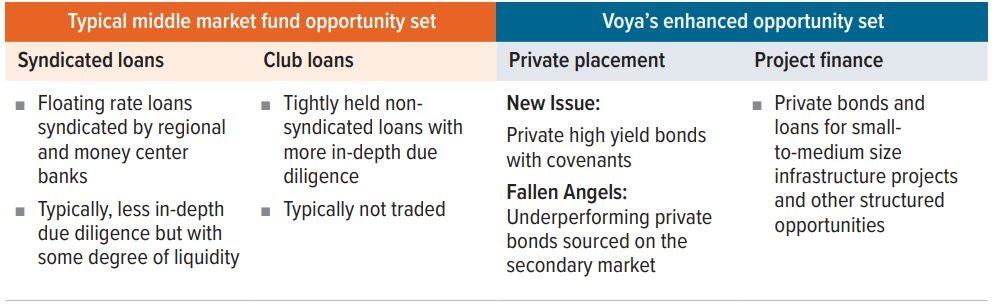

Combining middle market loans with strategically sourced deals in private placement and project finance markets allows for a more diversified portfolio that has the potential to deliver returns that have been less correlated to economic cycles.

A diversified approach to middle market lending

With similar credit quality, yield and structure as middle market loans, private placement debt and project finance loans are a natural complement for investors looking to invest in the middle market space. Through this expanded opportunity set, investors can build a diversified portfolio of loans with attractive terms and stronger structural dynamics for lenders (Exhibit 1).

As a result of Voya’s highly selective approach, only 6% of the loans we evaluated since inception in 2013 made it into our enhanced middle market portfolio.

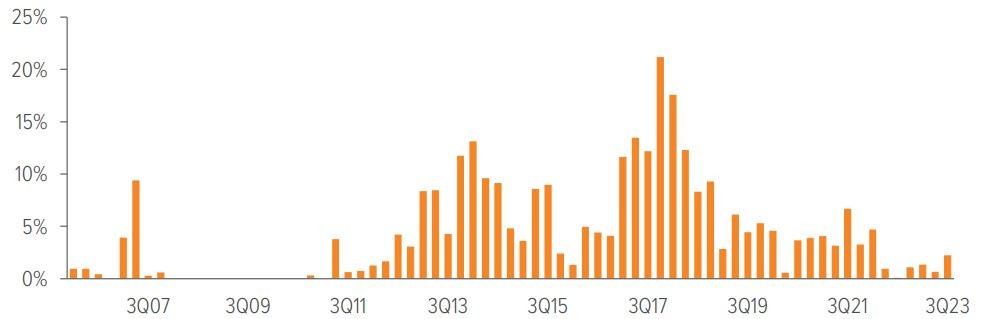

Unlike other areas of the credit market where borrowers are forgoing or loosening loan covenants, these structural protections remain intact among middle market loans (Exhibit 2).

Source: LSEG. As of October 2023.

While other credit markets are experiencing an increase in loans with more “borrower friendly” terms, covenants are still prevalent among middle market loans.

“Cov-lite” loans as a percentage of total middle market loan issuance has generally been below 10% since 2007. In contrast, cov-lite loans as a percentage of the S&P/LSTA Leveraged Loan Index are significantly higher, reaching 79% in 2018.1

Project finance and private placement loans typically include strong structural protections and hard collateral, and a highly selective approach focused on rigorous underwriting and bottom-up research can help investors capitalize on the attractive illiquidity premiums found in these markets.

In the sections that follow, we explore the makeup of these three different areas of the private credit market and explain how Voya’s enhanced middle market team invests in each.

Middle market overview

Middle market lending is a subset of the broader private credit market space and typically refers to loans made to companies with annual revenue between $50 million and $1 billion.

What are the investment benefits of middle market lending?

Compared to corporate public bonds and liquid leveraged loans of similar credit quality and duration, middle market lending may achieve additional yield and total return due to illiquidity premiums, higher up-front yields, origination fees, and lower actual credit losses (primarily because of covenants and other structural attributes that have potential to help lenders in preserving and recovering value in the event of credit degradation).

How big is the market?

The private credit market has grown from $875 billion in 2020 to $1.4 trillion at the start of 2023 and is estimated to grow to $2.3 trillion by 2027.2

Market participants play different roles

The middle market lending space has multiple market participants, each serving a distinctive function:

- Insurance companies: These entities invest in middle market loans seeking higher yields compared to traditional fixed-income securities. Their long-term investment horizons align well with the typically longer duration of private credit instruments. Insurance companies are often more risk-averse, preferring senior secured loans with lower default risk.

