Having trouble remembering the difference between a CDR and a CRT? We’re here to help.

A

Agency MBS: Securities issued by governmental or quasi-governmental agencies such as Fannie Mae (Federal National Mortgage Association), Freddie Mac (Federal Home Loan Mortgage Corporation)— collectively known as the GSEs—or Ginnie Mae (Government National Mortg`age Association). Agency securities are not rated by rating agencies; instead, their rating is tied to the U.S. government’s—giving agency MBS the same implied rating as U.S. Treasury bonds. Agency MBS can be collateralized by a pool of residential mortgages or commercial (multi-family) mortgages. Securities trade in various forms specific to each GSE as well as via a shared platform for financing residential loans from both Fannie Mae and Freddie Mac (the so-called UMBS).

At times, lenders will opt to finance GSE-conforming loans in the non-agency market. These are called agency prime RMBS or agency investor RMBS, because these segments would qualify for GSE backing but are instead issued into the non-agency RMBS market, allowing investors to earn the return associated with assuming credit risk.

Amortization: A process of repaying loan or bond principal in a series of payments over a period of time until the instrument is paid off. In mortgages, the periodic payment consists of a growing portion of principal and a declining portion of interest over time.

Asset-backed securities (ABS): ABS, perhaps the securitized sector with the broadest mix of underlying types of collateral, is typically used to describe bonds backed by pools of non-mortgage loans, receivables, or other contractual debt. Collateral types were most traditionally consumer oriented but have more recently (post global financial crisis, mainly) broadened to include collateral tied to commercially oriented parts of the economy. Auto loans are by far the largest ABS sector, followed by unsecured consumer loans, credit card receivables, equipment leases, private student loans, and more. The total U.S. asset-backed securities market is estimated to be around $880 billion.

B

“B” piece: Unique to the CMBS market, a term applied to the classes or tranches of CMBS rated BB+ and lower, including the NR (non-rated) tranche.

C

Call protection: Language within transaction structures or on specific loans or collateral that protects the lender against early prepayment (i.e., mitigates prepayment risk). Call protection is prominent within the CMBS market. (Residential mortgages tend to offer full prepayment optionality to borrowers.) Related language outlines the specific terms of the call protection, such as lockout, penalty points, yield maintenance, defeasance, or a combination thereof over the loan term.

CMBX: A group of indexes that are the only remaining pre-global financial crisis synthetic indexes referencing securitizations. Each CMBX index consists of 25 equally weighted, similarly rated CMBS conduit tranches from a particular vintage of CMBS. Using the CMBX, one can either gain synthetic risk exposure to a portfolio of CMBS by selling protection or take a short position by buying protection. The notional balance, amortization, and writedowns for a CMBX index closely mirror the balance, principal payments, and writedowns of the corresponding portfolio of cash CMBS. The indexes are rolled into a new “on the run” series every year. The first vintage of indexes began trading in March 2006. S&P is the administration and calculation agent for the CMBX indexes, after its acquisition of IHS Markit in 2022.

Collateral: Assets that have been used to guarantee a bond, loan, mortgage, or other debt instrument. Collateral can be physical assets (a house is used to guarantee a residential mortgage loan) or financial ones (residential mortgage loan contracts are used to guarantee RMBS).

Collateralized loan obligation (CLO): CLOs are pools of corporate loans that have been structured, tranched, and sold into the fixed income market with varying weighted average life profiles. This is the securitized sector that ties most closely to corporate credit markets. CLOs are generally collateralized by floating-rate, below investment grade, senior secured first-lien loans to corporations. Importantly, this market is separate and distinct from so-called collateralized debt obligations (CDOs), a relic from the pre-global financial crisis era that featured assorted collateral types and degrees of leverage.

