Big data — no longer the exclusive domain of Silicon Valley — is reshaping traditional industries and creating opportunities for investors, even in surprising places like manufacturing and agriculture.

Highlights

- The process of gathering and interpreting large volumes of data to make smarter business decisions, or “big data” for short, is transforming nearly every industry, including those not typically associated with cutting-edge technology.

- For industrial companies, an ounce of data-driven predictive maintenance can be worth a pound of cure against production stoppages, while agricultural companies are using information collected from fleets of tractors to optimize output.

- We believe big data has the power to create competitive advantages for companies that are leading the charge, representing a key theme in our analysts’ toolbox for generating sustainable alpha for investors.

More industries are implementing advanced analytics

As we continue our article series on growth opportunities in big data, we shift our focus from technology enablers and consumer companies to sectors that are relatively new to sophisticated data analysis. Advances in parallel processing and cloud computing have led to breakthroughs in productivity and competitive advantages in every corner of the economy. Although some sectors such as media and retail companies were obvious first adopters, the benefits of big data analysis are seeping into traditionally low-tech operations, from factory floors to farming. The benefits of applying big data are flowing directly to companies’ bottom lines.

Source: Voya Investment Management.

Although the practice of maintaining corporate data bases to improve operations is not new, evolving technology has led to game-changing improvements. As a result, some old-line industrial companies are partnering with or acquiring technology enablers for data collection and analysis to improve efficiency and gain a competitive advantage. Below, we look at two surprising beneficiaries of big data: manufacturing and agriculture.

Fixing manufacturing disruptions before they happen

Factory managers will tell you that productivity and yields are all about reducing unplanned outages. Software companies specializing in data collection and analysis are enabling major manufacturers to reduce costs and downtime by anticipating equipment failures and avoiding unexpected shutdowns altogether.

Analysis of seemingly mundane information such as machine vibrations, acoustical patterns and infrared thermography can highlight maintenance requirements and potentially avoid costly malfunctions. Unplanned shutdowns can also harm the environment. A single unplanned shutdown of a refinery in California in 2017 lasting just a few hours released 31,000 lbs. of sulfur dioxide into the atmosphere, equal to the total sulfur dioxide emissions of 2015 and 2016 combined.1

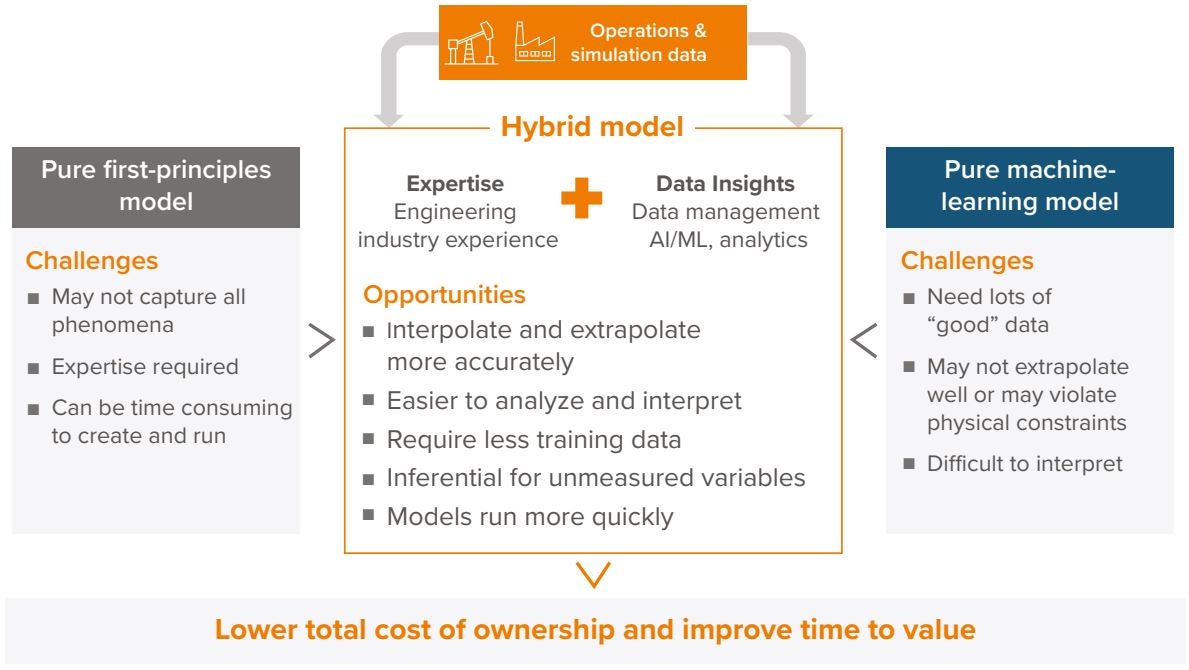

Manufacturers are finding that the best approach to using collected information is by combining the best of human expertise and machines. Experience-based engineering isn’t very good at capturing and applying vast amounts of diverse data (at least on its own). Meanwhile, pure machine learning, rapid though it is, requires carefully scrubbed statistics, and often the results can’t easily be extrapolated. By joining the brute force computing power of artificial intelligence with hands-on human engineering, companies can accelerate the payoff of their investments (Exhibit 2).