- Pension plans: Pension funds invest in middle market loans as a way to diversify their portfolios and help achieve steady income streams. They tend to focus on higher-quality loans given their obligation to meet long-term liabilities to pensioners. Pension plans often invest through private debt funds or CLOs (Collateralized Loan Obligations).

- CLOs: These structured finance vehicles pool loans and issue tranches of debt with varying risk and return profiles. CLOs enable diversification of lender risk and provide a mechanism for smaller investors to gain exposure to middle market loans.

- Hedge funds: Hedge funds participate in middle market lending, often seeking higher returns through riskier or more complex loans. They might engage in distressed debt, mezzanine financing, or other strategies that involve greater risk and potential reward.

- Mutual funds: These funds collect capital from individual investors to invest in a diversified portfolio of loans. They offer investors liquidity and the opportunity to invest in private credit with lower minimum investments compared to other vehicles.

- Private debt funds: These funds play a significant role in middle market lending, filling the gap left by banks.

- Private equity sponsors: These firms often work in tandem with lenders to finance leveraged buyouts, acquisitions, and growth initiatives of middle market companies. They can influence the structuring of loans and are key players in transaction-driven financing in the middle market.

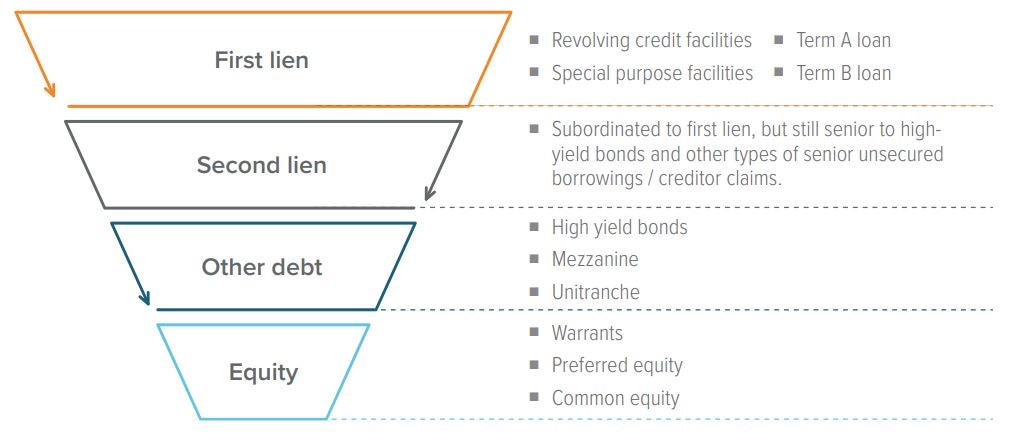

Middle market capital structure

The capital structure of middle market financing is a layered arrangement of various types of debt, each with its own risk profile, priority in the event of a default, and return expectations (Exhibit 3).

Voya’s enhanced middle market team has flexibility to derive value across the capital structure.

Source: Voya Investment Management. For illustrative purposes only.

First lien debt

First lien debt holds the highest priority in terms of repayment and typically has the lowest risk and includes:

- Revolving credit facilities: Flexible lines of credit allowing companies to borrow, repay, and re-borrow funds as needed, up to a predetermined limit. They are often used for short-term working capital needs.

- Term A loans: Amortizing loans, meaning they are paid down over time with regular payments of principal and interest. Term A loans are often used for financing specific investments or acquisitions.

- Special purpose facilities: Loans designed for a specific purpose, like financing a particular project, acquisition, or asset purchase. The terms and structures of these loans vary greatly depending on their purpose.

- Term B loans: Similar to Term A loans but usually have a longer maturity and a bullet repayment structure (where the principal is paid at the end). Term B loans are often used to finance larger investments and are more common in leveraged buyouts.

Second lien debt

Second lien debt has a lower priority than first lien debt in the event of a default, which results in higher risk and typically higher interest rates. These loans are secured by the same collateral as the first lien debt but are subordinate to it. They are riskier and therefore carry higher interest rates.

Other debt instruments

These forms of debt are typically unsecured or have a lower priority than both first and second lien debt.

- High yield bonds: These are unsecured bonds issued by companies and carry higher risk (and thus higher yield) compared to investment-grade bonds. They are a common financing tool for larger middle market companies.

- Mezzanine debt: This is a form of subordinated debt that often includes equity-like features (e.g., warrants). Mezzanine debt fills the gap between senior debt and equity, providing a balance of risk and return.