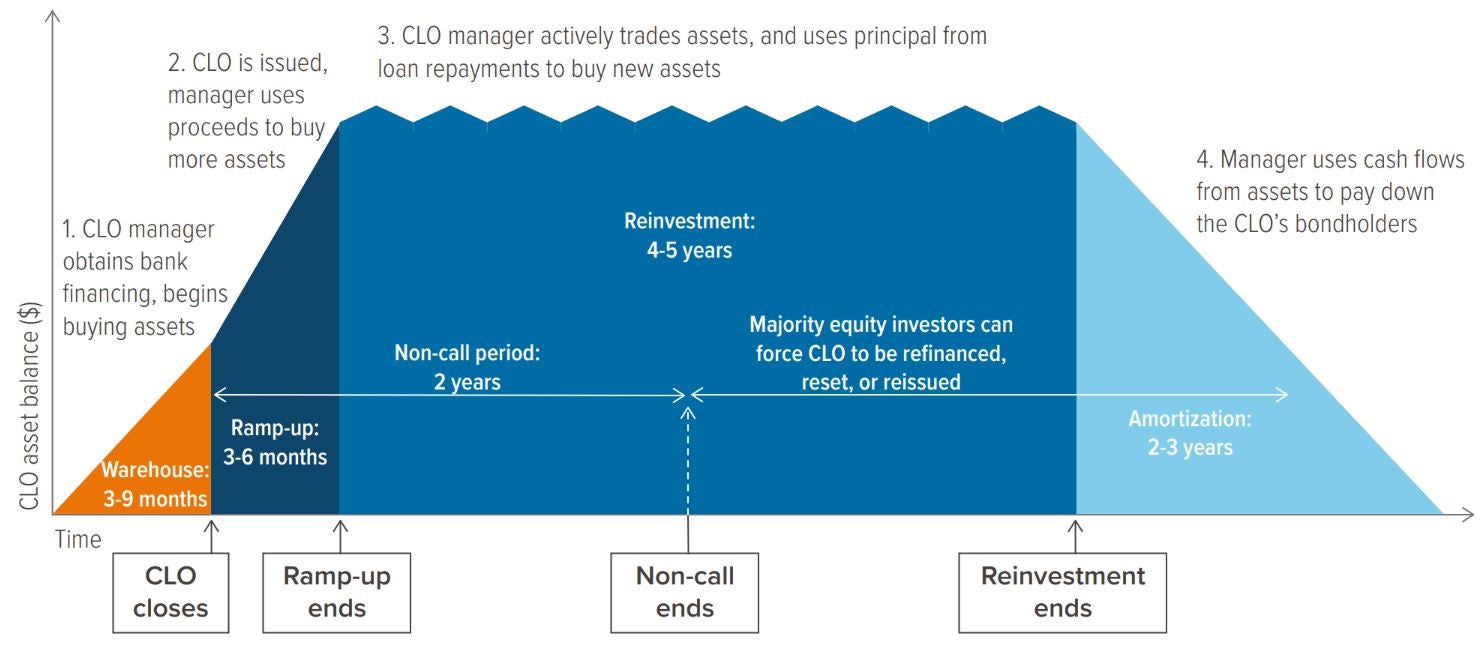

Most CLOs are actively managed, with the typical life cycle being a ramp-up period of 1-6 months after closing (in which the manager buys additional loans to fill the portfolio), then a reinvestment period of 2-5 years (in which the manager actively trades loans, typically with the goal of improving the portfolio’s credit quality and optimizing outcomes for debt and equity investors in the deal). Once the reinvestment period is over, the CLO starts its amortization period, during which principal repayments on the underlying loans are used to pay down CLO debt (Exhibit 1).

Majority equity holders in CLOs (those who hold the first-loss tranche in the waterfall) have the ability to call the CLO following a non-call period at the beginning of a transaction (typically 1-2 years). Calls may be executed to take advantage of tighter debt spreads (reducing the cost of liabilities), to reset an older transaction’s terms (extending the reinvestment period of the CLO and possibly reducing debt cost), or as a straight call, where the CLO is liquidated or otherwise completely reissued as part of a new structure.

Investor protections on CLOs include overcollateralization and interest coverage tests, as well as limits on the amount of low-rated loans, industry concentrations, and unsecured and/or second-lien debt that can be included in the portfolio.

Most CLOs are backed by broadly syndicated loans (BSLs); however, there is a rapidly growing market emerging for CLOs backed by private or middle market loans. The CLO market is estimated to be around $1.2 trillion, making it the largest sector in securitized credit.

Source: Voya IM.

