The remarkable growth of the Mag 7 stocks has captured the market’s attention, but investors may be overlooking the highest-growth companies.

There’s no denying that the “Magnificent 7” stocks—or, more recently, the “Significant 6” (less Tesla)—have shown impressive growth that’s warranted investor attention. But as companies grow larger, sustaining the same rate of expansion becomes increasingly difficult. Nevertheless, the largest seven U.S. companies have managed to defy the odds, resulting in their market capitalizations representing a staggering 29% of the total market.1

We see this dominance as a reminder that the investable stock universe is sizable, and that it’s easy to overlook less tapped areas of the market—where fast-growing companies exist beyond the industry giants.

Is now the time to diversify “down cap”?

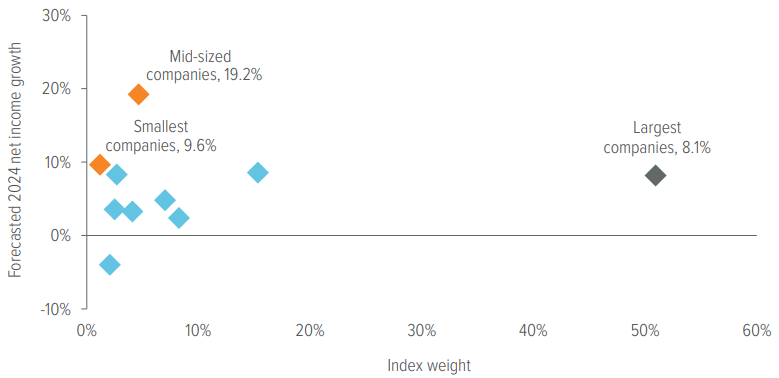

As we seek to diversify away from the larger names, our bottom-up fundamental research has uncovered a notable market anomaly: The smallest and mid-sized U.S. companies are projected to have higher growth in 2024, than the largest companies (Exhibit 1).

While considering these more pint-sized stocks, it’s necessary to strike a balance between their ability to generate alpha and their inherent risks and volatility. This balancing act informs our investment decisions as we focus on “down cap” companies that have high growth potential.

As of 2/26/24. Source: Strategas Securities, Voya IM.

|

A note about risk The principal risks are generally those attributable to investing in stocks and related derivative instruments. Holdings are subject to market, issuer and other risks, and their values may fluctuate. Market risk is the risk that securities or other instruments may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security or instrument may decline for reasons specific to the issuer, such as changes in its financial condition. More particularly, the strategy invests in smaller companies which may be more susceptible to price swings than larger companies because they have fewer resources and more limited products, and many are dependent on a few key managers. |