Key Takeaways

Private equity (PE) investing has traditionally been dominated by large institutions, but it has been gaining ground within individual investor portfolios through the secondary market.

Investing in PE secondaries involves buying interests in a PE fund from an existing investor, typically after the fund’s investment period ends.

Potential benefits of investing in a PE secondaries fund include diversification against traditional stock and fixed income investments, generally faster returns than investing in primary PE, better transparency of fund holdings before buying interests, and discounted buying opportunities.

Individual investors can now access the formerly exclusive club of private equity through registered investment vehicles that focus on secondary investments, allowing for greater flexibility and potentially accelerated cash flow.

PE: From exclusive to inclusive

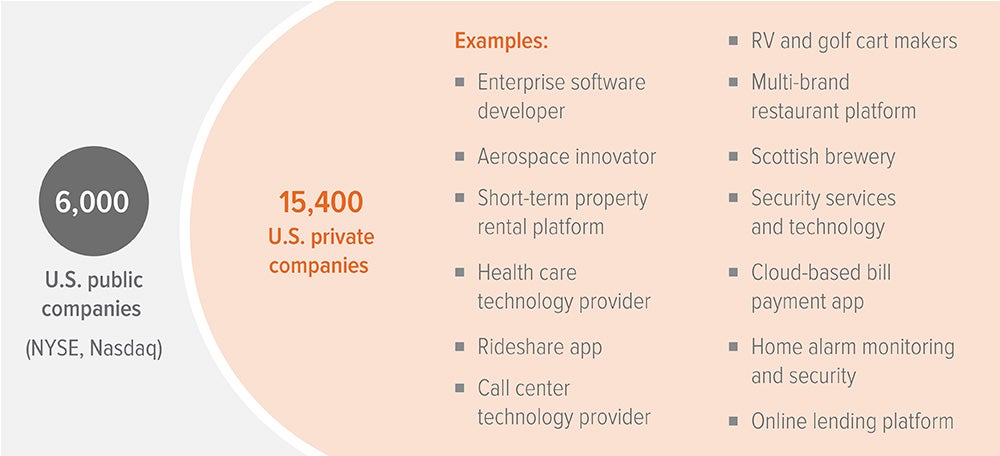

For every Amazon or Apple traded on public stock exchanges, there are a thousand privately held businesses seeking investor capital to grow. In the U.S. there are over twice as many private equity-backed companies as publicly listed ones (Exhibit 1). Private companies represent every major industry, from technology and manufacturing to retail, including some of the fastest-growing and most disruptive startups. Yet many investors avoid this asset class because it seems inaccessible and complicated.

As of 2025. Sources: MarketCapWatch Global Index, Bain, Cambridge Associates, and Global Visualist. 87% of the roughly 19,00 U.S. companies with revenues of $100+ million are not accessible on public exchanges.

