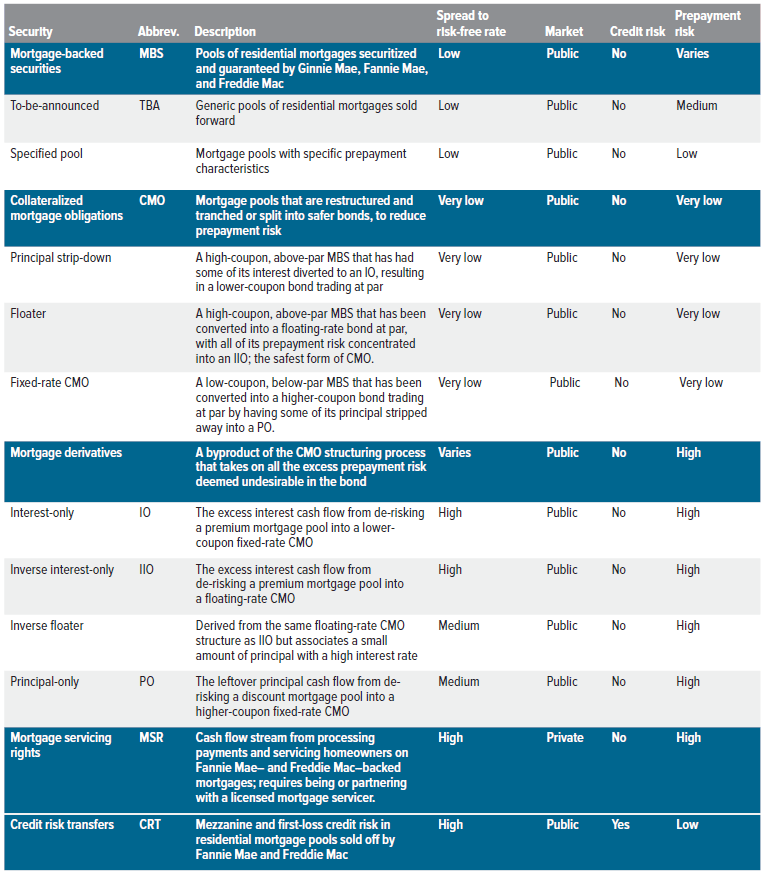

Residential mortgages are transformed by investors’ de-risking process into a spectrum of assets, from very stable CMO bonds to mortgage derivatives, credit risk transfers and more. The result is a broad range of liquid investment opportunities featuring differentiated risk profiles and attractive risk-adjusted returns.

Executive summary

The agency mortgage-related assets market is unique within fixed income in that its primary risk driver isn’t credit risk, but prepayment risk—i.e., the risk that homeowners prepay their mortgages at a faster or slower rate than expected. It is also a chronically inefficient market, in that the de-risking process driven by its major investors creates a slew of interesting byproducts such as mortgage derivatives, credit risk transfers, and mortgage servicing rights, that have no natural home and thus are inherently cheap. With proper hedging, and deep fundamental analysis of prepayments, diligent investors can gain the sort of information edge that has become extinct in most other markets.

The market

- Agency mortgage-backed securities (MBS) include several types of related assets formed through de-risking by banks and government sponsored enterprises (GSEs), perennially offering attractive yields and minimal credit risk.

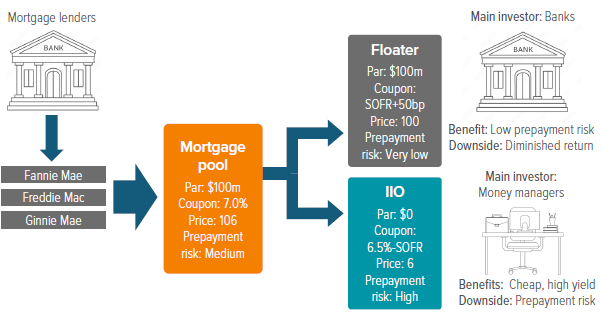

- The structuring of MBS into safer collateralized mortgage obligation (CMO) bonds diverts prepayment risk into byproduct mortgage derivatives such as interest-only (IO) and inverse interest-only (IIO) securities, which in Voya’s experience trade at a high option-adjusted spread to risk-free rates.