Commercial mortgage-backed security (CMBS): Securities whose underlying assets are commercial mortgages. CMBS can be collateralized by all income-producing forms of commercial real estate, most typically categorized as offices, hotel/ hospitality, retail, industrial, and multi-family, but also less common/smaller segments like single-family rental, self-storage, life science offices, and data centers. The GSEs issue agency-backed CMBS, which are used exclusively to finance loans they have acquired in the multi-family sector. On the non-agency (or “private label”) side of CMBS, common issuance types include:

- Conduit: The largest private label CMBS segment, these securities are fixed rate, with multiple loans and a range of property types.

- SASB: Single asset single borrower loans are, as the name suggests, made up of either only one asset or multiple assets of one borrower, and they can be either fixed or floating in nature.

- CRE CLOs: These are commercial real estate (CRE) CLOs, collateralized by pools of shorter-term mortgages on transitional properties, typically in the multi-family sector. The CMBS market is estimated to be $1.7 trillion in outstandings ($1 trillion in agency, $0.7 trillion in non-agency).

Constant default rate (CDR): A percentage of the outstanding collateral principal that is expected to default in one year. The default is assumed to be a liquidation.

Constant prepayment rate (CPR): A percentage of the outstanding collateral principal that is expected to prepay in one year. A CPR represents an assumed constant rate of prepayment each month (expressed as an annual rate) rather than a variable rate of prepayment.

Convexity: Measures the degree to which a bond’s duration will change when interest rates change. Substantial convexity (either positive or negative) means that a bond’s price is asymmetrically impacted by changes in interest rates. A bond measuring with positive convexity implies that the bond’s price will rise more when yields fall than its price will decline when yields rise. A bond measuring with negative convexity (typical for RMBS, given prepayment optionality for borrowers) implies just the opposite: The bond’s price will fall more when yields rise than its price will rise when yields fall.

Credit enhancement: This refers to the various forms of structural protections within a transaction that are designed to mitigate risk of nonpayment of the underlying assets. This is usually achieved by the documentation of a priority of payments, which establishes subordinate interest(s) in cash flows from the underlying assets, whereby credit losses are taken by the most subordinate tranche(s) first (first-loss or equity tranche) and then flow upward if/ as subordinate classes are exhausted. Other forms of credit enhancement include excess spread, overcollateralization, and reserve/spread account.

Credit rating: Credit ratings are an assessment of the risk of default of a company, municipality, or country. The higher the credit quality (or rating), the lower the perceived risk of default. AAA rated are the highest; D rated are the lowest. Ratings below BBB are classified as non-investment grade, or junk, and are considered to be riskier.

Credit risk transfer (CRT): A product of the post-global financial crisis era, CRTs refer to a form of mortgage credit risk issued by the GSEs as a way of transferring default risk associated with Fannie Mae- or Freddie Mac-insured mortgages to the private market. CRT bonds are floating-rate instruments with minimal empirical duration risk, a unique attribute in the mostly fixed-rate mortgage-backed securities market. The GSEs first began issuing CRTs in 2013, and, after the program’s initial few years, they have experienced very few credit writedowns given the improved credit quality of mortgages since the global financial crisis. However, with relatively long spread duration and low amounts of credit enhancement, they require rigorous bottom-up research on the credit risk of each CRT’s underlying collateral pool. The CRT market is estimated to be about $50 billion in outstandings.

Source: Voya IM.

D

Deleveraging: Given the amortizing nature of most securitized credit transactions, bonds can be repaid at a faster rate than in other credit markets. Combining this attribute with the prioritization of repayment to senior bonds first, securitized credit transactions naturally de-lever over time as the bond principal balances are paid back and structural protections increase. This attribute, unique to securitized credit markets, can foster ratings upgrades over time.

E

Excess interest/excess spread: A form of credit enhancement that can arise when interest received from repayments of the underlying assets is greater than the interest paid on the securitization debt classes.

F

Fiber: Securitization of cash flows from fiber networks by lower-rated telecoms in order to finance further network rollout. Given deal structure, higher credit ratings can be achieved, contributing to a potentially lower cost of capital than their corporate credit rating allows in the corporate debt or loan markets. This is a relatively new area of securitization that has seen rising issuance since its circa 2020 beginning.

