The markets often see elections as a sideshow—not as the main event.

Exposure to social media and the 24-hour news cycle can create a lot of stress during election years for investors, who often worry that politics will have a negative impact on their portfolio. The good news is that financial markets generally don’t share the public’s fascination with elections.

Policy, not politics, is what typically influences the economy and markets the most—and policy takes time to shape. Here, we explore some of the common questions that investors might have this year.

Am I better off waiting to invest until after November 5?

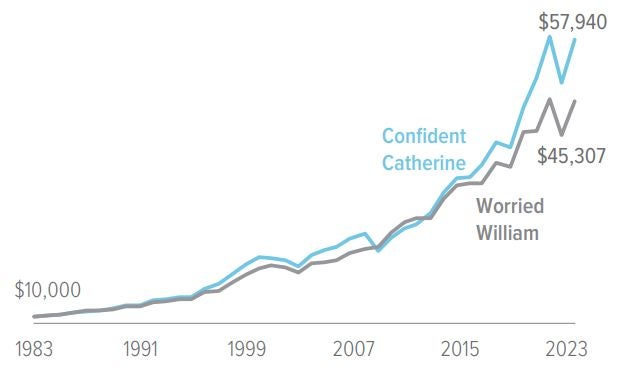

Consider two investors: Confident Catherine and Worried William each invested $10,000 in a 60/40 blend of stocks and bonds 40 years ago, at the start of 1983.

Catherine stayed invested regardless of the election cycle.

William moved to cash each election year, then reinvested the following year when the election was over. By chance, William managed to avoid the dotcom collapse in 2000 and the global financial crisis in 2008. And yet...

After 40 years, Catherine’s portfolio was worth $12,633 more (22%!) than William’s, just by sticking to her long-term plan.

As of 12/29/23. Source: YCharts, Voya IM. 60/40 S&P 500 and Bloomberg U.S. Aggregate Bond Index. William shifts to cash (Bloomberg U.S. Treasury Bellwethers 3-Month Index) in election years. Past performance is no guarantee of future results.

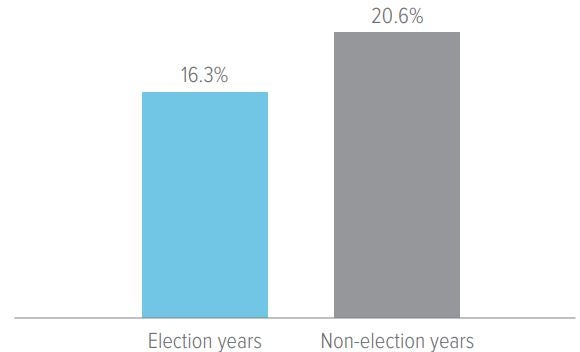

Okay, but stocks are more volatile in election years, right?

There are moments during election season when markets may be more volatile, such as immediately before Election Day. This is normal behavior.

However, over the course of an entire election year, stocks have historically been much less volatile than in non-election years.

Source: Slickcharts, Voya IM. Standard deviation of monthly data.

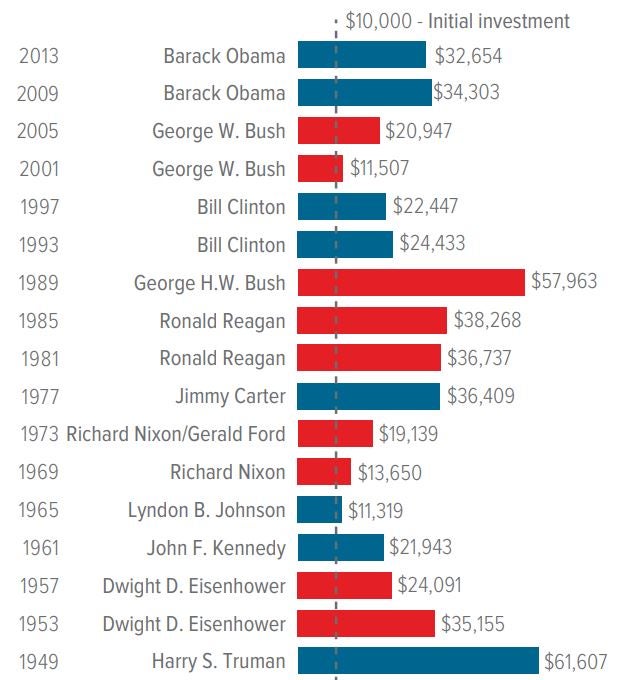

Do markets like one party more than another?

Investors often worry that the market will suffer if their candidate doesn’t win. But what do the data show?

Over 10-year horizons, U.S. stocks have delivered positive returns, no matter which party holds the White House.

As of 06/10/24. Source: Morningstar Direct, Voya IM. Past performance is no guarantee of future results.

Does the election affect the stock market over the long term?

Although it’s tempting to focus on just the immediate results of the election, keep in mind the three longer-term transmission mechanisms through which elections can affect the market.

Fiscal policy

Several key provisions of 2017’s Tax Cuts and Jobs Act—which was passed during Trump’s time in office—will expire in December 2025. As a result, whoever wins the election must confront a substantial fiscal cliff in the first 12 months of their term.1 Extending the Act’s lower marginal tax rates for individuals and the business tax breaks that are set to expire could increase the primary deficit over the next ten years; doing nothing could mean a major nominal tax hike that would affect consumers and corporations.

Monetary policy

The Federal Reserve has historically been immune to political pressures, instead committing to its dual mandate of price stability and maximum employment. Fed Chair Powell reinforced this message recently, stating that the central bank’s policy decisions will be guided by what its members believe the right thing is for the economy. While elections can affect monetary policy through the president’s nomination of the Fed Chair, the U.S. Senate gets the final say in the nomination.

Geopolitics

We’re living in an era of heightened geopolitical tensions. A shifting balance of power in Washington could have implications for how the U.S. approaches tense situations, and the markets closely watch how events unfold. Changes in international trade policies can also affect security prices and create volatility in the markets.