- Mortgage lenders sell off their mortgage servicing rights (MSRs), an estimated $75 billion private market where the securities tend to trade at an even higher average premium to risk-free rates than IOs and IIOs, but is similarly sensitive to prepayment risk.1

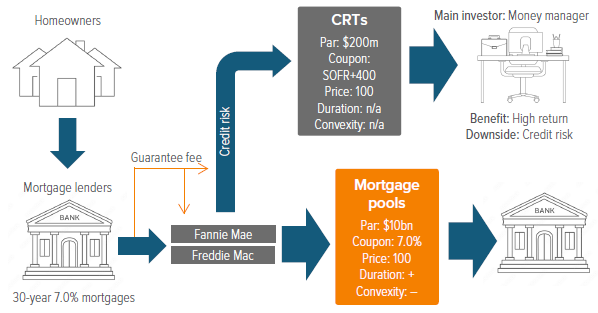

- Credit risk transfers (CRTs) are a newer type of asset consisting of mezzanine risk sold by the government agencies at 250–425 bp above risk-free rates.2 CRTs become more valuable in the high-prepayment situations that make IOs and IIOs less valuable.

Investment factors

- With low correlations to both fixed income and equity investments, properly hedged mortgage-related assets offer potential diversification benefits and attractive real rates of return.

- Although non-agency mortgage securities exist, investors typically focus on securities issued by Ginnie Mae, Fannie Mae or Freddie Mac, which are considered essentially free of credit risk given their backing by the U.S. government.

- As mortgage prepayments are the largest risk in the asset class, good prepayment calls are the main driver of alpha. Yet most market participants use out-of-the-box prepayment models.

- Prepayment rates that are 1% lower than market expectations can increase yield by 1% for the life of an IO/IIO asset.3

- With few large-scale or specialist investors in the market, it is possible to retain an information edge over other participants via deeper prepayment analysis and expertise to identify when standard prepayment models fall short.

As of 10/31/2023. Source: Voya IM.

What are mortgage-related assets?

Although the alphabet soup of mortgage-related assets may seem complex, their origins are largely familiar. Most people inherently know what a mortgage is, because they’ve had one at some point: it’s a contract under which a borrower pledges a property as collateral for a loan from a lender. The lender can move to seize the property in the event that the borrower fails to make their payments.

The contract includes a loan amount (say, $400,000), an interest rate (7.0%), a frequency of payments (monthly) and a loan term (30 years). Although fixed-rate loans are most common with U.S. residential mortgages, there are also adjustable-rate mortgages and hybrid fixed/floating-rate mortgages.

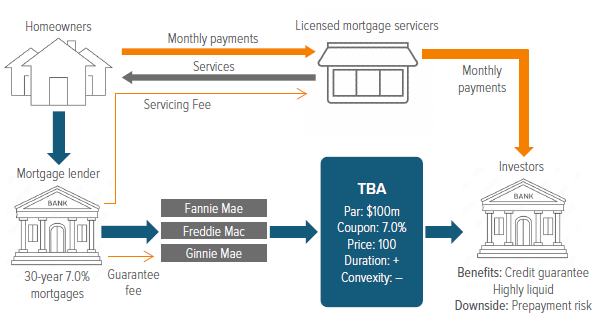

Most lenders don’t just sit on their loans. They turn around and sell them to Fannie Mae, Freddie Mac, or Ginnie Mae—collectively known as government-sponsored enterprises (GSEs), or the “agencies.”4 The GSEs borrow cheaply at government interest rates, buy the mortgages, and then package them into pools of broadly similar amounts, rates, terms, and structure. The mortgages themselves serve as collateral for the resulting securities, which are known as mortgage-backed securities (MBS) and/or mortgage pass-throughs, since the loan issuer (or its mortgage servicer) collects the monthly payments from all the homeowners in the pool, then passes that collected principal and interest through to the holder of the security.

Mortgage pass-throughs are sold into the secondary market in order to generate more liquidity for new loans. And it is a huge market: The three agencies created a total of $1.8 trillion in new mortgage-backed securities in 2022.5 Banks, foreign investors and asset managers all buy mortgage pass-throughs to capture spread over Treasuries in a product with minimal credit risk.

The less than 5% of mortgages that are ineligible for purchase by the GSEs are sold to private entities, who package them and sell them as non-agency securities. These mortgages include “jumbo” loans that exceed a federal limit, loans on second properties, and loans made with insufficient documentation or to borrowers with poor credit.

Mortgage pass-throughs

The majority of agency mortgage-backed securities are traded in TBA (to-be-announced) form, up to three months ahead of settlement, with buyers knowing only the issuer, maturity, coupon, price, par amount, and settlement date until 48 hours before they receive their securities. These are commonly 30-year maturities with coupons of 2–7.5% depending on prevailing interest rates. In essence, TBAs are sold in the same manner as commodity futures.

