Generative AI needs the kind of data and processing power that only cloud computing can provide — and this creates attractive investment opportunities.

Highlights

- Generative AI is having an “iPhone moment” — it has the potential to transform not only the hardware, software and security industries, but the ways that consumers create and absorb information.

- AI relies on the infrastructure offered by large-scale cloud service providers called “hyperscalers,” without which it would essentially just be computer code.

- Generative AI could be the next major catalyst for growth in cloud computing, reminiscent of how the launch of Amazon Web Services helped bring cloud services into the mainstream.

Companies are all-in on AI

Generative artificial intelligence (gen-AI) technology has existed for decades, but there’s a reason that applications such as ChatGPT and DALL-E recently captured the public imagination. These game-changing technologies have shown the world how transformative and disruptive AI can be. That’s why some tech industry watchers are saying the recent advances in gen-AI are an “iPhone moment” — a reference to the way Apple’s 2007 launch of the iPhone introduced a new era of mobile connection, consumption and computing.

Similar to the iPhone, gen-AI has the potential to fundamentally alter how consumers create and absorb audio, visual and textual information. But many of the same companies that were caught flat-footed by the iPhone are keenly aware of how gen-AI can help them increase productivity and streamline workflows — and perhaps transform entire industries. To avoid being outrun, companies of every stripe are accelerating AI investment, quickly deploying practical AI tools such as GPT plugins and chatbots, and holding in-depth discussions about the implications for their businesses, employees and investors.

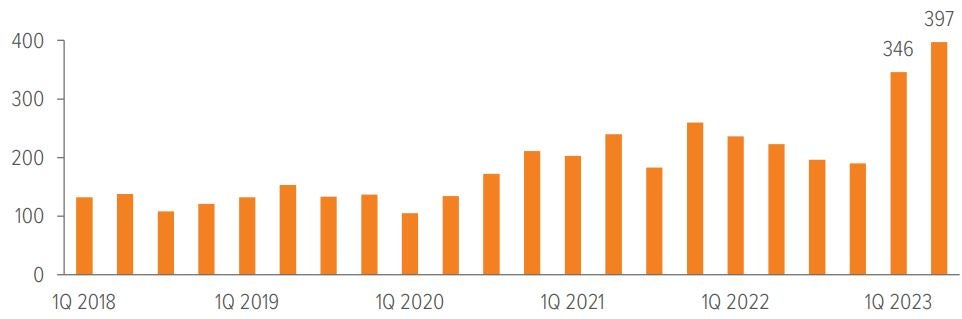

That may be why there’s been such a spike in mentions of “AI” and “cloud” during recent earnings calls (Exhibit 1). And in May, Goldman Sachs issued a report1 estimating a 400 basis point improvement in aggregate profit margins for U.S. companies over the next decade due to the incorporation of various AI technologies (especially generative AI).

As of 06/30/23. Source: Bloomberg.

Cloud computing is central to AI’s future

AI isn’t a single technology, but an umbrella term that covers a variety of technologies and training techniques (natural language processing, virtual agents, robotic process automation, deep learning, machine learning, etc.). Each of these tools needs an immense amount of data and significant computational power to train and run its models. Without the infrastructure to make it all work, AI is essentially just computer code.

That’s why cloud computing is essential to fulfilling AI’s promise — and only the large-scale cloud service providers, called “hyperscalers,” are equipped to handle the enormous data workloads. (The hardware alone used to train the GPT-4 model was estimated to cost $100 million.2) Even these massive hyperscalers will need to expand as data volume and complexity continue to grow.

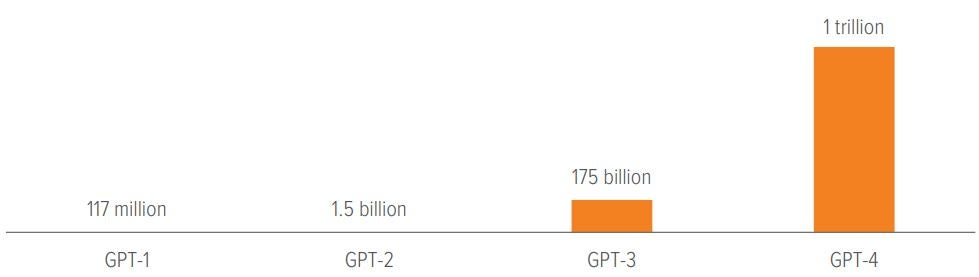

Case in point: Consider how much data was needed to build, train and improve the large language models at the core of generative AI technologies:

- The machine learning model off of which GPT-3 is run was trained on 45 terabytes (TB) of text data, which is the equivalent of 1 million feet of bookshelf space.

- The developers used approximately 175 billion model parameters (configuration variables). More trainable parameters mean more accurate output (Exhibit 2).

- About 2.5 quintillion (10^18 bytes) of data are created every day globally — an amount that is expected to double every two to three years.3 The true power of gen-AI lies in its ability to convert this data into useful tools for companies and consumers.

As of 03/23. Source: OpenAI. GPT = Generative pre-trained transformer.

How investors can capitalize on the growth opportunity

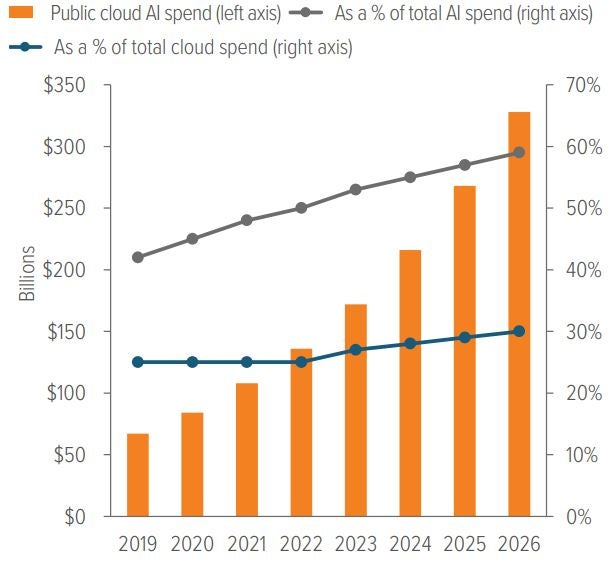

A few years ago, cloud spending was forecast to continue double-digit growth for the foreseeable future, but the industry was widely believed to have entered the mid-stage of its life cycle. ChatGPT, DALL-E and other gen-AI applications changed all that — a transformational moment reminiscent of 2006, when the launch of Amazon Web Services helped bring cloud services into the mainstream. As such, we believe generative AI will be the next major catalyst for growth in cloud computing (Exhibit 3).

- The total volume of cloud spending related to AI is expected to grow substantially over the medium term to over $300 billion by 2026.4

- Of the total addressable market of AI-related spending, the portion dedicated to cloud infrastructure and services is expected to grow from 50% today to almost 60%, reflecting the data-intensive nature of future models and inference uses.4

- RBC Capital Markets projects an increase of 26% in cloud providers’ total addressable market due to generative AI.5

Beyond the cloud, we believe other AI-enabled industries will benefit as they leverage large language models to gain efficiencies in their operations and focus their revenue-generating efforts on the highest-yielding areas. We believe some of the main beneficiaries will be:

- Software (cloud service providers, SaaS, customization)

- Technology hardware (advanced GPUs, data centers, edge computing)

- Security (data protection, data audits, regulatory compliance)

Given the expansive and transformative power of generative AI, and its ability to reach into many industries and sectors, we believe investors should take a more diversified and comprehensive approach to the opportunity set.

As of 03/23. Source: Morgan Stanley Research, IDC.