Key Takeaways

Regional banks face earnings pressure as $2.8 trillion of commercial real estate (CRE) loans, made at high valuations and low interest rates, are set to mature in the next five years.

While equity markets are concerned about specific stocks with large CRE exposures, public credit markets appear to be taking it in stride.

Embracing the opportunity, private credit and other alternative lenders have stepped up to provide lending solutions amidst the disruptions.

Following the unexpected failure of Silicon Valley Bank nearly one year ago, New York Community Bank’s downgrade puts regional lenders in the hot seat again. However, the current spotlight is on a few banks with high exposure to commercial real estate, which may strain earnings but likely won’t “break the bank.”

What’s happening?

New York Community Bancorp (NYCB) was downgraded by Moody’s last week due to a decline in the value of its real estate loans for office and rent-regulated multifamily properties. NYCB reduced its dividend and increased reserves to mitigate potential losses on non-performing loans. It’s worth noting that this situation may be specific to NYCB due to its acquisition of Signature Bank’s assets, which necessitated higher capital reserves, and its concentrated loan book. With 46% of its loan book in commercial, industrial & construction loans, and another 44% in multifamily, NYCB is hardly the model of a modern diversified lender.1 However, the broader regional banking sector is also facing concerns regarding the implications of commercial real estate loans.

Commercial real estate woes

The current state of commercial real estate is widely recognized: Lenders are facing potential losses related to CRE loans that were made at higher valuations, while borrowers are struggling to refinance their maturing loans.

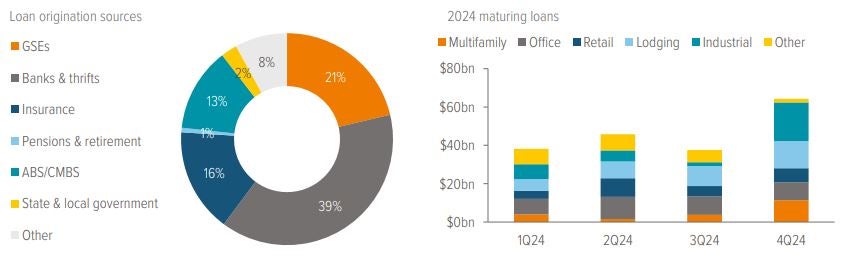

How big is the potential problem? About $2.8 trillion in commercial real estate loans are maturing over the next five years—including over $500 billion in 2024 alone.2 Banks and thrifts hold about half of these loans (Exhibit 1). Today’s high interest rates, which have made refinancing maturing loans more costly, exacerbate the problem. At the same time, owners of certain office properties are experiencing declines in both revenue and property value.

The market faced a similar issue of substantial maturities in 2015–2017. The Federal Reserve helped keep long-term rates artificially low using quantitative easing (QE), reducing refinancing challenges caused by large maturities. But now, the Fed is looking to cut short-term rates even as it’s shrinking its balance sheet (reversing QE). This could make refinancing less costly and ease pressure on borrowers and lenders facing maturities. In the meantime, some banks—particularly Japanese and German ones, but also U.S. banks such as NYCB—have reported negative effects from increasing reserves for their U.S. commercial real estate loans.

The potential fallout from bank failures

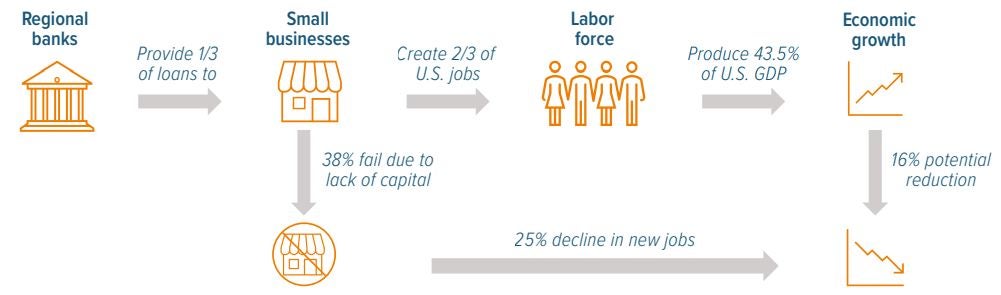

Regional bank failures can hinder loans for startups, small businesses and consumers; limit innovation; decrease spending (especially for retail, travel and leisure); cause market volatility; and slow economic growth (Exhibit 2).

