Key Takeaways

We remain positive on leveraged credit based on attractive yields and a favorable fundamental backdrop. The overall carry should continue to boost performance on both a total return and excess return basis.

Although the economy has slowed, growth remains more than adequate for leveraged borrowers to increase earnings and service their debt. Furthermore, easing Fed policy should lower financing costs and provide a buffer in the event of a more pronounced slowdown in economic activity. That said, we are attuned to risks of a sharper economic slowdown and eroding margins, which could drive the potential for heightened volatility over the next few quarters.

We view the current environment as favorable for experienced credit pickers, presenting attractive opportunities among issuers across both loans and high yield. On balance, however, we are currently more constructive on the high yield market due to the prospect of lower front-end rates.

Impending rate cuts favor high yield over loans, but both markets offer attractive opportunities for credit pickers given high income, supportive fundamentals and strong investor appetite.

Going into 2024, we believed leveraged credit was well positioned to deliver solid returns. Underpinning our views were solid credit fundamentals, attractive all-in yields and strong technicals, which together could weather periodic bouts of volatility and a modest widening of credit spreads. Our initial outlook has largely played out despite headwinds of slowing U.S. growth and persistent geopolitical risks. Notwithstanding some episodic spikes in global volatility—most recently around the soft July nonfarm payrolls print and the unwind of the yen carry trade—leveraged credit has produced solid returns. As a result, our original full-year return projections remain intact, and we believe leveraged credit remains attractive in the current environment.

2024 YTD review

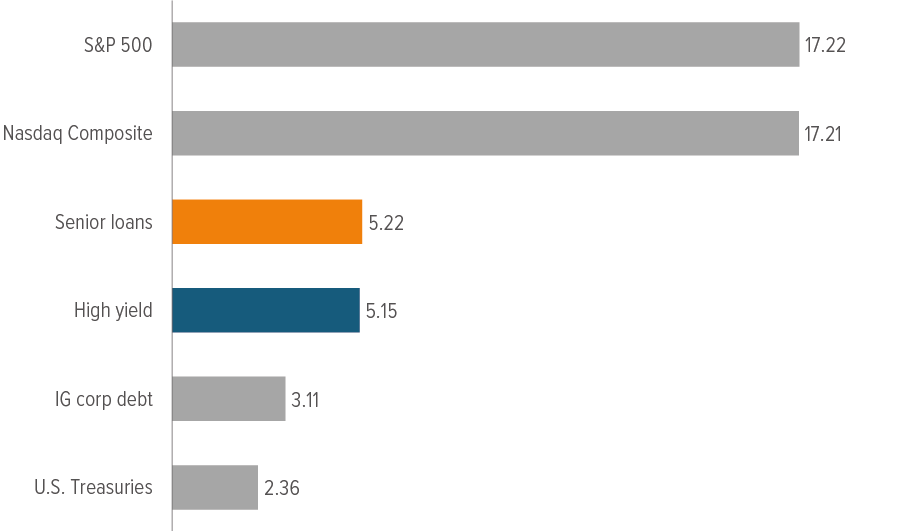

Exhibit 1: Risk assets have performed well

As of 08/15/24. Source: LCD, Barclays, Bloomberg. See back page for index definitions and additional disclosures.

Financial assets have performed well so far in 2024 despite bouts of volatility caused by higher-than-expected first-quarter inflation readings and second-quarter concerns about slowing growth. Ultimately, the “soft landing” thesis remained intact as inflation eased toward the Federal Reserve’s 2% target, while U.S. growth held up and the labor market rebalanced without a meaningfully higher unemployment rate. As a result, risk assets have broadly delivered positive returns year to date (Exhibit 1).

