The current market backdrop presents opportunities to benefit from lower rates, durable earnings streams and high quality “all-in” yields.

Quick take

Supportive environment for stocks

As the U.S. Federal Reserve eases its restrictive monetary policy, the next few quarters will be a balancing act between managing inflation and slowing economic growth, but not a recession.

Preference for U.S. large and mid-cap stocks

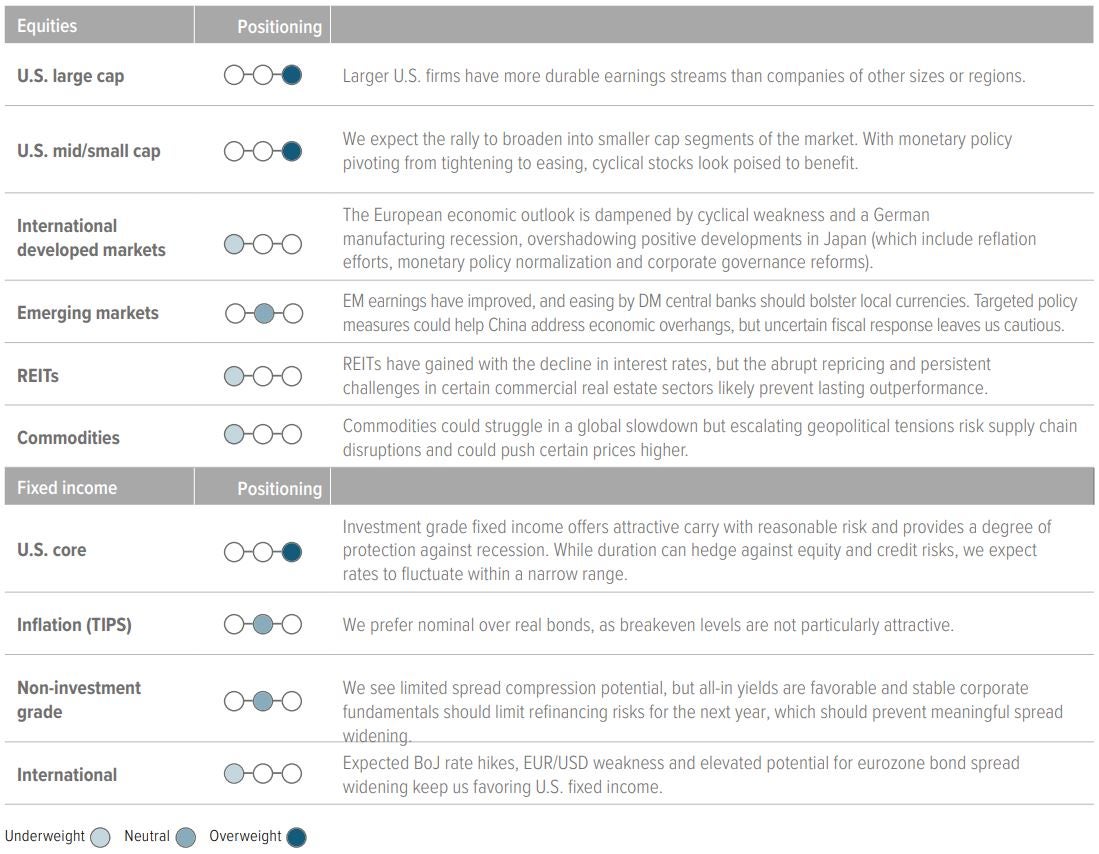

Larger U.S. stocks have durable earnings streams but we expect the equity rally to broaden to smaller companies. Japan has shown signs of life, but Europe is broadly weak. Emerging markets have improved, but China’s fiscal responses raise uncertainty.

High-quality fixed income remains attractive

In the fixed income market, there is a preference for higher-quality investments, especially investment grade bonds and securitized credit products, as all-in yields remain attractive.

Tactical indicators

Economic growth (solid but slowing)

As the U.S. Federal Reserve eases its restrictive monetary policy, the next few quarters will be a balancing act between managing inflation and slowing economic growth a slowdown to 1.5%-2.0% GDP growth expected, but not a recession.