Source: Voya IM.

The other category of agency MBS is the specified pool. As the name suggests, a specified pool provides much more complete information to buyers about the mortgages it contains at the time of sale than a TBA does. Specified pools are created because investors are willing to pay a higher price for mortgages with certain traits. Most mortgages lack these traits and are instead grouped in pools of “TBA-like” generic collateral.

The most valuable traits for inclusion in a specified pool are those that provide some protection from call risk or extension risk. Mortgages vary across dozens of dimensions—loan size, loan purpose, property occupancy, mortgage rate, geographic location, credit score, age, originator, servicer, government program, and loan modification history, to name a few—and these traits historically shed some light on how likely a borrower is to refinance (if mortgage rates move lower) or hold on to their loan (if rates move higher). The less efficient a borrower is in exercising their prepayment option, the more investors are willing to “pay up” for that kind of collateral, relative to a generic TBA.

For many mortgage lenders, TBAs and specified pools (collectively known as mortgage pass-throughs) offer greater balance sheet liquidity, lower credit risk, greater diversification, and a generally more efficient use of capital than holding on to their own loans.

For investors in MBS more broadly, the appeal of the asset class is that it is highly liquid, has low credit risk, and offers more yield than U.S. Treasuries. While mortgage-backed securities have a tight correlation to generic fixed income rate risk, this can be (and often is) hedged out. MBS also have only limited correlation to other asset classes. That correlation lessens the more one moves deeper into the specialist instruments, becoming more of a play on the rate of mortgage prepayments.

Prepayment: The mortgage market’s differentiator

Borrowers have the right to pay off their mortgage ahead of schedule. Prepayment is common behavior in the mortgage market, and understanding it is the key to driving alpha.

Prepayments happen for several reasons, including:

- A homeowner decides to move and sells their house, resulting in that mortgage being paid off early.

- Interest rates fall, and a homeowner refinances at a lower rate, paying off their existing mortgage.

- Home prices rise, and a homeowner with a lot of equity in their home does a cash-out refinance, ending their old mortgage and taking on a new, larger one.

These are examples of call risk—i.e., the risk that return of principal happens faster than expected and the life of the bond is shortened. This benefits holders of discounted MBS, because principal purchased below par is returned at par. By the same measure, it puts holders of premium MBS at a disadvantage, because principal purchased above par is returned … at par.

But the mortgages in a pool can also prepay at a lower rate than expected, such as in a high-inflation environment or in a slowing economy, when the economic incentives for prepayment change for a given pool of mortgages. This is called extension risk, as it extends the weighted-average life of the bond. This disadvantages holders of discount MBS, as the lower prepayments extend the life of the below-market coupons. It’s good for holders of premium MBS, as they get above-market coupons for longer.

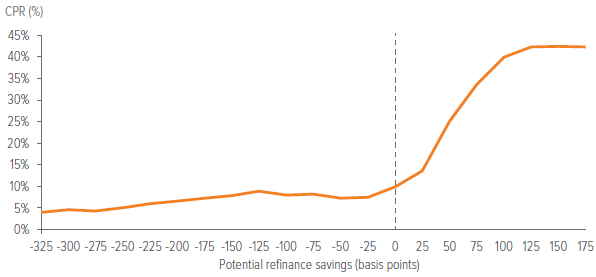

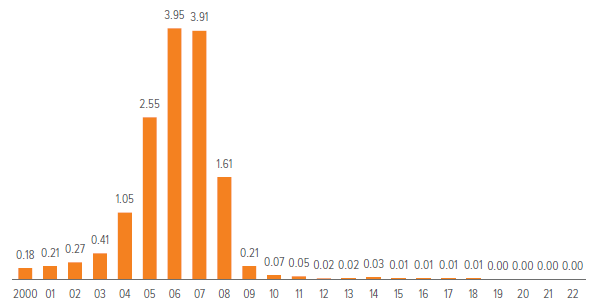

Source: Freddie Mac; CPR & CDR. Data from 2021-2022.

Prepayments are measured against the Conditional Prepayment Rate (CPR), which is the percentage of outstanding principal in a mortgage pool expected to be paid off prematurely each year. As can be seen in Exhibit 3, prepayments hover around 4–9% when rates are high or rising, and there is no financial incentive to refinance. The prepayments that happen are due to non-rate-related events such as moving home or cashing out high equity. However, once rates decline to where homeowners can save 50 basis points by refinancing, prepayments can quickly rise to over 40%. Thus, mortgage-backed securities generally have negative convexity and some reinvestment risk.

