Amid a landscape of robust securitized issuance and, on balance, supportive macroeconomic environment, the securitized credit market is demonstrating resilience, buoyed by the relative strength of U.S. consumers and initial repair in commercial real estate.

In this outlook, we take a quick look back at our forecasts to start the year, and share our detailed views on the outlook for each sub-sector.

As of 08/14/24. Source: Voya IM.

As of 08/06/24. Source: Voya IM.

The backdrop: Strong securitized issuance into a receptive market for duration

Credit risk on firm footing as consumers remain well supported

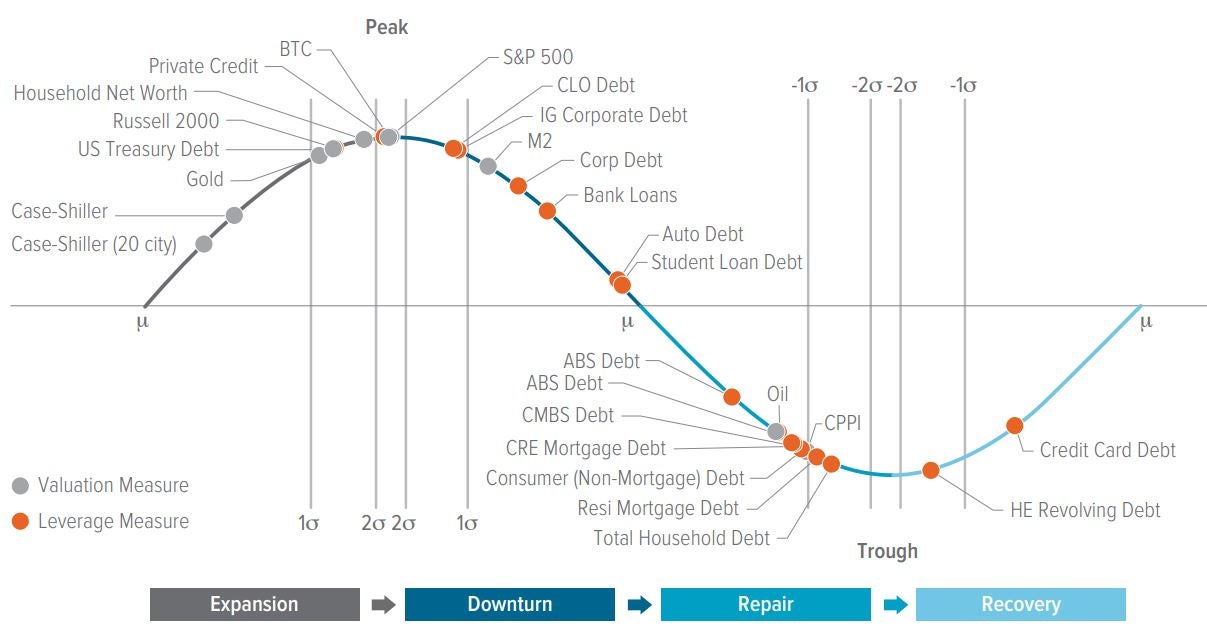

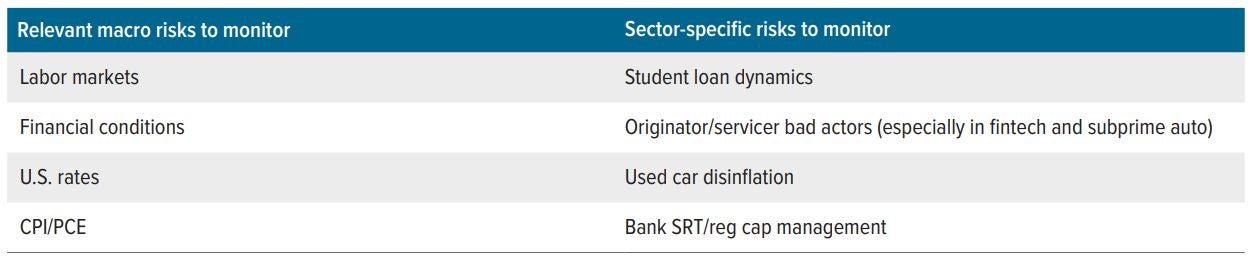

The securitized credit market is heavily tied to the strength (or lack thereof) of the U.S. consumer. And the good news for securitized investors is that consumers, in aggregate, are in relatively good shape. Income growth has slowed, and the savings rate is below its historical average. And consumer balance sheets appear strained as shown by the recent uptick in credit card borrowers with delinquent payments. Consumption patterns have changed and a slower pace has emerged.

