The current market backdrop presents opportunities for allocators to benefit from corporate cash flows, valuation discounts and high quality “all-in” yields. However, in this uneven macro environment, we emphasize balance in our multi-asset portfolios, favoring U.S. large and mid-cap equities and high-quality fixed income.

Quick take

Growth expected to slow

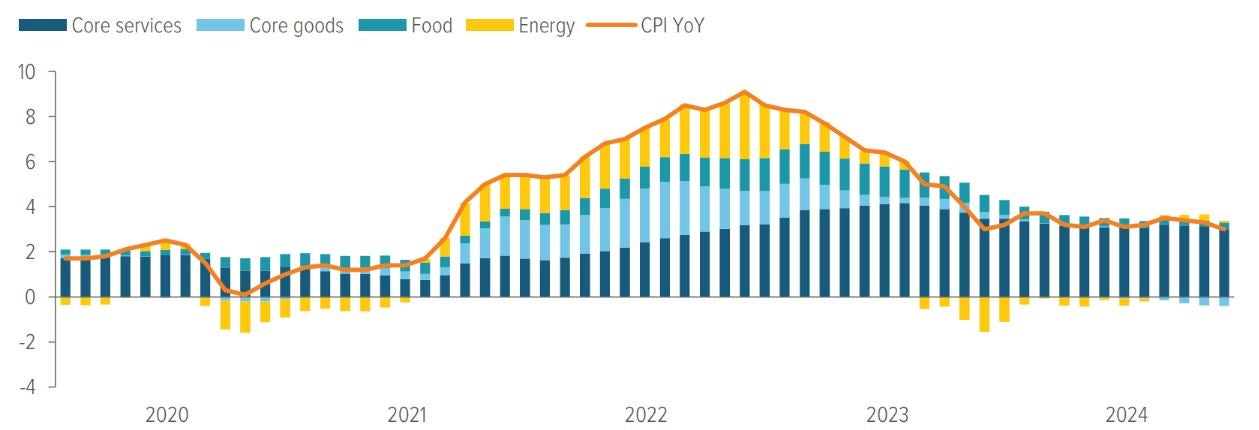

The U.S. economy has demonstrated resilience, with an average real annual GDP growth of 3.4% since 2021, despite ongoing inflation and significant monetary policy tightening. However, growth is expected to slow for the rest of the year, as excess savings from the pandemic stimulus packages have been depleted. Inflation is back on a declining trend; the Consumer Price Index (CPI) fell for the fourth consecutive month in June to 3.0% year over year, while core personal consumption expenditures (PCE), the Fed’s preferred inflation measure, declined to 2.6%.

Preference for U.S. equities persists

U.S. equities are supported by earnings quality, growth potential and stability amid global economic uncertainties. On the other hand, international equities, especially European and emerging markets, are facing challenges due to geopolitical tensions and increasing policy uncertainty. China’s economy grew 4.7% in 2Q24, less than expected and below its 5% growth target. Meaningful risks persist due to ongoing deleveraging from the property crisis, deflationary forces, dropping foreign direct investment and an unfavorable regulatory environment.

High-quality fixed income is attractive

In the fixed income market, there is a preference for higher-quality investments, especially investment grade bonds and securitized credit products, as all-in yields remain attractive.

Tactical indicators

Economic growth (solid but slowing)

2Q24 U.S. real gross domestic product (GDP) increased at an annual rate of 2.8%. Consumer spending, private inventory investment and nonresidential fixed investment drove the increase. We believe growth will slow in the second half of the year as consumption and business fixed investment moderate.

Fundamentals (neutral)

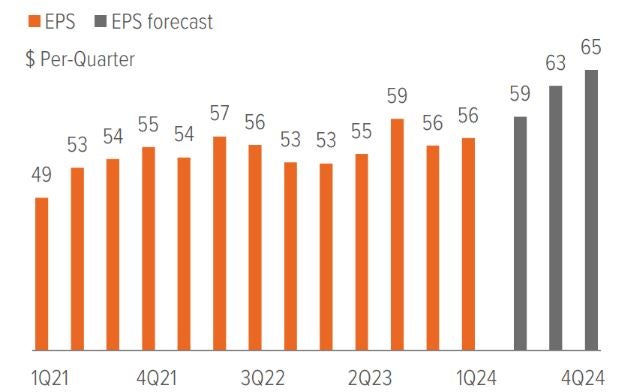

S&P 500 1Q24 earnings grew 8.2% year over year,1 with 8 of the 11 sectors increasing and 79% of companies beating expectations. We think U.S. corporate earnings can continue growing near expectations (in the high single digits) as technology stocks maintain positive momentum and other sectors begin to catch up.