The simplest way to understand negative convexity is that a mortgage-backed security has a habit of doing what its investor least wants it to do: When it’s at a discount, its life will tend to extend; when it’s at a premium, its life tends to shorten. Because many investors aren’t too thrilled about that, an entire industry has grown up around mitigating that negative convexity and other risks with safer, if pricier, alternatives: the collateralized mortgage obligation market.

Collateralized mortgage obligations

Collateralized mortgage obligations (CMOs) are created by pooling mortgage pass-throughs and splitting their cash flows into a number of tranches. The characteristics of CMO tranches depend on the purpose behind creating that CMO, so they vary by average life, coupon, stability, prepayment risk and credit rating. Just as with mortgage pass-throughs, there are agency CMOs and non-agency CMOs. Agency CMOs, which represent the majority of the CMO market, carry the same credit guarantee as agency mortgage pass-throughs.

Investors want to have their cake and eat it too: a liquid instrument with minimal credit risk and low prepayment risk that yields more than U.S. Treasuries.

One way investors use CMOs is to broaden the MBS market’s appeal by creating structured instruments, such as sequential pay classes and planned amortization classes (PACs), that serve a wider range of cash flow needs than standard MBS. This allows banks to invest in CMOs with the shortest average life, while asset managers tend to favor intermediate-life instruments. Insurance companies, naturally, take the longest-dated products. These structures also have an implicit de-risking element. They redistribute prepayment risk across the life of the CMO or, as with PACs, build the ability to absorb a range of prepayment outcomes straight into the structure.

What primarily drives demand for CMO creation, however, is explicit de-risking. Conservative investors want to have their cake and eat it too: a liquid instrument with minimal credit risk that yields more than U.S. Treasuries, and which also lacks the negative convexity and prepayment risk of an MBS. And the market is happy to provide, albeit at a richer price.

For example, mortgage investors frequently strip call and extension risk (and some yield) from MBS that are highly above or below par to create a CMO tranche that is priced close to par and less uncertain for them to hold. This process also creates a mortgage derivative byproduct that is highly sensitive to prepayments, retains the negative convexity of the original MBS, and has no natural investor base. Unsurprisingly, these instruments tend to be very cheap, even when prepayments come in bang-on market consensus.

A structurally inefficient market

Thus we arrive at the great structural inefficiency of the CMO and mortgage derivatives market. Everyone is aware of prepayment risk, but there are two major disincentives for banks and other investors to spend adequate effort researching and forecasting prepayments. First is that the holders of vanilla de-risked CMOs can get by with a generic prepayment model that makes lots of mistakes in evaluating the finer points of prepay analysis, because that CMO has largely made the prepayment risk someone else’s problem. Second, those other investors—the ones who buy the under-loved byproducts of the CMO de-risking machine—do so at such low prices that, even using market consensus prepayment estimates, they can be a fantastic deal.

There are major disincentives for investors to spend adequate effort researching and forecasting prepayments.

A typical buyer of prepayment risk–heavy mortgage derivatives is an asset manager seeking to beat the Bloomberg U.S. Aggregate Bond Index, who will put a sliver of their allocation into these instruments. These small allocations may not justify time-consuming, expensive research and analysis of prepayments, especially when there are standard, out-of-the-box prepayment models (such as those from Yield Book and Bloomberg) that do the job well enough.

The main issue with out-of-the-box models is they are dependent on extrapolating based on historical data. And, in the words of everyone’s favorite compliance disclaimer, “past performance is no guarantee of future results.”

The models must also be parsimonious, using as streamlined an approach as possible to predict a much richer reality. Anyone with a passing knowledge of residential real estate can guess that a boom town such as Phoenix, Arizona, bears little resemblance to the New York City or Puerto Rico residential markets. Yet the models are tasked with creating a national prepayment estimate, and do so by deliberately flattening out regional and other market nuances.

The models’ approach results in numerous small errors: the aforementioned flattening of market nuance; the inability to react to the impact of a new development, such as a government policy change, until months after it occurs; and a tendency to overfit to recent data, such as the impacts of the 2020 pandemic on the market. These errors cannot be fixed by simply updating the model more often and/or looking at a broader range of data. They are inherent limitations of relying on any prepayment model without the further expertise to refine the outputs.

