Key Takeaways

The biggest driver of alpha (and risk) in mortgage derivatives is prepayments— the rate at which homeowners pay off their mortgages early, most commonly by refinancing.

With residential mortgage rates at 7.29%, prepayments are both very low and less dependent on the next move in interest rates than at any other time in recent history.

Spreads in IOs and IIOs have remained wide, however—the sector is still offering yields upwards of 10%, with minimal credit risk and little correlation to either fixed income or equity returns.

When fewer people refinance, IOs and IIOs become more valuable

Interest-only (IO) and inverse interest-only (IIO) securities are byproducts of some mortgage investors’ de-risking process. An investor in a mortgage pool priced above par can convert that security into a less risky lower-coupon or floating-rate collateralized mortgage obligation bond priced at par by stripping away some of its future interest cash flow. This excess interest—and prepayment risk—has to go somewhere, and so it is swept into a zero-principal, interest-only instrument that has no natural home and thus tends to be quite cheap. Some IOs are currently yielding upwards of 10%, with spreads of 500 basis points over Treasuries at recent prepayment speeds.1

Agency IOs and IIOs have minimal credit risk, because they are derived from mortgages backed by Fannie Mae, Freddie Mac or Ginnie Mae. However, they are highly sensitive to mortgage prepayments, which are both their biggest risk and biggest opportunity. Prepayments coming in 1% lower than market expectations can add 1% of yield for the entire life of the IO or IIO, which tends to be 5–10 years.2

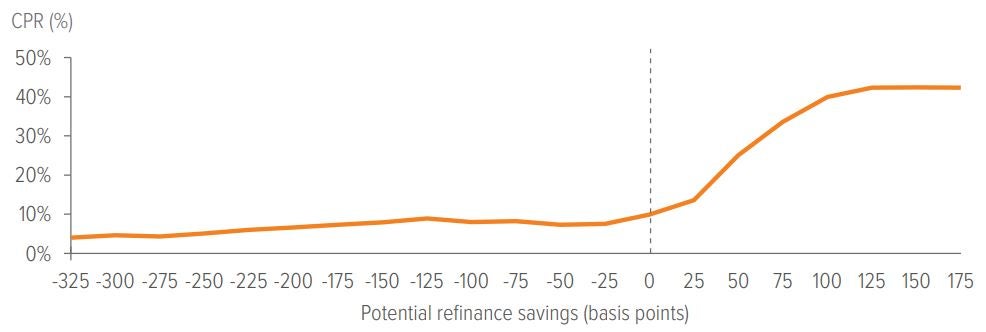

The biggest driver of prepayments is homeowners refinancing their mortgages to a lower rate:

Source: Freddie Mac; CPR & CDR. Data from 2021–2022. Current prevailing mortgage rate of 7.29% as of November 22, 2023.

Prepayments are measured by the conditional prepayment rate (CPR), which is the percentage of outstanding principal in a mortgage pool paid off prematurely each year. As can be seen in Exhibit 1, prepayments range around 4–9 CPR when current rates are the same as or higher than the underlying mortgages’, meaning there is no financial incentive for homeowners to refinance. Historically, it takes market mortgage rates falling 50 basis points (bp) below a homeowner’s existing mortgage rate before the homeowner is incentivized to refinance.

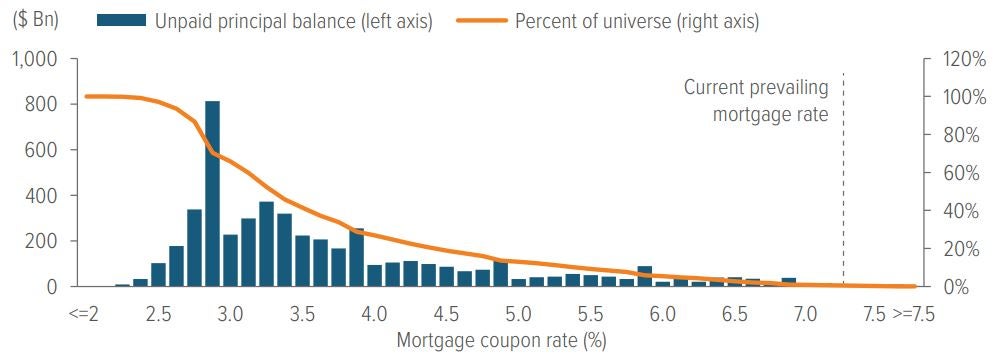

Now let’s see how many mortgages from the past 30 years might have a financial incentive to refinance, even if current rates drop 50–100 bp:

As of 11/22/2023. Source: Fannie Mae, Freddie Mac, Voya IM.

That would be almost none of them, then. The vast majority (87%) of outstanding mortgages have rates below 5%, with most clustered in the 2.75–3% range.

