Buying assets at a discount is one of the key benefits of investing in secondary private equity funds. But is it the most significant driver of long-term returns?

The investment math favors the growth side of the equation

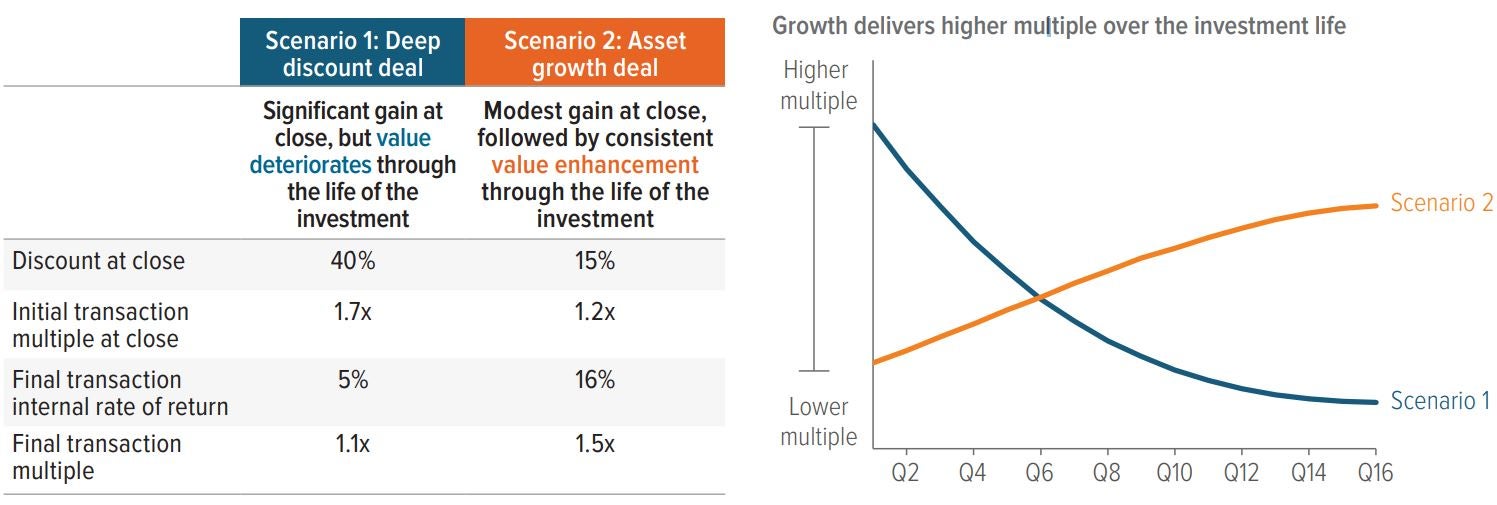

Discounts certainly come into play, but we have found that the growth prospects of the underlying companies are a greater predictor of return potential. Here are two hypothetical scenarios that illustrate the difference (Exhibit 1, left side).

Scenario 1: Buying an asset for 60% of its fair value (deep discount deal). The advantage of purchasing at a large discount is that the acquirer registers a big gain at the close of the deal—in this case, a 40% unrealized gain on day one. But when an asset is priced at a steep discount, there’s usually a reason. Most often, the asset is overvalued at the current level, so its future worth will likely decline. While this investment may end up being profitable in the long run, the total return is likely to be modest. In this illustration, the beneficial upfront discount dissolved, delivering suboptimal long-term returns.

Scenario 2: Buying a growing asset for 85% of its fair value (asset growth deal). While purchasing at a discount remains part of the investment thesis, identifying conservatively valued assets that show signs of growth can power better performance. What does growth mean? Businesses that are growing revenue and/or accelerating profitability via expansion into new geographies, by executing on novel strategies, or through the acquisition of competing or complementary businesses. The underlying growth of these businesses can enhance investment performance over the long term. In this illustration, the growth trajectory of the underlying assets piloted robust returns over the long term in spite of a smaller initial discount.

Source: Pomona Capital, Voya IM. For illustrative purposes only. Investing in private equity is a risk and there is no guarantee that an investment in private equity or in a Pomona-sponsored fund will be profitable. The above scenarios are for illustrative purposes only and are theoretical; there is no guarantee an investment in a Pomonasponsored fund will exhibit any of the above characteristics or return profile. Please read the Risk section below for more information. Right chart shows theoretical inception-to-date multiple throughout the life of a secondary transaction.

This illustration also highlights the significance of investor time horizon to performance. Over the short term, highly discounted transactions can outperform since the price break is immediately beneficial. But in the long term, discounts may be less meaningful than growth (Exhibit 1, right side). Most secondary funds have holding periods of at least three years, which tends to favor the longer-term benefits of growth over discounted pricing.

