablers that provide big data tools and technologies. Next, we’ll explore how we identify companies that we believe are using technology effectively, employing data to their advantage in the most productive ways.