Our proven strategy can help diversify a fixed income allocation—providing a complement or alternative to full-market high yield and core bonds.

Use Voya US Short Duration High Income as a complement or alternative to high yield

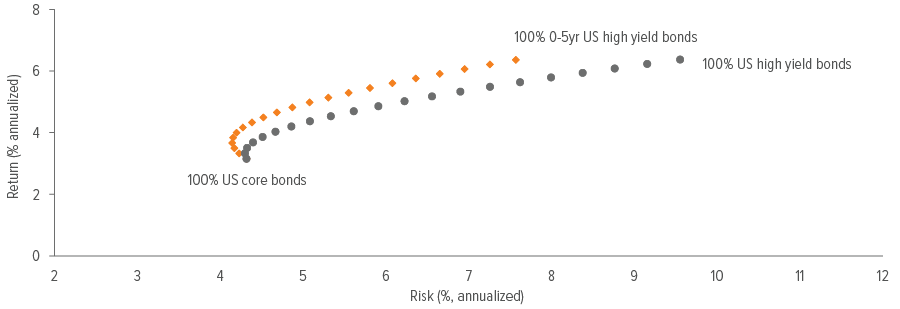

High yield bonds are often used to diversify fixed income allocations, and short duration high yield bonds have proven to be an effective tool in doing just that. This is because short duration high yield bonds have historically delivered comparable returns to full-market high yield but with less volatility, meaning they can be used to expand the efficient frontier of a fixed income portfolio (Exhibit 1).

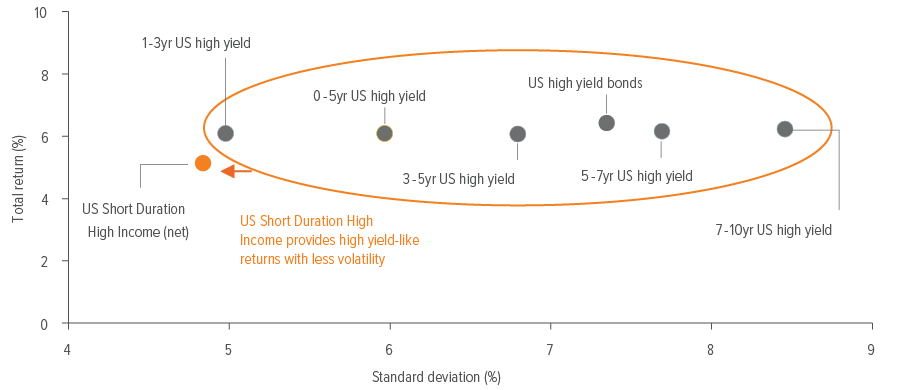

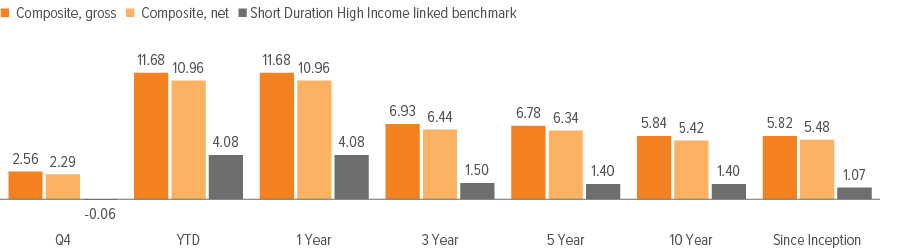

Voya US Short Duration High Income has done a particularly good job of this over its history (Exhibit 2); as a result, it can be used to complement (or even replace) an allocation to full-market high yield. The Strategy has a lower beta to the high yield market, potentially enhancing portfolio diversification by offering a narrower range of annual returns and providing an asymmetric return profile.

As of 12/31/24. Source: Voya IM, FactSet, ICE Data Services, Morningstar. Past performance is not indicative of future results. See index associations and additional disclosures at the end of this document. For Exhibit 2, the data above is supplemental information to the Voya US Short Duration High Income GIPS-compliant composite table at the end of this document. The Composite represents the investment results of a group of fully discretionary portfolios managed according to the Strategy

Use Voya US Short Duration High Income as a complement or alternative to core bonds

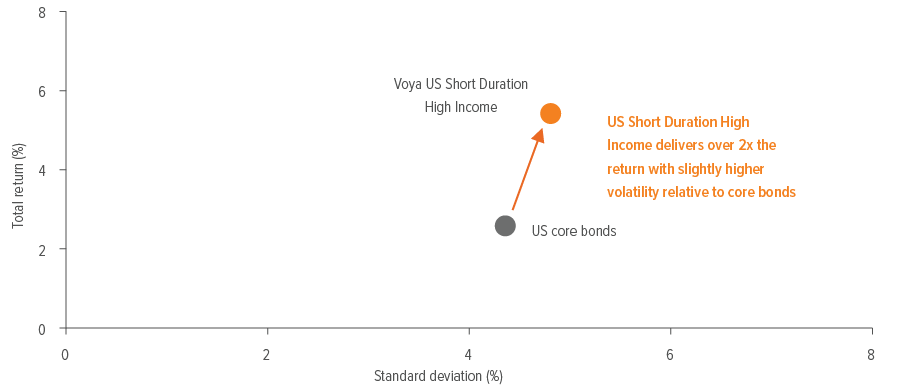

Like they do with full-market high yield, short duration high yield bonds can increase returns and lower volatility relative to core bonds. The Strategy has historically provided consistent income and strong risk-adjusted performance compared with core bonds overall, resulting in greater returns with similar volatility (Exhibit 3).