However, unemployment remains low by historical standards, and while income growth may have slowed, real household income remains elevated and higher than at any time prior to 2018. Coupled with a rising stock market and home price appreciation that has increased household net worth, consumers are wealthier in aggregate. And feedback loops from slower consumption has a silver lining – it has brought Fed cuts into the picture, with positive implications for the cost of consumer credit.

Importantly, and as signaled in our earlier outlook, there is a clear difference between consumers in higher income brackets versus those with lower income, which has implications for sub-sector positioning in securitized portfolios (more on this later).

Negative real estate headlines haven’t slowed the repair in CMBS

There has been no shortage of bad news hitting the commercial real estate (CRE) market. Pension plans are selling stakes in New York and San Francisco buildings for significantly less than they originally paid. Office vacancy rates remain well above pre-pandemic levels and, with an estimated $1.2 trillion of U.S. CRE debt maturing in the next two years, loan delinquencies and distressed sales are expected to increase.1

Investors might expect this bad news for CRE would translate into negative performance for CMBS. However, as bad as the news seemed, the CMBS market was actually priced for worse, a function of it being a public market with daily marking. As more certainty came to the CRE market, CMBS rallied off of extremely depressed levels, a dynamic that we believe still has room to run (although as we said earlier, security selection will play an increasing role driving returns).

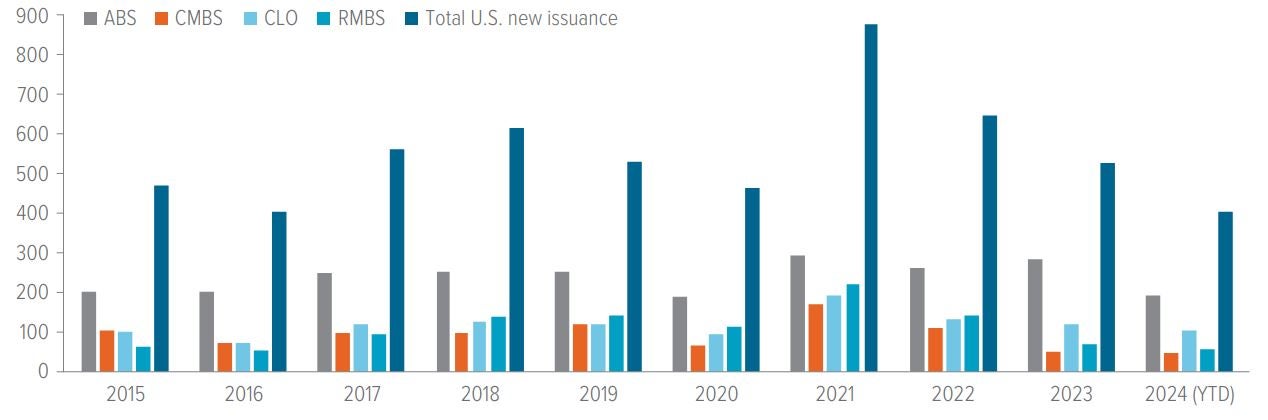

It’s been a historically strong year of securitized issuance, fostering harmonious market conditions

Strong issuance is a sign of a healthy market and issuance in the securitized market has been robust, with 2024 shaping up to be one of the strongest years in recent history (see new issuance chart below). In this environment, ramping allocations has rarely been more efficient for investors. Issuers have fed off the affinity by bringing a wide array of deals with intriguing breadth, building more investor interest in a virtuous cycle for market participants.