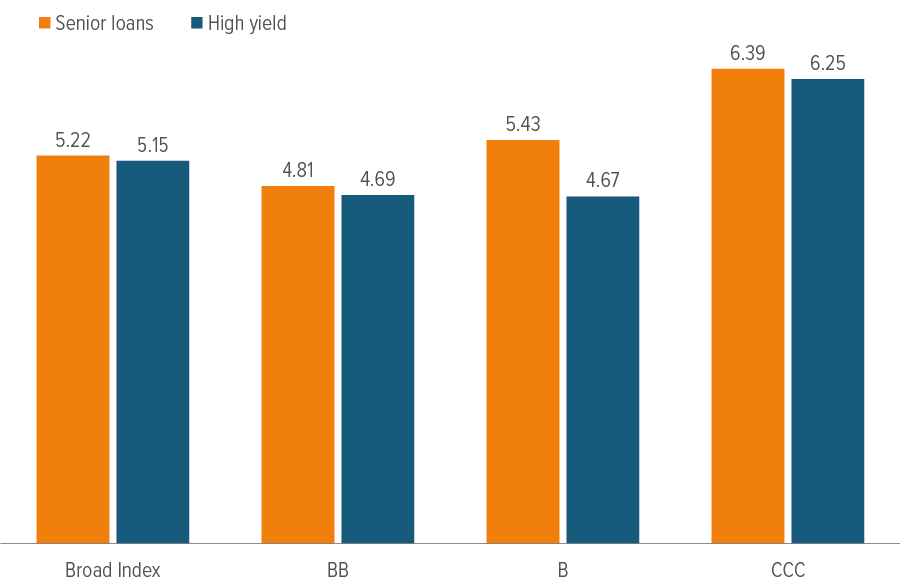

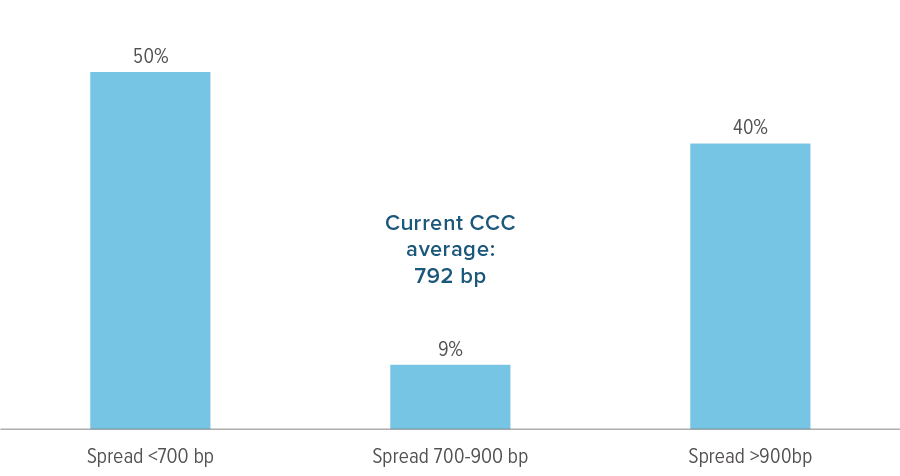

Against this stable background, leveraged credit has outperformed other spread products, consistent with expectations. Returns have been relatively uniform across ratings segments, although lower-rated categories have slightly outperformed given the stable macro backdrop (Exhibit 2). However, it hasn’t exactly been rosy for the entire right tail. Plenty of idiosyncratic situations and secular industry pressures have persisted, leading to a high level of dispersion within CCCs (Exhibit 3). That’s an area where careful credit selection remains paramount.

As of 08/15/24. Source: LCD, Barclays, Bloomberg. See back page for index definitions

and additional disclosures.

As of 07/31/24. Source: Bloomberg, Barclays Research.

Outlook

We believe leveraged credit is likely to benefit from greater confidence that the Fed will successfully orchestrate a soft landing. Valuations don’t necessarily screen cheap, but investors are being adequately compensated in the current environment, resulting in a favorable risk/reward ratio. Strong technicals and stable fundamentals continue to support spreads, while high starting yields provide a cushion against spread widening. Credit selection remains key, as the market continues to be bifurcated between the “haves” and “have-nots.”

