Utilities are sparking new investor interest as AI injects an unexpected growth dimension. Will this transformational driver reenergize the sector?

AI is powering a grid upsurge

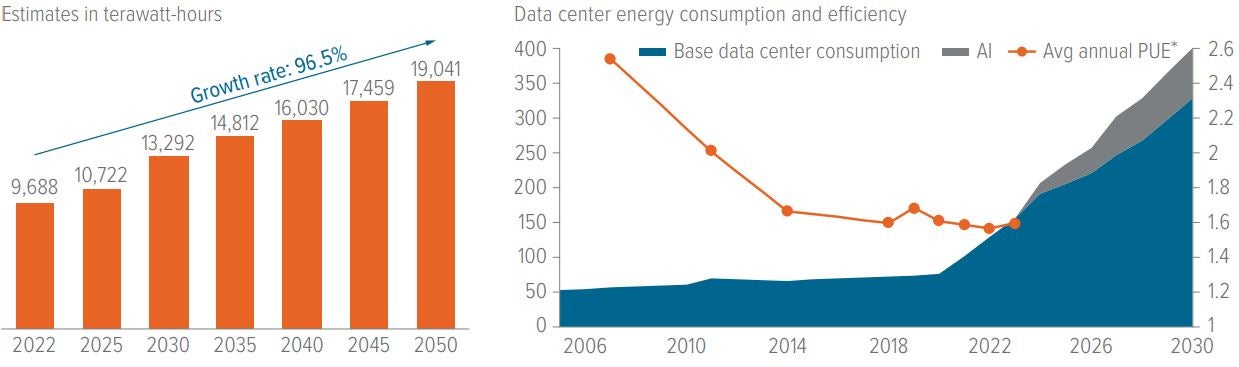

Artificial intelligence (AI) has now touched nearly every aspect of life. And, as it turns out, powering AI applications requires a lot of energy. U.S. data centers currently consume as much electricity as all households in New York and Florida combined. With the rapid adoption of AI and development of AI-powered data, this consumption is projected to nearly triple by 2035, matching the combined usage of New York, Florida, Texas, and California households!1

AI data centers are significantly more power intensive than traditional ones. To illustrate, every AI-powered online search query uses ten times more electricity than a traditional Google search.2 And that’s just with today’s early-generation chips. As technology advances and new AI chips are developed, power consumption is expected to rise further.3

This burgeoning demand for electricity is transforming the power sector and propelling utilities toward significant growth. Unlike typical businesses in other sectors that enhance their profits through higher sales, price increases or cost reductions, regulated utility companies follow a different path to profit.

Although they break even on operating expenses, they profit from capital expenditures (capex) on new infrastructure. Regulated utility companies recover the costs of new projects plus earn a regulator-set return on equity. For instance, PPL Corporation, a Pennsylvania-based energy company, reported that an additional $125 million investment raised its earnings per share by $0.01.4 This model links infrastructure expansion directly to utility profits, and power companies are expected to increase capacity by up to 96% in the coming decades (Exhibit 1).5

As of March 2023. Left chart source: U.S. Energy Information Administration, Annual Energy Outlook 2023. Right chart data extrapolated from IEA, Uptime Institute, BCG, ERPI, Lawrence Berkeley National Lab; Voya IM estimates. * Power usage effectiveness (PUE) quantifies a data center’s energy efficiency by dividing the total energy usage by the energy consumed by the IT equipment alone. A lower PUE indicates higher efficiency, with 1.0 implying that all energy use is for computation.

However, years of crying wolf risk regulatory approval delays

Over the last 20 years, U.S. power demand has been flat. Despite this lack of growth, utilities have repeatedly secured regulatory approval to purchase more power, anticipating increases in demand that never materialized.

As a result, regulators have become increasingly skeptical about approving new power purchases, especially since these costs are typically passed on to consumers.

Regulatory reluctance is an emerging concern for utility companies. The process from obtaining approval to procuring power is lengthy, and delays in approvals could extend those timelines, jeopardizing capacity estimates. In other words, energy projects take a long time, and the AI buildout is happening at a faster pace than the energy market moves.

This concern was evident in recent earnings calls, where references to “data centers” increased sixfold and mentions of “AI” spiked significantly, compared with those in the previous year. To alleviate regulatory bottlenecks and disapprovals, certain companies have filed proposals with their public utilities commissions to create new rate categories for data centers and cryptocurrency customers. The proposals include requirements for long-term commitments from these customer groups, which could ensure that proper investments are made in the electric grid while protecting other customers from paying for unused infrastructure. For example, data center customers may need to sign a 10-year commitment that includes guaranteed payment of 90% of their forecasted power needs, even if they use less.

Utilities offer a dual opportunity to boost portfolio returns

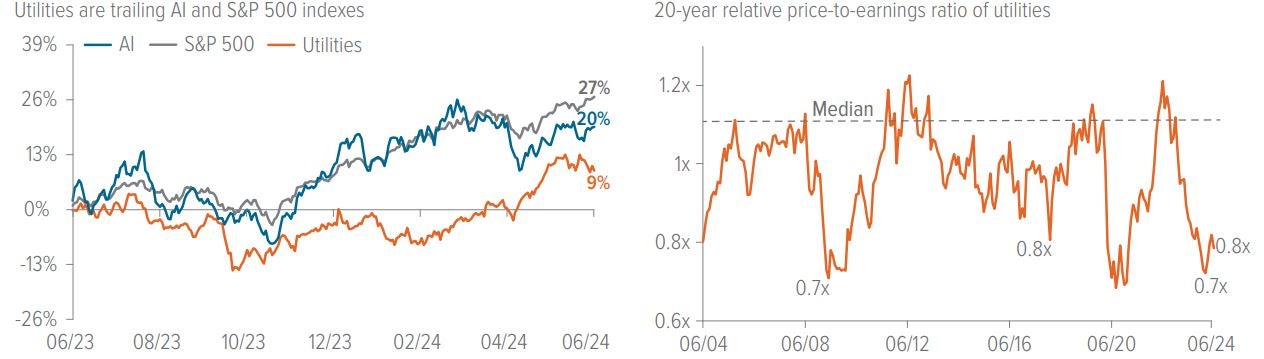

Utility stocks, the quintessential value play, have long offered attractive dividend yields. But those have been the extent of their return potential for many years. Today, utilities still offer a 4% average yield.6 However, there is now an evolving growth opportunity in the sector that we believe is not yet fully reflected in stock prices.

AI-driven price adjustments have been made in other sectors (such as technology), but utility stocks have lagged. While some individual utility stocks have risen recently, the sector is significantly trailing the returns of the AI and broader U.S. market indexes over the past 12 months. And utility stocks look cheap right now—they’ve only been this inexpensive twice in the last 20 years, excluding the pandemic period, and they offer what we view as an opportunity to capitalize on bond-like yields with growth-equity-like price appreciation (Exhibit 2).

Source: Bloomberg, YCharts, Voya IM. Left chart: Utilities represented by the PHLX Utility Sector Total Return Index and AI represented by the Nasdaq CTA Artificial Intelligence Total Return Index. Data from 06/12/23–06/11/24. Right chart: Data shows the relative forward price-to-earnings ratio of the S&P 500 Utilities Sector Index to the S&P 500 Index for the past 20 years (as of 05/31/24).

A note about risk The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. |