Freddie “K” bonds: A series of structured multi-family loan pass-through securities issued by Freddie Mac (FHLMC, a GSE) as senior, guaranteed bonds for timely interest and principal payment. Each transaction has an unguaranteed, subordinated “B” piece, stemming from the GSEs’ requirement to transfer credit risk on mortgages they purchase. There are around $300 billion in outstanding K bonds issued.

G

GSE: Abbreviation for “government-sponsored enterprise.” GSEs were established by Congress to facilitate the flow of credit to different parts of the economy, particularly the housing and mortgage markets. The Federal National Mortgage Association (FNMA, a.k.a. Fannie Mae) and the Federal Home Loan Mortgage Corporation (FHLMC, a.k.a. Freddie Mac) are the two most prolific issuers in securitized markets, both in agency markets and, via CRT transactions, in private label markets.

I

Interest only (IO) securities: These are offered tranches in securitization transactions (most typically CMBS and RMBS) that comprise the aggregate payment stream of all interest from the underlying mortgage(s) due on a certain security that exceeds the coupon paid on the security. In this context, the excess interest is sold as a separate tranche with no associated principal, at a small fraction of the price of the security or of classes with a similar credit rating. A simplified example would be a CMBS with a weighted average coupon of 5% collateralized by mortgages with a weighted average coupon of 6%, where the excess interest payments from the collateral are funneled into IO tranches. Since they have no associated principal, IO tranches are highly sensitive to prepayment and extension of loans, which can drastically change their duration. As such, IOs have relatively high price volatility, and they represent a levered bet on prepayments on the underlying collateral coming in above or below market assumptions. See Exhibit 2 (under CMBS) for an example structure incorporating IO tranches. IOs and their siblings, inverse interest only securities (IIOs), are also created as part of the agency collateralized mortgage obligation (CMO) process.

J

Jumbo mortgage: Typically issued in private label markets, a jumbo mortgage is an RMBS collateralized by residential mortgage loans that are larger than those the Federal Housing Finance Agency will allow the GSEs to purchase (updated annually by the FHFA based on home price appreciation; currently in 2025, this tops out at $806k or $1.2m in certain high-cost areas). These are usually loans used to finance purchases of high-cost residential properties. Due to their large size and more substantial debt service requirements, they tend to be owed by the highest-credit-quality mortgage borrowers. They may also be referred to as prime jumbo.

L

Loss-adjusted yield: In securitized parlance, loss-adjusted yield is the annualized return an investor expects to receive on a bond investment, expressed as a percentage and based on the bond’s coupon payments, purchase price, and maturity value, adjusted for expected prepayments and losses. Since the global financial crisis, this has become market convention when projecting securitized bond yields.

M

Mezzanine bonds: Mezzanine (or “mezz”) bonds are tranches in the middle range of a multi-class security— more secure than the first-loss tranche but less secure than senior classes. According to market convention, mezzanine typically refers to tranches rated between AA and BBB-.

N

Non-agency mortgage-backed security (non-agency MBS): A security made up of a pool of mortgages that are not guaranteed or insured by Fannie Mae, Freddie Mac, or Ginnie Mae. This can be for a range of reasons, including: loans exceeding GSE size limits (jumbo), a lack of documentation and/or credit history problems from the borrowers (non-qualifying mortgages), or second-lien mortgages. Without the guarantee of the GSEs, non-agency (a.k.a. private label) securities are subject to credit risk, and investors in them may not receive all of the promised principal and interest payments.

Non-qualifying mortgages (non-QM): These are residential mortgages that deviate from the specific requirements set by the Consumer Financial Protection Bureau for what constitutes a “qualifying mortgage.” The loans offer more flexibility to lenders and borrowers when documenting and/or verifying income, financing investment properties, or accommodating unusual financial situations (such as reliance on assets rather than income for repayment). Non-qualifying mortgages often come with higher interest rates as compensation for their higher credit risk.

NPL: Non-performing loan. This is a non-agency RMBS subsector collateralized by loans that are considered in default because the borrower has not made scheduled payments for 90 days or more. Now, long after the global financial crisis, the NPL market is significantly smaller than it used to be, although Fannie Mae and Freddie Mac have programs in which they buy out NPLs from agency RMBS pools and sell them to issuers in the non-agency RMBS market.

