Voya’s Fixed Income CIO talks private and public fixed income trends for the year ahead—and what they mean for your portfolio.

Risks

- Convexity is back: Tight spreads mean risk is disproportionately on the downside for common passive fixed income strategies, while falling rates are likely to push up prepayment on some residential mortgage-backed securities.

- More money, more problems: As debt supply continues to rise across public and private markets, more cracks may show up in balance sheets—especially in the tech sector.

- The K-shaped consumer: While the majority of U.S. consumer spending is strong, many subprime and near-subprime borrowers are struggling—and there may be hidden risks in securitizations from newer lending startups.

Opportunities

- Commercial real estate: Values are down, but transaction volume is back—and along with it, some of the best upside potential in fixed income.

- Investment grade private credit: Significant new borrower demand fueled by large public company capex is helping to maintain spreads of 100 bp+ over equivalently rated public bonds.

- Residential mortgage-related asset strategies: In an era of high stock/bond correlations, mortgage derivatives tend to have low correlations to other assets— and have historically offered attractive returns and low volatility.

Love the yield, hate the spread

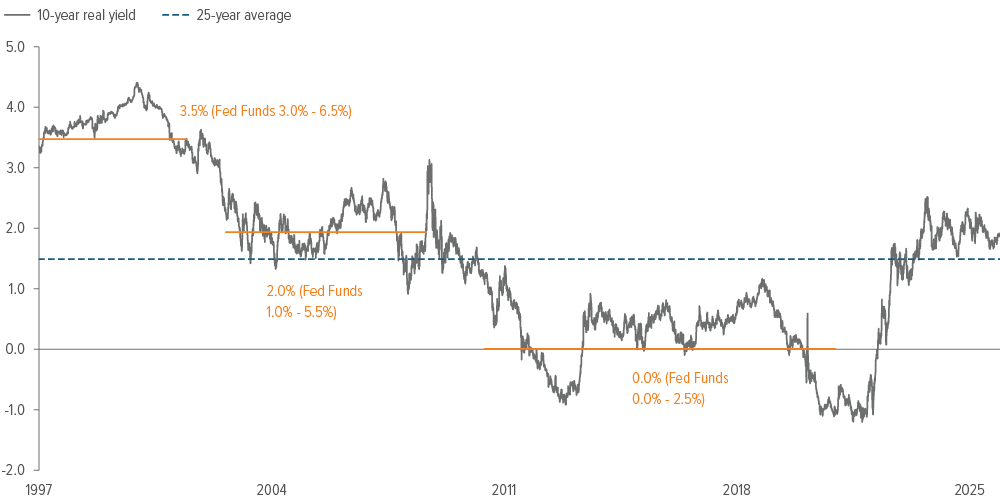

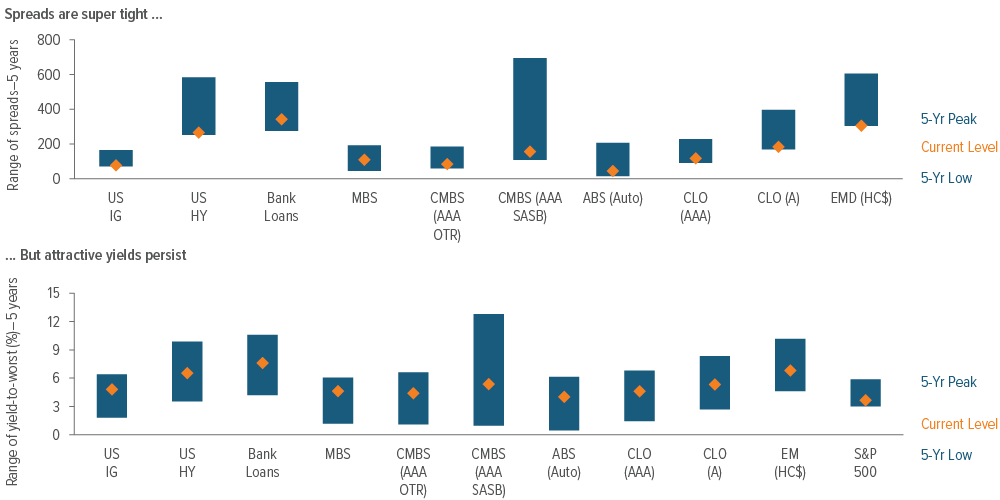

With real yields at generational highs, fixed income is a very attractive place to be right now (Exhibit 1). But with spreads in many core fixed income sectors also at their tightest in decades, potential upside is much more limited than potential downside.

