The following are historical insights based on market conditions at a point in time. Any forward-looking statements contained herein are based on information at the time. Current views, performance and portfolio information may differ materially from those expressed or implied in such statements. Voya IM makes no representation that past publications will be updated.

Bank lending and deal flow on the decline, economic stress on the rise and some of the best yields our teams have seen. It’s a surprisingly good time for private credit.

Since taking on the newly created role of head of private credit and alternatives last year, I’ve spent much of my time on the road, face to face with current and prospective clients. Through a long, hot summer of meetings with pension plans, consultants, OCIO offices and insurance companies, conversations often focused on the perceived declines in deal flow, credit quality and regional bank lending. In many cases, these sources of concern are the very things creating opportunities for private credit investors who are able to pivot between adjacent markets:

- The turmoil in regional banking and subsequent liquidity crunch have driven up yields for private credit investors, in many cases into the low double digits.

- A slowdown in classic syndicated deal flow has masked upticks in activity in direct deals, EM project finance deals, and non-U.S. deals, as well as interesting “fallen angel” opportunities.

- Commercial real estate’s ongoing vulnerability to credit deterioration underscores the value of strategies that are less correlated to economic cycles and/or possess more flexible remits.

Corporate: Flexibility for the win

Subdued M&A activity and a perceived decline in syndicated/sponsor deals this year seem to be creating confusion among some clients about whether now is a good time to invest. This is where flexibility becomes important, because the deals are there for large platforms such as Voya’s. We benefit from a broad global sourcing funnel that includes direct deals, high yield project finance and private placements. From our perspective, there is still strong deal flow, and we see significant opportunities.

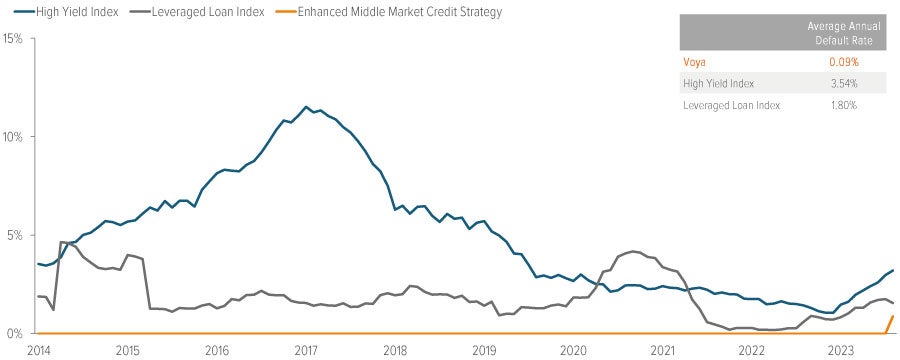

Our Enhanced Middle Market Credit (EMMC) team saw 86 middle market deals YTD through the end of July, versus 92 deals over the same period last year. This is the advantage of the EMMC team’s broader opportunity set; 44% of its $2 billion in assets is allocated to private placements and project finance deals sourced through its extensive network, with returns uncorrelated to the broader middle market. This ability to diversify plus the team’s restructuring experience have allowed the EMMC Strategy to build a highly attractive performance record, with zero losses (Exhibit 1).

As of 8/31/2023. Source: Voya Investment Management; Moody’s (high yield default rate); Pitchbook Data, Inc. (leveraged loan default rate). Average annual default rate reflects 2014 through August 2023 for the Enhanced Middle Market Credit Strategy and 2014 through 2023 for the high yield index and leveraged loan index. Inception date: 12/19/13.

We believe the current economic climate is likely to yield the best vintage of deals we’ve done in the EMMC program.

For me, one of the primary appeals of Voya’s EMMC Strategy in this market is how well the team is designed to handle times of economic stress. The EMMC team has over 15 years of experience in global workouts and restructurings. Team members are well aware of how things go wrong, and they structure their deals with an intense focus on capital preservation. Portfolio managers Gaurav Ahuja and Avi Tolani think the current economic climate could yield the best vintage of deals they’ve done in the EMMC program.

One especially promising area over the next couple years is the void that will be created by the pullback of regional banks from the loan market, coinciding with the huge maturity walls set to confront the market in 2024 and 2025. The team also anticipates opportunities in “fallen angel” deals, in which non-client insurance companies become forced sellers of private bonds downgraded to below investment grade. Gaurav and Avi have had fantastic success in these situations previously, stepping in to provide liquidity and picking up those bonds in the secondary market.

The EMMC team has an impressive 10-year history trading on Voya’s general account and, more recently, on behalf of 15 additional insurance companies. For the first time, we are opening this Strategy to our broader alts platform clients, allowing them to invest alongside us in an EMMC fund.

