Key Takeaways

GNMA bonds are privately issued mortgage-backed securities that are explicitly guaranteed by the U.S. government, offering diversification benefits and attractive yields relative to Treasury bonds.

Historically, GNMA bonds have outperformed when equities and credit securities decline, helping to generate positive portfolio returns through bear markets.

Soaring mortgage rates have massively reduced prepayment risk, creating a more compelling entry point for GNMA bonds relative to the previous decade.

GNMAs can be a compelling way to defend against unexpected market shocks, offering a risk profile similar to U.S. Treasuries but with higher yields.

What are GNMAs?

GNMA bonds are any privately issued mortgage-backed securities guaranteed by the Government National Mortgage Association (GNMA, also known as “Ginnie Mae”) to have timely repayment of principal and interest. GNMA is a wholly owned government agency established in 1968 to guarantee mortgage-backed securities for single-family and multi-family loans insured by various government agencies. GNMA bonds are the only mortgage-backed securities that are explicitly guaranteed by the United States government.

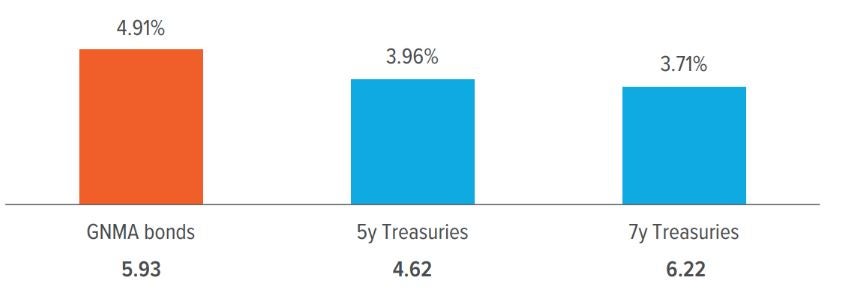

As of 03/31/25. Source: Bloomberg Index Services, Ltd., Voya IM. Yield to worst is the minimum yield that an investor can expect to receive on a bond, considering all possible call or repayment dates. Duration is the number of years it takes to recoup a bond’s true cost, based on the present value of all future coupon and principal payments. Past performance is no guarantee of future results. Investors cannot invest directly in an index.

GNMA bonds represented by the Bloomberg GNMA Index. 5y and 7y Treasuries represented by the Bloomberg Bellwether Indices.

GNMAs can be an anchor during market events

Investors seeking relative safety typically consider instruments such as U.S. Treasuries, money market funds, short-term bond funds, or cash. But cash and money market instruments don't offer the diversification potential of GNMA bonds, and U.S. Treasuries offer less yield relative to GNMAs.

GNMA bonds have a history of mitigating risk and delivering attractive yield through a variety of market environments, helping investors navigate uncertainty. Few “low-risk” bond sectors have delivered this protection historically, including short-term bond strategies.

