Key Takeaways

Historically consistent outperformance, regardless of when the initial investment was made.

Stronger downside mitigation during previous significant market declines compared to primary private equity and public equity.

Three control levers throughout the investment process offer a potential performance edge.

Private equity secondary funds have a history of strong performance across various market conditions, suggesting that their success typically isn’t tied to market timing. Instead, it relies on control.

Although secondaries are a form of equity and private investing, they are distinct from both primary private equity (PE) funds and public stocks. Nonetheless, we believe many investors regard their performance as comparable.

To illustrate the differences in returns, we compared the performance of private equity secondary funds to global public equities and primary private equity funds over several decades. This comparison—across various market cycles and during deep public market drawdowns—demonstrates both the resilience and consistency of secondary PE strategies. What makes the performance sustainable? Control.

Consistent long-term performers

Over trailing 3-year periods between 2005 and 2024, secondaries outperformed global public equities in 18 out of 20 observations. Over trailing 10-year periods, roughly representing a full market cycle, private equity secondaries outperformed in every instance (Exhibit 1).

Exhibit 1: Secondaries have outperformed public equities in both the short and long term

Mitigate downside risk

We believe secondaries also have a return edge over primary PE funds for two reasons: Secondaries have shorter holding periods since they buy later in a fund’s life, and assets are often purchased at discounts.

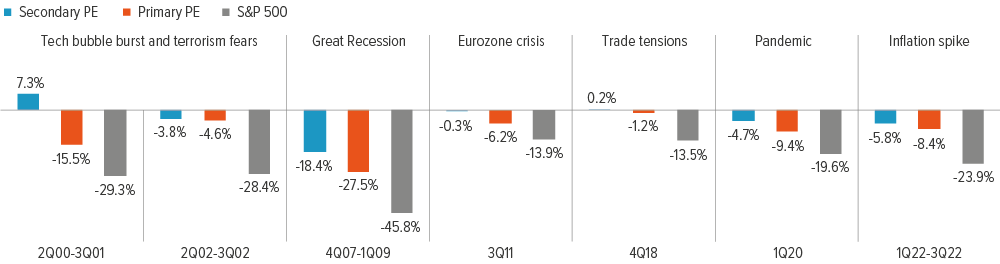

Additionally, secondaries have a demonstrated history of delivering downside mitigation in times of market stress. Since 1999, secondary funds have consistently outperformed primary private equity and public equity during steep public market downturns (Exhibit 2).

As of 12/31/24. Source: Pomona Capital, Capital IQ (S&P), Cambridge Associates (CA Index). Data show cumulative quarterly returns during drawdown periods from 1999 to 2024. Past performance is not an indication of future performance. There is no guarantee that an investment in a Pomona-sponsored fund will ultimately be profitable. See index descriptions in disclosures.

We cannot predict how secondaries will perform during the next cycle or against primary peers. However, the resilience of private equity secondaries during major events—such as the Great Recession, a bull market, and a global pandemic—suggests they may have an edge in managing volatility and delivering consistent outcomes.

In our view, these outcomes are not dependent on when you invest but rather on the structural benefits of secondary private equity. For example, secondaries typically offer diversification that mitigates concentration risk in a particular sector or region. Additionally, since secondaries are often acquired at a discount from limited partners in primary funds, the lower prices can provide extra protection against volatility.

Underlying edge: Control

We believe a key driver of secondaries’ historical outperformance and downside mitigation stems from the three points of control that secondaries investors have throughout the investment process:

1 Highly selective investments

Secondaries fund managers often acquire interests in known, existing PE funds years after they were initially formed, so the underlying portfolio companies are generally more established than early-stage PE companies. This can allow secondaries fund managers to carefully evaluate long track records of performance, potentially giving them greater insight into those companies.

2 Negotiated pricing

Secondaries fund managers have the opportunity to negotiate the price of potential assets, often acquiring them at discounts to net asset value. In contrast, investors in public markets can only transact at real-time market prices with no negotiating power.

3 Operational influence

A distinction of private equity relative to public equities is that general partners of private equity funds typically have oversight over the management, operating activities, and overall strategy of the companies they own, potentially adding significant value. This additional value is passed on to secondary PE funds who own stakes in primary PE funds. In our view, these attributes have contributed to the outperformance of private equity secondaries through changing conditions, making the asset class suitable as a core holding for many investors.

To learn more about the Pomona Investment Fund, contact your Voya rep or visit http://voya.com/pomona

Risks to investing

General private equity risks: Private equity investments are subject to various risks. These risks are generally related to: (i) the ability of the manager to select and manage successful investment opportunities; (ii) the quality of the management of each company in which a private equity fund invests; (iii) the ability of a private equity fund to liquidate its investments; and (iv) general economic conditions. Private equity funds that focus on buyouts have generally been dependent on the availability of debt or equity financing to fund the acquisitions of their investments. Depending on market conditions, however, the availability of such financing may be reduced dramatically, limiting the ability of such private equity funds to obtain the required financing or reducing their expected rate of return. Securities or private equity funds, as well as the portfolio companies these funds invest in, tend to be more illiquid, and highly speculative.

Primary investment: Risks include the ability to identify sufficient investment opportunities, blind pool, the manager’s ability to select and manage successful investment opportunities, the ability of a private equity fund to liquidate its investments, diversification, and general economic conditions.

Secondary investments: Risks include the ability of the manager to select and manage successful investment opportunities, underlying fund risks; these are non-controlling investments, no established market for secondaries, identify sufficient investment opportunities, and general economic conditions.