Yet these negatives are generally not enough to force investors to cast aside the convenience of stock prepayment models, especially given that the investors with the largest allocations to this space specifically invest in CMOs that were created to reduce prepayment risk.

Mortgage derivatives

CMOs are only some of the instruments created through the de-risking process described above. For the other half of the structure, we need to look at the process’s inevitable and fascinating byproducts: mortgage derivatives. These are not synthetic products in the equity derivative sense, but they do contain elements of implied leverage. The market for mortgage derivatives is large and liquid, and it has produced attractive risk-adjusted returns for decades via advanced, bespoke analysis of prepayment behavior.

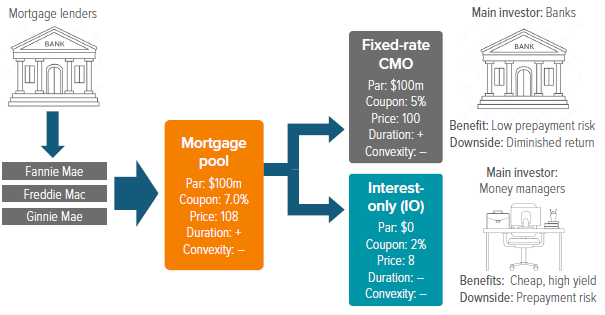

When mortgage-backed securities’ coupons are mismatched to prevailing interest rates and thus are trading way above (coupon > rate) or way below (coupon < rate) par, a common strategy is to restructure them into a nice, safe CMO bond whose coupon is a closer match to market interest rates and which thus trades at par.

The extra interest (above par) or principal (below par), and the associated risk, gets dumped into byproduct instruments, such as interest-only (IO), inverse interest-only (IIO), and principal-only (PO) securities. These byproducts are mortgage derivatives. The other half of the split—the primary goal of the transaction—is just a CMO bond.

The mortgage derivatives market is large and liquid, and it has produced viable high-return strategies for decades.

These CMO/mortgage derivative splits overwhelmingly use agency mortgage pass-throughs as collateral, as the lack of homogeneity in non-agency pools limits structuring ability and also (yikes) introduces credit risk. The instruments are structured by dealers, usually at the behest of a bank or other mortgage investor holding, say, more above-par MBS than they’d like. Very large investors in this space, such as Voya, can also work with dealers directly to create a security they want to invest in.

There is an estimated $50–70 billion in outstanding mortgage derivative issuance, and tens of thousands of individual instruments trading.6 Banks send out offering sheets and bid lists daily via Bloomberg with primary and secondary offerings of mortgage derivative securities.

Source: Voya IM.

When a pool of mortgages is trading well above par, such as during a time of sustained low interest rates, it can be turned into either a fixed-rate CMO with a lower coupon than the underlying pool (“principal strip-down”), or a capped floating-rate CMO (“floater”) instrument that trades closer to par. In both cases, the rest of the cash flows from those pools have to go somewhere—and that’s where the mortgage derivatives come in. For principal strip-downs, the associated mortgage derivative is an interest-only (IO) instrument. For floaters, they create an inverse interest-only instrument (IIO).

In a principal strip-down/IO split, the mortgage investor sells those pools to a dealer, and the dealer structures them into a fixed-rate CMO with a lower coupon trading at par that the investor buys back, as well as an interest-only (IO) mortgage derivative that gets sold off into the general market. The interest-only instrument is exactly what it sounds like. There are no principal payments associated with it; it is a cash flow consisting of MBS interest payments which, as the underlying mortgages are paid off, will decline and eventually stop.

An even more straightforward de-risking structure in an above-par MBS situation is the floater/inverse interest-only (IIO) split. The resulting floating-rate CMO is the safest security that can be created in a CMO form. It has the GSEs’ high credit rating, attractive spreads versus funding cost, and virtually none of the prepayment risk of the original premium-priced pool, because that risk has all been concentrated into the IIO, a much smaller security. All the principal is directed to the floater, while the IIO only receives interest.

Source: Voya IM.

There are also inverse floaters, where the coupon has an inverse relationship with its benchmark interest rate (e.g., 6.5% minus SOFR), similar to an IIO. One of the reasons an investor might choose an inverse floater structure is that it is essentially a levered purchase of pass-throughs financed at the risk-free rate plus the option-adjusted spread (OAS) of the floater. In addition to often superior financing, there is no risk of margin calls. Since floater prices are relatively stable, the inverse floater absorbs all the risk and the reward of the original pass-through.

