Interval funds provide a way to invest in less-liquid assets while still offering periodic redemptions. This structure blends the potential for higher returns with flexibility, giving investors greater control over their portfolios. Here’s what you need to know.

What are interval funds?

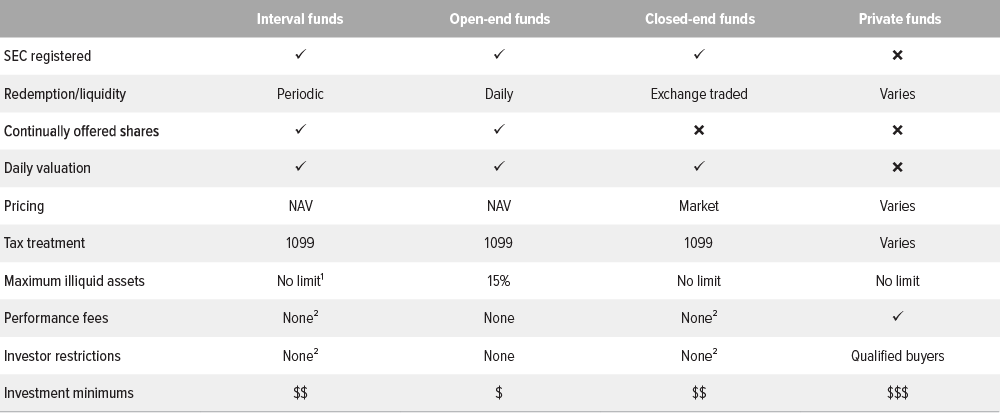

Interval funds are continuously offered, SEC-registered funds that periodically offer to repurchase a certain number of shares at monthly or quarterly intervals (hence the name). Technically considered closed-end funds under the Investment Company Act of 1940, interval funds combine aspects of both open-end and closed-end funds, providing access to less-liquid securities that are usually reserved for institutional investors of private funds (Exhibit 1).

How do redemptions work?

Investors may buy shares of an interval fund at any time based on the fund’s net asset value (NAV), which is printed daily. However, unlike traditional closed-end funds, interval funds do not trade on secondary markets such as listed securities exchanges. Instead, shareholders may sell shares through a redemption process.

At each interval period, interval funds must offer to repurchase a minimum of 5% of their total shares outstanding, although they may choose (at their discretion) to repurchase a greater amount. Shareholders are notified at least 21 days prior to the repurchase request deadline, during which time shareholders can submit their requests. If the total redemption requests exceed the offer amount, investor redemptions are granted on a pro rata basis.

Source: Voya IM.

¹ Must maintain sufficient liquidity to meet repurchase offers.

² May vary by fund and share class.

What are the potential benefits?

Higher yields from less-liquid securities

Traditional open-end and closed-end funds are restricted from owning more than 15% of assets classified as illiquid, which can limit opportunities to invest in certain types of attractive securities. By contrast, interval funds have no such limitations, giving portfolio managers the flexibility to construct portfolios of high-conviction ideas without liquidity constraints.

By widening the field of opportunities, interval funds may offer greater access to less-liquid securities that offer the potential for higher returns. (Investors typically demand higher yields in exchange for accepting less liquidity—a characteristic known as an “illiquidity premium.”) Private funds routinely access this premium for institutional clients and other qualified buyers. Interval funds bring this premium to individual investors, with lower investment minimums and without the complex tax forms, lengthy subscription agreements or performance fees associated with many private funds.

Portfolio diversification

Portfolios consisting of less-liquid securities may generate income from alternative sources than what are typically found in more liquid markets such as government and corporate bonds, stocks, and cash. As a result, interval funds may pursue strategies that behave differently from other investments, which can improve risk-adjusted returns.

Who should invest in interval funds?

An investment in interval funds may not be suitable for everyone. While the funds do offer periodic redemptions, it is prudent to consider them illiquid, as there is no guarantee that investors will be able to sell in a timely manner. However, investors with long-term investment horizons looking for opportunities to earn higher income from less liquid securities may find interval funds attractive.

A note about risk: Although interval funds provide limited liquidity through periodic repurchase offers, investors should consider the funds to be an illiquid investment. There is no secondary market for interval funds, and none is expected to develop. Furthermore, unlike with open-end funds, which permit daily redemptions, investors cannot sell interval fund shares at any time. Because of these factors, investments in interval funds are subject to liquidity risk, as an investor may not be able to sell their shares in a timely manner at an advantageous price. There is no guarantee that an investor will be able to tender all or any of their requested fund shares in a periodic repurchase offer. The NAV of an interval fund may be volatile, and a fund’s use of leverage will increase this volatility.