Fixed Income can help navigate today's challenges - but what’s the right mix?

Three key points for investors evaluating unconstrained fixed income:

-

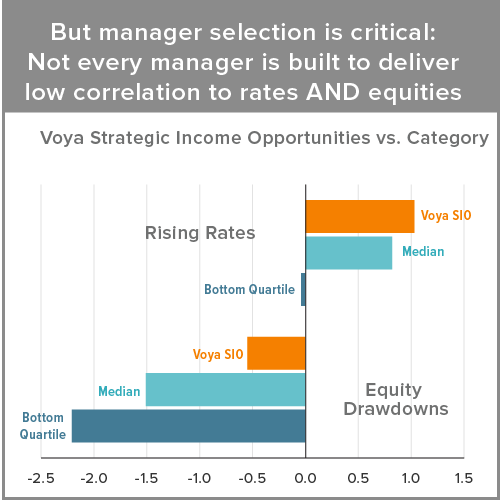

Manager selection is always important – in the unconstrained space it matters even more

-

There is significant dispersion in risk and returns among unconstrained strategies—understanding your manager’s strategy is critical

-

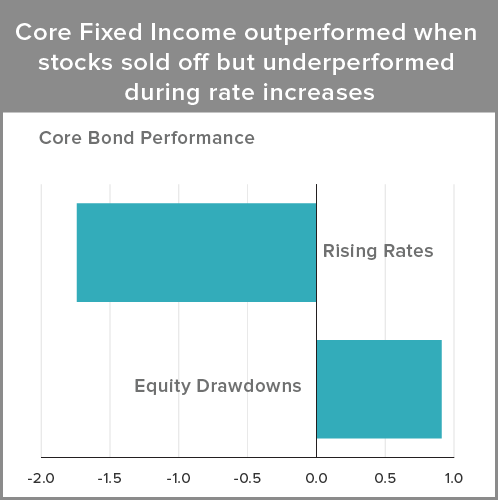

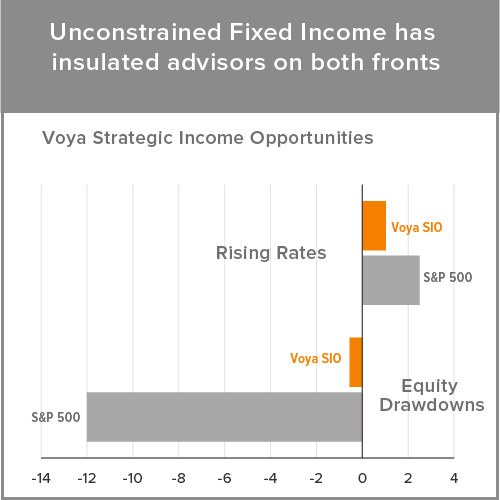

- Successful unconstrained strategies seek low correlation to rates AND stocks (not just rates)

- Most strategies focus on rates—less than half focus on both

- Unconstrained fixed income is a complement not a substitute for Core Plus

- Beware of strategies packaged as the “the new core”

Voya’s Approach: Unconstrained Fixed Income does not mean unconstrained risk

Voya’s unconstrained strategy, the Voya Strategic Income Opportunities Fund (IISIX), draws on the credit research, macroeconomic and risk expertise of Voya’s 200+ Fixed Income professionals.

Our Fixed Income platform was created to meet the complex investment management needs of Voya’s own life insurance business. When it comes to unconstrained strategies, this means we take a different approach than many of our competitors. Instead of focusing on maximizing short-term returns, we believe focusing on minimizing volatility is the key to long-term consistent success of an unconstrained strategy.

Investment Risks

All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. High-Yield Securities, or “junk bonds”, are rated lower than investment-grade bonds because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities. To the extent that the Fund invests in Mortgage-Related Securities, its exposure to prepayment and extension risks may be greater than investments in other fixed-income securities. The Fund may use Derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses and have a potentially large impact on Fund performance. Foreign Investing does pose special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic. As Interest Rates rise, bond prices fall, reducing the value of the Fund's share price. Other risks of the Fund include but are not limited to: Bank Instruments; Company; Credit; Credit Default Swaps; Currency; Floating Rate Loans; Interest in Loans; Interest Rate; Investment Models; Liquidity; Market; Market Capitalization; Municipal Securities; Other Investment Companies; Prepayment and Extension; Price Volatility; U.S. Government Securities and Obligations; Portfolio Turnover; and Securities Lending Risks. Investors should consult the Fund's Prospectus and Statement of Additional Information for a more detailed discussion of the Fund's risks.