Valuations (neutral)

In aggregate, large cap U.S. equity forward earnings multiples are above their historical average, but strong corporate cash flows support this. U.S. smaller cap and non-U.S. equities trade at a discount. While this lower valuation is warranted for international markets, U.S. mid caps look increasingly attractive.

Sentiment (neutral)

The recent rotation out of the Mag 7 into more value-oriented and smaller cap stocks has reduced the extreme positioning and helped hold broad sentiment measures in neutral territory. However, with markets nearing overbought levels, the potential for returns looks muted.

Investment outlook

Macro environment: Slower but steady at the surface

Following persistent inflation and significant monetary tightening, the stamina of the U.S. economy has been remarkable. Since 2021, real annual GDP growth has averaged 3.4%, versus the 2.4% from 2010 to 2019. At the same time, the unemployment rate has averaged 4.3% in the post-pandemic period, versus 6.3% in the post-global-financial-crisis period.

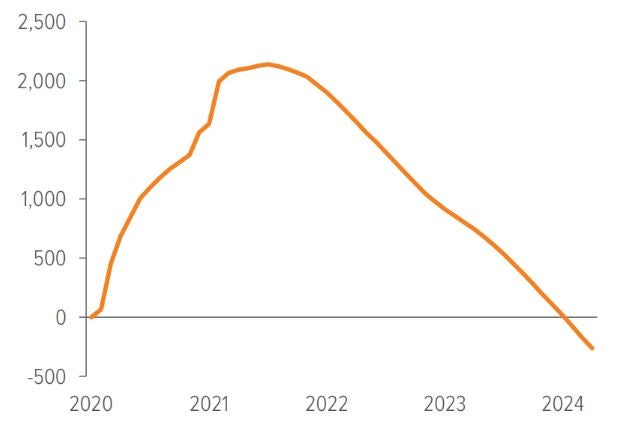

However, the demand-side effect of high interest rates is becoming increasingly apparent, as excess savings have all been depleted (Exhibit 1, next page) and evidence continues to support our view that growth will be below-trend and should exert downward pressure on prices.

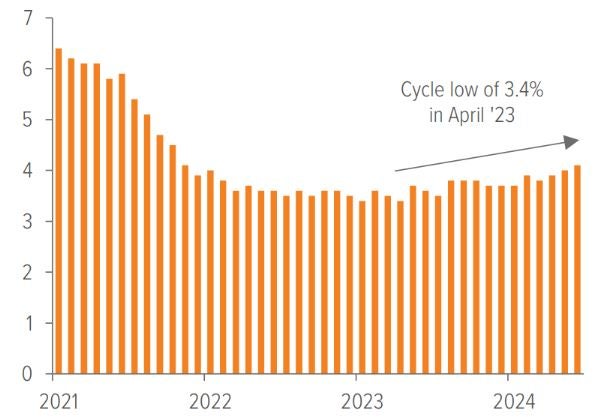

In the latest reading, U.S. real GDP growth increased to 2.8% in 2Q24, up from 1.4% in 1Q24, but trending down as demonstrated by the unemployment rate, which rose for the sixth consecutive quarter to 4.3% in July (Exhibit 2).

Contracting employment components in the Institute for Supply Management’s purchasing managers’ indexes (PMIs) also indicate the labor market’s softening trend, but a surprising increase in job openings to 8.1 million in May suggests cooling rather than a fast freeze. Moreover, a weaker labor market’s effect on the consumer could be somewhat offset by the resumption of disinflationary trends, which should support real incomes at a level consistent with 2% inflation.

Portfolio positioning

We remain balanced in our view on global stocks versus bonds. U.S. large cap equities and high-quality fixed income are our favorite asset classes.

As of 05/01/24. Source: Federal Reserve Bank of San Francisco, Bloomberg, U.S. Bureau of Labor Statistics (BLS), Voya IM.

As of 06/30/24. Source: BLS, Voya IM.