Technicals should remain supportive

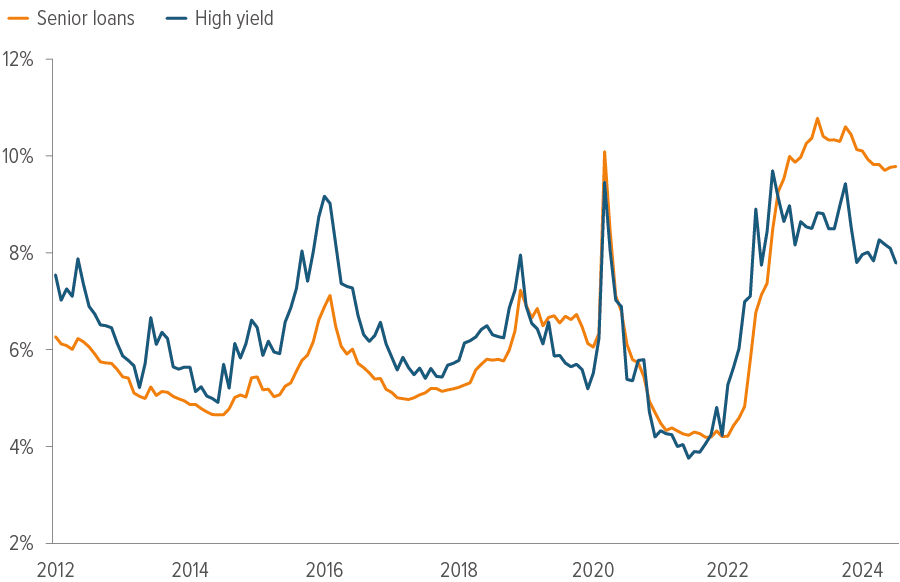

Leveraged credit spreads have remained resilient for most of the post-Covid era, with only brief bouts of volatility. Growing earnings and solid balance sheets have certainly played a role in keeping spreads contained, although we attribute a portion of this strength to robust technicals. Proceeds from debt issuance have been used primarily to refinance existing debt and extend maturities, with only modest M&A and re-leveraging activity. At the same time, investors have continued to pour additional funds into leveraged credit markets to capture yields not seen in recent years (Exhibit 4), with high yield retail funds experiencing more than $20 billion of inflows YTD.

The leveraged loan market has been supported by the collateralized loan obligation market (the primary buyer base for loans), where issuance has exceeded expectations. Spurred by improved CLO equity economics and strong demand for AAA rated tranches from banks and other institutional investors, CLO managers issued $115 billion in new CLOs in the first seven months of 2024, an 82% increase over the prior-year period.

The openness of credit markets has benefited issuer credit quality in several ways:

- The solid economic backdrop has made financing markets more willing to accept lower-rated loans seeking to extend their maturities, creating a virtuous cycle of improving credit profiles.

- Healthy risk appetite has spurred a meaningful return of repricing activity to the loan market. Repricing transactions, which don’t count towards new supply, have tracked well over $400 billion YTD (a new record), resulting in lower interest costs for borrowers.

- While private credit has remained an option for companies with financing needs, the trend has shifted this year in favor of the broadly syndicated loan (BSL) market, as a bevy of loans has been issued to refinance deals that were previously funded by direct lenders.

As of 07/31/24. Source: LCD, Barclays, Bloomberg. Yields shown on a yield-to-maturity (YTM) basis. See back page for index definitions and additional disclosures.

We believe the attractiveness of yields will remain firmly intact as the Fed begins to cut rates, creating a continued strong technical for leveraged credit. While rate cuts should encourage more activity on the M&A front, we don’t foresee a meaningful increase in leveraged M&A transactions until financing costs meaningfully decrease. As such, we expect opportunistic transactions to remain the primary driver of new supply in the medium term. Meanwhile, high all-in yields should continue to attract long-term investors to the space, and we don’t expect CLO issuance to abate anytime soon.

