An environment of few IPOs and low M&A activity can create a buyer’s paradise for secondary market funds as private equity investors look for liquidity options.

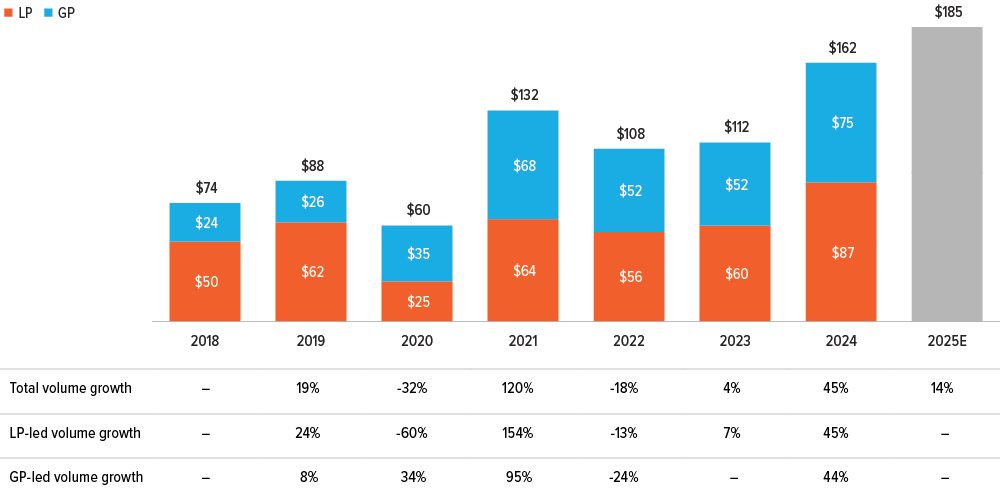

Secondaries deal volume1 continues its rapid growth this year. Following a 45% increase to $162 billion in 2024, the volume continued on the same trajectory in the first quarter of 2025, rising from $32 billion in 1Q24 to an estimated $50-65 billion in 1Q25.2 The full-year volume for 2025 is expected to exceed $185 billion (Exhibit 1). Limited partners (LPs) are again the primary source of secondary offerings as they seek liquidity in a sluggish deal market.

As of 01/25. Source: Jefferies Global Secondary Market Review. Data may not foote due to rounding.

Cash flow pressures are motivating sellers

Three trends are prompting liquidity needs:

1. Capital calls: LP capital calls have outpaced distributions for 18 straight months as of 2Q24,3 forcing LPs to generate cash flow through the sale of their stakes.

2. Self-funding erosion: The ability of private equity programs to provide continuous liquidity to fund new investments has diminished, leading them to sell stakes to invest in alternative funds.

3. Heightened uncertainty: Macroeconomic challenges—such as Liberation Day, “closed” M&A and IPO markets, and ongoing geopolitical disputes—have compounded liquidity needs, prompting sellers to increase cash flows.

Why do investors sell? Private equity investors sell their fund interests through secondary transactions for variety of strategic and tactical reasons. Common motivations include portfolio rebalancing, liquidity needs, and regulatory or capital constraints. They may want to reduce exposure to certain managers, strategies, or geographies. Some investors also sell in order to simplify their portfolios, manage vintage-year concentrations, or take advantage of favorable market pricing. Sometimes, other factors may motivate sellers. For example, recent headlines have noted a surge in selling by universities as they seek capital to offset lost research grants and to prepare for a scenario where they could lose their non-taxable status. These funding deficits have increased the need for more liquidity from their endowments to bridge the gap. However, the fact that sellers are motivated does not mean assets are “on sale.” Many university endowments are highly knowledgeable about the worth of their assets, so even as the volume of transactions increases, pricing and discounts may not be more favorable.