Fortunately, after several hotter-than-expected readings in the first quarter, inflation has resumed its descent; the CPI fell for the fourth straight month—to 3.0% YoY—in June (Exhibit 3). Core CPI declined to 3.3%, as goods inflation turned negative, but remains above pre-pandemic levels on elevated services prices. Importantly, shelter prices (the biggest driver of services inflation) experienced their smallest monthly increase since August 2021. This welcome news seems to confirm the efficacy of the Fed’s policy and align with our economic forecasts.

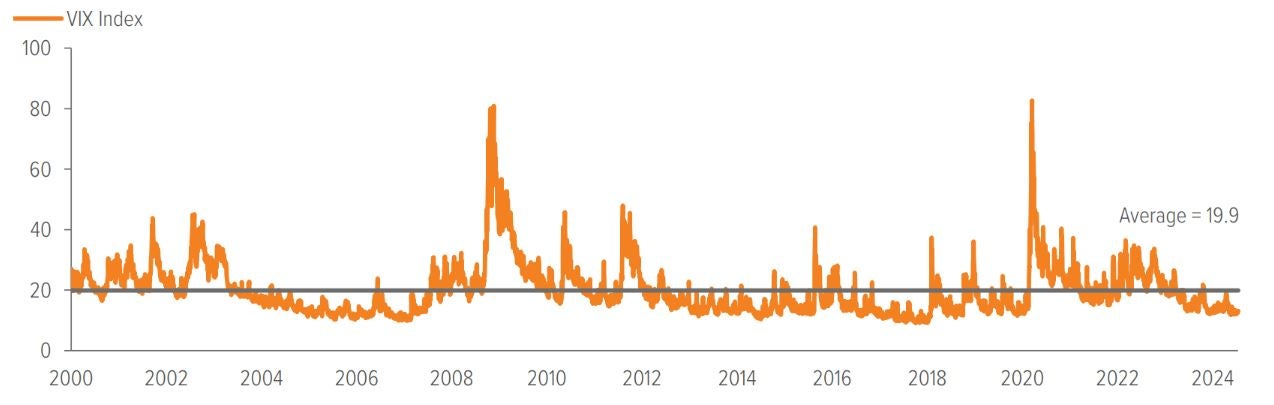

Given the normalization in supply chains and a rebalanced labor market toward pre-pandemic levels, we believe prices will drift lower without unemployment leaping higher. We expect the U.S. economy to continue to grow and avoid a recession over the next 12 months. Our belief is that pullbacks will be short-lived and a significant decline in equity markets isn’t likely. However, our view doesn’t suggest that there is significant upside to equities markets in the near term. In fact, the recent pickup in equity volatility from previously low levels and the impending U.S. election will likely pressure crowded trades and risky corners of the market (Exhibit 4 , next page).

As U.S. investors grapple with potential economic crosscurrents characteristic of a late-cycle environment, we maintain a neutral posture between stocks and bonds that balances their competing inherent risks.

As of 06/30/24. Source: Bloomberg, U.S. Bureau of Labor Statistics, Voya IM.

As of 07/16/24. Source: Bloomberg, U.S. Bureau of Labor Statistics, Voya IM.

U.S. equities: Back to the well as winners poised to keep winning

The current global economic landscape and market dynamics suggest strategic positioning that favors U.S. assets—specifically large cap stocks. The U.S. is in a better economic situation than much of the rest of the world—given relatively stable economic conditions, technological innovation and strong financial markets—which has made the country a global destination for investor flows. We have good reason to believe this will continue. As a result, the U.S. is our favored region.