This is what we mean by convexity is back: The risks in much (but not all!) of fixed income are disproportionately to the downside if sentiment shifts. Corporate credit risk is in a weird place right now, with unsecured high-yield debt yielding the same as residential mortgages. And, speaking of residential mortgages, with the Fed Funds rate down 175 bp from its mid-2024 high, we’re likely to see prepayments rise as people refi out of those 2023-2024 7% mortgages.

This year, out-performance is likely to come from outside core fixed income.

As at 12/31/25. Source: Bloomberg, Voya IM.

In short, you want to stay in fixed income for the yield, but the biggest parts of the Agg (corporate bonds, agency MBS, and Treasuries) really don’t have much room to go further up in price. This means it’s time to get active and intentional about public fixed income allocations—and, for institutional investors, high-quality private fixed income assets.

How do you do that? There are five ways to increase returns in fixed income: add credit risk, duration, complexity, illiquidity, or leverage.

Most investors fixate on credit risk as the main lever of returns, and that’s where a lot of opportunities are missed—whether going down the capital stack at times (like now) when it may not be wise, or affecting attitudes towards the other return levers.

For example, securitized credit frequently offers a complexity premium, and investment grade private credit tends to offer both complexity and illiquidity premiums. Yet newer investors often push back on these sectors as they can only translate “premium” into “credit risk.”

The time to get over that mindset is now.

Savvy investors will look to other levers of return than credit risk.

As of 12/31/25. Source: Bloomberg Index Services Limited and Voya IM.US IG is Bloomberg U.S. Corporate Index, U.S. HY is Bloomberg U.S. High Yield Index, MBS is the Bloomberg U.S. MBS Index, EMD (HC$) is the JPM EMBI Global Diversified Index, CLO AAA and CLO A are JPM CLOIE AAA and A rated indices, respectively, ABS is JPM Auto ABSAAA Index, CMBS AAA OTR and AAA SASB are JPM CMBS Indices for the respective segments.

Adding complexity, illiquidity, and/ or leverage to portfolios can potentially increase return and mitigate downside risk.

More money, more problems

Tight public spreads are likely to have another effect on the market in 2026: a wave of supply. Part of it is projected M&A activity, and part is refinancing low-cost bonds and loans taken out during 2020- 2021’s era of extraordinarily cheap debt. But the biggest part is tech debt.

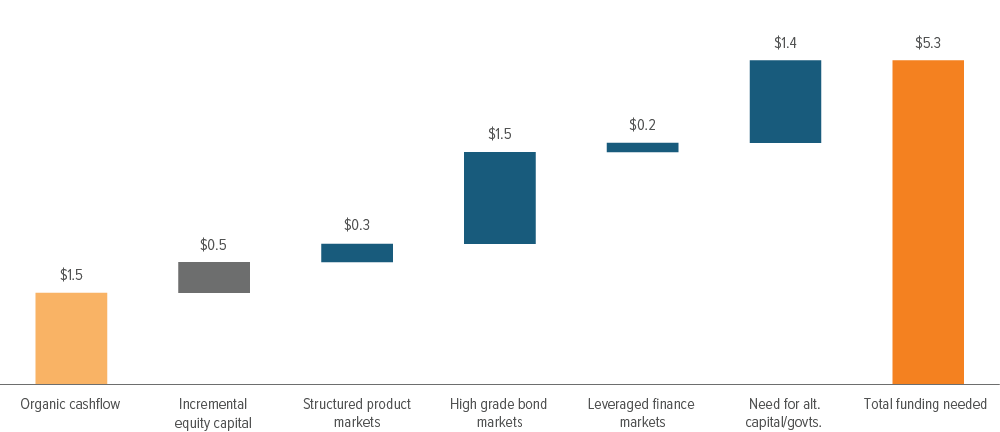

The AI universe’s issued debt already makes up over 16% investment grade bond market, passing the $1.25 trillion mark at the end of 2025. Data center-related debt issuance alone is projected to add another $1.5 trillion to that by 2030—and a further $1.9 trillion to other debt markets (Exhibit 3).

Brace yourself for a wave of debt issuance this year.

As of 11/30/25. Source: J.P. Morgan.

And where you have debt growth, you have debt problems.

Are we in line for a 2008-style systemic debt crisis? No, not really. Are we in line for a 2001-style TMT debt fallout? Maybe!

A lot of this new debt is in tech and tech-related sectors. Hyperscaler capex is not where the problems are likely to occur. But service providers that have levered up to support the growth of AI remind us a lot of the oilfield service providers in the commodity bust of 2014-2016. Both of these business models are at the end of the whip—and if it cracks, they’re going to feel it the worst.

There’s little systemic risk, but we are likely to see more individual defaults.

