Secondary private equity can potentially enhance the return and risk profile of a traditional 60/40 portfolio.

The core investment portfolio needed to balance return and risk–long viewed by financial advisors as a prototypical 60/40 stock/bond allocation–is taking on a different look. We believe advisors are coming to the same conclusion as institutional investors: alternatives are not alternatives anymore.

Accordingly, advisors appear to be making alternatives a core component of strategic asset allocations. As a result, some investors are seeking to add private markets to portfolios to potentially achieve greater longer-term returns and mitigate risk.

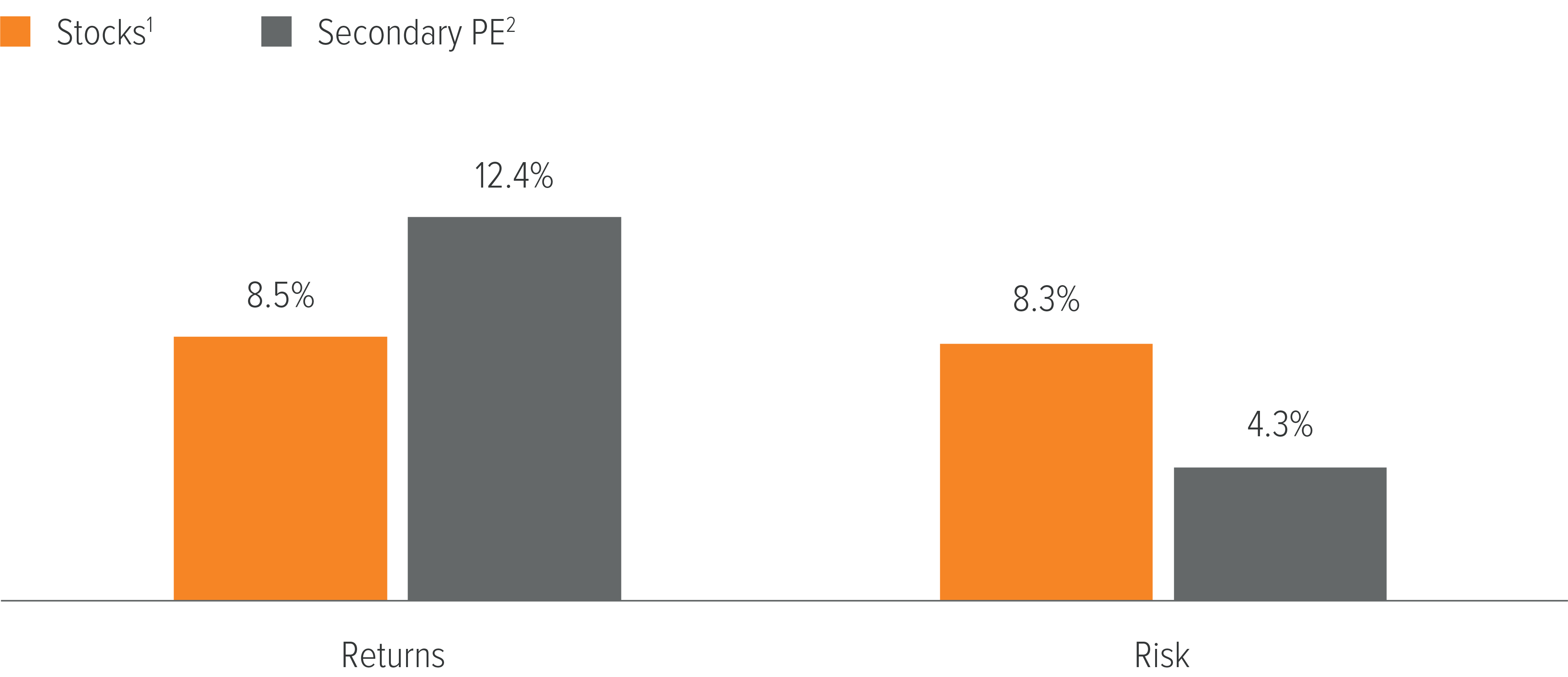

A long track record of higher returns and lower risk

Secondary private equity (PE) has emerged as an alternative way to access private markets. Investors may benefit from its potential for attractive returns, modest volatility and lower correlations to other asset classes.

Over the long term, secondary private equity has delivered higher absolute and risk-adjusted returns compared to public equities (Exhibit 1).

As of 12/31/24. Source: MSCI, Bloomberg and Cambridge Associates. Past performance is no guarantee of future results. See disclosures for index definitions and other disclosures.

