When most people think of digital twins, they might envision their own avatars wandering around the metaverse. But the corporate world has turned the technology into something much more practical, making replicas of products and infrastructure to use in bold new ways.

Key takeaways

- From virtual cars to a digital copy of an entire nation, the world is increasingly relying upon digital twins.

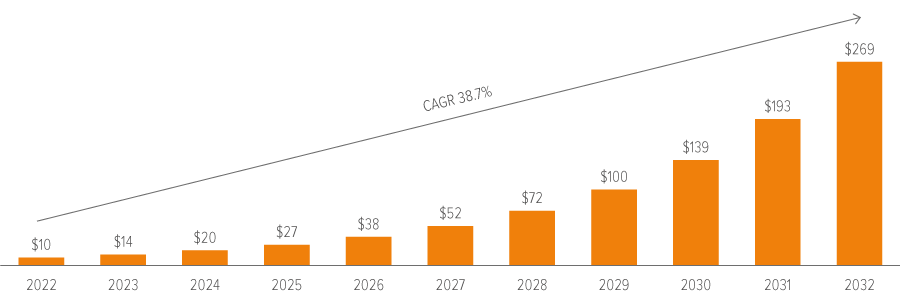

- The global digital twin market could reach $269 billion by 2032, a CAGR of 38% from today’s level.

- This technology helps firms predict maintenance, optimize resources, develop innovative products and more—which is why we believe digital twins will soon become ubiquitous.

In the news: Digital twins on the rise

Digital twins are software-based replicas of existing physical objects or systems that can be powered by artificial intelligence (AI) and fed by real-world sensors to keep the virtual copy updated in real time. While digital twins aren’t new, recent leaps in AI and data science have prompted a growing number of companies and governments to use twin technology to gain efficiencies, spur innovation and cut costs. Here are a few notable examples:

Improving the automotive experience

A well-known electric car manufacturer (“ECM”) creates a digital twin of every car it sells. By outfitting each car with sensors and then aggregating that data in a digital twin in the cloud, ECM can track its cars throughout their lifespans. Monitoring the performance of each car in the field helps determine which ones are functioning properly and which ones need maintenance. ECM can then address a host of issues with customized software updates—for example, fixing a rattling door by adjusting the car’s hydraulics. By minimizing the need for repairs and maintenance, ECM can reduce the cost of servicing cars under warranty and enhance the customer experience.

Keeping infrastructure safe

Digital twin software helped a European robotics company (“ERC”) construct and monitor the world’s first 3D-printed bridge. ERC equipped this pedestrian bridge with a network of sensors that help capture all activity—from walking to running to cycling—for the bridge’s digital twin. This helps engineers monitor the bridge’s structure and gain real-time information about how it’s responding to the stresses caused by everyday use. ERC’s experience could help turn 3D printing into a mainstream engineering tool, radically changing the conventional construction process.

Making cities smarter

Cities and countries are also getting in on the action. In the U.S., the Orlando metro region has developed a 3D model of its buildings, topography and infrastructure to help grow its image as a hub for technology, and to help predict how different infrastructure investments could change the city for better or worse. And in Singapore, a massive digital twin is helping this small but densely populated nation function more sustainably. Singapore’s model currently uses more than 100 terabytes of raw data—including 3 million street-level images and 160,000 overhead views.1

Why it matters

The digital twin market seems set to experience robust growth. One recent study estimates the global digital twin market will grow from $10 billion in 2022 to $269 billion in 2032, a compound annual growth rate (CAGR) of 38.7% (Exhibit 1).2 Consulting firm McKinsey also found that 70% of C-suite executives at large enterprises are already exploring and investing in digital twins.3 So, how might companies and investors benefit from the increasing use of digital twins? Here are some of their many potential applications across industries.

As of 08/23. Source: Precedence Research.

Predictive maintenance

In manufacturing, digital twins can be used to predict when equipment is likely to fail so that maintenance can be performed before an issue arises. This can help reduce downtime and prevent disruptions in the production process.

Resource optimization

Digital twins can help optimize the use of resources such as energy and water. For example, companies can reduce resource consumption—without compromising productivity—by monitoring how different pieces of equipment are being used in the field.

Product development

The automotive industry is using digital twins to develop new vehicles faster and at a lower cost. The technology lets engineers test out different design options virtually before building prototypes.

Simulation

Digital twins can be used to simulate various scenarios, such as traffic patterns or demographic shifts. This information can then be used to make better-informed decisions about where to build new infrastructure or how to allocate resources.

The bottom line

Digital twins leverage many different technologies, including unstructured databases, the internet of things (IoT), AI, virtual reality (VR), augmented reality (AR), cloud computing and more. We believe that as these technologies evolve, the use of digital twins is likely to grow as well, which could spell opportunity for forward-thinking investors.