Securitized credit is insensitive to political volatility

Surprising election outcomes in India, Mexico, France and other countries around the globe have caused spikes of volatility in broader financial markets. And the race to November 5th is bound to be filled with plot twists. Yet so far this year, securitized credit has marched ahead unperturbed by geopolitical risks, showing a traditional hallmark as a fixed income sector with lower correlation to broad risk markets.

As of 06/04/24. Source: Voya IM.

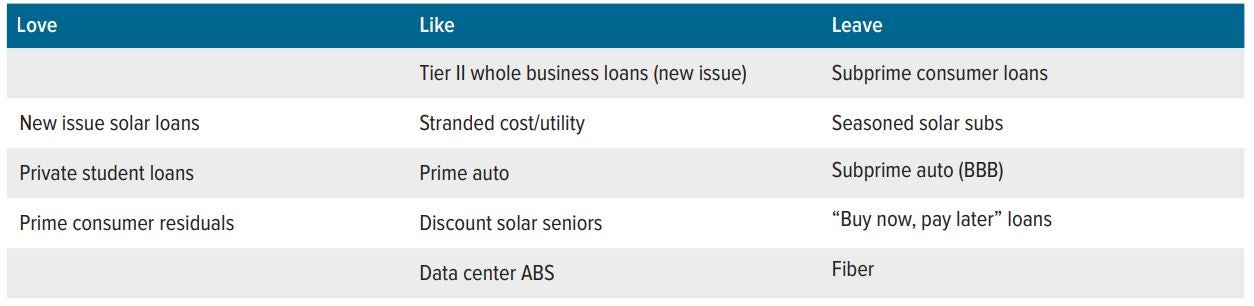

ABS: “Steady eddy” stays on the straight and narrow

ABS issuers are monetizing strong investor demand as the pace of new issuance has hit historically high levels. As articulated above, the “harmony” between issuers and investors has created a virtuous cycle of reliable primary market execution, inspiring more issuance which attracts more capital, reinforcing stable risk/return opportunities. Crucially, underwriting quality has been strong against the later stage economic backdrop, aiding in keeping the virtuous cycle intact.

Our preference in ABS is for securities tied to higher-income consumers, as lower-income borrowers are more likely to feel the strain of stalling economic growth and less likely to benefit from the buffer of higher stock and home prices.

As of 8/14/24. Source: Voya IM.

As of 8/14/24. Source: Voya IM.