When an investor is holding a bunch of significantly below-par MBS due to a rise in interest rates, they can work with a dealer to split them into a structure consisting of a fixed-rate CMO and a principal-only (PO) instrument. For instance, take a TBA with a par of 100 and a 3% coupon, which, due to its low coupon is trading at $85. This could be split into: (1) a PO with a price of $70 and a 0% coupon, and (2) a fixed-rate CMO with a price of $100 and a 6% coupon.

POs and discount-priced mortgages are good hedges for mortgage servicing, but after 20 years of extremely low interest rates, very few POs exist, and they are not currently a significant focus of market participants’ business practices. The post-pandemic rise in interest rates has not yet been followed by a new wave of PO creation.

IOs and IIOs are by far the most common mortgage derivative instruments in the market today. This is largely due to years and years of very low interest rates, which resulted in mortgage pools’ prices rising well above par and staying there.

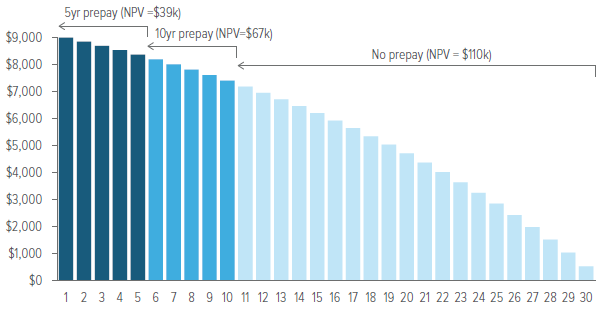

By design, IOs and IIOs behave very uniquely as instruments. A key reason for this is that a homeowner’s monthly mortgage payments start out as primarily composed of interest and end as mostly principal (Exhibit 6). Thus, IOs have a highly negative duration at creation, due to the link between borrower behavior and interest rates. An IO’s average life is also typically shorter than that of the underlying pool.

Source: Voya IM. NPV discount is 4%.

IOs and IIOs are priced based on market consensus CPR, which itself leans heavily on out-of-the-box prepayment models. IO and IIOs’ sensitivity to prepayment risk means that considerable alpha can be generated by engaging in deeper fundamental analysis and forecasting prepayments more accurately than the market. For example, if the market expects 6% prepayments per year, and only 5% of borrowers actually prepay, that 1% change in CPR can potentially add 1% of yield for the life of that IO investment.7

Because IOs and IIOs have such concentrated prepayment risk, they are not a natural fit anywhere, and nobody’s going to invest in them unless they’re really cheap. And they usually are: In Voya’s experience, IOs and IIOs trade at significant option-adjusted premiums to the risk-free rate.

Buyers of IOs and IIOs include insurance companies seeking to enhance portfolio performance as well as commercial banks, which sometimes use IOs to manage overall portfolio duration and enhance returns in a high–interest rate environment. Asset managers may make very small allocations to mortgage derivatives to enhance portfolio performance, because even to base case market consensus prepayment assumptions, IOs and IIOs deliver considerably more yield than a Treasury would. Hedge funds invest in mortgage derivatives to perform relative value trades, as well as to express their views on basis, carry, prepayments, and volatility.

IOs and IIOs are also the purest and most liquid way to express prepayment assumptions, and there is a vibrant, public market in them that presents meaningful opportunities to capture relative value and trade in and out of positions. These characteristics inspire their use in several common trading strategies:

- A rate of return hedge is when an IO is added to a fixed income portfolio to reduce the portfolio’s duration and flatten out its rate of return across different yield curve shifts.

- A synthetic premium is when the coupon of a TBA is boosted by adding an IO to it. For example, adding 100 bp of a 5.5% IO to a 5% Fannie Mae pass-through creates a 6%pass-through which, due to the cheapness of IOs, may be cheaper than buying a 6%Fannie Mae pass-through outright.

- A combo strategy is when an investor buys an IO from one pool and a PO from a different pool, such as a 5.5% IO and a 5.0% PO. This indicates that the investor believes that FNMA 5.5s will prepay slower than market consensus, and that FNMA 5.0s will prepay faster.

While it is easy to capture the cheapness of IOs and IIOs, if an investor doesn’t understand the borrower behavior and hedge the interest rate risk, they become subject to sizeable rate risk. Investing in IOs and IIOs requires considerable quantitative and fundamental expertise in prepayment analysis, as well as hedging to neutralize rate risk.