Source: Aspentech, 2021

An example of information analysis illustrates the current state of big data in industrials. One of the world’s leading manufacturers with a wide range of products recently acquired a controlling interest in a software company that optimizes industrial processes. The acquirer, more than a century old, has a history of adding creative, innovative products to its line-up. By acquiring the software company, it has added a key capability to collect and analyze large volumes of data to reduce factory down-time resulting from unplanned maintenance and malfunctions. New data collection and analysis have significantly improved the company’s return on investment, product by product.

Big farming gets small

Manufacturers of farming equipment are harnessing data in updated, powerful ways to help farmers lower costs and maximize yields. The strength of agricultural big data is derived from optimizing planting and harvesting decisions. Information is collected from fleets of tractors in the fields and transformed by farmers into direct gains in productivity.

Data collection goes far beyond numbers generated by tractors. Information is collected from planters, sprayers, GPS, moisture sensors, drones and satellites. This information allows farmers to analyze weather conditions, assess soil quality, select seeds, and efficiently apply fertilizers, irrigation, herbicides and insecticides. The goal is to analyze data in real time, and to combine the results with historical information collected over recent years to reduce the overall uncertainty of farming.

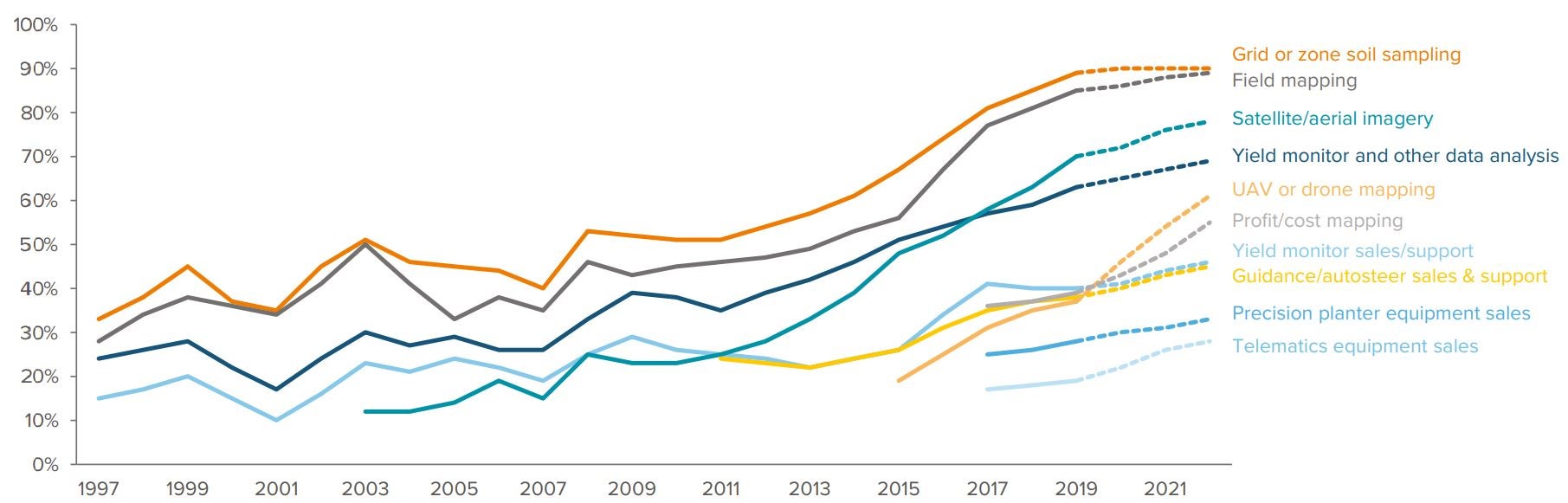

The benefits of optimizing the use of diverse forms of data include lowering costs, increasing yields, and helping protect the environment. A 2020 study found a net annual benefit of nearly $90 per acre per year, while the benefit to cost ratio has averaged 9.7 to 1.2 The adaptation of such data collection and analysis is expanding quickly (Exhibit 3).

As of 02/22/21. Source: “The Value of Data/Information and The Payoff of Precision Farming,” Mike Boehlje, Purdue University.

A new dimension for industrial analysts to ponder

At the time big data made its debut some years ago, it was nearly impossible to imagine the reach and power of data collection and analysis. Big data quickly proved itself in consumer finance and mass retailing, and now has a foothold in traditional industries. Paired with experienced data collection partners or in-house expertise, industrial leaders can pull ahead, offering potential outperformance in investment portfolios by increasing efficiency that was not possible just a few years ago. Analysts who understand the impact of big data on their areas of focus may add a deeper level of insight into companies. At Voya, our sector analysts regularly meet with companies, talk with industry experts and conduct customer and competitor research to uncover those companies that are at the forefront of big data collection in order to drive additional sources of alpha for our portfolios.