Weekly Notables

It was an eventful week in the markets. The escalating conflict between Israel and Iran drove oil and gas prices higher, adding to geopolitical uncertainty. Meanwhile, the Fed held interest rates steady, as growth was marked down, while inflation and unemployment were revised higher, reflecting the anticipated impact of tariffs. Policymakers remained cautious, emphasizing the low urgency to begin cutting rates at this time.

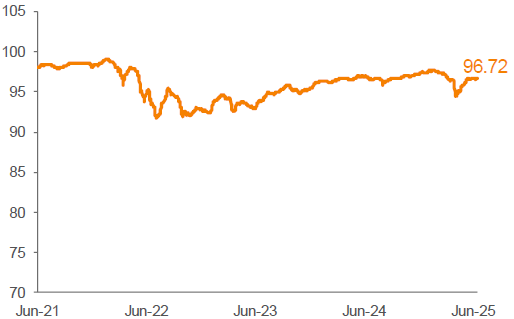

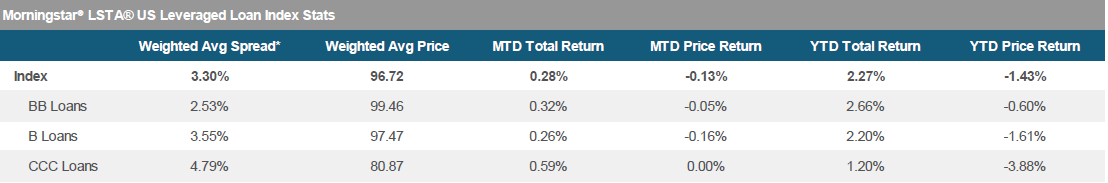

Despite the uncertainty, the loan market was steady, as the Morningstar® LSTA® US Leveraged Loan Index (Index) returned 0.08% for the seven-day period ended June 19. The average Index bid price increased by 7 bp, closing out the week at 96.72.

In the primary market, issuance activity was mixed, with a blend of refinancing, LBO and M&A-related deals. Total institutional volume was about $6.3 billion, down from $12.4 billion last week. In addition, repricings fell to $3.4 billion from $9 billion in the previous week. In the forward calendar, net of the anticipated $28.3 billion of repayments not associated with the forward pipeline, the amount of repayments now outstrip new supply by about $5.1 billion, versus $2 billion last week.

There was a notable dispersion across all rating categories. For the week, Double-Bs, Single-Bs and CCCs returned 0.08%, 0.09% and -0.06%, respectively. There were eight CLO deals that priced this week, pushing the YTD volume to $92.5 billion. On the other hand, retail loan funds saw an outflow of $134 million for the week ended June 18.

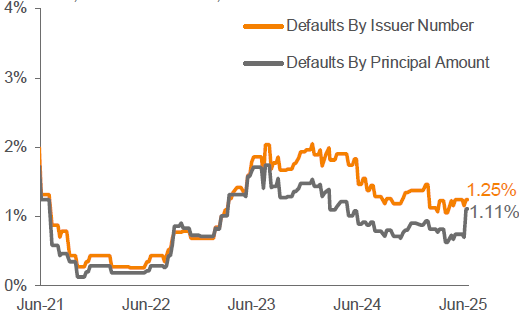

There were no defaults in the Index this week.

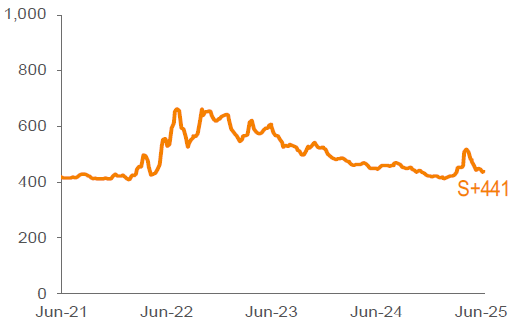

Source: Pitchbook Data, Inc./LCD, Morningstar ® LSTA ® Leveraged Loan Index. Additional footnotes and disclosures on back page. Past performance is no guarantee of future results. Investors cannot invest directly in the Index. *The Index’s average nominal spread calculation includes the benefit of base rate floors (where applicable).