Mortgage servicing rights

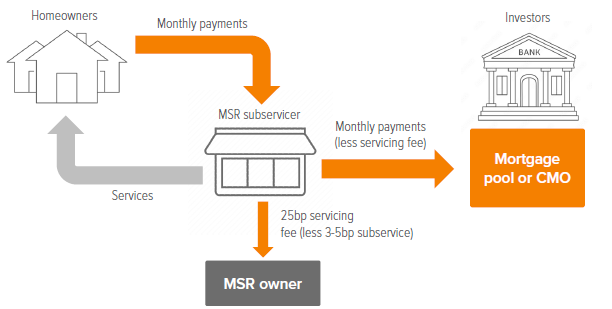

When a mortgage is securitized through the GSEs and becomes part of a mortgage pass-through, someone still needs to make sure that payments from the homeowner are collected every month and delivered to the correct investors. There also needs to be a person for the homeowner to turn to if they are facing difficulty with their mortgage, and who can initiate loan mitigation or foreclosure proceedings. Mortgage lenders generally have very little interest in doing this, so they sell off their mortgage servicing rights (MSRs) to third parties. This is a surprisingly large market, with 2022 seeing over $1 trillion in trading volume in what Voya estimates to be $75 billion in outstanding mortgage servicing rights issuance.8

Source: Voya IM.

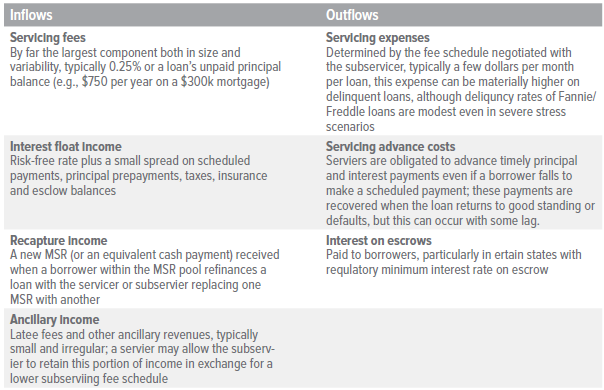

In return for servicing mortgages, MSR owners receive a fixed annual fee of about 25 basis points on the outstanding principal balance of the underlying loans—far more than the 2–3 basis points that it typically costs to perform the work of servicing. For a marginal expense over the servicing cost, MSR owners may hire subservicers to perform the primary servicing functions, receiving the net servicing income. Many homeowners will be familiar with this arrangement, having taken out a mortgage with a big, household-name bank only to get payment requests from a smaller company with a completely unfamiliar name.

MSRs can reach twice the spread of IOs, but with a nearly identical prepayment risk profile.

Much like an IO, the value of this stream of fee income is mainly determined by prepayments. The longer the mortgage lasts, the higher the net present value of the MSR’s cash flow. But as its underlying mortgages are paid off, the cash flow declines and the MSR becomes worth less. The servicing fee and subservicing cost are the dominant components of MSR cash flows, but not the only ones (Exhibit 8).

Source: Voya IM.

To own an MSR, an investor must either be a licensed mortgage servicer or partner with one. This barrier restricts the pool of potential buyers, making it difficult for lenders to unload supply they would prefer not to hold on their books due to punitive capital requirements. This supply, coupled with the inefficient asset pricing, creates an opportunity to extract value.

In Voya’s experience, MSRs can trade at twice the spread of IOs, but with a nearly identical prepayment risk profile. Co-issue MSRs—when a mortgage lender sells servicing rights at the same time it sells the underlying mortgage loan or pool to a GSE—tend to run even cheaper, increasing the premium to the risk-free rate. (Co-issue transactions offer MSR sellers quicker timelines and certainty of execution, so sellers are often willing to sell at wider generic spreads than those found in the bulk MSR market.)

Despite the importance of prepayments, MSRs’ risk tends to be priced inefficiently.

Despite the importance of prepayments, MSRs’ risk tends to be priced inefficiently. First, most MSR sales are done in bulk, combining generic cohorts of loans in ways that help market participants survive and thrive, but with far cruder pricing methods than those used in the more granular MBS market. Second, mortgage servicers naturally tend to focus their resources on running an operating business rather than developing strong prepayment expertise, which may cause them to underestimate certain important drivers of prepayment behavior. Lastly, valuation calculations are often based on stale models.

Involvement in the MSR market is a virtuous circle, which can lead to better modeling of prepayment activity.

