Key Takeaways

The investment case for US high yield is compelling—appealing total return potential supported by stable credit fundamentals.

Adding US high yield bonds to a core fixed income allocation has historically improved risk/reward profiles, but short-duration high yield in particular can help expand the efficient frontier.

Get to know Voya Short Duration High Income Fund and its goal of delivering strong risk-adjusted performance. Consider using it to complement a core fixed-income allocation, or as a complement to full-market high yield.

Portfolio Manager Jim Dudnick discusses how, where and when to consider short-duration high yield bonds—and what makes Voya Short Duration High Income Fund stand out.

Why is US high yield attractive today?

Looking at the broader US high yield market, we see multiple reasons why this is a compelling asset class. With yields over 7%, high yield offers the potential for equity-like returns but with less volatility.1 When we look at credit fundamentals, we also see strong support for the high yield market.

- Credit metric stability: Net leverage remains below the long-term average, and interest coverage is settling above the long-term average. The result is a high yield bond market that has a higher credit quality skew and is better positioned to weather an economic slowdown (should it occur).

- Muted default rate expectations: In addition to balance sheet health, near term refinancing obligations remain low, and management teams continue to exercise balance sheet discipline. Given these factors, the default rate for US high yield should stay below the historical average of 3-4%.

Why invest in the short end of the high yield market?

We see three primary benefits to investing in the front end of this asset class:

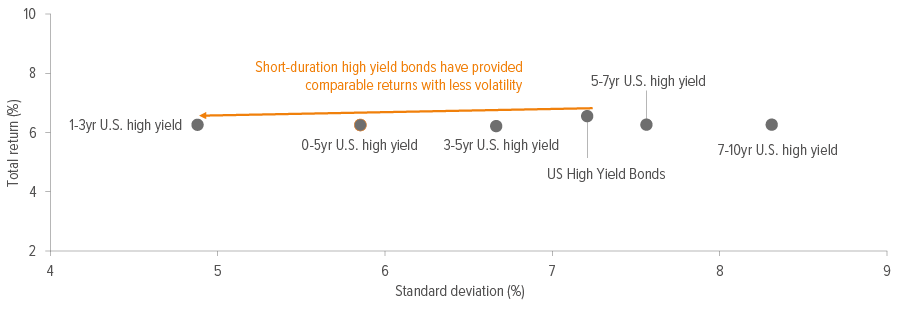

- A better risk/return ratio. The front end of the US high yield market (as measured by the 1-3 Year US High Yield Index) has provided comparable returns to the broader US high yield market, but with significantly lower volatility (Exhibit 1).

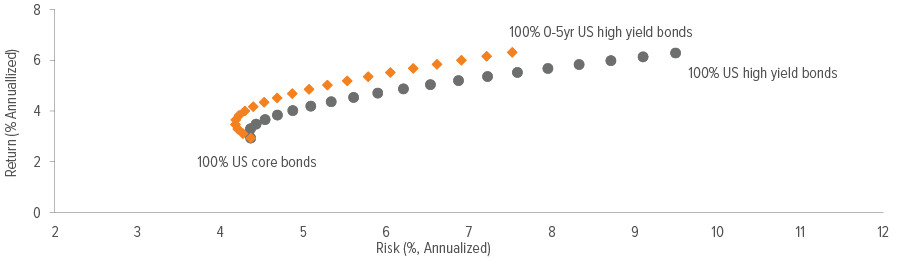

- An expanded efficient frontier. Investors have long known that adding US high yield bonds to their core fixed income allocations can improve outcomes and expand the efficient frontier. But many investors don’t know that short-duration high yield has done a particularly good job of expanding the efficient frontier (Exhibit 2).

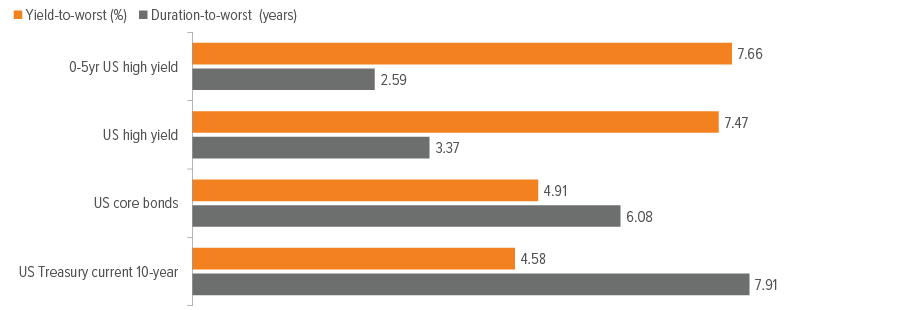

- A compelling yield-to-duration tradeoff. Record-high new issuance and refinancing activity in 2020 and 2021 pushed coupons and interest expense down and maturities out, creating an even more compelling yield-to-duration trade-off at the short end of the US high yield market (Exhibit 3).

As of 12/31/24. Source: Voya Investment Management, FactSet, ICE Data Services. Past performance is not indicative of future results. This statement reflects performance and characteristics for the time period shown, results over a different time period may have been more or less favorable. See index associations and additional disclosures at the end of this document. Investors cannot invest directly in an index. Index returns are presented as net returns, which reflect both price performance and income from dividend payments, if any, but do not reflect fees, brokerage commissions or other expenses of investing.