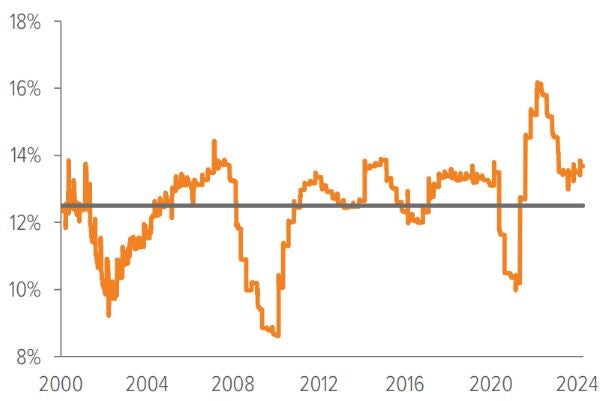

We think large cap stocks are particularly appealing due to their earnings quality, growth potential and momentum. However, we recognize that earnings expectations are somewhat extended (Exhibit 5). With nominal GDP growth falling, meaningful upside to sales growth will be difficult, but solid profit margins (Exhibit 6) and high returns on equity should continue to support valuations. While pressure to maintain their earnings growth trajectory is high, U.S. technology mega caps are facing scrutiny on artificial intelligence spend. For example, hyperscalers— including Amazon, Meta, Microsoft and Alphabet—have spent about $360 billion over the past year.2 Eventually, these firms will need to prove their investments will generate revenues and earnings, but companies need time to move from training models to production before accurate assessments can be made, and results aren’t required yet. Meanwhile, AI infrastructure providers—such as those supplying chips, memory and servers—are producing massive cash flows. We also like the overall stability of large companies as a buffer against global economic and geopolitical uncertainties and we believe they continue to offer a compelling risk/reward opportunity.

As of 07/16/24. Source: FactSet, Bloomberg, U.S. Bureau of Labor Statistics, Voya IM.

As of 07/16/24. Source: FactSet, Bloomberg, U.S. Bureau of Labor Statistics, Voya IM.

Offsetting our continued U.S. large cap overweight is a persistent underweight to REITs. Higher interest rates have driven this stance, as increased borrowing costs have pressured REIT performance. Additionally, the volume of commercial real estate debt due for refinancing poses a substantial financial risk at these higher rates, particularly for the office and retail sectors, which are still grappling with structural challenges. Furthermore, the volatility and potential overvaluation of publicly traded REITs (compared with their net asset value) create concerns about their ability to generate returns in the current environment. Given these factors, we believe more attractive investment opportunities exist elsewhere.

International equities: Challenges outweigh optimism and hope

Although bright spots exist, international stocks aren’t attractive right now overall.

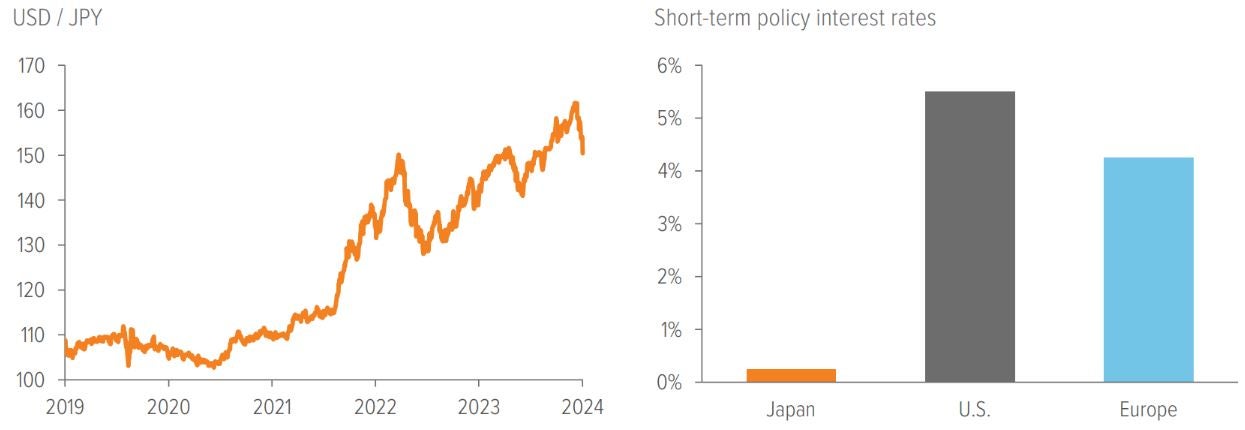

Japan’s economic dilemma: Mixed impact from a weak yen creates policy challenges

Japan is still contending with a weak currency while attempting to normalize monetary policy. It has benefited from outflows from China and its currency has helped export-oriented segments of the economy. However, risks to an extremely weak currency exist. Policymakers are attempting to provide support with modest increases in interest rates, which typically bolster the domestic currency. Meanwhile, interest rate differentials favor other developed markets. This has put Japan in a precarious position, as it can’t afford to raise rates to a level that would curtail domestic consumption and corporate investment.