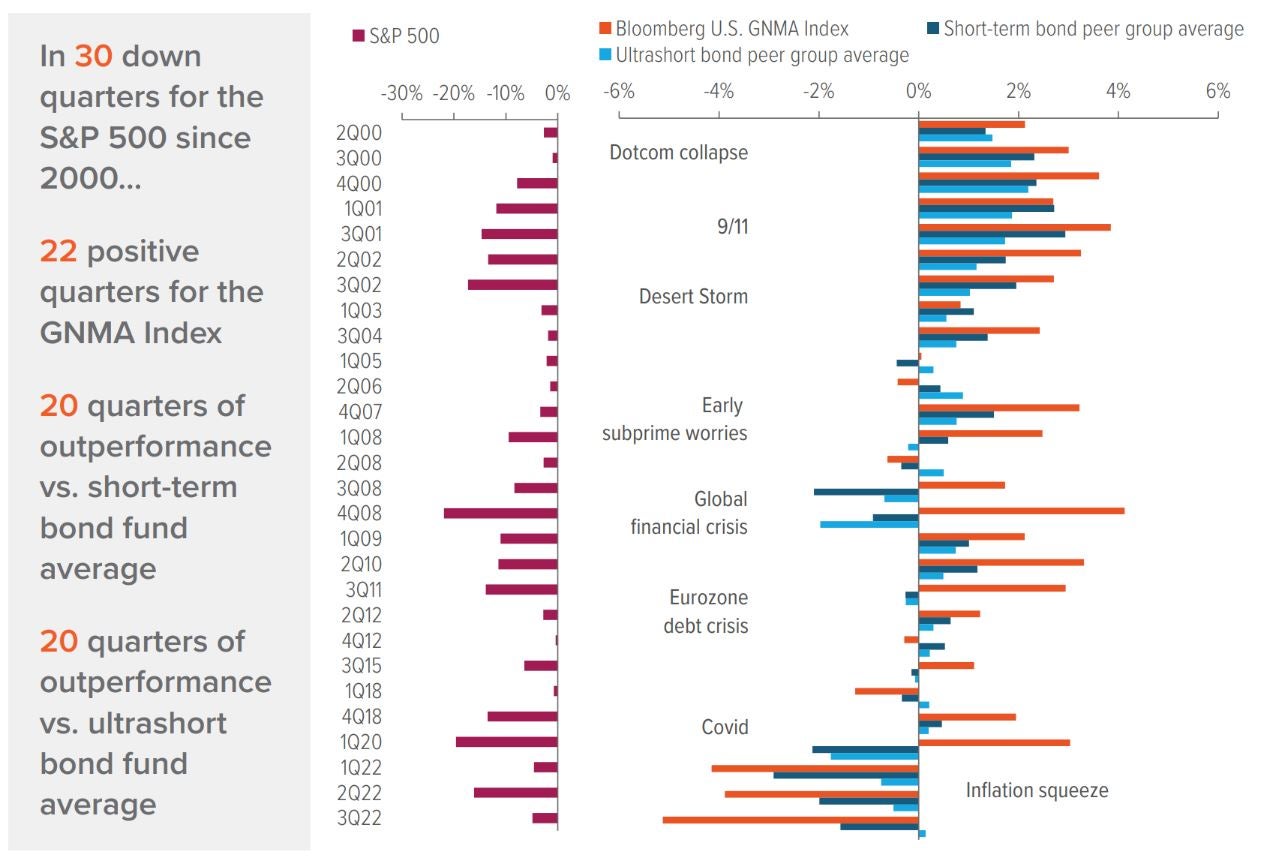

For example, the S&P 500 Index has declined in 30 of the 97 quarters since the start of 2000. GNMA bonds had positive returns in a large majority of these periods, and frequently outperformed the fund averages for Morningstar’s Short-Term and Ultrashort bond peer groups. Notably, GNMAs had positive returns in periods of extreme volatility, such as the global financial crisis and Covid. By contrast, the ultrashort and short-term bond fund peer group averages had negative returns during these crises, as they may have included more credit risk than investors realize.

One notable exception was in 2022, when high inflation created substantial headwinds for most fixed income sectors, including GNMA bonds.

As of 03/31/25. Source: Standard & Poor’s, Morningstar, Voya IM. Past performance does not guarantee future results. Investors cannot invest directly in an index. See back page for definitions and important disclosures.

How do GNMA bonds compare with various “low risk” alternatives?

Why GNMAs now

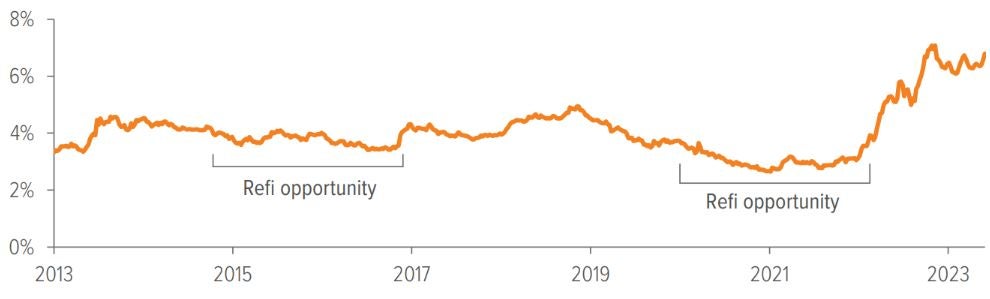

Historically, the benefits of falling interest rates on GNMA bonds have been tempered by the resultant increase in mortgage refinancing.

However, the post-Covid interest rate environment provided opportunities to purchase a new home (or refinance an existing higher-rate loan) at historically low mortgage rates.

As a result, many homeowners are sitting happily with mortgage rates that are significantly lower than the current prevailing rate.

This means there would need to be a substantial move lower in rates to bring back the financial incentive to refinance. We believe this situation makes GNMA bonds a historically attractive diversifier.

The below chart shows how sensitive mortgage-backed securities (like GNMAs) are to interest rate movements because borrowers can prepay. When rates are low and refinancings are easy, MBS convexity (which measures how the duration of a bond changes as interest rates fluctuate, indicating how much the price of a bond will change for a given change in yield) is very negative (shown in dark blue below). Prices don’t rise much if rates fall further, but they can fall faster if rates rise—an investor headache.

When rates are high and refis are rare, convexity moves toward zero. Cash flows become more predictable and price behavior looks more like a regular bond.

As of 05/31/23. Source: Freddie Mac (Primary Mortgage Market Survey), Bloomberg,

A note about risk: All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. You could lose money on your investment and any of the following risks, among others, could affect investment performance. The following principal risks are presented in alphabetical order which does not imply order of importance or likelihood: Credit; Derivative Instruments; Environmental, Social, and Governance (Fixed Income); Interest Rate; Liquidity; Market Disruption and Geopolitical; Mortgage-and/or Asset-Backed Securities; Other Investment Companies; Prepayment and Extension; Portfolio Turnover; Repurchase Agreements; Securities Lending; U.S. Government Securities and Obligations; When-Issued, Delayed Delivery and Forward Commitment Transactions. Investors should consult the Fund’s Prospectus and Statement of Additional Information for a more detailed discussion of the Fund’s risks. While the Fund invests in securities guaranteed by the U.S. government as to timely payments of interest and principal, the Fund shares are Not Insured or Guaranteed. Investors should consult the Fund’s Prospectus and Statement of Additional Information for a more detailed discussion of the Fund’s risks. An investment in the Fund is not a bank deposit and is not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other government agency.