Source: Voya IM. Data sourced from the U.S. Chamber of Commerce Small Business Data Center, 5/25/23; FDIC.gov; Federal Reserve; zippia.com; Small Business Administration. For illustrative purposes only.

Regionals also play a key role in financing commercial properties. Although other institutions lend to the real estate market, a sharp pullback by regional banks could be destabilizing. However, we are less concerned about this retreat for three reasons:

1. Much of the pullback has already occurred relatively painlessly over the past year, as banks’ post-SVB conservatism coincided with interest rates hitting 20-year highs. This dampened borrower demand and caused CRE transactions to drop 50% from the year prior.

2. Stricter regulations will likely be imposed on regional lenders, and this may contribute to short-term market worries but longer-term financial health.

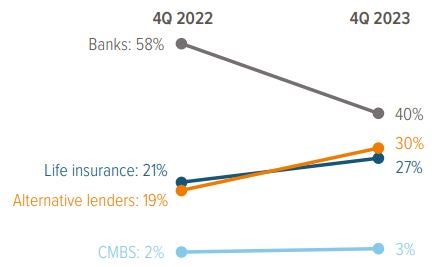

3. Liquidity needs can be met by insurance companies, pension funds and alternative lenders, who’ve demonstrated a willingness to step up and provide capital to the commercial real estate market (Exhibit 3).

As of 12/31/23. Source: CBRE Research.

Insights from our investment teams

Mounting pressure in the financial sector is rarely good news, but this time it’s well known and limited to commercial real estate. We expect the troubles may take years to shake out, and we anticipate flare-ups on lenders’ balance sheets as bad loans are written down. In a recent interview, Fed Chair Powell acknowledged that CRE is a “sizable problem” facing some smaller and regional banks, but the Fed is working with them. The last time this happened (2007–2008), the Fed created the residential mortgage-backed security market to take these loans off banks’ balance sheets.

Our investment teams understand the challenges. Here are some of our thoughts.

Public equities: Impacts not fully priced into stocks

We are concerned about CRE and anticipate significant loan charge-offs regardless of the economic landing. A credit cycle is expected to emerge in the coming years, potentially leading to additional bank failures. Life insurers with substantial exposure to commercial real estate also raise caution. We believe the market has not fully priced in potential impacts.

Fixed income: Opportunities in less exposed regionals and money centers

Regarding credit, we view NYCB’s situation as unique due to its CRE exposure and the actions it had to take to align with larger, more diversified banks as its assets grew. While we anticipate pressure on regional banks more broadly, our confidence remains in regional banks with lower CRE exposure, super-regional banks and money centers.

Private credit: Stepping up to the opportunity

Not all sectors within CRE face the same challenges. In particular, we would note the office sector has the most serious structural woes, which may lead to losses and a prolonged resolution process. However, the wholesale pullback in bank lending has created attractive opportunities for private debt funds across project finance, investment grade private placements, energy & infrastructure lending, and yes, even commercial real estate. These placements are made at a significant premium to similarly rated public debt and come with more thorough covenants and greater downside protection. For example, our real estate team has stepped into the liquidity void left by regional banks in the construction loan market and is achieving career-high yields on loans that also boast conservative underwriting.

Multi-asset: CRE exposure dampens appetite

We don’t see the challenges plaguing the real estate sector causing systemic risk. Some regional and community banks with concentrated loans in commercial real estate may fail, but large banks, in general, have more diversified loan books. In addition, the Fed has recently shown a willingness and ability to provide liquidity to troubled banks quickly, should the situation prove unstable. However, we think that investor appetite for U.S. REITs may be dampened in the near term until markets gain greater clarity and confidence.