Separately managed accounts (SMAs) have been around for over 50 years. Here’s what you need to know to determine if one is a good fit for your clients.

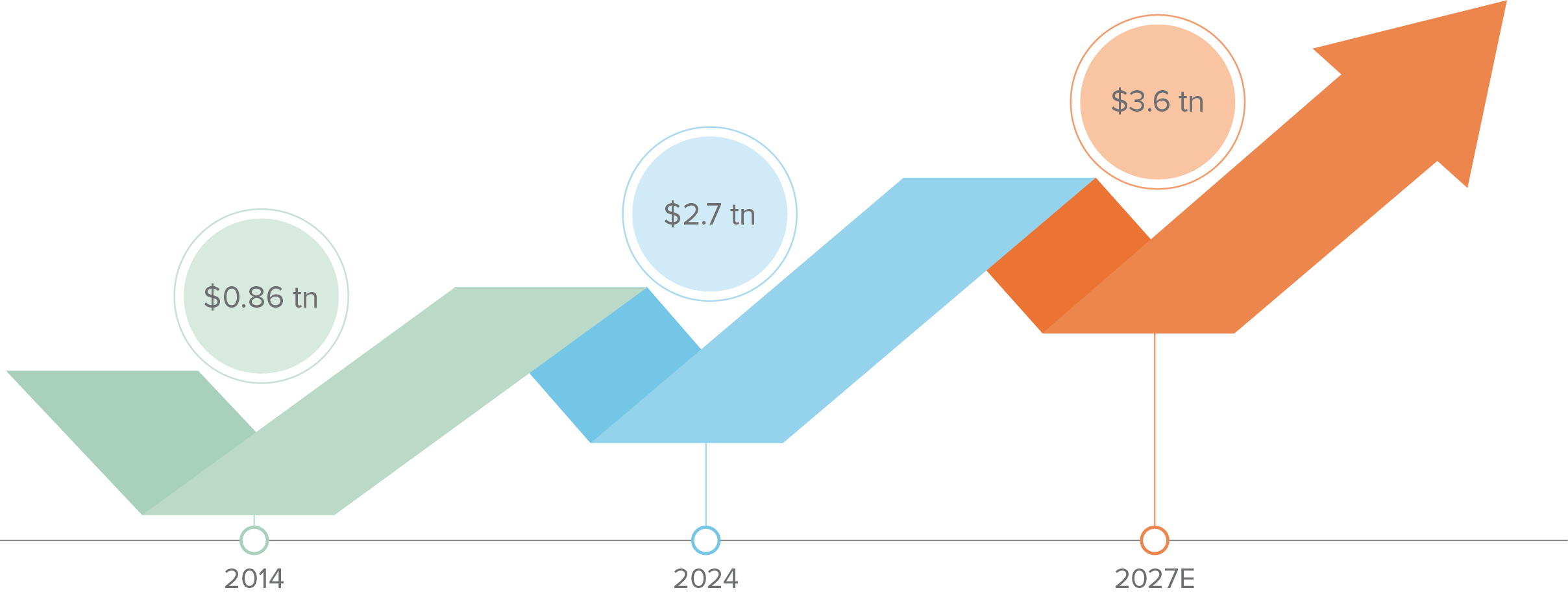

SMAs are a growing market

Over the last 10 years, assets in SMAs have grown 10.9% annually—and investment consultants expect another 33% increase over the next three years.1

What are the key attributes of SMAs?

SMAs offer attractive benefits

Because account holders directly own individual securities, SMAs offer distinctive benefits over pooled vehicles like mutual funds.

A note about risk

Investing involves risks of fluctuating prices and uncertainties of rates of return and yield. Capital value of SMAs may fluctuate, particularly over short-term periods can expose the investor to potential losses should the account be liquidated during a market downturn. Consider potential liability of Income and Capital Gains Tax. Income Distributions from SMAs are not guaranteed and can vary over time. SMA costs include, but are not limited to, brokerage, management, and performance fees. SMAs may include exposure to growth assets, such as shares. These assets can provide substantial long-term capital growth, however this comes with an elevated risk of loss. Therefore, the time horizon of the investment should be carefully considered to manage this risk.