Bitcoin’s evolution from fringe experiment to institutional asset is reshaping global finance—driving innovation, portfolio diversification, and the rise of a powerful ecosystem of companies powering the digital economy.

Since its inception in 2009, Bitcoin’s emergence as a decentralized, scarce digital asset has laid the foundation for an entirely new financial paradigm—one that is increasingly gaining traction among institutional investors, policymakers, and traditional financial institutions. This paper explores the evolving role of Bitcoin and its broader ecosystem, highlighting three key themes shaping its long-term potential:

- A new asset class with structural advantages: Bitcoin’s deflationary design, decentralized governance, and low correlation to traditional markets1 have made it an attractive hedge and long-duration asset. Its evolution from an experimental protocol into a credible store of value is redefining how portfolios are constructed in a world of inflation uncertainty and fiscal volatility.

- The rise of a supporting ecosystem: The growth of crypto has spurred a robust ecosystem of companies—exchanges, custodians, payment rails, miners, and infrastructure providers—that are scaling blockchain utility across finance, commerce, and technology. Investments in these businesses provide diversified exposure to the crypto economy beyond direct token ownership.

- Institutionalization and integration into traditional finance: With regulatory clarity improving globally, and with infrastructure maturing—thanks to ETFs, custodians, and bank-backed digital asset services— Bitcoin and cryptocurrencies are increasingly integrated into mainstream finance. From university endowments to multinational banks, stakeholders are embracing digital assets, not as a speculative bet but as a strategic allocation in modern financial portfolios.

Bitcoin’s journey to legitimization

Bitcoin emerged in the aftermath of the 2008 global financial crisis as a response to centralized banking systems. Introduced by the pseudonymous Satoshi Nakamoto, Bitcoin’s blockchain technology—in its most simple form, a digital database that records information in a transparent and unchangeable way—allows for secure transfer of value, capped at a finite supply of 21 million coins. Bitcoin is often referred to as “digital gold,” and its scarcity, decentralization, and growing role as a macro hedge have remained central to its appeal. With each halving cycle (every four years, reducing new supply), Bitcoin has historically seen increased scarcity-driven demand.

Many investors, particularly early entrants to the asset class, have benefited from Bitcoin’s significant growth. However, its potential use cases and global impact were not immediately known. On May 22, 2010, programmer Laszlo Hanyecz made the first real-world Bitcoin transaction by paying 10,000 BTC for two pizzas—over a billion U.S. dollars at today’s exchange rate—marking a pivotal moment in cryptocurrency history and paving the way for transactions and trading.

Over the past ten years, the rise in crypto ownership has occurred at double the pace of early Internet adoption (Exhibit 1).

As of 12/31/24. Source: Blockforce Capital; Our World in Data; Crypto.com, “Crypto Market Sizing Report 2024,” 01/17/25.

The growth of the crypto ecosystem

Bitcoin’s transformation from a niche concept to a cornerstone of global finance reflects its growing acceptance among institutional leaders and governments.

Bitcoin remains the preferred asset among investors, accounting for roughly 60% of all cryptocurrency-related assets. Over time, its success inspired the development of thousands of other cryptocurrencies, known as “altcoins.” Among them, Ethereum, the second-largest cryptocurrency by market capitalization, stands out for introducing programmable smart contracts, enabling the rise of decentralized applications (dApps), decentralized finance (DeFi), and non-fungible tokens (NFTs). Subsequent platforms like Solana, Avalanche, Cardano, and many others have further advanced the space through innovations in scalability, interoperability, and user experience.

As digital assets like Bitcoin and Ethereum have gained traction, they have catalyzed the emergence of a robust and rapidly growing ecosystem of companies that support, expand, and commercialize blockchain technology. For example, the advent of centralized exchanges (such as Coinbase, Binance, and Robinhood) has made it easier for individuals to purchase Bitcoin and other crypto assets, trading fiat currencies for something much less tangible.

Source: Voya IM. For illustrative purposes only.