What this also means is the sector’s defining trait—borrowers’ prepayment behavior— depends less on the next move in interest rates than it has at any time in recent history.

Diminished prepayment uncertainty has not yet been priced in

The market understands that prepayment speeds are likely to stay low. Prepayment speeds have been slow for over a year now, hovering around a CPR of 5. But spreads in the sector have not tightened. IOs and IIOs are trading at roughly the same spreads— and have much higher yields, given the upward moves in interest rates—as they were in 2020–2021, when prepayment uncertainty was much higher.

Prepayment uncertainty has declined because when nobody refinances, not only are prepayments much slower overall, but the remaining sources of prepayments are much more stable and predictable. For example, people moving for work or due to changes in their families. This means that investors engaging in detailed fundamental analysis of prepayments are, by and large, able to forecast prepayments to a much greater degree of accuracy.

However, not many investors bother doing deep fundamental analysis of prepayments. IOs and IIOs are held by a broad range of investors, but many only hold tiny allocations to juice a little extra return out of fixed income portfolios and/or modify their duration and rate of return. Mortgage derivatives are not these investors’ main business, so they rely heavily on out-of-the-box prepayment models, such as those from Yield Book or Bloomberg. And with IOs and IIOs so cheap right now, in such a low-uncertainty environment, investors are still able to achieve 10% yields on a hold-to-maturity basis to market consensus prepayment assumptions. But anywhere models are less than perfect in their forecasts of borrower behavior, there is an opportunity to do better.

Deep prepayment expertise can search out relative value

There is a huge dispersion in borrower characteristics between the different mortgage pools from which IOs and IIOs are derived. Mortgage originators group similar loans together based on defining traits that make their prepayment behavior distinctive, because that makes the ensuing securities more appealing to investors. This might be a geographic concentration (e.g., New York loans, which have different tax consequences for refinancing), a certain size of loan balance, a property type (e.g., loans on vacation homes), a borrower credit score range, a particular federal or state guarantee program, or a combination of these. This naturally creates variation in the prepayment rates of these mortgage pools—and of any IOs and IIOs derived from them—versus the market’s national average CPR assumption.

IOs and IIOs are very cheap right now by most measures, and that’s enough for most market participants. But not Voya. Our mortgage derivatives team’s core expertise is in prepayment behavior and how it creates relative value. We specialize in analyzing changes in the mortgage landscape— including factors such as credit underwriting, federal and local government policy, originator solicitation behavior, and impacts of financial technology, to name but a few—and how they may affect particular subsets of borrowers. For example:

- A state passes a tax on mortgage refinancing. An IO populated by borrowers from that state may now prepay a bit slower than the national average.

- A particular bank pulls back from mortgage lending, making it more difficult for borrowers in that bank’s main catchment area to refinance a loan.

- Changing regulatory requirements increase fixed compliance costs, disproportionately impacting prepayments of smaller loans.

- A growing second-lien and home equity line of credit market gives cash-strapped borrowers an attractive alternative to a cash-out refinance.

Once we have a view on which subtypes of borrowers are likely to prepay differently to market expectations, we then find mortgage-related assets with concentrations of those types of borrowers. Because most participants in the mortgage derivatives market neither want nor need to engage in this granularity of analysis, those securities’ prices often do not reflect the impact of this borrower subtype’s differing behavior.

Voya is a multibillion-dollar investor in the mortgage derivatives space, with a core prepayment expertise that goes back 30 years. As one of the largest investors in the sector, with a team of seasoned mortgage investors, Voya is able to dedicate resources to deep, fundamental prepayment analysis. This ability to target undervalued securities, as well as capture relative value opportunities, enables Voya’s mortgage derivatives group to obtain highly attractive returns for its clients.

Conclusion

Mortgage derivatives are a highly liquid, publicly traded asset class with a history of attractive returns going back decades, and they exhibit little to no correlation with other asset classes. IOs and IIOs are historically cheap right now, yields of 10% are attainable for most investors, and prepayment speeds are at their lowest since the early 1980s—resulting in correspondingly low prepayment uncertainty. As more large institutional investors expand their portfolios into alternative investments, this represents a highly opportune time to enter the mortgage derivatives market.

Our team would welcome the opportunity to discuss how mortgage derivatives can complement our clients’ portfolios.

|

Risks of Investing The principal risks are generally those attributable to bond investing. Holdings are subject to market, issuer, credit, prepayment, extension, and other risks, and their values may fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. The strategy invests in mortgage-related securities, which can be paid off early if the borrowers on the underlying mortgages pay off their mortgages sooner than scheduled. If interest rates are falling, the strategy will be forced to reinvest this money at lower yields. Conversely, if interest rates are rising, the expected principal payments will slow, thereby locking in the coupon rate below market levels and extending the security’s life and duration while reducing its market value. |