- Unitranche debt: This is a hybrid loan combining senior and subordinated debt into a single facility with a blended interest rate. It simplifies the capital structure and can expedite the financing process but may come with higher costs. Unitranche debt is typically senior secured and can also include a revolver.

Private placement market overview

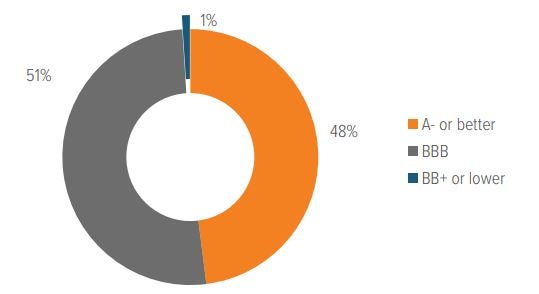

Private placements are essentially longterm loans to corporations, 90% of which are investment grade. Functionally, private placements are a hybrid of a public bond and a traditional bank loan. They share characteristics with public bonds, including a fixed rate structure and term length. Similarities with bank loans include greater upfront due diligence, priority debt and financial covenant protection, and a more engaged relationship with borrowers.

While the majority of the market is investment grade, the market also offers below investment grade opportunities through new issuance in the agented and direct markets. Because insurance companies and pension funds are the most common investors in the private placement market, there is little appetite for below investment grade securities among market participants. (Of the agented new issuance in 2023, only 1%, or $69 billion, was below investment grade, as shown in Exhibit 4). This makes for a favorable market environment for below investment grade market participants.

Beyond opportunities in new issuance, Voya’s enhanced middle market team also sources below investment grade deals among “fallen angels.” In the private placement market, a fallen angel refers to a bond or debt instrument that was originally issued with an investment grade rating but has since been downgraded to a noninvestment grade status. This downgrade typically occurs due to a deterioration in the issuer’s creditworthiness, which might be the result of changes in market conditions, adverse business developments, or shifts in the issuer’s financial health.

Investment grade securities are considered lower risk and are often favored by more conservative investors, such as pension funds and insurance companies. When these securities are downgraded to below investment grade, they may no longer meet the investment criteria of these conservative investors, leading to potential selloffs and increased market volatility for these securities.

As a result, Voya’s enhanced middle market investment team actively looks for the opportunities created by lenders becoming forced sellers when investment grade credits are downgraded.

Voya is among the largest lenders in the investment grade private placement market, providing the enhanced middle market team with unique access to the below investment grade components of the private placement market.

Private Placement Market data is as of 12/31/2023. Source: BoA USPP Market Snapshot

Project finance market overview

Project finance offers contractual cash flows

The infrastructure project financing market is a specialized segment of finance that deals with funding the construction and operation of large-scale infrastructure projects. This market plays a critical role in developing and maintaining essential facilities like roads, bridges, airports, power plants, and telecommunications networks.

As infrastructure projects progress into construction, the developers and sponsors who provided the initial investment capital typically tap banks for traditional project financing. However, the amount banks can lend is often capped at a percentage of the project’s costs. As a result, flexible, highly specialized investment managers can capitalize on this financing inefficiency by devising creative, more efficient financing structures, thereby earning upfront fees and privately negotiating deals with attractive yields.

From an investment perspective, the long-term contractual cash flows of infrastructure projects can isolate investors from broader market cycle risk and deliver a return stream that is less correlated to other asset classes.

Financing vehicles in the project financing space include:

Off balance sheet joint ventures (JVs)

Off balance sheet joint ventures are a common structure in infrastructure project financing. In this arrangement, the project is financed and operated through a joint venture company formed by the project sponsors. This JV is legally and financially separate from the sponsors’ main businesses, meaning the liabilities and assets associated with the project do not appear on the sponsors’ balance sheets. This separation helps in risk mitigation and can improve the creditworthiness of the project by isolating it from the financial risks of the parent companies.

HoldCo (Holding Company) financing

HoldCo financing involves the creation of a holding company to own the project assets. This holding company, or HoldCo, typically raises funds through equity and debt to finance the project. The HoldCo structure offers a layer of legal and financial insulation between the project and the sponsors, which can be beneficial in terms of risk management and tax planning. It also allows for easier aggregation of multiple projects under one umbrella, which can be advantageous for large entities managing multiple infrastructure initiatives.

