Get the latest insights from our securitized credit desk.

A 2-month stretch without fresh economic data and no fresh ‘credit cockroaches’ in securitized since our October talking points (thankfully). Layer in the approaching holidays, and it seems there is less to explore than in recent months. Yet, there is a palpable urgency in markets with volatility back across equities and rates. Securitized issuance remains at a feverish pace across sectors. Let’s dig in:

Macro Inputs

- Fed Speak: Without the collection of key economic data during the government shutdown (went back to 10/1!), a “fog” has set in for Fed members, some by their own admission. Accordingly, we have found the messaging around further rate cuts as more uncertain and some may say unlikely, at least for the December 10th meeting.

- This has manifested in higher rate-vol, both realized (Fed Funds futures for a December cut repriced to 30% chance from 70% B.O.M.) and implied (MOVE +27% MTD thru 11/19).

- From our perspective, this has contributed to the pick-up in credit market vol (VIX +36% MTD thru 11/19, HY OAS +23bps MTD thru 11/19).

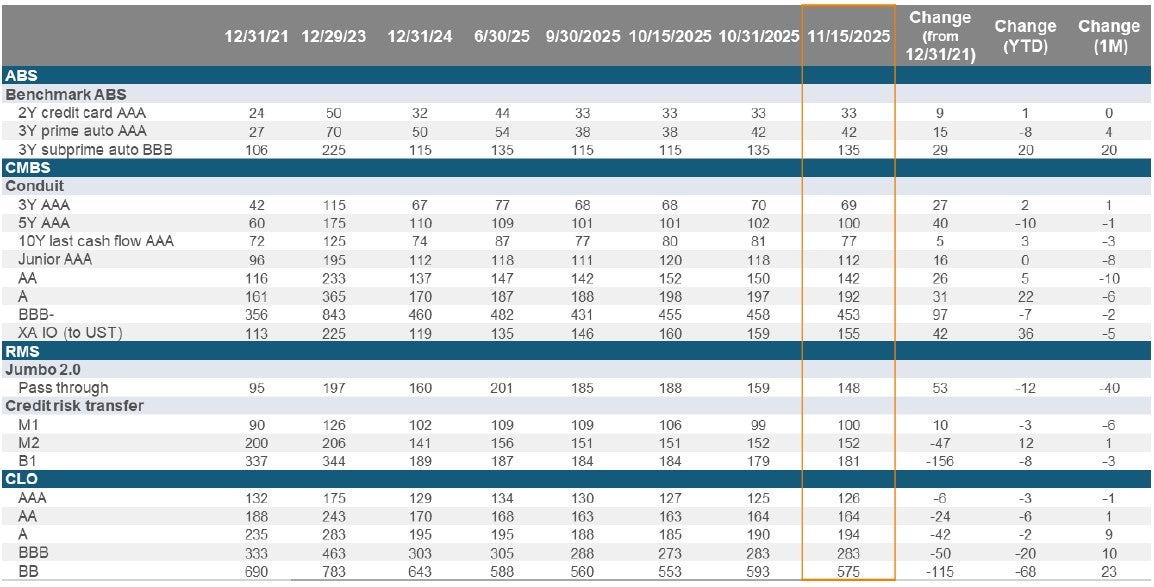

- Securitized credit markets have not been entirely immune, although spread widening (see table below) has been isolated to deeper credit risk parts of our markets or in sectors more traditionally connected to rates (see agency MBS).

- AI ‘Bubble’ Fears: A range of catalysts challenging the previously dominant AI phenomenon in markets emerged in recent weeks, including concerns around spending plans by hyperscalers, investor survey data citing widespread bubble fears, concerning takes from thought leaders and some impatience around tangible gains from AI technology.

- This has manifested in the afore cited pick-up in credit market volatility, with equities demonstrating this most acutely (SPX -2.9%, QQQ -4.6% MTD thru 11/19).

- However, debt markets have also been challenged as evidenced by the widening in credit spreads in HY (cited above) and even IG corps (+5bps MTD thru 11/19).

