Improving participant outcomes means going beyond the retirement plan.

Why is participant financial wellness important?

In our latest biannual survey of plan sponsors and participants, we uncovered some critical issues.1

- Financial stress affects everyone. Research shows that money problems account for 59% of employees’ stress in the workplace, which can affect their mental and physical well-being and their performance at work.2

- Financial stress can cause a delayed retirement. Over half of the financially stressed employees we surveyed plan to postpone their retirement—at an average cost to an employer of $51,000 per employee.3 Delayed retirement can also mean delayed career trajectories for newer workers.

- Financial wellness programs help with employee retention. According to our research, workers generally view their employers as a trusted source. That creates an opportunity for sponsors to retain employees by offering support in key areas, including improving overall financial wellness and retirement income planning.

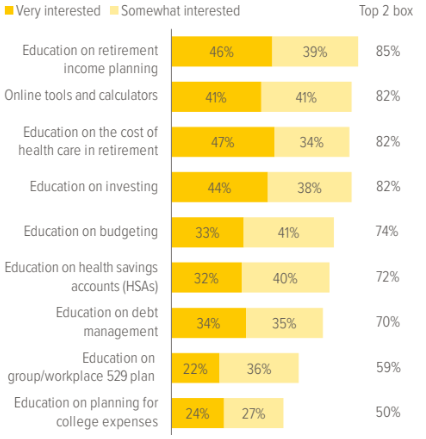

The good news is that defined contribution (DC) plan sponsors and participants have become increasingly aware of the importance of financial wellness and how it can improve outcomes. In Voya IM’s 2025. Survey of the Retirement Landscape: Plan Sponsor Sentiments sponsors indicated that financial wellness is a critical area of focus. And in our related Participant Perspectives survey, more than 80% said they are very or somewhat interested in financial wellness programs through their employer—especially education on retirement income planning, health care costs and investing (Exhibit 1).

5 areas of financial wellness focus for plan sponsors

1 Financial decision-making

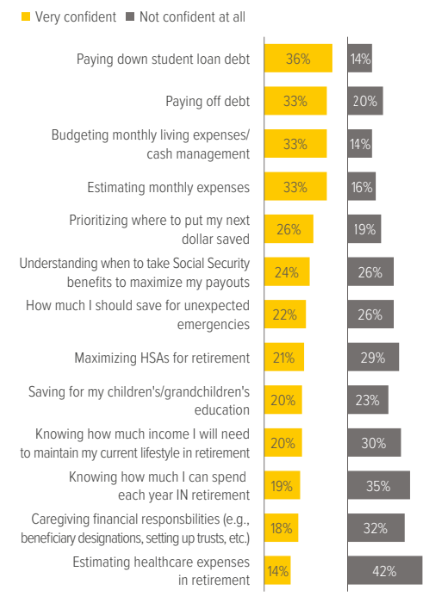

The issue: In making financial decisions, participants said they are fairly confident about how to pay off debt and budget for monthly living expenses. But their confidence began to decline when considering how to estimate monthly expenses, how to prioritize where to save and how much to set aside for unexpected emergencies (Exhibit 2). Importantly, Black and Latino employees have lower levels of financial confidence than White and Asian employees.

The solution: Employers with a thoughtfully designed financial wellness platform can make it easy for participants not only to see the big picture, but to act on it. Offering employees access to online financial planning tools and a comprehensive financial education program are two ways to help increase their financial confidence, as is working with an advisor or specialist who can directly interact with employees.

2 Retirement education

The issue: Our research shows that many participants don’t have a plan for their DC assets when they retire. This sentiment was significantly higher among women (47%) than men (28%). White, Black and Latina women all lag men of their respective racial/ethnic group in savings rates and average account balances, which suggests an opportunity for sponsors to provide specialized retirement education and support for female workers.

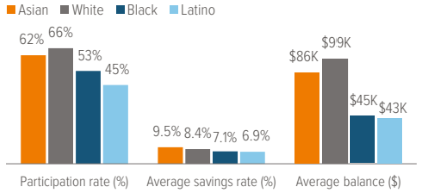

Our research also found that, on average, Black and Latino employees exhibit lower retirement plan participation, lower savings rates and smaller average account balances compared with Asian and White employees (Exhibit 3).

As of 06/30/22. Source: Voya Financial DEI Analysis report.

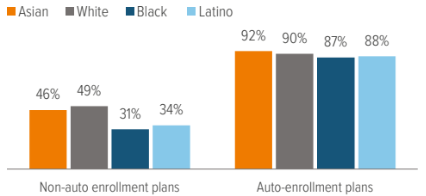

The solution: Auto-enrollment and step-up plan features are a powerful tool to even the playing field. Black and Latino employees that have access to retirement plans with auto enrollment have a participation rate that is two to three times higher than their peers at employers with plans that don’t offer auto enrollment (Exhibit 4).

As of 06/30/22. Source: Voya Financial DEI Analysis report.

3 Investment education

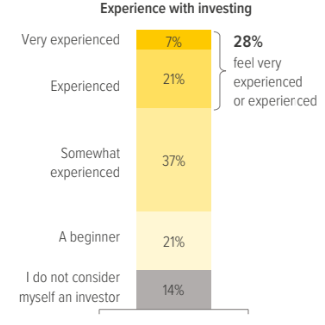

The issue: According to our research, many employees don’t view themselves as experienced investors, and they want more investment education (Exhibit 5). Areas of interest include retirement income, managed accounts and financial wellness. One concerning observation in our research is that 16% of participants don’t know how they invest within their DC plan—a sentiment that was significantly higher among female respondents.

The solution: Participants are looking for assistance in making investment decisions. 84% expressed interest in having access to a financial professional who can answer their questions and provide investment education and advice. They also indicated strong interest in education about retirement income, managed accounts, and plan auto features. Many of these products/services help address areas in which participants cited low levels of confidence

4 Emergency savings

The issue: All participant groups share one financial vulnerability—a single unplanned expense can disrupt financial stability due to a lack of emergency savings. We found that 20% of employees have less than three months of emergency savings and 30% have no emergency savings at all. Only 28% have six or more months of emergency savings. Our data also show that participants with inadequate emergency savings were 30% more likely to reduce their plan contribution rates.

The solution:One idea is an emergency savings account (ESA) that can help workers gradually save to cover unexpected costs—and potentially prevent them from dipping into their DC plans. In our view, the ideal solution to emergency savings is optional and out-of- plan and is therefore easy to implement.

5 Student loan repayment support

The issue: Student loan debt is now the second-largest debt category, behind only home mortgages. According to our research, 95% of employees with student loan debt would be more likely to save more for retirement if they felt like their student debt was under control.

The solution: Employers can implement a number of approaches to help employees pay down student loan debt, including tuition assistance, loan contributions, student loan benefit offerings and retirement plan match programs.

Student loan debt can represent a substantial percentage of younger workers’ income and can keep them from making meaningful retirement plan contributions. The Secure Act 2.0 allows for a flexible employer match design that may help these employees save more, increase their retirement confidence and reduce financial stress.

Student loans and SECURE 2.0

Employees with student loans often have to choose between paying off their student debt and contributing to their retirement plan. With this provision, employees can get their employer’s help building retirement savings through matching contributions to their retirement plan based on their student loan payments. |