Inflation is cooling, the economy is resilient and starting yields offer a cushion against further rate volatility—there’s a lot to like about fixed income in 2025.

Recent rate volatility isn’t really about inflation

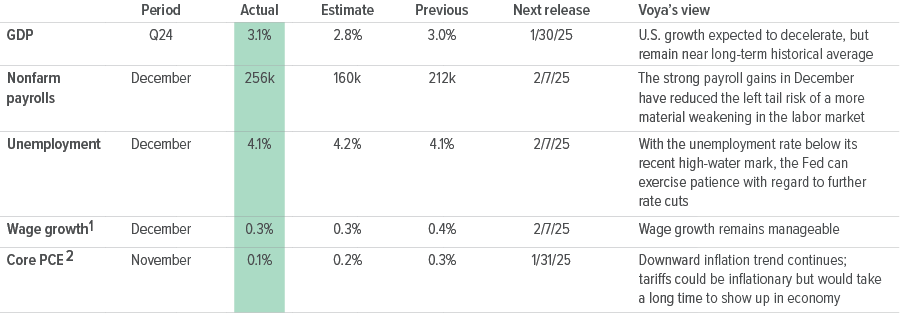

The December jobs report confirmed the resilience of the labor market and broader economy, but it also raised concerns about the Fed’s next policy move—the old “good news is bad news” effect. The prospect of a higher-for-longer environment spooked some fixed income investors who were already grappling with the recent increase in long-term rates.

What’s driving yields higher? The good news is that it’s not inflation. Inflation signals such as breakeven rates and 5-year/5-year forward inflation indicators are pointing to well-anchored expectations, reaffirming the downward trend.

Instead, look to the term premium—the extra compensation investors demand for holding longer-term bonds to account for uncertainties about future economic, market and fiscal conditions. Recently, higher Treasury issuance (amid softening demand) and shifting market expectations for growth, rates, and fiscal policy have pushed this premium higher, even as the inflation outlook has remained stable.

The resulting picture remains one of a healthy economy that’s gently cooling, which bodes well for credit markets.

As of 1/17/25. Source: Bloomberg, Factset, Voya IM.

1 Average hourly earnings (month-over-month).

2 Month-over-month data, personal consumption expenditures price index.

Starting point matters

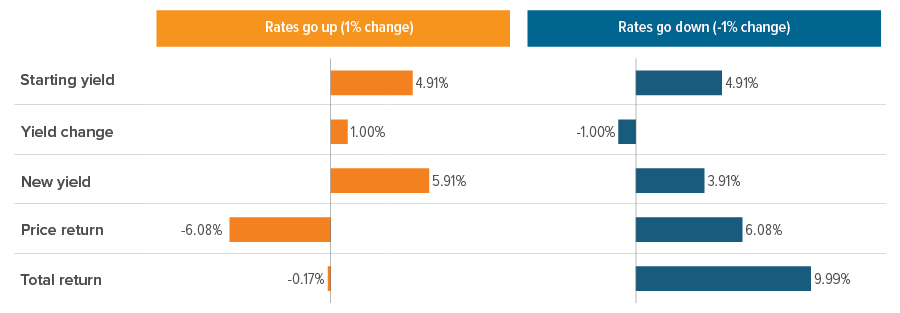

We believe long-term interest rates are unlikely to rise meaningfully from current levels based on our inflation and growth estimates. However, tight credit spreads mean greater potential volatility. But investors have a major advantage in their corner: high starting yields (Exhibit 1).

Basic bond math shows that a rate move from 1% to 2% (+100%) is far more damaging than a move from 4% to 5% (25%). And there’s much more income being generated to offset potential losses.

Using the U.S. Aggregate Bond Index as an example, if rates hold steady for the next year, the expected gross return would be roughly the current carry of 4.9%. Rates would need to rise by nearly 1% (to a 20-year high!)—representing a major course adjustment for the economy—for price declines to overtake income. And if a surprise happens that pushes the economy into recession, a flight to the relative safety of bonds could help cushion volatility in equities.

As of 12/31/24. Source: Bloomberg Index Services Ltd., Voya IM. For illustrative purposes only. Calculations are based on the Bloomberg U.S. Aggregate Bond Index current duration of 6.14 years and assume immediate parallel shift in yield curve (with the new yield then earned for the 12-month period) and that all bonds in the index are priced at par. Bonds pose a higher risk than Treasury bills, which are guaranteed as to the timely payment of principal and interest. Investors cannot invest directly in an index. See back page for index definition and additional disclosures.

There’s more to bonds than Treasuries

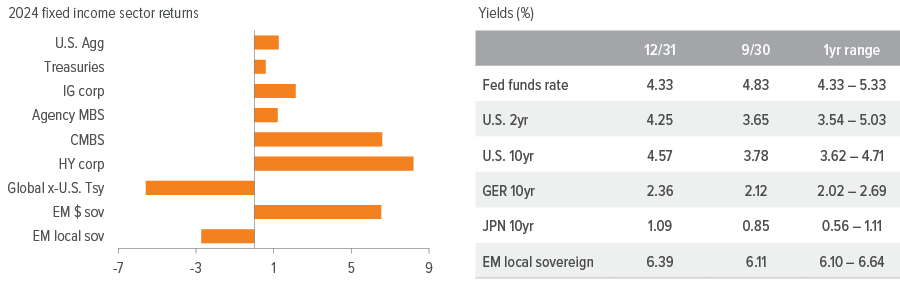

When headlines focus on “bonds,” they often conflate the broader fixed income market with Treasury performance. But 2024’s results show a clear divergence—while Treasuries posted modest returns, other growth-oriented fixed income sectors like high yield and CMBS offered opportunities to generate outperformance (Exhibit 2).