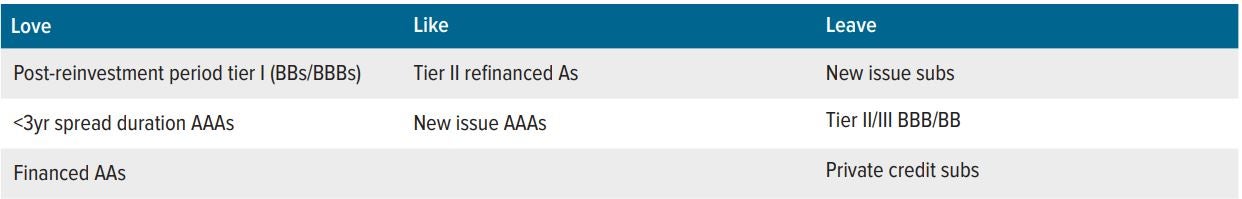

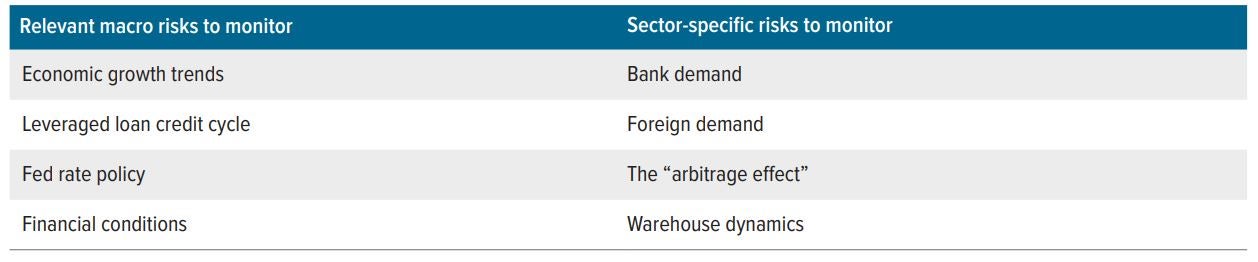

CLOs: Buyer beware

After a long streak of outperformance, CLOs are yet more vulnerable to falling rates and slower economic growth, with the sector facing potentially imminent headwinds from the Fed reducing rates and the feed through into lower CLO base rates (3-month SOFR). While the floating-rate nature of CLOs attracts investor demand when the Fed raises rates, this reversal of Fed policy should drive outflows, particularly from recently burgeoning CLO ETFs. This technical dynamic combined with the potential for stress from corporate borrowers in CLOs’ underlying loan collateral pools leaves the sector disproportionately exposed to a growth slowdown. As a result, we favor a continued defensive approach in CLOs, heavy on deals from tier 1 managers and higher rated investment grade classes.

As of 8/14/24. Source: Voya IM.

As of 8/14/24. Source: Voya IM.

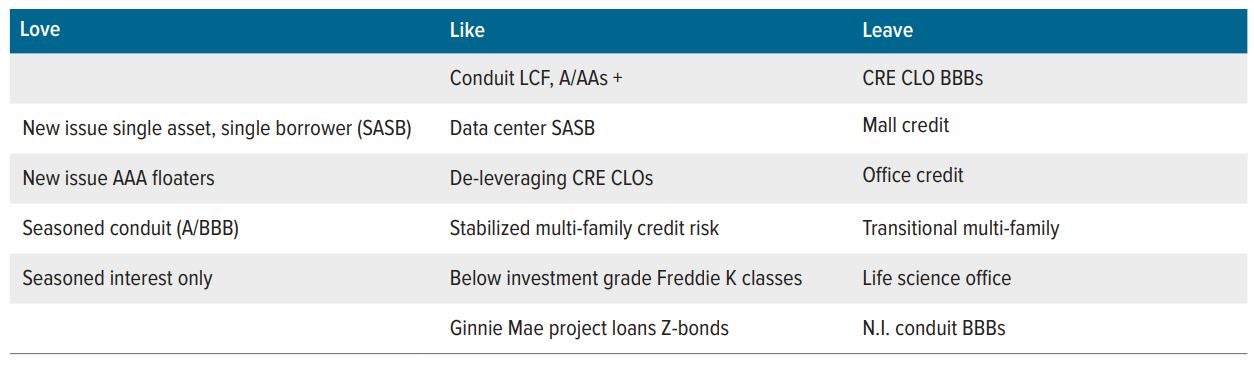

CMBS: Ascent continues but time to get more selective

Improved financial conditions have helped reduce the crisis like spread premiums once available in CMBS, effectively reducing “easy money” opportunities. As remaining problem loans continue to resolve, collateral based security selecting will slowly but surely replace simply asset allocating to the sector and “buying the sector”. Property type remains the key dimension when navigating the opportunity set. For example, office property fundamentals continue to suffer from the pandemic inspired shift to remote and hybrid working arrangements, a phenomenon that has proven durable, with a glacial pace of retracement. In addition, the fundamentals of enclosed malls with traditional department store anchor tenants are weak as consumer preferences continue to evolve in favor of differentiated “experiences” and specialized stores.

As of 8/14/24. Source: Voya IM.

As of 8/14/24. Source: Voya IM.