In addition to exchanges, the crypto ecosystem includes custodians, miners, wallet providers, data analytics platforms, payment processors, infrastructure providers, and enterprise software firms (Exhibit 2). These companies play a foundational role in scaling the crypto economy—facilitating secure trading and storage, enabling institutional access, and building the tools that allow decentralized applications to function efficiently. As adoption continues to broaden across industries and geographies, these businesses represent a compelling way to gain exposure to the growth of the digital asset space.

Institutional adoption of Bitcoin soars

In recent years, institutions have increasingly recognized Bitcoin as a legitimate and high-performing asset, and its returns have rivaled or exceeded those of most other asset classes. Institutional participation boosts Bitcoin’s credibility and aids market liquidity and price stability, encouraging broader acceptance.

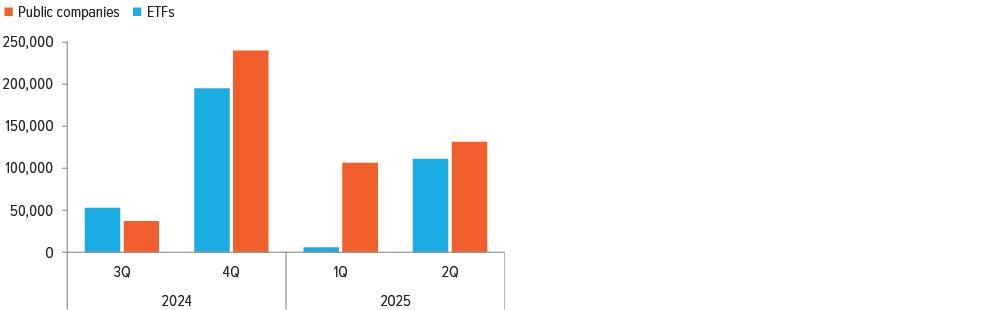

In 2Q25, corporate treasuries surpassed ETFs in Bitcoin buying for a third consecutive quarter. Public companies acquired about 131,000 coins in 2Q25, growing their Bitcoin balance 18%, according to data provider Bitcoin Treasuries. ETFs showed an 8% increase (or about 111,000 Bitcoin) in the same period (Exhibit 3).

As of 06/28/25. Source: BitcoinTreasuries.net

One of the more notable shifts in institutional crypto investment is occurring among university endowments and foundations. Emory University recently became the first U.S. university to publicly disclose a significant investment in Bitcoin, setting a precedent for peer institutions. This move reflects growing awareness of the strategic role digital assets can play in diversifying long-duration portfolios, particularly those that seek to preserve intergenerational wealth. Other prestigious universities, such as Oxford and MIT, have also demonstrated crypto-friendly postures—accepting Bitcoin for tuition payments and exploring blockchain-based payment systems.

These developments signal an emerging trend: the integration of digital assets into both operational and investment strategies across higher education.

The combination of high return potential, inflation protection, and portfolio diversification makes Bitcoin an increasingly viable component of endowment and foundation portfolios. As regulatory clarity improves and the market continues to mature, more institutions are likely to follow Emory’s lead.

Regulatory clarity and global progress

For years, unclear regulation was a major barrier to institutional adoption. Bitcoin was initially seen as a shady way for potentially unseemly characters to hide money or perform transactions anonymously. But as Bitcoin’s mainstream acceptance and performance results increased, so did its recognition as a viable store of value.

The endorsement and development of regulatory frameworks are critical for institutional investors, who require legal clarity and operational confidence before deploying capital. Increasingly, global policymakers appear to understand that crypto is not merely a speculative trend but rather a transformative financial technology with economic and geopolitical implications. The potential policy stance of the Trump administration could further influence adoption and innovation. The previous administration took a more antagonistic stance toward the crypto industry, including regulatory crackdowns on exchanges and decentralized finance platforms. A reversal of that approach— characterized by clearer rules, tax incentives, and supportive innovation policies—could open the floodgates for an increase in institutional capital.