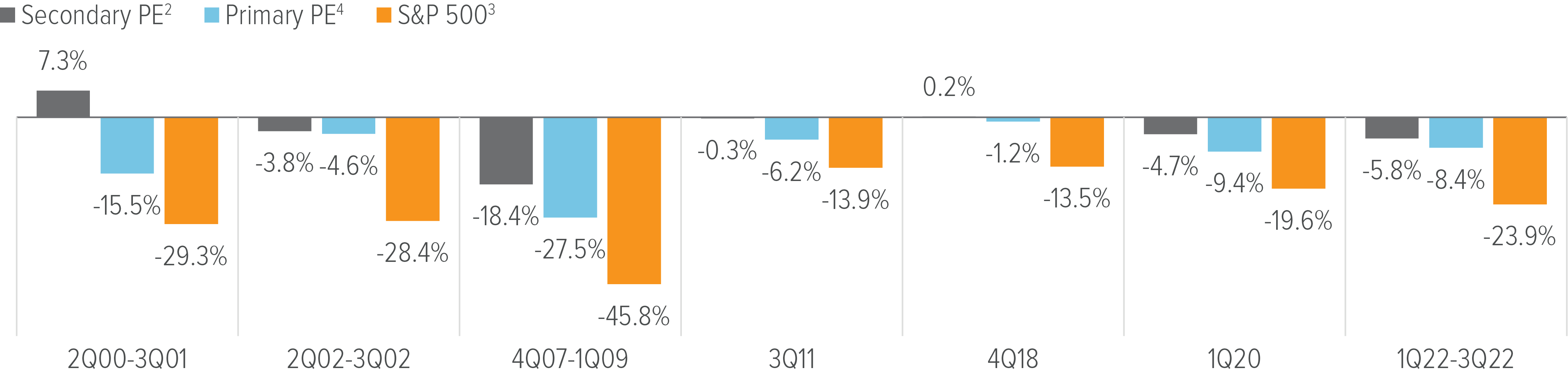

Historically strong downside protection

When broader market conditions deteriorate, secondary private equity investments have exhibited lower volatility and downside risk compared to public equity, and even primary private equity investments (Exhibit 2).

As of 12/31/24. Source: Pomona Capital, Capital IQ (S&P), Cambridge Associates (CA Index). Data show cumulative quarterly returns during drawdown periods from 1999 to 2024. Past performance is not an indication of future performance. There is no guarantee that an investment in a Pomona-sponsored fund will ultimately be profitable. See disclosures for index definitions and other disclosures.

Secondary PE: A potential path to more attractive risk-adjusted returns

Adding secondary private equity to a 60/40 portfolio is a possible strategy to help enhance risk-adjusted returns. As the data below illustrates, reallocating a portion of the portfolio from public equities and bonds to secondary private equity enhanced the risk-return profile of the portfolio (Exhibit 3).

By strategically incorporating secondary private equity into a traditional 60/40 allocation, advisors can seek to enhance risk-adjusted returns, diversify their holdings, and create a more balanced and resilient investment strategy for their clients’ portfolios.

Exhibit 3: Adding secondary PE to a 60/40 portfolio increased returns and lowered risk

Annualized returns and standard deviation for 20 years

A note about risk

General risks to consider

Secondary investments: The ability of the manager to select and manage successful investment opportunities, underlying fund risks; these are non-controlling investments, no established market for secondaries, identify sufficient investment opportunities, and general economic conditions.

Primary investment: Identify sufficient investment opportunities, blind pool, the manager’s ability to select and manage successful investment opportunities, the ability of a private equity fund to liquidate its investments, diversification, and general economic conditions.

Venture Capital: Characterized by a higher risk and a small number of outsize successes, has the most volatile risk/reward profile of the private equity asset class.

Growth Equity: These companies typically maintain positive cash flow and therefore present a more stable risk/reward profile.

Mezzanine Financing: Has the most repayment risk if the borrower files for bankruptcy and in return, mezzanine debt generally pays a higher interest rate.

Leveraged Buyout: Generally exited through an initial IPO, a sales to a strategic rival or another private equity fund, or through a debt-financing special dividend, called a dividend recapitalization.

Distressed Buyout: Offer the opportunity to invest in debt securities that trade at discounted or distressed levels with the potential for higher future value if the company recovers.

General private equity risks

Private equity investments are subject to various risks. These risks are generally related to: (i) the ability of the manager to select and manage successful investment opportunities; (ii) the quality of the management of each company in which a private equity fund invests; (iii) the ability of a private equity fund to liquidate its investments; and (iv) general economic conditions. Private equity funds that focus on buyouts have generally been dependent on the availability of debt or equity financing to fund the acquisitions of their investments. Depending on market conditions, however, the availability of such financing may be reduced dramatically, limiting the ability of such private equity funds to obtain the required financing or reducing their expected rate of return. Securities or private equity funds, as well as the portfolio companies these funds invest in, tend to be more illiquid, and highly speculative.