Infrastructure: It’s easy being green

For non–investment grade private credit investors looking for strong risk-adjusted returns in a slowing economy, Renewable Energy & Infrastructure Debt (REID) could be an appealing allocation right now.

As REID portfolio co-manager Thomas Emmons says, “Utilities don’t go bankrupt when their sales go down; they go back to the regulators and get rate increases.” The risk-adjusted return profile for debt investment within renewable energy is grounded in predictable revenue streams and the presence of hard assets, which are being deployed to generate revenues from investment grade off-takers. Plus, the technology is proven.

That’s a strong fundamental base for a debt investment, especially as the renewable energy industry tends to be less correlated to economic cycles. And because the sector’s economic merits stand on their own, the environmental benefit is almost icing on the cake. It’s easy being green when there’s no sacrifice of return or credit standards.

The renewable energy business is generally less correlated to economic cycles. The environmental benefit is almost icing on the cake.

This year, REID has been a beneficiary of the post–Silicon Valley Bank disruptions in regional banking, which have sucked some liquidity out of the financing market. In the past six months, lending from debt funds has become more cost competitive and therefore attractive to the project sponsors. This has created additional opportunity to achieve attractive returns. REID products also tend to be floating rate, which cuts return risk in a volatile interest rate environment.

Real Estate: Stepping into the void

There are a few things happening in the real estate market that are being confused in headlines. Some concerns are valid — specifically those about office, where valuation declines will likely lead to actual losses for many lenders, and where issues will take time to fully resolve. But others present opportunities. For example, the ongoing turmoil in the banking sector (historically 25–30% of the commercial mortgage market) has caused a significant financing void. This is allowing our real estate managed accounts team to secure favorable terms for first-mortgage debt in the form of participating construction loans.

Participating construction loans now offer the potential for real estate equity returns with debt risk–based capital charges.

A participating construction loan is a flexible financial solution that effectively bridges the gap between the borrower’s needs and the lender’s risk management. Terms range from two to three years, with extension options, currently providing a 7% annual coupon paid monthly through interest reserve from loan proceeds. In addition, participating construction loans allow lenders to partake in the cash flow of the property and the eventual sale (or refinance) of the property at loan maturity. The percentage participation is usually between 30% and 45% of the net operating income, and the same share upon exit.

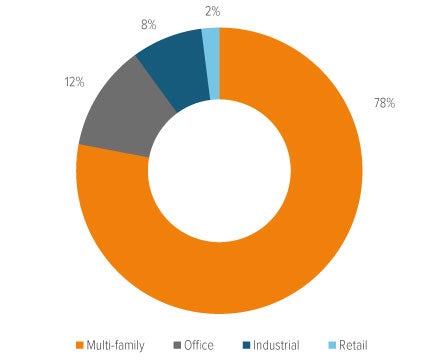

Historically, these first-lien construction loans had a relatively high loan-to-cost (LTC) ratio of 90%, with a 75% loan-to-value (LTV) ratio based on the as-complete valuation. However, given the current market dislocation, lenders can source loans with much lower LTC and LTV ratios, and this is creating compelling investment opportunities. Participating construction loans now offer the potential for real estate equity returns with debt risk–based capital charges, which are significantly lower than real estate equity risk–based capital charges. We see the most compelling loans in the industrial, multi-family, grocery-anchored retail and self-storage sectors.

For the office sector, we expect the new world order of remote work to translate to higher vacancy rates and falling property values. While it is too early to say our office properties will escape unscathed, both our general account and our Commercial Mortgage Lending Fund (CMLF) have maintained a significant underweight to the space. In fact, according to a recent Barclays report on the commercial real estate holdings of insurance companies, our general account had the lowest exposure to office (as a percentage of the total portfolio) among our peers.1 And the office properties we have exposure to tend to be less capital intensive than typical loans in the space.

We’ve always had a bias against office and hotel, across all our investment strategies, due to the high capital requirements involved. Our head of real estate, Greg Michaud, jokes that in the 30 years he’s been with Voya the team has never been overweight office. That said, as with the construction space, our real estate team is ready to take advantage of opportunities created by other lenders walking away from loans in office. Typically, these situations concern a near-term maturity where the existing lender has not extended the loan, or a property acquisition that is moving forward with closing.

A team going from strength to strength

Lastly, I wanted to publicly congratulate our private credit team on the stunning growth and success of the platform over the past three years. In terms of assets under management for insurers, we are now officially the #3 private asset manager, the #1 private placement manager, the #2 real estate manager and the #2 infrastructure debt manager.2

Please feel free to reach out to me or the team if you’d like to chat further about any of Voya’s market-leading alternative strategies.