About the Survey

Since 2016, Voya Investment Management has conducted a biennial survey to gain insights into the evolving perceptions and practices of those who advise, implement, and benefit from employer-sponsored retirement savings programs. The 2025 Survey of the Retirement Landscape captures a decade of trends that we will share through a three-part series covering defined contribution (DC) specialists, plan sponsors, and plan participants.

In this report, our research focuses on DC specialists. Our goal is to:

- Understand the evolving needs of plan sponsor clients and prospects

- Help DC specialists align their services with sponsor priorities

- Identify business opportunities for DC specialists to address

- Reveal participant preferences to guide specialists in supporting positive outcomes

Previous waves of the survey were conducted in March 2023 and 2021, December 2018, and April 2016.

Methodology

From mid-January to mid-February 2025, we conducted an online survey of retirement plan sponsors and DC specialists focused on the retirement plan market. As in 2023, we included active DC plan participants in the survey to better understand their perspectives on issues such as retirement readiness, investing, and financial confidence.

The study distinguishes specialists by type: heavy-focus DC specialists (whose practices emphasize plan sponsor clients) and emerging DC specialists (for whom plan sponsors represent a smaller proportion of business). The study also segments sponsors based on plan size: $1-5 million, $5-25 million, and over $25 million. Details on the definitions and methodologies of the study can be found in the appendix. Some exhibits may not sum due to rounding.

Key findings

On retirement readiness

This year, more participants said they feel somewhat or very prepared for retirement, compared with 2023. DC specialists were more aligned with participants’ confidence level than plan sponsors (who were generally more optimistic) were.

Are participants very/somewhat ready for retirement?

On the value of specialist services

Specialists were more likely to think that plan sponsors place a high value on investment selection and monitoring—which they do. But the thing sponsors said they value even more is retirement income options, ranking it considerably higher than specialists perceived.

On caregiver support

Specialists and plan sponsors recognized the importance of focusing on the financial needs of caregivers. However, more than 80% of both groups estimated that caregivers made up less than 20% of plan participants. According to AARP data, the real number is likely much higher.

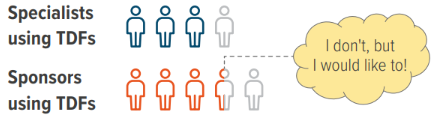

On target date funds

Specialists and sponsors continued to see target date funds (TDFs) as key components of retirement plans. Three in four specialists included them in plans they advise, while three in five sponsors had them in their plan. Of the sponsors who did, nearly half said they would like to in the future. Even more telling: Participants who used TDFs were twice as likely to strongly agree that they felt very confident in their ability to reach retirement goals, versus those who didn’t.

On retirement income solutions

The bigger a sponsor’s plan, the more likely they were to say their aging participant base is putting more focus on the need for retirement income solutions. Sponsors and specialists agreed on the need to add a retirement tier to plans, although sponsors expressed more interest in retaining terminated and retired participant assets in the plan than specialists perceived. This interest is well grounded, as a full third of participants said they had no clear plan for their DC plan assets when they retire.

On financial wellness programs

Sponsors and specialists were aligned on the importance of helping participants with holistic financial wellness, presenting an opportunity for specialists to provide educational resources.

What do participants want most from financial wellness program?

- Education on retirement income and investing

- Online tools and calculators

- Help understanding health care costs in retirement