Fundamentals (positive)

S&P 500 2Q24 earnings grew 13.2% year-over-year1 , with nine of the 11 sectors increasing and 79% of companies beating expectations. We expect aggregate U.S. earnings to grow in the high single digits, driven by technology stocks and aided by lower wage growth, with potential upside surprises due to significantly reduced estimates.

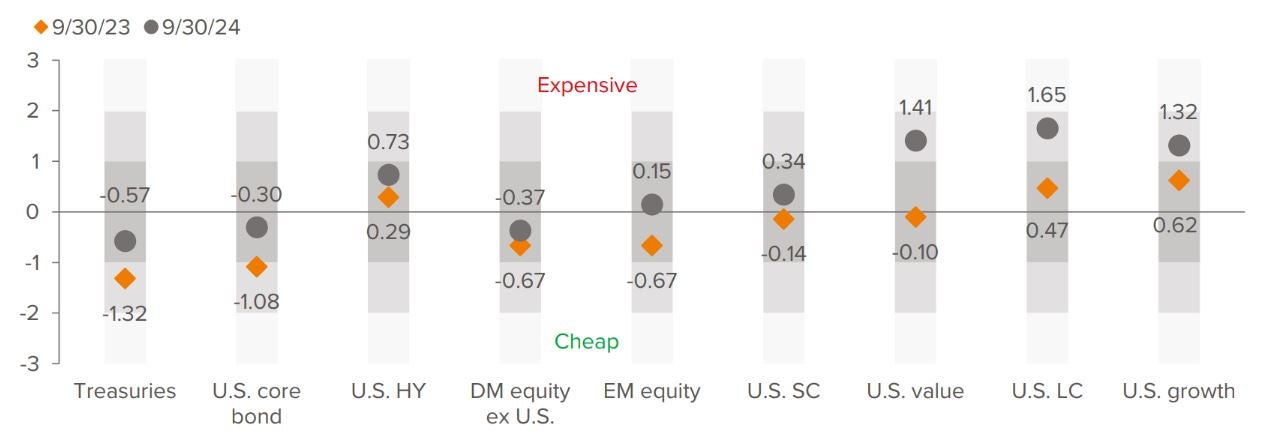

Valuations (neutral)

Large cap U.S. equity forward earnings multiples, while above their historical averages, are backed by robust corporate cash flows. Meanwhile, U.S. small cap and non-US equities are trading at a discount, although discounts are justified for international markets, especially Europe. U.S. mid-caps appear to be attractively priced.

Sentiment (neutral)

Both short-term and longer-term metrics suggest sentiment is overbought. While this skews forward returns less favorably, sentiment is not the best tool for timing market tops.

Investment outlook

Macro environment: Recession concerns abate, as inflation eases and the Fed cuts rates