Understanding value can help drive better returns

The Pomona Investment Fund (PIF) adheres to the tenets of conservative valuations, superior growth and profitability, which together drive greater potential for the asymmetric return profile we seek. How does this work in practice? We look for partners with whom we have strong relationships—sponsors with conservatively priced, attractive growth assets who have exhibited an ability to deliver consistent returns through multiple economic cycles.

Our portfolio metrics demonstrate the value, profitability and growth characteristics we pursue. Exhibit 3 shows an analysis of PIF’s 10 largest holdings against a peer group of similar public companies. Valuations were based on each firm’s value relative to operating earnings over the last 12 months (TEV/LTM EBITDA) while growth and profitability were measured by the LTM EBITDA growth rate and LTM EBITDA margins, respectively. The analysis shows that our holdings were more attractively valued than those of peers with significantly higher growth.1 Additionally, our holdings had greater profitability. This demonstrates that the process works, bolstering our conviction that the fund is positioned for strong future returns.

As of 06/30/23. Source: Pomona Capital. PIF calculations based on 10 largest portfolio company exposures (as of 03/31/23). Comps represent comparable publicly traded businesses for each of the 10 portfolio companies.

|

A note about risk Investing in private equity is a risk and there is no guarantee that an investment in private equity or in a Pomona-sponsored fund will be profitable. The above scenarios are for illustrative purposes only and are theoretical; there is no guarantee an investment in a Pomona-sponsored fund will exhibit any of the above characteristics or return profile. Discussed below are the investments generally made by Investment Funds and the principal risks that the Adviser and the Fund believe are associated with those investments and with direct investments in operating companies. These risks will, in turn, have an effect on the Fund. In response to adverse market, economic or political conditions, the Fund may invest in investment grade fixed income securities, money market instruments and affiliated or unaffiliated money market funds or may hold cash or cash equivalents for liquidity or defensive purposes, pending investment in longer-term opportunities. In addition, the Fund may also make these types of investments pending the investment of assets in Investment Funds and Co-Investment Opportunities or to maintain the liquidity necessary to effect repurchases of Shares. When the Fund takes a defensive position or otherwise makes these types of investments, it may not achieve its investment objective. The value of the Fund’s total net assets is expected to fluctuate in response to fluctuations in the value of the Investment Funds, direct investments and other assets in which the Fund invests. An investment in the Fund involves a high degree of risk, including the risk that the Shareholder’s entire investment may be lost. The Fund’s performance depends upon the Adviser’s selection of Investment Funds and direct investments in operating companies, the allocation of offering proceeds thereto, and the performance of the Investment Funds, direct investments, and other assets. The Investment Funds’ investment activities and investments in operating companies involve the risks associated with private equity investments generally. Risks include adverse changes in national or international economic conditions, adverse local market conditions, the financial conditions of portfolio companies, changes in the availability or terms of financing, changes in interest rates, exchange rates, corporate tax rates and other operating expenses, environmental laws and regulations, and other governmental rules and fiscal policies, energy prices, changes in the relative popularity of certain industries or the availability of purchasers to acquire companies, and dependence on cash flow, as well as acts of God, uninsurable losses, war, terrorism, earthquakes, hurricanes or floods and other factors which are beyond the control of the Fund or the Investment Funds. Unexpected volatility or lack of liquidity, such as the general market conditions that prevailed in 2008, could impair the Fund’s performance and result in its suffering losses. The value of the Fund’s total net assets is expected to fluctuate. To the extent that the Fund’s portfolio is concentrated in securities of a single issuer or issuers in a single sector, the investment risk may be increased. The Fund’s or an Investment Fund’s use of leverage is likely to cause the Fund’s average net assets to appreciate or depreciate at a greater rate than if leverage were not used. The Fund is a non-diversified, closed-end management investment company with limited performance history that a Shareholder can use to evaluate the Fund’s investment performance. The Fund may be unable to raise substantial capital, which could result in the Fund being unable to structure its investment portfolio as anticipated, and the returns achieved on these investments may be reduced as a result of allocating all of the Fund’s expenses over a smaller asset base. The initial operating expenses for a new fund, including start-up costs, which may be significant, may be higher than the expenses of an established fund. The Investment Funds may, in some cases, be newly organized with limited operating histories upon which to evaluate their performance. As such, the ability of the Adviser to evaluate past performance or to validate the investment strategies of such Investment Funds will be limited. In addition, the Adviser has not previously managed the assets of a closed-end registered investment company. Closed-End Fund; Liquidity Risks. The Fund is a non-diversified closed-end management investment company designed principally for long-term investors and is not intended to be a trading vehicle. An investor should not invest in the Fund if the investor needs a liquid investment. Closed-end funds differ from open-end management investment companies (commonly known as mutual funds) in that investors in a closed-end fund do not have the right to redeem their shares on a daily basis at a price based on net asset value. |