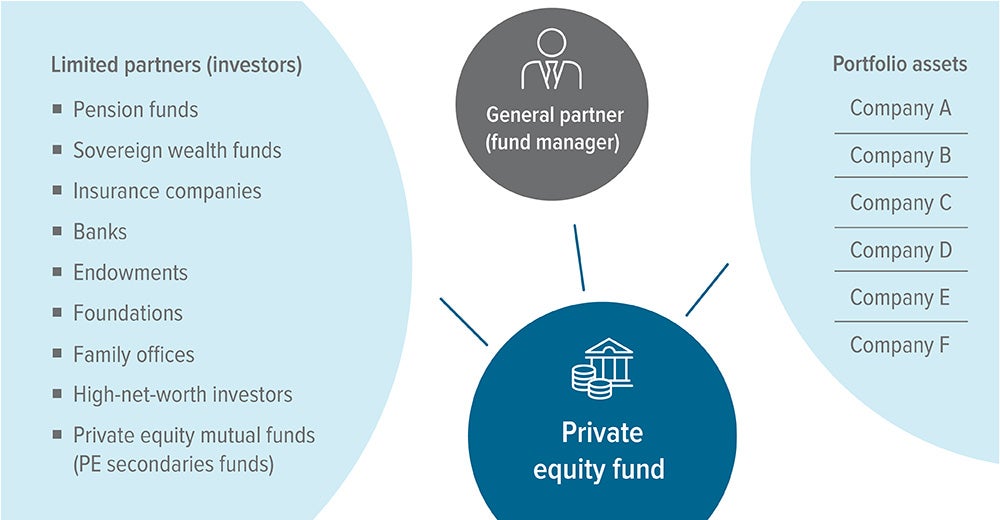

It’s true that PE has historically been an exclusive club for large institutional investors, such as pension funds, sovereign wealth funds, and insurance companies (along with family offices and certain ultra-high-net-worth investors).

However, the newer investment vehicles have opened the market to a wider range of investors. Some of these investment solutions address hurdles that previously have discouraged broader adoption by reducing investment minimums, simplifying tax filings, and offering regular liquidity opportunities.

What’s changed? The answer is in the growing access to PE interests. For example, PE secondaries may offer an attractive way to enhance a well-diversified portfolio.

What is PE?

When a privately owned company wants to grow its operations, it may seek funding from a PE management firm in exchange for a stake in future profits. This approach may offer an attractive alternative to conventional forms of financing, such as taking out a loan (which can be expensive) or listing shares on a public stock exchange (which may not be feasible).

The PE fund manager (also called a general partner, or GP) raises capital from investors—known as limited partners (LPs)—pooling the funds with its own capital into a fund that invests in a diversified portfolio on behalf of the LPs (Exhibit 2). Portfolio assets typically consist of the equity of private companies, but may also include debt investments, commercial real estate and infrastructure projects such as solar farms, transportation systems or water treatment plants.

GPs may bring expertise and resources to the companies in their portfolios. By working with company management teams, the GP may seek to enhance the equity value of its investments in several ways.

- Accelerating revenue growth. The GP and management team may drive additional revenues by launching new products, expanding to new markets, increasing sales efforts and making acquisitions

- Enhancing profit margins. Cost savings may be achieved by focusing on higher-margin products, leveraging economies of scale and fine-tuning product pricing

- Improving the capital structure. As a company generates cashflow, it may be able to reduce its debt over time, decreasing its financial risk

- Upgrading operations. A GP may help the company improve its management, market strategy and operating model, potentially increasing the value of the enterprise

Source: Pomona Capital.

A note about risk

There are no guarantees a diversified portfolio will outperform a non-diversified portfolio. Diversification does not guarantee a profit or ensure against a loss. Past performance is no guarantee of future results.

Private equity may not be suitable for every investor, may involve a high degree of risk, and may be appropriate investments only for sophisticated investors who are capable of understanding and assuming the risks involved.

All investments in bonds are subject to market risks. Bonds have fixed principal and return if held to maturity, but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates.

All equity investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. Foreign investing does pose special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic. Emerging market stocks may be especially volatile. Stock of an issuer in the Fund’s portfolio may decline in price if the issuer fails to make anticipated dividend payments because, among other reasons, the issuer of the security experiences a decline in its financial condition. Securities of small- and mid-sized companies may entail greater price volatility and less liquidity than investing in stocks of larger companies. Private equity investments are subject to various risks. These risks are generally related to: (i) the ability of the manager to select and manage successful investment opportunities; (ii) the quality of the management of each company in which a private equity fund invests; (iii) the ability of a private equity fund to liquidate its investments; and (iv) general economic conditions. Private equity funds that focus on buyouts have generally been dependent on the availability of debt or equity financing to fund the acquisitions of their investments. Depending on market conditions, however, the availability of such financing may be reduced dramatically, limiting the ability of such private equity funds to obtain the required financing or reducing their expected rate of return.

Private equity funds as well as securities that invest in such funds and companies in which such funds or securities may invest tend to lack the liquidity associated with the securities of publicly traded companies and as a result are inherently more speculative.