O

Option-adjusted spread (OAS): Expressed in basis points, OAS is a measure of the additional yield over comparable Treasuries, intended to compensate investors for credit, liquidity, and various other types of risk. Importantly, OAS adjusts the “nominal yield” to account for the cost of the option investors in callable bonds are effectively short. As a result, OAS is lower than the nominal spread. This is most apparent in residential MBS, where borrowers have a legal option to fully prepay their loans at any time.

On the run/off the run: Market jargon. The most recently issued security in a particular class is known as on the run. Off-the-run securities are older, not the most recent issue. For example, an on-the-run CRT refers to the most recent Fannie Mae or Freddie Mac CRT issue.

Overcollateralization: Overcollateralization is a form of credit enhancement where the outstanding principal balance of the collateral backing a security is in excess of the outstanding certificate principal owed to the bondholders. A simplified example is a CLO with principal of $100 million, backed by a pool of broadly syndicated corporate loans with principal of $105 million. This allows some losses to occur in the collateral before holders of even the CLO’s lowest tranches are affected.

P

Pool: a collection of similar loans or other financial contracts grouped together, usually to serve as collateral for a bond or other debt instrument.

Prepayment risk: Also referred to as extension risk, contraction risk, or convexity risk. This is the risk that arises due to the ability of borrowers to repay their loans prior to maturity, which creates uncertainty regarding the average life of a bond backed by these types of loans. Typically, prepayments speed up (and the average life contracts) when rates fall, and prepayments slow down (and the average life extends) when rates rise. Yields on bonds that can be prepaid are generally higher to compensate investors for this uncertainty. In order to reduce prepayment risk, most commercial mortgages have call protection provisions. Residential mortgages typically do not offer such protections, affording mortgage borrowers full optionality to prepay their mortgage loans. Thus, prepayment risk is a significant consideration for holders of RMBS, especially when interest rates are volatile.

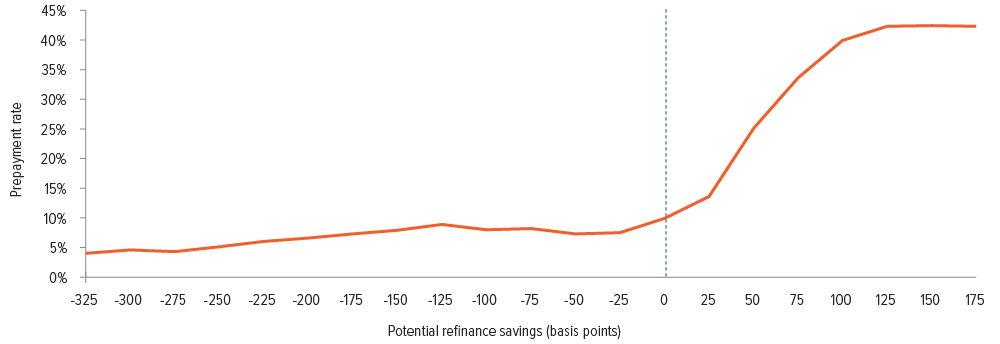

Source: Freddie Mac; CPR & CDR. Data from 2021-2022.

P

Prime: Used to describe loans or pools of loans made to borrowers with good credit history, typically defined as borrowers with high FICO scores, no “derogatory” credit events, and overall low default risk.

Priority of payments: A critical provision within securitization structures (codified into transaction documentation) that defines how, when, and to whom available funds from repaying or recovered collateral will be distributed to bondholders. Priority of payments is the basis of credit enhancement, which allows tranches of securitized bonds to have higher ratings than the underlying collateral by typically specifying that all interest and principal payments are made to the highest-rated tranches first, then the next highest, and down to the unrated/residual tranche. See also: waterfall.

Private label securities: Securities backed by collateral issued by private sector entities, including banks, thrifts, and other financial institutions. These securities are also known as non-agency securities, indicating that they are not guaranteed by agencies such as Fannie Mae, Freddie Mac, or Ginnie Mae.