This structural inefficiency creates a further source of alpha for MSR investors with specific prepayment expertise. For such investors, involvement in the MSR market becomes a virtuous circle, in that a relationship with mortgage servicers can give unique insights into mortgage behavior at the ground level, which can lead to better modeling of prepayment activity.

Credit risk transfers

Credit risk transfer (CRT) bonds are unsecured, floating-rate GSE obligations, with cash flows based on the performance of a reference pool of mortgages. Each pool contains all loans acquired by that GSE within a specified timeframe of a few months, within a broad set of criteria—for example, 30-year mortgages with 60–80% LTV that have never missed a payment and have passed through the agency’s quality control measures. Pools each contain 20,000–100,000 underlying loans, providing tremendous diversification of collateral. The typical CRT has a 2-to-5-year weighted-average life and a 10-to-20-year final maturity.

The GSE sells only the mezzanine and first-loss tranches to investors. Any principal losses are initially absorbed by the first-loss piece (which is at least partially retained by the GSE), then to mezzanine tranches, and finally, if needed, by the senior (retained) tranche.

CRTs are a relatively new asset class, introduced in 2013 to transfer Fannie Mae and Freddie Mac credit risk out of taxpayers’ hands and into private investors’. Still, $21.6 billion of single-family residential CRTs were issued in 2022, sharing risk on 90% of qualifying 30-year mortgages Fannie and Freddie acquired.9

Source: Voya IM.

Seasoned mezzanine CRTs with realistic prepayment and default scenarios trade at a 250–450 bp premium to the risk-free rate.10 These returns can be enhanced by selecting underpriced securities within the sector and taking advantage of relative value trading opportunities. That spread represents attractive fundamental value given the relatively short average life and low likelihood of a first dollar of loss, particularly for seasoned deals. These attractive spreads remain available in part because the asset class is still fairly new, leaving many investors without the needed expertise to evaluate opportunities in the sector.

Seasoned mezzanine CRT securities are structured with a 2008-style housing crisis in mind, but they benefit from the strong underwriting standards of the post-crisis period.

Many large investors are deterred from CRTs because the bonds are generally rated below investment grade. However, these seasoned mezzanine CRT securities are also astoundingly creditworthy (Exhibit 10). They are structured with a 2008-style housing crisis in mind, but the mortgages in the reference pools reflect the strong underwriting standards of the post-crisis period. Also, home prices are up 46% since January 2020.11 Loan-to-value ratios of some seasoned collateral in the CRT universe are already below those of similar 2004-vintage loans at the inception of the housing crisis.

As of 06/30/2023. Source: FNMA.

In addition to their standalone merit, CRT securities are an excellent complement to agency mortgage IO and IIO securities. Agency IOs and IIOs offer substantial option-adjusted spreads, but the investor must take on prepayment risk. In the event of accelerated prepayments, which erode the value of IOs, the creditworthiness of CRT securities improves as credit enhancement builds up more quickly and weighted-average lives decline. In this way, CRT investments also benefit from much of the same prepayment expertise, in terms of identifying relative value, as investments in mortgage derivatives and other mortgage-related assets.

Conclusion

Agency mortgage-related assets regularly provide attractive returns with minimal credit risk, and when properly hedged, they have low correlations to other major asset classes. Plus, the structural market inefficiencies surrounding mortgage derivatives and MSRs enable a substantial information advantage for large, sophisticated investors. The asset class’s main risk comes from U.S. homeowners prepaying their mortgages in surprising numbers. With mortgage rates at 20-year highs and home sales sluggish, this seems unlikely—yet spreads in the sector remain wide, making the timing opportune for investments in the asset class.

Voya’s Mortgage Derivatives team is a multibillion-dollar institutional investor in the mortgage-related assets space, with decades of specialization in prepayment analysis. We would welcome the opportunity to discuss how this strategy complements investors’ portfolios. Please contact our team to learn more.

|

Risks of investing The principal risks are generally those attributable to bond investing. Holdings are subject to market, issuer, credit, prepayment, extension, and other risks, and their values may fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. The strategy invests in mortgage-related securities, which can be paid off early if the borrowers on the underlying mortgages pay off their mortgages sooner than scheduled. If interest rates are falling, the strategy will be forced to reinvest this money at lower yields. Conversely, if interest rates are rising, the expected principal payments will slow, thereby locking in the coupon rate at below market levels and extending the security’s life and duration while reducing its market value. |