There’s also the risk of displacement from AI, especially in software businesses that have typically run with a lot of leverage because of high recurring revenues. These companies are largely funded in the high yield private credit space. But there’s also large, publicly listed services businesses such as consultancies and advertisers that could see radical changes in their business models due to AI, which may result in financial pressures and debt downgrades.

A lot of cheap 2020-2021 debt is also up for refinance, and there are likely to be selected issues around companies who are already hitting the “yikes” level of debt service coverage ratios with the loans they have now. Also, given eroding due diligence covenant standards across both leveraged loans and high yield private credit, we’ll probably see a few more cases of fraud.

The mantra here is to stay high up in the capital stack, but with IG corporate bonds on a 78 bp spread at end 2025, that’s where we need to maintain credit quality but press some of the other fixed income levers for return.1

Specifically, investment grade private credit frequently offers illiquidity and complexity premiums—and, with infrastructure placements, often a duration premium as well. The move of hyperscaler capex off balance sheet produced significantly more borrower demand for investment grade private credit in 2025, and that’s likely to continue.

The mantra is to stay high up in the capital stack.

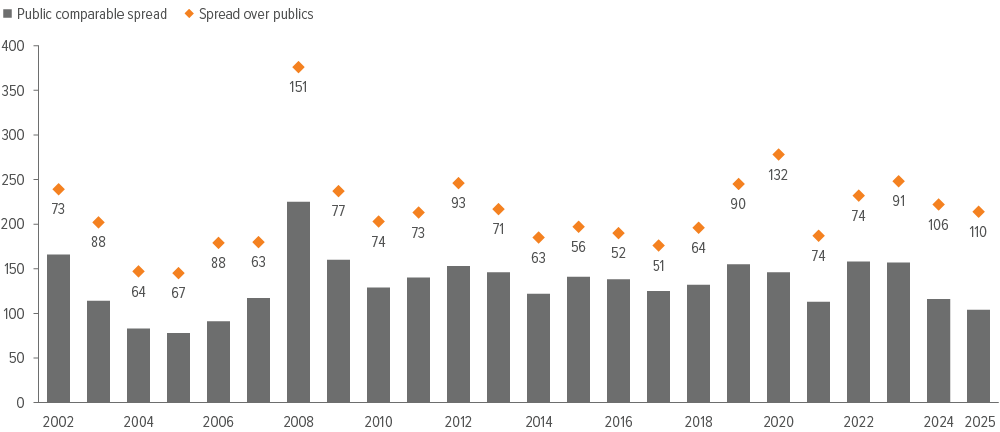

That new, large-scale borrower demand has helped keep IG private credit spreads steady even as IG public spreads moved down. IG private credit spreads have been over 100 bp to comparable corporate bonds only a few times over the past 20 years: 2008 and 2020, when financial conditions were very tight, and the past two years, when the private market saw an influx of new borrower demand (Exhibit 4).

What this means for investors right now is they can effectively rotate out of public high yield corporate bonds into investment grade private credit and achieve a meaningful step up in quality for the same or better spread.

Why are public companies suddenly hitting the private market? Heavy capex plans combined with the need to keep balance sheet leverage ratios attractive. For example, investment grade private credit is a good fit for hyperscalers’ data infrastructure construction, since it offers more complex deal terms such as delayed draws and interest accrual during construction periods that public markets and the leveraged lending markets have a hard time digesting. The private markets also have a long history of project and infrastructure finance that helps with underwriting.

Institutional investors can rotate out of high yield corporate bonds into investment grade private credit right now and potentially achieve the same or better spreads.

As of 12/31/25. Source: J.P. Morgan.

Don’t get caught in the K-hole

The U.S. economy goes the way of the consumer, and specifically the middle class and above consumer. Those consumers have been doing very well and spending a lot, and so broadly GDP growth has remained good.

Subprime and near-prime consumers haven’t been doing nearly as great, and this has given us what’s been called the “K-shaped economy:” the top half of consumers are thriving, but the bottom half are not. There’s good news and bad news about these subprime and near-prime consumers.