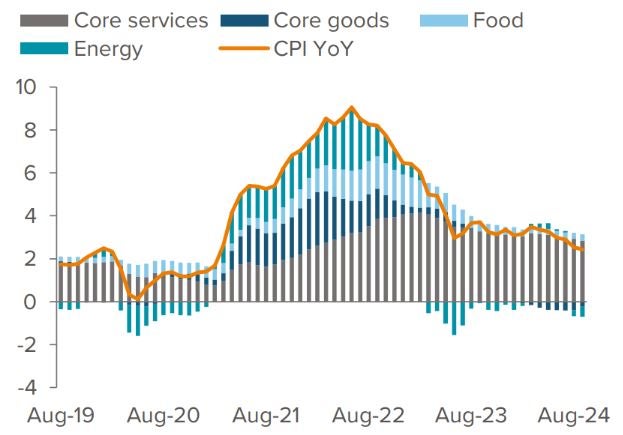

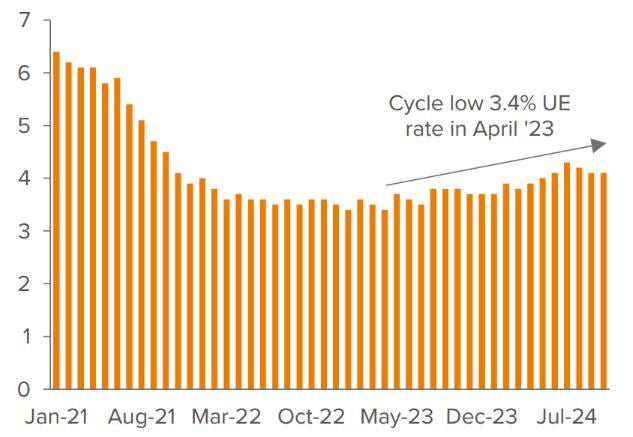

Inflation has continued to subside, reaching a three-year low in September (Exhibit 1), which has allowed the Federal Reserve to commence a gradual reduction in interest rates. The Fed initiated this process with a substantial 50 basis point cut in September and 25 basis points in November, demonstrating a proactive approach to bolster the labor market. This shift underscores the Fed’s pivot in focus from inflation to employment. Although the labor market has shown signs of softening, the rise in unemployment since the 3.4% April 2023 low has been gradual and primarily due to an increase in labor supply, driven largely by immigration, which is more manageable than unemployment caused by widespread layoffs. Furthermore, in September, the U.S. job market added a robust 254,000 jobs, exceeding expectations and lowering the unemployment rate to 4.1% (Exhibit 2). This suggests that the economy may be more resilient than anticipated, supported by easing inflation and rising real wages. However, further rate cuts are probably necessary to stabilize the labor market as it adjusts to the balance between supply and demand. The Fed projects that its rate-cutting cycle will conclude by the end of 2026, with its target rate settling at 2.9%.

Given our view that the U.S. will avoid a recession due to the Fed’s swift actions to support the labor market, we question whether the “neutral” rate of interest— the rate at which monetary policy neither stimulates nor constricts economic growth—will drop this low. Nonetheless, it is prudent to prepare for lower short-term rates in the future. In an environment characterized by positive economic growth, solid employment and declining interest rates, stocks typically perform well.

Portfolio positioning

We maintain a balanced stance between stocks and bonds, with a preference for U.S. large cap and mid cap equities, as well as high-quality fixed income.

As of 09/30/24. UE as of 10/31/24. Source: Federal Reserve Bank of San Francisco, Bloomberg, U.S. Bureau of Labor Statistics, Voya IM.

U.S. stocks: Strong earnings and Fed support justify valuation

We remain positive on U.S. equities, particularly large caps. The overall economic outlook is still positive, with Fed policy supporting employment and thereby consumer spending. With the election concluded and some uncertainty lifted, we expect corporate spending to resume as managers, reassured by the known political configuration, restart projects that were temporarily put on hold. Earnings have been, and we believe will continue to be, strong. Unlike previous quarters, earnings estimates have been revised significantly lower and could result in larger than normal earnings surprises.

However, we recognize some factors could constrain returns over the longer term. First is the incongruity of expected increases in rising profits alongside falling interest rates. Since these typically do not coincide, either 2025 earnings will come down as the economy slows, or expectations for rate cuts will need to reprice. Secondly, S&P 500 valuation ratios—such as P/E— look expensive versus history (Exhibit 3) and, to some degree, cross sectionally, contributing to our view that U.S. equity returns will be lower than they have been in the past two years.

Still, we think higher valuations are partly due to the shifting composition of the S&P 500 index. The increasing weight of the technology sector and related companies, with their capital-light business models, suggest that margins may have reached a new, higher steady state. This shift makes current valuations seem more reasonable and leads us to believe equity returns could align with earnings growth over the medium term. Therefore, we remain overweight U.S. large cap stocks, but have gradually reduced it in favor of mid cap stocks given their more attractive valuations and expectation that they will disproportionately benefit from lower borrowing costs.

Stocks may enjoy another boost as investors gain clarity about domestic political leadership. President-elect Trump’s proposal to extend the 2017 tax cuts could further fuel this momentum by securing lower individual tax rates and prolonging bonus depreciation for capital investments and research costs while he looks to reduce corporate tax rates further. While the recent uptick in rates seems to be driven by a positive growth outlook—usually a plus for equity markets—a sudden and significant increase in rates over a short period could lead to equity market turbulence.

As of 09/30/24. Source: Bloomberg, U.S. Bureau of Labor Statistics, Voya IM. Asset class valuation Z-scores based on 25-year average valuation measures.2

International Equity

The outlook for international or non-U.S. equities is mixed, with varying economic conditions across regions presenting both risks and opportunities for investors. Tariff and trade policy uncertainty could become an increasing drag for certain countries.