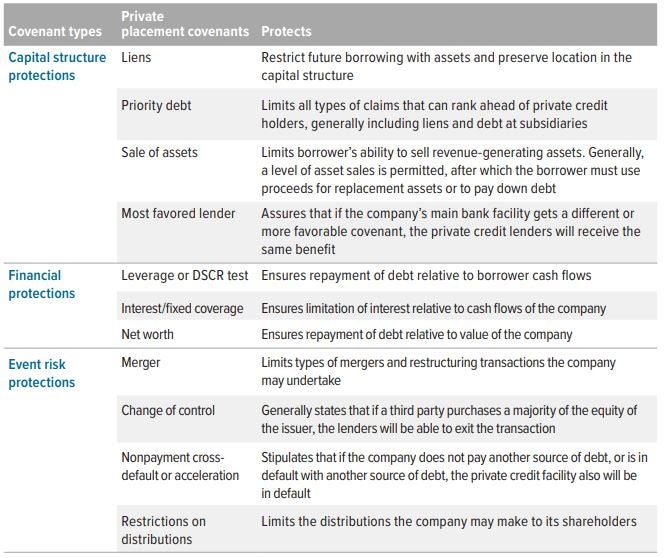

Covenants provide built-in risk protection for middle market loans

Covenants are designed to maintain pari passu, i.e., equal, treatment with other creditors and to force prepayment while the credit is still financeable by its banks or other lenders. When an exit is not possible, lenders can renegotiate terms to increase the yield via fees and coupon rate increases, or improve recovery rates if payment default ultimately occurs. Generally, covenants provide three types of protection:

- Protect the note holders’ position in the capital structure

- Protect against credit deterioration (financial covenants)

- Protect against “event risk,” or the company favoring its equity holders over its lenders

The table below provides more detail on the different type of covenants and their advantages:

Deal sourcing to create diversified portfolios

The structure survives— Voya’s enhanced middle market team remains laser focused on identifying loans with strong covenants and structural protections.

As middle market lending soars in popularity, loan selection has become more important than ever. Casting a wider net across middle market loans, private placements and project financing enables us to uncover more deals that have attractive terms and avoid becoming over-reliant on one industry or private equity sponsor.

Voya’s enhanced middle market team provides a differentiated sourcing approach relative to other middle market investors that are reliant on key sponsor relationships for deal sourcing.

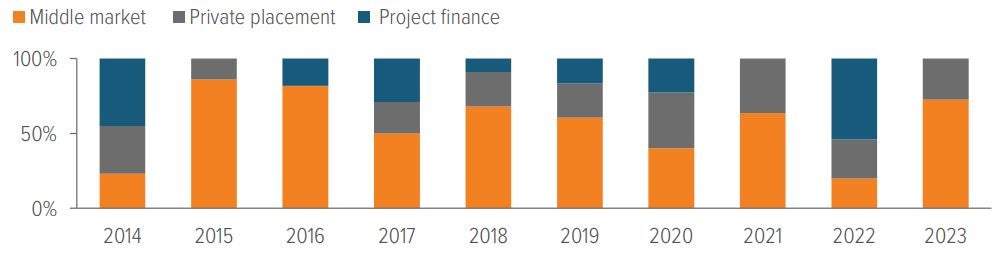

This diverse sourcing strategy creates the ability to pivot to the appropriate channel/lending partners as dictated by market conditions and the relevant opportunity set (Exhibit 6).

A bottom-up strategy with flexibility to capitalize on changing market conditions.

For example, from 2017 to 2019, there was a notable step back in middle-market deals, primarily driven by frothy market conditions and a degradation in deal documentation. In the years 2020 and 2022, the middle market capital deployment was further reduced, influenced by the lower quality of M&A activity. This downturn was largely attributed to the impacts of Covid-19 and prevailing market conditions. However, this period allowed for the identification of more promising opportunities in private placements and project financing.

In 2023, the landscape shifted favorably for middle-market opportunities. Attractive investment options emerged, offering double-digit returns for top-of-capital-stack risks. These opportunities were bolstered by strong structural protections, such as financial maintenance covenants and low loan-to-value ratios (LTVs), as the market began to lean in favor of lenders once more.

Additionally, private credit played a crucial role during this time. It effectively filled the gap created by the dislocation in public and bank financing markets, offering an alternative financing solution that became increasingly important in the evolving economic landscape.

Combining middle market loans with the strategic sourcing of deals in the private placement and project finance markets reduces risk through a broader spread of investment types, and taps into different market dynamics and opportunities as market conditions change. This enhanced approach to middle market lending helps investors build a diversified portfolio of loans with attractive terms and stronger structural protections for lenders.

Risks of Investing Middle market, private placement and project finance loans: The principal risks are generally those attributable to bond investing. Holdings are subject to market, issuer, credit, prepayment, extension and other risks, and their values may fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. |