As of 12/31/24. Source: Voya Investment Management, FactSet, ICE Data Services. Past performance is not indicative of future results. This statement reflects performance and characteristics for the time period shown; results over a different time period may have been more or less favorable. See index associations and additional disclosures at the end of this document. Investors cannot invest directly in an index. Index returns are presented as net returns, which reflect both price performance and income from dividend payments, if any, but do not reflect fees, brokerage commissions or other expenses of investing.

As of 12/31/24. Source: Voya IM, FactSet, ICE Data Services. Past performance is not indicative of future results. This statement reflects performance and characteristics for the time period shown, results over a different time period may have been more or less favorable. See index associations and additional disclosures at the end of this document. Investors cannot invest directly in an index. Index returns are presented as net returns, which reflect both price performance and income from dividend payments, if any, but do not reflect fees, brokerage commissions or other expenses of investing.

Get to know Voya Short Duration High Income Fund

Philosophy

Active management focused on in depth industry assessment, thorough fundamental analysis, and rigorous credit research can uncover compelling investment opportunities and minimize portfolio volatility, producing superior risk adjusted performance.

Team

- Seasoned investment team with dedicated portfolio management

- Aims to achieve strong risk adjusted performance

- Consistent application of investment philosophy over multiple market cycles

Fund2

- Objective: High level of current income with lower volatility than the broader high yield market

- Outcome oriented approach

- Focuses on shorter duration issues to help minimize interest rate risk and utilizes a rigorous credit research process to help minimize potential credit losses

How Voya Short Duration High Income Fund addresses three key risks

Interest rate risk, credit risk and liquidity risk are the main risks that cause a bond to move up or down in price

Here is how Voya Short Duration High Income Fund addresses these risks:3

Where does Voya Short Duration High Fund fit in investor portfolios?

The Fund seeks consistent income and strong risk-adjusted performance compared with fixed income—both core bonds and high yield.

As a result, one way to use Voya Short Duration High Income Fund is to complement an allocation to full-market high yield. The Fund seeks a lower beta to the high yield market, potentially enhancing portfolio diversification by offering a narrower range of annual returns, and providing an asymmetric return profile.

Voya Short Duration High Income Fund can also be a good complement to a core fixed income allocation. The Fund seeks a low correlation to core bonds to help diminish the magnitude of negative performance outcomes and reduce overall volatility—all while seeking enhanced returns and improved positioning with a higher yield and a lower duration.

Voya US Short Duration High Income

Summary: Capital preservation emphasis, investing in high-yield corporate debt while seeking to minimize credit, liquidity, and interest rate risks.

Objective: The Fund seeks a high level of current income with lower volatility than the broader high yield market.

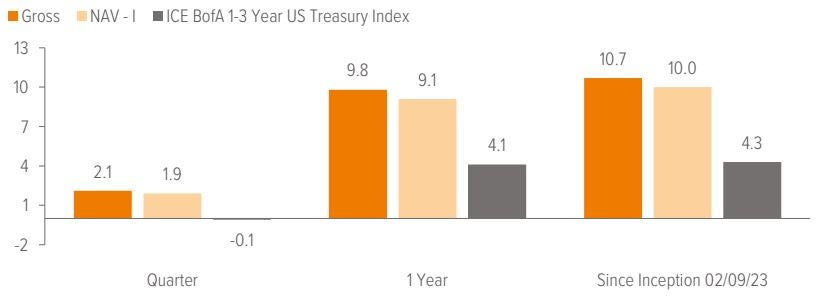

Inception–Class I: February 9, 2023

Strategy/Fund assets: 3.25–3.75 years

Portfolio managers: James Dudnick, CFA; Steven Gish, CFA; Justin Kass, CFA

Benchmark: ICE BofA 1-3 Year US Treasury Index

As of 12/31/24 unless otherwise noted. Past performance does not guarantee future results. See disclosure for more important information. Performance numbers for time periods greater than one year are annualized. Current performance may be lower or higher than the performance information shown. The investment return and principal value of an investment in the portfolio will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. You may obtain performance information current to the most recent month-end by visiting www.voyainvestments.com. Returns for the other share classes will vary due to different charges and expenses. Performance assumes reinvestment of distributions and does not account for taxes. SEC fund returns assume the reinvestment of dividends and capital gain distributions and include a sales charge. Net Asset Value fund returns assume the reinvestment of dividends and capital gain distributions. Results would have been less favorable if the sales charge were included. Source: Voya Investment Management.

The performance quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. The investment return and principal value of an investment in the Portfolio will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month-end, please visit www.voyainvestments.com.

1 The Adviser has contractually agreed to limit expenses of the Fund. This expense limitation agreement excludes interest, taxes, investment-related costs, leverage expenses, and extraordinary expenses and may be subject to possible recoupment. Please see the Fund’s prospectus for more information. The expense limits will continue through at least 08/01/2025. Expenses are being waived to the contractual cap.

2 Current Maximum Sales Charge: 2.50%.

3 ICE BofA 1-3 Year US Treasury Index.