Europe: Economic stagnation, regulator overhang and political instability

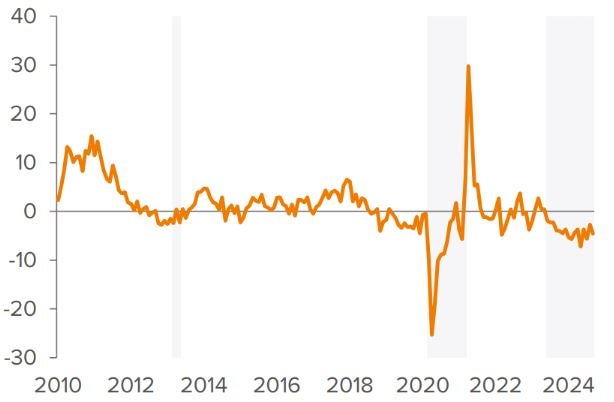

We maintain an underweight stance on European stocks due to several interconnected challenges. The European economy is grappling with sluggish activity, exacerbated by weak demand from China and high domestic real interest rates, which hinder trade and overall economic growth. Germany, Europe’s largest economy, continues to experience a notable slowdown in manufacturing activity (Exhibit 4) and is nearing its second consecutive year of contraction. Macroeconomic headwinds, including geopolitical risks and global trade disruptions, further dampen the outlook.

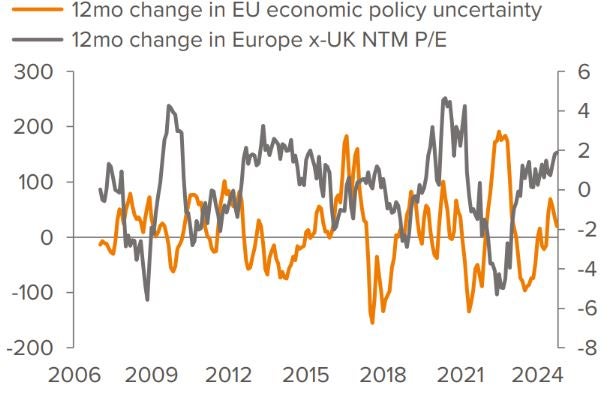

Eurozone earnings are expected to be lackluster in the 2025, with recent data indicating flat near-term growth potential. Additionally, Europe’s high labor costs, persistent core inflation and tighter fiscal policies, coupled with ongoing domestic political instability contribute to a cautious investment environment. While relative valuations remain attractive, if political uncertainty continues to rise—particularly related to trade policy—earnings multiples could be pressured lower (Exhibit 5). This and weak economic indicators lead us to retain a defensive approach to Europe.

As of 09/30/24. Source: Bloomberg, Eurostat accessed through Federal Reserve Bank of St. Louis. Line shows the non-seasonally adjusted year-over-year German industrial production. Shaded areas indicate recession.

As of 10/31/24. Source: Bloomberg, Voya IM. Left axis: Change in EU economic policy uncertainty; Right axis (inverted scale) Change in Europe x-UK NTM P/E.

Japan: Policy shifts and new leadership brighten the outlook

We maintain a neutral stance on Japanese stocks due to a mix of economic and political factors. While Japan’s economy seems to be moving in the right direction, currency stability remains a challenge. The new Prime Minister, Shigeru Ishiba, was historically a monetary hawk who supported rate hikes. More recently, following the Bank of Japan’s first rate hike in 17 years, he pushed back against policy normalization, contributing to the subsequent decision to hold rates steady, reflecting uncertainty about the economic outlook. This prompted renewed speculation against the yen and led some to question the administration’s commitment to boosting spending through gains in incomes. Despite the policy hesitancy and potential lack of credibility, improvements in corporate governance and earnings revisions point to upside for Japanese firms. The political backdrop, including Ishiba’s call for a snap election, adds to the uncertainty.

Japan’s corporate fundamentals have improved with continued efforts to enhance returns on equity and pressure underperforming publicly listed firms to take shareholder-friendly actions. We expect the BoJ to proceed cautiously with policy normalization, mindful of the weak top-line growth and slowing inflation. Despite recent volatility, we believe Japan’s efforts to phase out extraordinary monetary easing will continue over time and ultimately benefit the country. We are closely monitoring the BoJ’s narrative for signals about future policy moves.

Emerging Markets: China’s stimulus sparks excitement, but sustainability remains uncertain

The Fed’s pivot to easier monetary policy, which appears poised to continue as developed market central banks are early in their monetary easing cycle, led to USD weakening since May, which has been beneficial for emerging market assets. However, the actual level of Fed rate cuts will depend on incoming data—which recently has been better than expected—and the impact on the dollar and emerging market assets.

China is another highly influential factor on emerging market performance. Consistently dismal returns for the better part of the last three years have reduced the country’s weight in emerging market equity indices, but it remains the largest component.

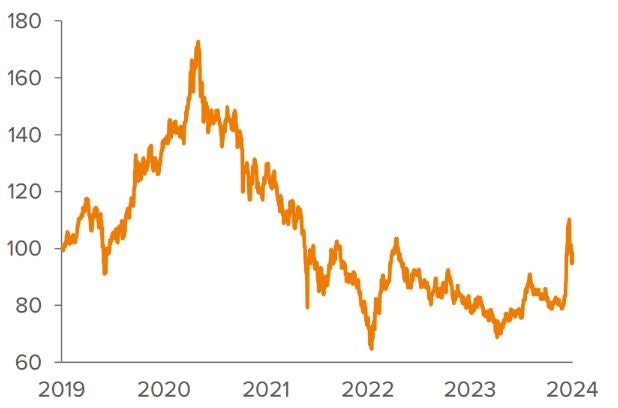

China has a long history of disappointing investors, and the latest drawdown has been painful. However, following such steep falls, recoveries can be swift and explosive. This occurred in the back half of September after authorities rolled out a substantial, wide-ranging stimulus package, causing stocks to rally roughly 30% in a couple of weeks (Exhibit 6).

Key monetary actions included cutting the repo rate, lowering the required reserve ratio, reducing the minimum downpayment for second home mortgages and instituting stock market purchase facilities. Additionally, swap lines to purchase unsold housing from real estate developers were opened for government-sponsored enterprises. On top of this, the Politburo committed to more fiscal measures aimed at consumer spending. These policies are designed to help stabilize the housing market and prevent further declines in share prices, thereby trimming tail-risk from global markets.

Despite the relief rally, we are skeptical that these solutions will sustainably solve the underlying structural problems, and their effect on consumer demand and investor risk appetite is still uncertain. The country will continue to contend with geopolitical tensions, declining western foreign direct investment and potential tariffs.3 These issues, along with challenges in the real estate market and the need for sustainable growth, contribute to our hesitancy in boosting investment stakes in EM. As a result, we remain neutral.

As of 10/31/24. Source: Morningstar, Voya IM. Data show the 5-year investment growth of the MSCI China NR USD Index.

Overall, non-U.S. equities, particularly in Europe, face significant challenges due to sluggish economic activity and weak trade. High domestic real interest rates further dampen economic prospects, leading us to continue holdings our home country bias.

Fixed Income: High quality coupon clipping

Our views on fixed income are little changed this quarter. We continue to overweight U.S. investment grade core bonds. Spreads are tight, but policy and fundamentals are supportive and carry remains attractive. Within the asset classes, lower-beta securitized assets, such as agency mortgages and consumer-oriented asset-backed securities, as well as high-quality corporates, look appealing. These sectors should benefit from solid macro conditions and favorable supply and demand dynamics.

We are underweight leveraged loans. Slower economic growth, falling interest rates and tilts toward cyclical sectors dependent on discretionary consumer spending keep us cautious. We don’t have strong conviction on the near-term direction of rates. While we do believe the Fed will continue to reduce rates, the short end of the curve already has significant cuts priced in and the long-end yield seems fair given our views on growth and inflation, preferring nominal bonds as a hedge against the downside in equity returns.

Our aversion to international fixed income is based on the same factors that drive our underweights to non-U.S. equities. There are cases to be made for certain countries, but overall, foreign securities aren’t as compelling as U.S. assets, in our opinion. Furthermore, we’re not convinced that global bonds will keep benefiting from a weaker USD. However, the incoming Trump administration has openly discussed the dollar’s strength, and policy changes could potentially shift this dynamic once they take office.

For Voya’s thoughts on the U.S. election please see “5 Investor Takeaways: Red Wave Paves the Way for Economic Protectionism.”