Fundamentals are healthy…but proceed with caution

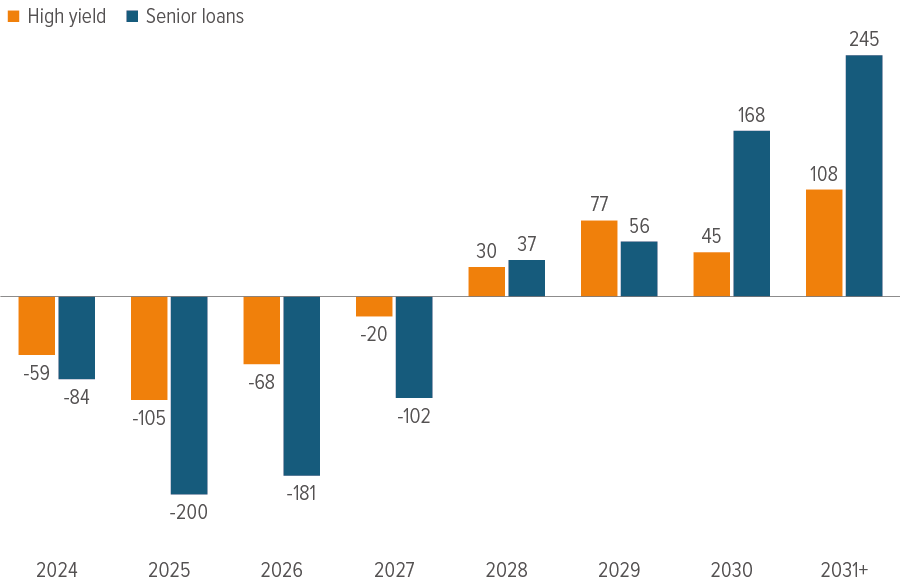

On the whole, fundamentals have been healthy for leveraged credit borrowers. Issuers have made significant progress chipping away at near-term maturity walls since the start of last year (Exhibit 5). Higher rates and company-specific challenges have pressured certain lower-quality issuers. However, the fundamental trajectory for most borrowers remains positive, and risk is largely concentrated in specific pockets of the market. Solid earnings growth has kept leverage and interest coverage ratios at relatively healthy levels, while default activity has been largely benign (except for a few idiosyncratic situations.)

As of 08/08/24. Source: J.P. Morgan Research. See back page for index definitions and additional disclosures.

Looking ahead, stable growth and expected rate cuts should be supportive for credit fundamentals. Loan borrowers, who have faced the immediate transmission of higher rates, will experience some reprieve as rates decline. Although earnings growth and positive credit momentum are likely past their peak, key metrics aren’t expected to deteriorate meaningfully absent significantly softer growth. We still expect only a gradual increase in defaults over the medium term. This is in line with our previous expectations for a longer but flatter default cycle that should be largely concentrated in problematic sectors and weaker pockets of the market.

Risks to watch: softening growth and shrinking margins

The macro environment remains supportive, with our base case view calling for a gradual slowing of economic growth toward trend and a more balanced labor market, which should ease inflation pressures without leading to a large increase in unemployment. These dynamics should allow the Fed to begin cutting rates, benefiting both consumer spending and business investment. However, we believe the risk of a downside outcome has increased.

The main risk is the potential for a more meaningful slowdown in growth if the Fed keeps rates too high for too long, which would put pressure on earnings and credit fundamentals and lead to wider spreads. Second, most borrowers have managed to pass through a large portion of price increases to consumers, thus preserving margin growth. However, as pricing power slowly diminishes against a backdrop of disinflation, we are carefully monitoring issuers’ earnings and commentary for signs of margin erosion.

Summary

- We maintain our positive outlook for leveraged credit based on attractive yields and a supportive economic backdrop.

- We expect leveraged borrowers will continue to grow earnings and manage their debt effectively, aided by stable (but slowing) economic growth and monetary easing.

- Careful credit selection remains essential due to market bifurcation between stronger and weaker issuers, which underscores the need for strategic credit management.

A note about risk

Principal risks for senior loans: All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield. Voya’s senior loan strategies invest primarily in below investment grade, floating-rate senior loans (also known as “high yield” or “junk” instruments), which are subject to greater levels of liquidity, credit and other risks than are investment grade instruments. There is a limited secondary market for floating rate loans, which may limit a strategy’s ability to sell a loan in a timely fashion or at a favorable price. If a loan is illiquid, the value of the loan may be negatively impacted, and the manager may not be able to sell the loan in order to meet redemption needs or other portfolio cash requirements. The value of loans in the portfolio could be negatively impacted by adverse economic or market conditions and by the failure of borrowers to repay principal or interest. A decrease in demand for loans may adversely affect the value of the portfolio’s investments, causing the portfolio’s net asset value to fall. Because of the limited market for floating rate senior loans, it may be difficult to value loans in the portfolio on a daily basis. The actual price the portfolio receives upon the sale of a loan could differ significantly from the value assigned to it in the portfolio. The portfolio may invest in foreign instruments, which may present increased market, liquidity, currency, interest rate, political, information and other risks. These risks may be greater in the case of emerging market loans. Although interest rates for floating rate senior loans typically reset periodically, changes in market interest rates may impact the valuation of loans in the portfolio. In the case of early prepayment of loans in the portfolio, the portfolio may realize proceeds from the repayment that are less than the valuation assigned to the loan by the portfolio. In the case of extensions of payment periods by borrowers on loans in the portfolio, the valuation of the loans may be reduced. The portfolio may also invest in other investment companies and will pay a proportional share of the expenses of the other investment company.

Principal risks for high yield bonds: All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. High yield securities, or “junk bonds,” are rated lower than investment grade bonds because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities. As interest rates rise, bond prices may fall, reducing the value of the portfolio’s share price. Debt securities with longer durations tend to be more sensitive to interest rate changes than debt securities with shorter durations. Other risks of the portfolio include, but are not limited to, credit risk, other investment companies’ risks, price volatility risk, the inability to sell securities and securities lending risks.