Looking ahead, we continue to see value in credit and growth-sensitive assets, particularly securitized credit. The strong economy and muted default expectations support these allocations, allowing investors to benefit from higher yields without overexposing portfolios to interest rate risk.

As of 12/31/24. Sources: Bloomberg, JP Morgan, Voya IM. See disclosures for more information about indices. Past performance is no guarantee of future results.

Sector outlooks

- While valuations are tight, we will use any periods of volatility to capitalize on opportunities as credit fundamentals remain solid and are expected to improve.

- Higher rates have not led to a decline in issuance, which is expected to continue at a brisk pace.

- We remain overweight financials and sectors insulated from potential risk of tariffs such as communications, as well as high-conviction BBB names.

- Current spreads do not adequately compensate for risk over the long term, and we are keeping some powder dry to add risk at wider levels.

- We expect credit stress and defaults to remain limited.

- From a positioning standpoint, we are overweight food/beverage and healthcare/pharma, and underweight technology, as well as media/ telecom companies with structurally challenged business models.

- While high starting yields should provide a buffer against potential volatility, credit selection will be critical as dispersion within and across sectors increases.

- A positive macro environment, easing monetary policy, and supportive technicals are expected to sustain demand for leveraged credit. However, stronger net supply, fueled by a rebound in M&A activity, may soften the supply-demand imbalance.

- While corporate fundamentals should improve as rates decline and earnings growth rebounds, the market remains bifurcated, emphasizing the importance of careful credit selection.

- If rates remain contained, then carry is king. Current coupon agency mortgage bonds offer attractive spreads, albeit with increased convexity risk (the risk a bond’s price will change more than expected when there are large changes in interest rates).

- The correlation of agency mortgages’ performance with overall volatility and rate directionality should continue to weaken, as the sector’s high relative yields have attracted investor demand—going forward we expect fund flows to be a larger driver of returns.

- Overall, fundamentals and the supply technical dynamics should remain a positive influence on mortgage returns going forward.

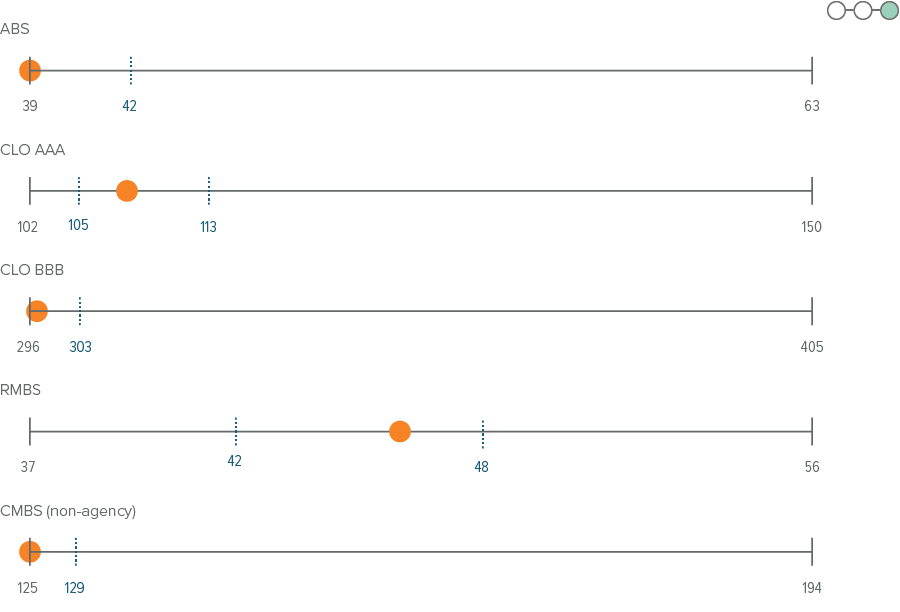

- Looking forward, we project less volatility in securitized credit spreads as the post-election buzz fades and the holiday season dampens market activity.

- With hopes for a pick-up in prepayment speeds dashed, paths for outperformance in RMBS are narrow with credit spreads at cycle tights. However, exceptional mortgage credit quality will continue to command sponsorship and we view any dips as an opportunity to buy.

- Improved financial conditions trump the friction from higher rates. While “easy money” in CMBS has been made, opportunities remain deep via careful security selection. Problem loans will continue to resolve as the recovery part of CMBS’ credit cycle advances to repair.

- While likely to prove short-lived, improved technical conditions for ABS will better ensure the sector’s attribute as a safe-haven allocation amidst bouts of market volatility. Risk in sub-sectors with low-income consumer cohorts remains salient, particularly if financing remains tight.

- Who likes higher for longer? CLO investors. While CLOs suffered cracks from 100 bp of rate cuts, the slower pace going forward steels investor enthusiasm, particularly if a pro-business policy mix keeps credit worries at bay.

- The growth outlook for emerging markets is modest, with risk skewed to the downside.

- Rollover risk has diminished given a robust new issue market that has restored access to frontier sovereigns and high yield corporates.

- Corporate fundamentals overall remain resilient and financial policy remains prudent. Corporate default rates are expected to be lower due to less defaults in Asia and Europe.

A note about risk

The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition.