Maximizing the probability of a successful retirement

Avoiding large drawdowns in the early stages of retirement is critical to the longevity of assets. Participants need a target date that is designed not just to maximize wealth accumulation in early career, but to also protect that wealth as they near and enter retirement.

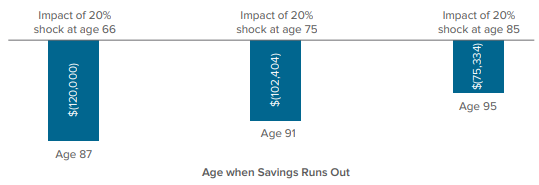

A retiree who experiences a 20% loss at 66 years of age depletes their assets almost 10 years earlier than a retiree who experiences a 20% loss at age 85.

Impact of a 20% Shock at Various In-Retirement Ages

The graph above shows a hypothetical example of the impact of a 20% loss at different ages in retirement, all else being equal. Assumptions include account balance at retirement of $500,000, annual return of 3.5% based on an equity/bond mix of 35%/65%, annual withdrawal rate of $25,000 (5% on the initial account balance) and a shock amount of -20%. Source: Voya Investment Management.

Voya key differentiators

Voya’s Target Date Blend Series are designed to specifically balance the evolving risk-return profiles of participants as they age to maximize the probability of a successful retirement. Our time-tested blend approach to target date design is centered around three key differentiators.

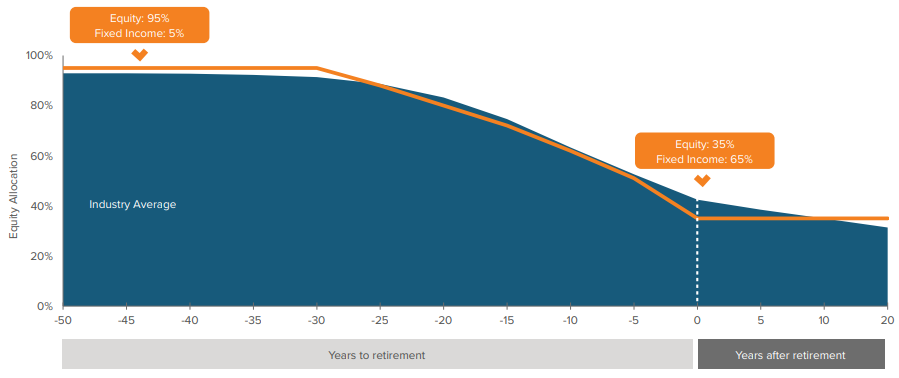

1 Between 50-40 years out from the fund’s “target date” the Voya’s Target Date Blend Series allocate 95% to equities compared to the industry average of 89%. At the “target date” the Voya Target Date Blend Series allocate 35% to equities compared to the industry average of 42%. Source: Morningstar. Average includes all mutual fund and VP target date suites in Morningstar. Equity allocations based on Years Target (YTT) Stock glide path data in Morningstar® Direct.

2 Multi-Manager refers to the use of investment managers including Voya Investment Management and outside managers, which may be offered through affiliated sub-advised funds.

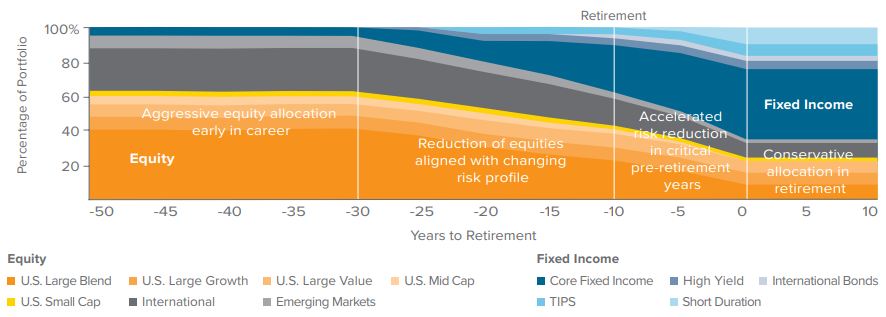

Participant-focused glide path

At Voya, our glide path relative to peers has a higher equity allocation for younger participants to build wealth and a lower equity allocation for participants near and in retirement to reduce risk to protect wealth.

Younger participants can afford to take on more investment risk in exchange for greater potential returns. However, in the later years, participants are more vulnerable to a market downturn, particularly the day they retire given.

- Account balances are generally at their highest

- Contributions end and withdrawals begin

- Retirees have the longest period of time to fund expenses without a salary

As a result, avoiding large drawdowns in the early stages of retirement is critical to the longevity of assets.

Voya’s Target Date Glide Path: Building Wealth in the Early Years, Protecting Wealth in the Later Years

- Higher allocations to equities for early career participants to help build wealth

- Reduced equity allocations as retirement approaches to help mitigate downside risk

This chart is for illustrative purposes only and may not reflect the current allocations of the Voya Target Date Funds. This illustration is intended to show how the Voya Target Date Funds transition over time. Source: Morningstar as of 6/30/2023. Average includes all mutual fund and VP target date suites in Morningstar. Equity allocations based on Years to Target (YTT) Stock glide path data in Morningstar Direct. This data may differ from Morningstar analyst reports, which combine Stock and Other. In select cases where the Manager has indicated in their prospectus that specialty or other asset classes are considered part of their Equity glide path (e.g. Real Estate and/or Commodities), we have done our best to add those allocations to the Stock YTT glide path data. Voya’s Target Date suite may periodically deviate from the Target Allocation, generally within the range of +/- 10% relative to the current Target Allocation.

Multi-manager approach

Voya’s Target Date Blend Series combine the strength of Voya’s investment capabilities with other well-organized investment managers to enhance diversification and reduce single manager risk.

To select and monitor managers, Voya has a dedicated team of career analysts with close to 20 years of experience.

*Multi-Manager” refers to investment managers other than Voya Investment Management, which may be offered through affiliated sub-advised funds.

Intelligent blend of active & passive

At Voya, we believe there is an advantage to utilizing a mix of both active and passive managers within our target date suites. The decision to use active or passive depends on many factors including the excess return potential for each asset class, the market environment and cost.

- Active managers may offer the potential for excess returns in less efficient asset classes and tend to outperform when markets sell-off

- Passive managers may offer cost effective exposure to highly efficient asset classes and tend to outperform in markets rally

Effective target date portfolio management goes beyond determining the optimal active and passive mix as and the optimal equity and bond mix over a participant’s lifecycle. Determining which sub-asset classes when implementing the equity and bond mix is equally important. Accordingly, sub-asset class breadth and how the sub-asset classes are adjusted to manage the various risks that a participant faces are also critical for a plan sponsor to understand and evaluate.

At Voya, we deliver broader exposure to a diverse set of asset classes, styles and investment managers seeking to generate a more consistent investment outcome for participants.

Managing Volatility with a Broad Set of Asset Classes

For illustrative purposes only. This is intended to show how the portfolio transitions over time and may not reflect current allocations. The Portfolio may periodically deviate from the Target Allocation (+/- 10%relative to the current Target Allocation). The sub-adviser may deviate by a wider margin to protect the Portfolio, achieve its investment objective, or take advantage of particular opportunities.

Voya’s Target Date Blend Series: Available Products

Target Retirement Series Mutual Fund | Target Solution Trust Series Collective Investment Trust | Solution Series Variable Portfolio |

Voya Multi-Asset Strategy and Solutions: Comprehensive Multi-asset solutions.

Multi-Disciplined Team

- Specialized groups each providing subject-matter expertise

- Incentive structure tied to both individual contributions and collective outcomes

- Culture of collaboration strengthens our decision-making process

Diversified Sources of Value Creation

Evidence Based and Research Backed

- Research and data-driven approach leveraging a global opportunity set

- Multi-manager, multi-strategy philosophy allows for diverse sources of returns

- Sophisticated quantitative techniques designed to incorporate multiple inputs and scenarios

Information Advantage

Client-Centric Perspective

- Help meet client objectives through a flexible portfolio construction and risk budgeting process

- Approach that adapts to evolving market conditions and client needs

- Distill portfolio complexities to help clients understand drivers of risks and returns

Focus on Client Outcomes

Related Resources

Detailed Information on Voya Target Retirement Funds

Principal Risks

There is no guarantee that any investment option will achieve its stated objective. Principal value fluctuates and there is no guarantee of value at any time, including the target date.

The “target date” is the approximate date when an investor plans to start withdrawing their money. When their target date is reached, they may have more or less than the original amount invested. For each target-date portfolio, until the day prior to its target date, the portfolio will seek to provide total returns consistent with an asset allocation targeted for an investor who is retiring in approximately each portfolio’s designated target year. On the target date, the portfolio will seek to provide a combination of total return and stability of principal.

Stocks are more volatile than bonds, and portfolios with a higher concentration of stocks are more likely to experience greater fluctuations in value than portfolios with a higher concentration in bonds. Foreign stocks and small- and mid-cap stocks may be more volatile than large-cap stocks. Investing in bonds also, entails credit risk and interest rate risk. Generally investors with longer timeframes can consider assuming more risk in their investment portfolio.

As with any portfolio, you could lose money on your investment in a Voya Target Date Blend Series. Although asset allocation seeks to optimize returns given various levels of risk tolerance, you still may lose money and experience volatility. Market and asset class performance and the assumptions used form the asset allocations for the Voya Target Date Blend Series. There is risk that you could achieve better returns in an underlying portfolio or other portfolios representing a single asset class than in the Voya Target Date Blend Series. Important factors to consider when planning for retirement include your expected expenses, sources of income, and available assets.

Participation in a Collective Trust Fund is limited to eligible trusts that are accepted by the Trustee as Participating Trusts. Eligible trusts generally include (i) certain employee benefit trusts exempt from federal income taxation under Code Section 501(a); (ii) certain governmental plans or units described in Code Section 414(d), Code Section 457(b), and Code Section 818 (a) (6); (iii) certain commingled trust funds exempt from federal income taxation under Code Section 501(a); and (iv) certain insurance company separate accounts as defined in the Investment Company Act section 2(a) (17). Neither the fund nor units of beneficial interest in the fund are registered under the Investment Company Act of 1940 or the Securities Act of 1933 in reliance on an exemption, under these acts applicable to collective trust funds maintained by a bank for certain types of employee benefit trusts. A collective fund is not a mutual fund; the collective investment trust fund is managed by Voya Investment Trust Co. There is no guarantee the fund will achieve its objective.

The strategies in this document utilize quantitative modeling in addition to other analysis to support investment decisions. Data imprecision, software or other technology malfunctions, programming inaccuracies and similar circumstances may impair the performance of these systems, which may negatively affect performance. Furthermore, there can be no assurance that the quantitative models used to support investment decisions in the strategy will perform as anticipated or enable the strategy to achieve its objective.

An investor should consider the investment objectives, risks, charges and expenses of the Fund(s) carefully before investing. For a free copy of the Fund’s prospectus, or summary prospectus, which contains this and other information, visit us at www.voyainvestments.com or call (800) 992-0180. Please read all materials carefully before investing.