However, Japan is getting relief from the recent rate cut in the eurozone and cooling inflation prints in the U.S., which raise the odds of a September Fed rate cut. BoJ officials want to raise rates multiple times before year-end and move toward a healthier, more sustainable monetary policy. However, they face obstacles from the rapid unwinding of a longstanding carry trade which may create near-term headwinds by negatively impacting earnings (due to the country’s economic cyclicality and export orientation).

Europe’s economic strain: High costs, political shifts and geopolitical tensions limit growth prospects

Europe’s high labor costs, stubborn core inflation and tighter fiscal policies while energy support measures phase out are expected to keep real GDP growth sluggish. The region won’t be rescued by a pickup in external demand as long as restrictions on exports to Russia and China remain in place for certain technologies. Exposure to geopolitical issues, such as the war in Ukraine and instability in the Middle East, continues to be an overhang. Domestic politics have turned increasingly negative, particularly with the recent government changes in France, the European Union’s second-largest economy. These developments are likely to lead to outcomes that are less favorable for investors.

U.K.’s political shift: Citizens and investors welcome change

Recent political developments in the U.K. have been perceived much more favorably. An overwhelming victory for Sir Kier Starmer’s Labour Party followed a tumultuous period of Conservative governance. The relative stability of the U.K. is a welcome development. Along with its position as one of the cheapest markets globally, macro data are improving, the BoE is expected to cut rates, and earnings revisions look set to increase, making the region a more compelling proposition for investors.

As of 07/31/24. Source: Bloomberg.

China: Worst has probably passed, but not necessarily sunny days ahead

Chinese stocks rallied in the second quarter on the back of stabilization in some key economic readings. Manufacturing and infrastructure investment were the key drivers, while exports and PMI appeared to have bottomed. Earnings may also be bottoming, and valuations are attractive. Buybacks and dividends have reached all-time highs. Production of electric vehicles, industrial robotics and solar technology continue to be strengths.

The Chinese Communist Party’s Third Plenum and the subsequent Politburo meeting in late July focused on reaffirming long-term strategic goals centered around innovation, green energy, and increased domestic consumption as drivers of economic growth. This shift toward long-term sustainability and self-sufficiency, combined with recently announced $42 billion stimulus package designed to support consumer spending and provide a more immediate boost to economic growth, have the potential both in the near term with respect to investor sentiment and long term as plans for fiscal and economic reforms unfold. While China has turned a corner, activity indicators suggest that a sustained pickup in economic growth will be difficult (Exhibit 8). Also, significant risks associated with geopolitics and ongoing deleveraging from the property crisis remain, especially given the wide range of U.S. election implications regarding trade policy and relations.

As of 06/30/24. Source: EM Advisors.

Fixed income: Comfort in quality

We maintain our preference for higher quality within fixed income. Despite limited upside potential due to already tight spreads, the supportive macroeconomic environment underpins solid corporate fundamentals, making the additional yield from investment grade bonds a worthwhile risk. Securitized credit products, particularly consumer-oriented asset-backed securities and residential mortgage-backed securities, appear attractive. Additionally, a beaten-down commercial mortgage-backed securities (CMBS) sector appears to offer value opportunities for savvy security selectors. Despite higher interest costs beginning to weigh on credit quality in the high yield space, defaults and credit stress remain limited. However, increasing tail risks keep us neutral.

We don’t have strong conviction on the near-term direction of rates, but do hold a modest long-duration posture in more aggressive, equity-heavy portfolios to provide added ballast to higher beta. We prefer nominal bonds over real bonds to hedge against the downside in equity returns. With some foreign central bank rate-cutting cycles already underway, certain countries’ bond markets look interesting; however, when considering the support for a strong U.S. dollar and the potential negative currency impacts, we remain underweight non-U.S. bonds.

A note about risk

The principal risks are generally those attributable to investing in stocks and related derivative instruments. Holdings are subject to market, issuer and other risks, and their values may fluctuate. Market risk is the risk that securities or other instruments may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security or instrument may decline for reasons specific to the issuer, such as changes in its financial condition. More particularly, the strategy invests in smaller companies, which may be more susceptible to price swings than larger companies because they have fewer resources and more limited products, and many are dependent on a few key managers.