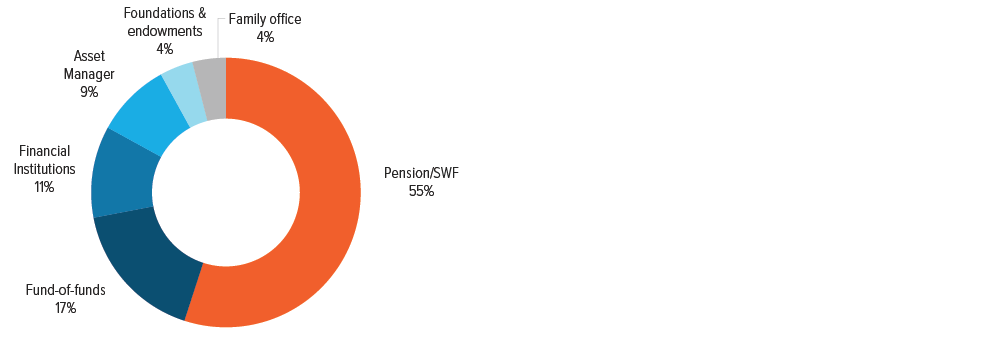

While university endowments have ramped up selling this year, endowment and foundation (E&F) activity is still a small percentage of the market. Pensions and sovereign wealth funds (SWFs) comprised the largest proportion of the LP market last year, which is not surprising (Exhibit 2). However, what was noteworthy was that 40% of LPs were firsttime sellers.4

As of 01/25. Source: Jefferies Global Secondary Market Review.

What could spur continued LP sales activity?

Two other factors may influence deal volumes for the foreseeable future.

A rollback in regulatory policies under the current administration is expected to stimulate broader private equity activity. While investors wait to see the effects of deregulation, the macroeconomic uncertainty and lack of distributions generated from their portfolios continue to dominate their focus.

Additionally, the democratization of private equity, which will open access to retail investors, has the potential to boost market activity. As individual participation increases, we expect not only greater investment inflows but also more frequent selling, which could further fuel growth in the secondary market.

Uncertainty creates opportunities for secondaries

Contrary to what some believe, market participants continue to engage in transactions, such as mergers and acquisitions, even during challenging economic periods. However, during times of uncertainty, rather than outright downturns, the market struggles to adjust. This ambiguity can cause participants to pause, delaying decisions as they wait for greater clarity. At the same time, a lack of visibility often drives more sellers to the secondary market, creating a wealth of potential opportunities. For secondary buyers, this environment allows for greater selectivity—making it a true buyer’s paradise.

A note about risk

General risks to consider

Secondary investments: The ability of the manager to select and manage successful investment opportunities, underlying fund risks; these are non-controlling investments, no established market for secondaries, identify sufficient investment opportunities, and general economic conditions.

Primary investment: Identify sufficient investment opportunities, blind pool, the manager’s ability to select and manage successful investment opportunities, the ability of a private equity fund to liquidate its investments, diversification, and general economic conditions.

Venture Capital: Characterized by a higher risk and a small number of outsize successes, has the most volatile risk/reward profile of the private equity asset class.

Growth Equity: These companies typically maintain positive cash flow and therefore present a more stable risk/ reward profile.

Mezzanine Financing: Has the most repayment risk if the borrower files for bankruptcy and in return, mezzanine debt generally pays a higher interest rate.

Leveraged Buyout: Generally exited through an initial IPO, a sales to a strategic rival or another private equity fund, or through a debt-financing special dividend, called a dividend recapitalization.

Distressed Buyout: Offer the opportunity to invest in debt securities that trade at discounted or distressed levels with the potential for higher future value if the company recovers.

General private equity risks: Private equity investments are subject to various risks. These risks are generally related to: (i) the ability of the manager to select and manage successful investment opportunities; (ii) the quality of the management of each company in which a private equity fund invests; (iii) the ability of a private equity fund to liquidate its investments; and (iv) general economic conditions. Private equity funds that focus on buyouts have generally been dependent on the availability of debt or equity financing to fund the acquisitions of their investments. Depending on market conditions, however, the availability of such financing may be reduced dramatically, limiting the ability of such private equity funds to obtain the required financing or reducing their expected rate of return. Securities or private equity funds, as well as the portfolio companies these funds invest in, tend to be more illiquid, and highly speculative.