The maturation of infrastructure has been pivotal to institutional participation:

- Regulated exchanges like Coinbase, institutional-grade custodians like Fidelity Digital Assets, and new investment vehicles like spot Bitcoin ETFs—approved by the U.S. SEC in early 2024—have bridged the gap between traditional finance and crypto.

- The endorsement of Bitcoin by figures like the Federal Reserve Chairman, who recently acknowledged it as a digital counterpart to gold, has further cemented its status.

- The European Union’s Markets in Crypto-Assets (MiCA) framework and Hong Kong’s push to become a crypto hub also reflect a global pivot toward constructive engagement with digital assets.

These developments reflect a broader acceptance of Bitcoin as a credible store of value and portfolio diversifier. These decisions paved the way for global adoption, shifting what was largely seen as a risky and speculative individual transaction to one that is increasingly ripe for wider institutional acceptance.

Long-term integration into traditional financial assets

The convergence of cryptocurrencies and traditional finance is already underway. Major banks, including J.P. Morgan and Citi, are piloting blockchain-based solutions for settlements and asset tokenization. In addition, stablecoins—cryptocurrencies pegged to reference assets, such as the U.S. dollar—are becoming more popular. They aim to combine the benefits of digital assets with price stability, making them ideal for payments, remittances, and decentralized finance (DeFi). Stablecoins may offer faster, cheaper cross-border transactions, and they are increasingly being integrated into traditional finance, with supply potentially exceeding $3 trillion by the end of the decade.2 Meanwhile, some monetary authorities are exploring central bank digital currencies (CBDCs), which adopt crypto-inspired frameworks for secure, efficient, and programmable monetary systems.

Beyond Bitcoin, Ethereum, and other “Layer 1” smart contract platforms could power the next generation of internet and financial infrastructure, Real-world asset tokenization (e.g., real estate, bonds, equities) and decentralized finance are likely to substantially expand crypto’s total addressable market. As these innovations take hold, they are expected to further redefine global capital markets—introducing new efficiencies, improving transparency, and democratizing access to financial services.

Bitcoin is (likely) here to stay

Bitcoin’s transformation from a nonconventional experiment into a globally recognized store of value and an increasingly institutional asset marks one of the most profound shifts in modern finance. Barring any unforeseen calamity or global collapse due to any technological flaws or hacks, Bitcoin is unlikely to go away. Cryptocurrencies, once dismissed as speculative tools, are now at the forefront of innovation, institutional strategy, and long-term portfolio construction.

As individuals, corporations, universities, foundations, asset managers, and policymakers increasingly embrace Bitcoin and other cryptocurrency and related assets, the financial system is undergoing a tectonic change. With regulatory clarity, institutional infrastructure, and the potential for outsized returns, Bitcoin and its counterparts are poised to become not just a complement to but a cornerstone of our global financial future.

A note about risk: Investing in cryptocurrencies and cryptocurrency-related companies involves risks which include, but are not limited to: Market volatility: Cryptocurrencies are known for their extreme price volatility. The value of cryptocurrencies can fluctuate widely within a short period, leading to potential significant losses for investors; Regulatory uncertainty: The regulatory environment for cryptocurrencies is rapidly evolving. Changes in laws and regulations can impact the legality, use, and value of cryptocurrencies. Investors should be aware of the legal status of cryptocurrencies in their jurisdiction and any potential regulatory changes that could affect their investments; Liquidity risks: The liquidity of cryptocurrencies can vary significantly. Some investments may have low trading volumes, making it difficult to buy or sell large amounts without affecting the market price. This can result in unfavorable trading conditions and potential losses.; Operational risks: Cryptocurrency exchanges and platforms may experience technical issues, outages, or security breaches. These operational risks can disrupt trading activities and lead to financial losses for investors.; Legal and compliance risks: Cryptocurrency-related companies may face legal and compliance challenges, including regulatory investigations, enforcement actions, and litigation. These risks can impact the company’s operations, reputation, and financial stability. Investors should carefully consider these risks and seek professional advice before investing in cryptocurrencies or cryptocurrency-related companies. It is important to stay informed about the latest developments in the cryptocurrency market and regulatory landscape.