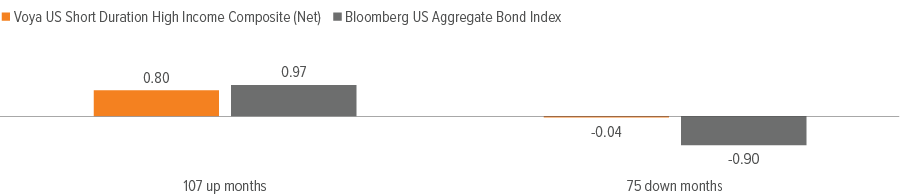

Furthermore, Voya US Short Duration High Income has proven to be a good complement to a core fixed income allocation (Exhibit 4). Its low correlation to core bonds helps diminish the magnitude of negative performance outcomes and reduces overall volatility—all while enhancing returns and improving positioning with a higher yield and a lower duration.

As of 12/31/24. Source: Voya IM, FactSet, ICE Data Services, Morningstar. Past performance is not indicative of future results. The data above is supplemental information to the Voya US Short Duration High Income GIPS-compliant composite table at the end of this document. The Composite represents the investment results of a group of fully discretionary portfolios managed according to the Strategy. See index associations and additional disclosures at the end of this document. Investors cannot invest directly in an index. For Exhibit 4, market participation is based on the average of monthly returns in up and down markets as determined by the respective index

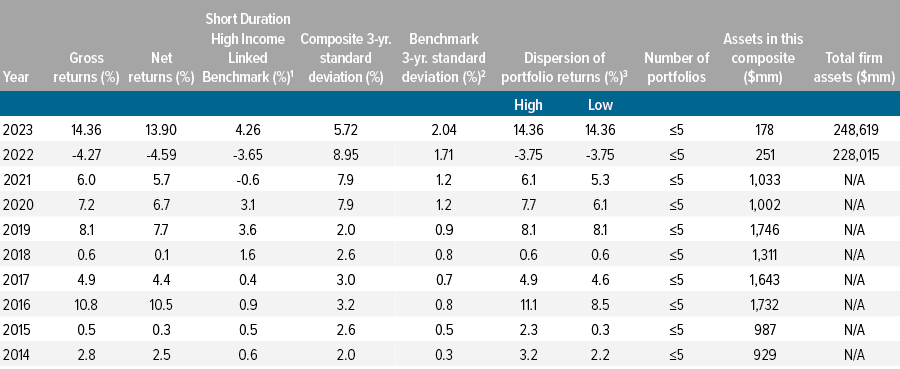

Voya US Short Duration High Income: A history of strong performance

The Voya US Short Duration High Income Strategy has historically provided consistent income and strong risk-adjusted performance, outperformed core bonds with similar volatility, and delivered broad high yield bond market returns with less volatility.

As of 12/31/24. Voya Investment Management claims compliance with the Global Investment Performance Standards (GIPSR). GIPSR is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Past performance does not guarantee future results. Performance numbers for time periods greater than one year are annualized. The Composite represents the investment results of a group of fully discretionary portfolios managed according to the strategy. Returns include the reinvestment of income. Gross-of-fees returns are presented before management and custodial fees but after all trading expenses. Net-of-fees returns are calculated by deducting a hypothetical management fee from the gross return on a monthly basis and geometrically linking the results to produce returns shown. The hypothetical management fee is equal to or greater than the asset-weighted average of each accounts’ fee schedule in the composite. The model fee used will result in a net return that is equal to or lower than a net return using actual fees. For a description of advisory fees, please see Form ADV, Part II. Gross returns should be used as Supplemental Information only

1 The Barclays 9-12 Treasury Index returns through December 31, 2013 and the ICE BofA 1-3 Year US Treasury Index from January 1, 2014 forward, which do not reflect the deduction of investment fees, have been provided for comparison purposes and have not been examined by independent accountants.

2 “ Composite 3-Yr St Dev” and “Benchmark 3-Yr St Dev” are rolling 3-year standard deviation calculations, which measure the variability of the gross-of-fee monthly performance returns for the composite and benchmark index over the preceding 36-month period on an annualized basis. If the composite has not been in existence for at least 3 years as of a particular year-end then “N/A” will be displayed.

3 “ Dispersion of Portfolio Returns” presented for each annual period is based on gross-of-fees returns and is equal to the highest and lowest annual return among the portfolios that are included in the composite for the full year. If there is not at least 1 account that was in the composite for the entire year, then “N/A” will be displayed.

A note about risk

Debt instruments: Debt instruments are subject to greater levels of credit and liquidity risk, may be speculative, and may decline in value due to changes in interest rates or an issuer’s or counterparty’s deterioration or default. High yield fixed income securities: There is a greater risk of issuer default, less liquidity, and increased price volatility related to high yield securities than investment grade securities. Market volatility: The value of the securities in the portfolio may go up or down in response to the prospects of individual companies and/or general economic conditions. Price changes may be short or long term. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the portfolio and its investments, including hampering the ability of the portfolio’s manager(s) to invest the portfolio’s assets as intended. Issuer risk: The portfolio will be affected by factors specific to the issuers of securities and other instruments in which the portfolio invests, including actual or perceived changes in the financial condition or business prospects of such issuers. Interest rate risk: The values of debt instruments may rise or fall in response to changes in interest rates, and this risk may be enhanced for securities with longer maturities. Credit risk: If the issuer of a debt instrument fails to pay interest or principal in a timely manner, or negative perceptions exist in the market of the issuer’s ability to make such payments, the price of the security may decline.