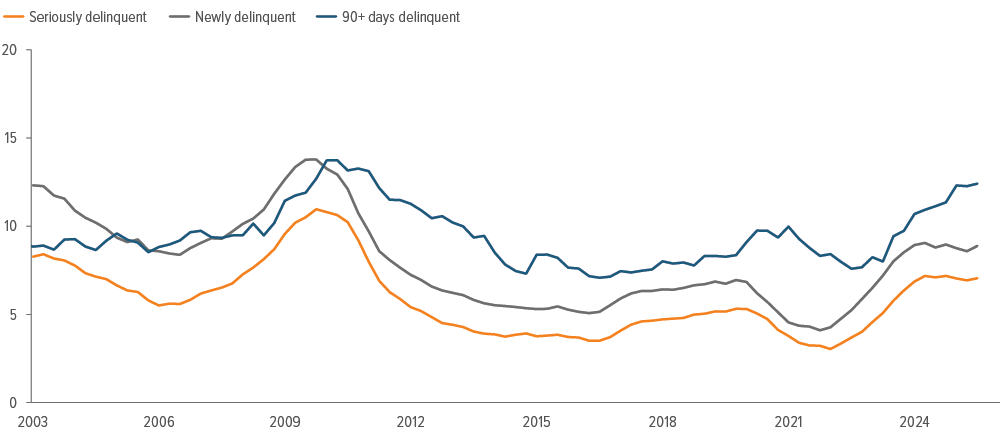

The good news is that their stress is more patchy than systemic: The average household debt service ratio remains low by historical standards, and as of end 3Q25, credit card delinquency rates are starting to decline after their early 2025 peak across all borrower categories (Exhibit 5). Auto loans seem to be the only consumer credit area where near prime and subprime defaults are still rising.2

Around 20% of consumers have subprime credit scores, and a further 20% have nearprime credit scores.3 These (generally lower income) cohorts tend to have very little effect on the overall economy. None of this is much of a problem unless you are specifically lending to or investing in debt extended to these subprime and near prime consumers, but there is one area I’d flag to keep an eye on: fintech and the subprime consumer.

This is where the potential bad news comes in. We’ve seen a lot of fintech startups that have moved aggressively into consumer lending over the past couple years. Some of those have models based heavily on recent default histories as a predictor of future activity, and that’s where the problem lies: In the immediate post- Covid environment, the revolving stress on these low-income cohorts went away for a period of time due to Federal stimulus and loan forbearance measures.

Newer fintech companies that are lending to subprime and near-prime cohorts and using models trained on those immediate post-Covid years may be in for a rude awakening as defaults are likely to come in faster and heavier than their models predict. Some of these lenders are securitizing loans into the consumer credit side of the private asset-based finance market, and we would be cautious about getting involved with them.

Be cautious with both public and private securitizations of consumer credit from fintech startups.

We do see areas of attractive consumer risk—both prime and subprime—higher up in the capital structure in public securitized credit, however.

Location, location, diversification

A basic financial skill is looking at a bull market and asking, “What hasn’t gone up yet, but has fundamentals that support it being able to go up” and then investing in that thing. In fixed income, a current answer to this could be commercial real estate.

The commercial real estate cycle became disengaged from the corporate credit cycle (which it normally lags) by the pandemic, which forced commercial real estate into an early correction. Since then, equity markets are at all time highs, corporate bond spreads are at generational tights, but non-office commercial real estate values are still down 10-20%.

Even with office, transaction and production volume came surging back to healthy levels in the second half of 2025, and the potential for further valuation decreases has diminished.

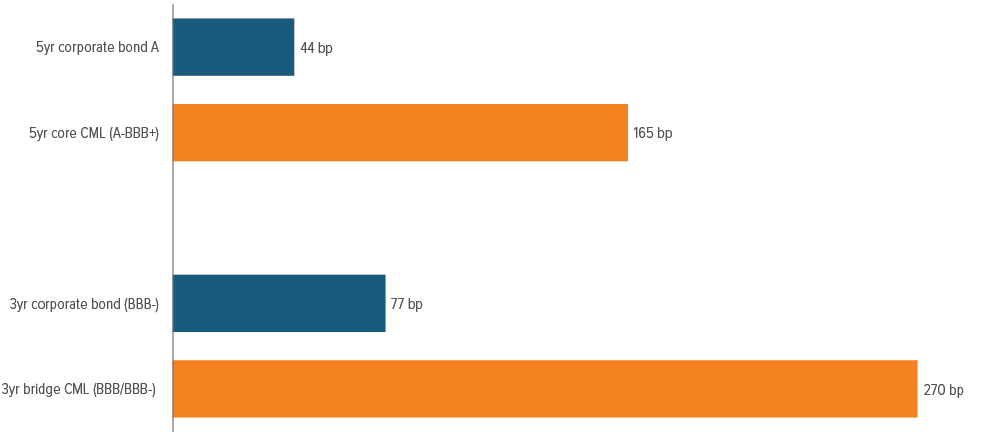

Taken all together, what that means is core CML looks good right now for institutional investors willing to pull that illiquidity lever (Exhibit 6).

Much of commercial real estate is starting its cyclical upswing.