- The feedback loops into securitized credit have been much less direct. Even for securitizations of data centers – wrapped in ABS and CMBS structures – spread widening has been contained and capital has continued to get accessed efficiently. See this post for where the largest CMBS deal backed by data centers ($3.5B BX 2025-VOLT, refinance of BX 2021-VOLT) priced just last week:

- While the deal took several weeks to clear the market, we assessed it as a function of its relatively large size and viewed the execution as efficient. The afore-described challenges to AI-related risks were not helpful, certainly, in promoting speedier execution.

- In the absence of more traditional menu of macro information, these factors consumed the majority of oxygen for markets to consume over the last month. We expect the re-opening of the government to offer the market a more balanced array of information to consume, albeit with some staleness in upcoming weeks before catching up to more real-time inputs. This should promote overall healthier decision making for risk-takers, even as liquidity tightens into weaker seasonals (holidays coming!).

- As I did last month, a quick summary of what we have consumed in securitized centric market data (monthly remits, housing data, CRE data, leveraged loan performance):

- Real estate has exhibited stability, if not strength.

- While not overpowering, both housing and CRE are showing increases in property values when measured on a nationwide basis: CoreLogic +1.5% YoY; RCA CPPI +4.2% YoY in their October updates.

- Pockets of weakness exist, particularly in housing where areas in FL and TX show home prices down >20% from peak values just a couple of years ago.

- But the overall story is one of stability, with the post Jackson hole drop in rates a catalyst for some notable recent increases in activity – healthy for markets. For example, we have observed increases in prepayment activity in RMBS sub-sectors, which in non0agency markets fosters transaction de-leveraging, which is good for credit risk takers.

- Lots of eyes on the health of consumers, perhaps needless to say, following the credit events endured in Sept-Oct. Consumer related sub-sectors (subprime auto, prime auto, student loans, credit cards, solar loans, unsecured loans) are sending differing signals on this front, but not confusing or difficult to interpret.

- Overall, consumer borrowing remains robust and access to credit is efficient across most quality cohorts.

- Based on new issuance volumes (see below table), financial conditions are relatively easy despite the afore alluded to difficulties and pick-up in market vol.

- Nothing in October remits suggested a change in our trends: subprime/low-income consumer cohorts are under stress (subprime auto DQs still climbing) while middle and upper income households are healthy, if perhaps unsettled with costs and the recent return of market vol.

- Real estate has exhibited stability, if not strength.

- A few pockets of softness noted in securitized markets, emanating primarily from the pick-up in credit market volatility.

- We call out CLOs as the primary culprit here, with subordinates (BBB and below) exhibiting weakness. Spreads have widened and we expect liquidity to constrict into year-end.

- We would also highlight that the weakness observed in ABS markets in Sept-Oct on the back of Tricolor did not continue to progress into November. The buy-the-dip mentality, honed in equity markets, was on display in new issue markets in recent weeks, even as equity market vol picked up.

- We participated in several transactions where we had our orders allocated amidst strong demand, and saw deals price inside of initial guidance, including in subprime auto ABS.

- A force in securitized markets continues to be new issue markets. New issue remains the dominant means to source risk, with secondary market activity an afterthought when looking to ramp new allocations. Secondary markets remain viable, but much more limited relative to new issue.

- We continue to observe strength, with that strength catching up in mortgage markets – resi and commercial – catching up to ABS and CLO markets over the course of the year.

- Liquidity has returned to being strong and deep in securitized markets, rebounding nicely into November as accounts reposition ahead of typically leaner weeks of supply in late November and December.

- An updated assessment of pipelines suggest that while CMBS new issue activity is indeed poised to slow into the holidays, a larger than typical number of issuers in ABS and RMBS both remain engaged and likely to issue again this year.

Outlook

- We hold on to our tempered outlook from the prior 2mths, with the more volatile macro backdrop likely to catch-up more broadly across securitized credit sectors in coming days.

- However, we expect to pivot our approach in markets to more risk-seeking ahead of year end, looking to get ahead of the typical “January effect’ in our markets that ushers in fresh capital and potential spread tightening.

- We expect new issue markets to promote opportunities in this regard, especially if liquidity becomes more valuable into holiday shortened trading sessions.

- We will continue to respect distressed credit signals throughout this upcoming period, anchoring to core risks with prime quality consumers and in real estate markets where early cycle attributes offer the clearest path home.

We hope everyone enjoys their Thanksgiving.

Voya Securitized Team