Project loans: A subsector of corporate lending where the loan is secured on the future revenues of a specific development project (building a manufacturing facility or a solar farm, for example). The borrower is usually a bankruptcy-remote JV or subsidiary of the main company. It’s a method of borrowing that keeps additional leverage off a corporation’s balance sheet and may also allow the JV or subsidiary to access a higher rating than the parent company’s overall debt rating.

PTs: Pass-through securities, used to denote bonds that are repaid by cash flows directly from the underlying assets (typically, residential mortgages) without any tranching or sequencing.

R

Residual: Often used to refer to the first-loss tranche in a private label securitization. It is the bond class that receives cash flow only after all other debt tranches have been paid their contractually owed interest and principal.

REMIC: Real estate mortgage investment conduit. These are specific legal structures that pool mortgage loans and issue MBS (both RMBS and CMBS) in a tax-advantaged fashion. REMICs allow for the creation of various classes of securities (tranches) with different risk and return profiles.

Re-REMIC: A resecuritization of a REMIC. Re-REMICs repool and restructure existing MBS to create new securities with different risk and return profiles.

Reserve account: A form of credit enhancement whereby a portion of the bond proceeds are retained to cover potential losses on the collateral pool.

Risk retention: On October 22, 2014, the federal regulatory agencies responsible for implementing regulations under the Dodd-Frank Wall Street Reform and Consumer Protection Act (itself passed in July 2010) finalized the risk retention rules for securitizations. Under these rules, which went into effect December 24, 2016, any financial institution that securitizes collateral pools via issuing bonds to investors must retain at least 5% of the credit risk associated with those bonds. While the form varies by sector, risk retention can be held in one of three ways:

- VRR: Retaining a “vertical interest” (or “VRR”) of 5% of each tranche, which is lower risk, lower return.

- HRR: Retaining a “horizontal interest” (or “HRR”) of 5% in the first-loss position, where the value of the strips is based on actual deal proceeds as opposed to notional balances (i.e., market value rather than par value). This is higher risk, higher return.

- LRR: Retaining an “L-shaped interest” (or “LRR”), which is a hybrid between the vertical and horizontal strips, seeking a more ideal balance between risk and return. There is a CMBS-specific alternative to satisfy a sponsor’s risk retention obligation, permitting the acquisition of a subordinate horizontal interest (i.e., the B piece) in the CMBS transaction by a third-party purchaser (or a majority-owned affiliate of the thirdparty purchaser). That purchaser agrees to hold the horizontal interest subject to conditions similar to the requirements that would be applicable to the sponsor’s retention of a horizontal interest. As a result of intense industry lobbying, CLOs were also later exempted from risk retention requirements in their entirety.

RPL: Re-performing loan. A loan that is current on payments but has been delinquent in the past. Similar to NPLs, the RPL market has shrunk significantly since the global financial crisis. Fannie Mae and Freddie Mac continue to have programs in which they buy out the RPLs in agency MBS pools and sell them into the non-agency MBS market.

S

Seasoned: Seasoning can refer to how long a bond has been outstanding or how long since its collateral was originated. A seasoned bond or collateral pool provides a longer record of monthly payments—which is helpful for forecasting future borrower behavior—and may have begun to de-lever.

Securitization: The creation of a new financial instrument representing an undivided interest in a segregated pool of assets. It allows originators of assets to obtain liquidity/financing for otherwise less liquid or illiquid assets and investors to obtain exposure to diversified forms of risk in a liquid fixed income market. Asset pools tend to be homogeneous in nature, with contractual, predictable cash flows that provide for full repayment. The ownership of the assets is usually transferred to a legal trust or special purpose, bankruptcy-remote corporation to protect the interests of the security holder(s). That special purpose vehicle is the sole source of repayment for related investors.

Seniors: Senior tranches are the tranches in a securitization that have the highest repayment priority from underlying collateral proceeds—and thus are typically afforded the most protection from loss. As a result, senior tranches are usually assigned an AAA rating. Exceptions can exist, particularly in newer asset types where rating agencies haven’t yet established sufficient comfort to grant their highest rating designation.

Senior-support: Tranches that would otherwise be first-priority senior bonds and still command commensurate ratings (i.e., AAA) but are created to support a super-senior tranche (see below) and provide additional credit enhancement.