As of 01/08/26. Source: Voya IM, Bloomberg. CML spreads represent averages; spreads tend to range 20-30 bp on either side of each number depending on the individual loan.

In public securitized credit there is a lot of opportunity in CMBS—pulling those complexity and leverage levers. An advantage of CMBS is also that, outside of single asset single borrower (SASB) securities, they offer a ready-made diversified portfolio of commercial real estate credit at whichever risk level investors feel most comfortable.

For institutional investors able to take a little more credit risk (say, BBB/BBB-), borrower demand for bridge/transitional CML has increased and there are attractive opportunities there to grab 250-290 bp over Treasuries on three-year loans (Exhibit 6).

High stock/bond correlation: Good until it isn’t

Investments in real estate-backed credit can also potentially diversify the portfolio in the event of a sentiment shift around corporate credit. It feels like everything is correlated right now—bond markets and equity markets moving in sync, with a one-year rolling correlation between the S&P 500 and the Total Return Bond Index of 0.9—so asset classes with a history of both attractive returns across economic cycles and low correlations to other asset classes are all the more valuable.4

This is where we really like mortgage derivatives, which are public fixed income securities that are effectively the remainders—the excess prepayment risk—of the collateralized mortgage obligation (CMO) creation process.

Banks like to turn agency mortgage-backed securities into par-priced components such as CMOs to reduce prepayment risk, and then they move the extra prepayment risk into interest-only (IO) or inverse interest-only (IIO) securities. It’s a big market—there are estimated to be $1.1 trillion in CMOs outstanding.

Investing in mortgage derivatives hits the leverage and complexity levers, but the core part of the strategy is fundamental analysis of the derivatives’ underlying mortgage pools. The securities themselves tend to be perpetually cheap for their yield (due to their complexity) and offer the potential of symmetric returns (unlike most of fixed income, where return potential is asymmetric). They’re also one of the few asset classes left where it’s possible to truly outperform simply by doing deep, nuts-and-bolts fundamental research.

Agency mortgage derivatives offer symmetric return potential and a history of low correlation to other fixed income sectors.

Voya has an open-ended, comingled strategy that allows easy institutional exposure to this asset class, which is one that most other asset managers do not offer. We have over 30 years as one of the largest players in the mortgage derivatives market, with a long history of low volatility and attractive investment returns in the strategy.

2026 fixed income resolutions

It’s a pretty great time to be a fixed income investor. With real yields as high as they are, investors with hefty core fixed income allocations are likely to have a good year— as long as nothing spooks the corporate bond market and sends spreads wider.

But for investors who are not satisfied with “good,” it’s also a great time to adopt some classic new year’s resolutions for your fixed income portfolio: 1) be more active, and 2) try new things.

An allocation to opportunistic securitized credit can help diversify public fixed income portfolios and add potential complexity premiums, while agency mortgage derivative strategies can add uncorrelated alpha.

For investors able to allocate to private fixed income, investment grade private credit is one of the few areas where borrower demand is outstripping supply, and commercial mortgage loans are early in their credit cycle and can offer attractive premiums to equivalent corporate bonds.

A note about risk

All investing involves risks of fluctuating prices and uncertainties of rates of return and yield. All security transactions involve substantial risk of loss. All investments in bonds are subject to market risks. Bonds have fixed principal and return if held to maturity, but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. High yield securities, or “junk bonds”, are rated lower than investment-grade bonds because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities. Highyield bonds may be subject to more liquidity risk than, for example, investment grade bonds. This may mean that investors seeking to sell their bonds will not receive a price that reflects the true value of the bonds (based on the bond’s interest rate and creditworthiness of the company). High yield bonds are also subject to economic risk, which describes the vulnerability of a bond to changes in the economy.

Private credit: Foreign investing does pose special risks, including currency fluctuation, economic, and political risks not found in investments that are solely domestic. As interest rates rise, bond prices may fall, reducing the value of the share price. Debt securities with longer durations tend to be more sensitive to interest rate changes. High yield securities, or “junk bonds,” are rated lower than investment grade bonds because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities. Other risks of private credit include, but are not limited to: credit risks, other investment companies risks, price volatility risks, inability to sell securities risks, and securities lending risks.

Commercial mortgage loans: Investments in commercial mortgages involve significant risks, which include certain consequences as a result of, among other factors, borrower defaults, fluctuations in interest rates, declines in real estate values, declines in local rental or occupancy rates, changing conditions in the mortgage market and other exogenous economic variables. The strategy will invest in illiquid securities and derivatives and may employ a variety of investment techniques such as using leverage, and concentrating primarily in commercial mortgage sectors, each of which involves special investment and risk considerations.