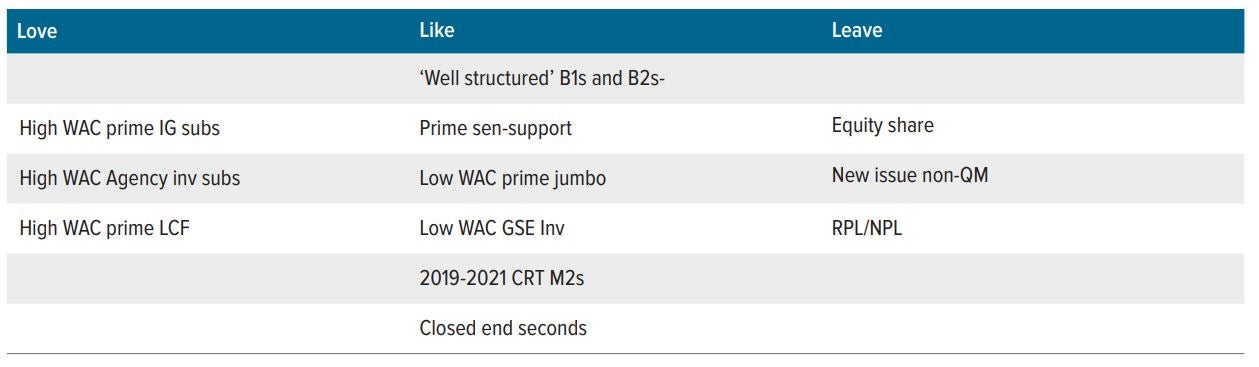

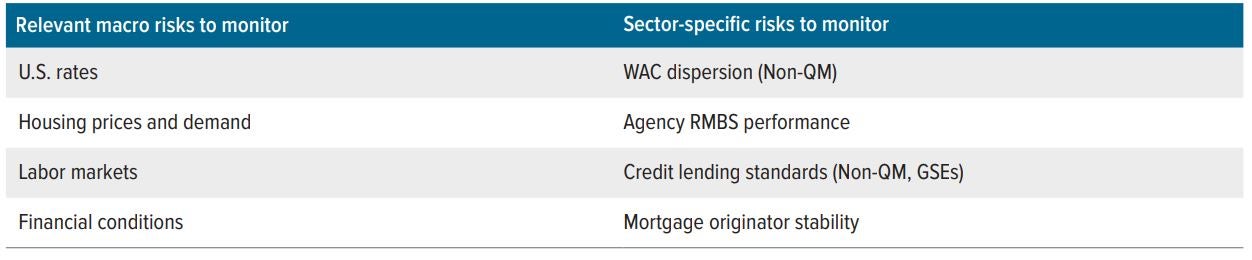

Non-agency RMBS: Mortgage credit is a rock star... is that a prepayment on the horizon?

The housing market is flashing late cycle signals, with home prices at all time highs, but getting there on generationally low levels of sales. Rising inventories reflect pent up selling pressure, and may prove the catalyst for a temporary move lower in home prices into the back-end of the year.

Regardless, residential-mortgage credit behavior is set-up to remain insulated from a modest decline in home prices. Average mortgage rates for existing homeowners are <4% and the buffer of homeowners’ equity remains at or near historical highs. In our view, any spread widening inspired by potential housing weakness would constitute a buying opportunity. Furthermore, if a decline in home prices is accompanied by a lower rate backdrop (likely associated with a slower economy), rock bottom prepayment rates may finally be set to pick-up.

As of 8/14/24. Source: Voya IM.

As of 8/14/24. Source: Voya IM.

Where does securitized credit fit in portfolios?

Securitized credit—with its U.S.-focused, consumer and real estate-centric risk drivers—can be an effective way to diversify a portfolio otherwise dominated by corporate credit and correlated with equity markets.

For investors balancing the need for attractive income with lower volatility, securitized credit offers characteristics potentially well suited to the current market environment. Moreover, the increasing variety of economic drivers, types of risk and investable supply within securitized credit has strengthened its credentials as a durable, through-the-cycle allocation.

Securitized credit managers with the appropriate expertise across each sub-sector can tactically adjust allocations based on the most attractive opportunities and perceived relative value at any given time, creating the potential for consistent outperformance as market conditions change during and through market cycles.

A note about risk

The principal risks are generally those attributable to bond investing. Holdings are subject to market, issuer, credit, prepayment, extension, and other risks, and their values may fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. The strategy invests in mortgage-related securities, which can be paid off early if the borrowers on the underlying mortgages pay off their mortgages sooner than scheduled. If interest rates are falling, the strategy will be forced to reinvest this money at lower yields. Conversely, if interest rates are rising, the expected principal payments will slow, thereby locking in the coupon rate at below market levels and extending the security’s life and duration while reducing its market value.