Servicer: Party responsible for the administration of securitization transactions, acting for the benefit of the certificate holders. The servicer’s responsibilities include reporting to the trustee, collecting payments from borrowers, advancing funds for delinquent loans, negotiating workouts or restructures (as permitted by the pooling and servicing agreement), and taking defaulted properties through the foreclosure process. More specialized duties may be associated with “master servicers” and “special servicers”—particularly in CMBS transactions, where special servicers are engaged on specific loans experiencing some predefined degree of distress.

Severity: Typically used to quantify the loss given default on collateral in a securitization. Can be referred to as LGD (loss given default) or implied by its reciprocal term: recovery.

Super-senior: A super-senior debt security or tranche represents the highest priority in repayment in a securitization. It is afforded more credit enhancement than would otherwise be required to obtain the rating usually awarded to senior bonds.

Solar loans: An ABS subsector consisting of loans to homeowners to install residential solar on their rooftops.

Stranded cost / utility: A benchmark-eligible form of ABS, stranded costs (also referred to as utility bonds) are costs that a utility would normally pass on to customers in a traditional cost-plus regulation scheme but that the utility can no longer pass on in a deregulated, competitive environment without pricing itself out of the market. They usually represent the amortization of older, high-cost generation facilities. Utilities frequently securitize these stranded costs in order to reduce balance sheet debt and secure upfront cash for new, less expensive generation and transmission assets.

Subordinates (“subs”): A tranche that is not senior in the structure is considered a sub or subordinate tranche. They carry varying degrees of risk, depending on their position in the structure. See also: mezzanine.

Subprime: A reference to the underlying collective credit quality of obligors/borrowers in a securitized collateral pool. Post global financial crisis, the term subprime is usually applied to forms of non-mortgage securitizations packaged as ABS, and it refers to securitizations collateralized by borrowers with poor credit standing (generally, a credit score below 640). The most common loans to subprime borrowers in ABS are to finance auto purchases, a subsector that is approaching $100 billion in outstandings.

T

Tranching: The splitting of a loan pool into several differently rated bonds that have a set prioritization of cash flow, with the highest-rated, shortest-duration bonds getting principal and interest first and the bottom-rated, longest-duration bonds getting what’s left (and thus being the first to take any losses due to default or delinquency).

V

Vintage: The year in which a securitization was created. This is important for a variety of reasons, most notably with regard to underwriting standards. A security that was created in a year when underwriting standards were loose is generally considered to be more risky.

W

Waterfall: Also referred to as a priority of payments (see above), waterfall describes the way principal and interest flow through a securitization structure. Specifically, principal and interest payments go to the top-rated, shortest-duration bonds first, then down the structure to lower-rated tranches until all bondholders in the structure are paid or until the available principal and interest run out due to losses in the underlying collateral, whichever happens first. Credit losses flow in the opposite direction: The lowest-rated (first-loss) tranche absorbs losses first; if that tranche defaults, the second-to-last tranche begins to absorb losses, and so forth.

WAC: WAC is the weighted average coupon of the underlying collateral pool. It offers significant information value, including prepayment risk (see above), and can be used to understand the level of convexity risk. WAC is especially important in RMBS, which have the least barriers to prepayment. RMBS pools with a WAC closer to current market rates generally have more prepayment risk, with prepayment rates spiking once the WAC hits 50 bp above market (Exhibit 3). Pools with a WAC much lower than current market rates are more insulated from prepayment risk, because their duration has already experienced significant extension.

Whole business ABS: Securitization of future receivables from a single business, usually franchise fees or intellectual property/royalties. This is a unique type of ABS in that it typically relies on refinancing of the transaction to repay bondholders, as opposed to amortization from scheduled payments from underlying obligors.

A note about risk: The principal risks are generally those attributable to bond investing. Holdings are subject to market, issuer, credit, prepayment, extension, and other risks, and their values may fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. The strategy invests in mortgage-related securities, which can be paid off early if the borrowers on the underlying mortgages pay off their mortgages sooner than scheduled. If interest rates are falling, the strategy will be forced to reinvest this money at lower yields. Conversely, if interest rates are rising, the expected principal payments will slow, thereby locking in the coupon rate at below market levels and extending the security’s life and duration while reducing its market value.