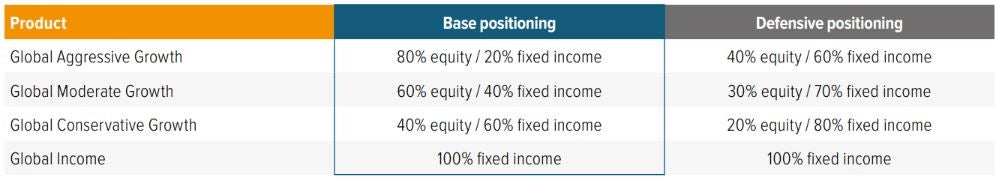

While investors grapple with continued geopolitical uncertainty, we maintained the base positioning in our Global Perspectives portfolios as U.S. corporate earnings remained positive.

Executive summary

Supportive environment for stocks

As inflation eases, the Fed has started cutting rates to support the labor market—which despite some softening, has shown resilience with robust job gains in September. Stocks may perform well in this positive-growth and declining-rate environment.

Preference for U.S. large and mid cap stocks

Larger U.S. stocks have durable earnings streams, but we expect the equity rally to broaden to smaller companies. Japan has shown signs of life, but Europe is broadly weak. Emerging markets have improved, but China’s fiscal responses raise uncertainty.

High-quality fixed income remains attractive

In the fixed income market, there is a preference for higher-quality investments, especially investment grade bonds and securitized credit products, as all-in yields remain attractive.

Second quarter 2024 review

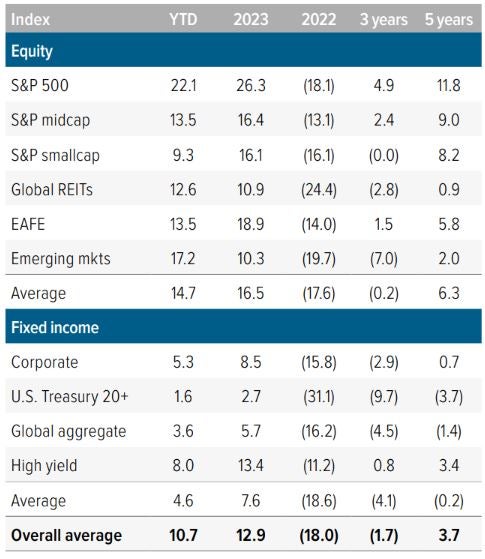

U.S. stocks advanced during the third quarter following the Fed’s larger-than-expected 50 basis points interest rate cut. Interest rate sensitive sectors—utilities and real estate—led, while energy and growthier segments—technology and communications—lagged. Small cap stocks outperformed large caps and value significantly beat growth (Exhibit 1).

International equities surpassed U.S. markets, with emerging markets leading the way. In developed markets, U.K. stocks performed well due to optimism around the general election and Bank of England rate cuts. The European Central Bank’s rate reduction in September aided Eurozone stocks despite manufacturing declines. Japan stood out by raising rates for the first time in 17 years. This move caused a sharp rise in the yen and a chaotic unwind of carry trades, resulting in negative local but positive U.S.-based performance. China stocks delivered the highest return, soaring over 20% in just a few weeks, following aggressive monetary stimulus and fiscal commitments.

U.S. bonds logged their first positive quarterly performance of 2024, as the 10-year U.S. Treasury yield fell from 4.48% at the beginning of July to 3.81% by quarter-end. Long duration bonds performed best, followed by high yield and investment grade. The U.S. dollar fell during the quarter, helping global aggregate bonds and broad emerging market debt outperform U.S. aggregate bonds.

As of 9/30/24. Source: FactSet, FTSE NAREIT, Voya Investment Management. The overall average model allocation includes 10 asset classes, equally weighted: S&P 500, S&P 400 Midcap, S&P 600 Smallcap, MSCI U.S. REIT Index/FTSE EPRA REIT Index, MSCI EAFE Index, MSCI BRIC Index, Bloomberg Barclays U.S. Corporate Bonds, Bloomberg Barclays U.S. Treasury Bonds, Bloomberg Barclays Global Aggregate Bonds, Bloomberg Barclays U.S. High Yield Bonds. Returns are annualized for periods longer than one year. Past performance is no guarantee of future results. An investment cannot be made in an index.

Macro environment: Recession concerns abate, as inflation eases and the Fed cuts rates

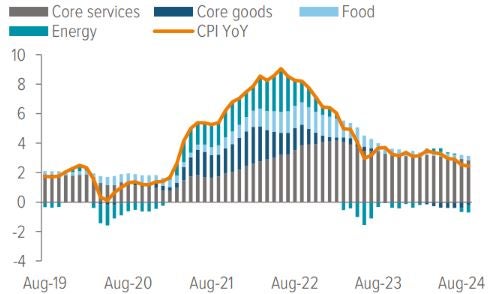

Inflation has continued to subside, reaching a three-year low in September (Exhibit 2), which has allowed the Federal Reserve to commence a gradual reduction in interest rates. The Fed initiated this process with a substantial 50-basis-point cut in September and 25-basis-point cut in November, demonstrating a proactive approach to bolstering the labor market. This shift underscores the Fed’s pivot from focusing on inflation to employment.

As of 09/30/24. Source: Federal Reserve Bank of San Francisco, Bloomberg, U.S. Bureau of Labor Statistics, Voya IM.

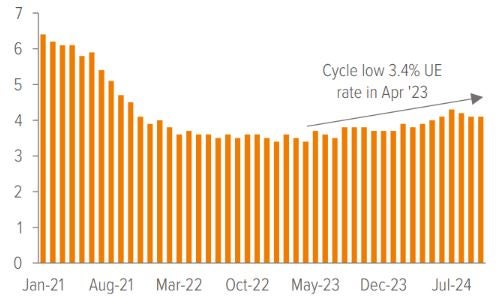

Although the labor market has shown signs of softening, the rise in unemployment since its April 2023 low (3.4%) has been gradual. And the increase is attributable primarily to growth in labor supply, driven largely by immigration, which is more manageable than unemployment caused by widespread layoffs. Furthermore, in September, the U.S. market added 254,000 jobs, exceeding expectations and lowering the unemployment rate to 4.1% (Exhibit 3).

This suggests that the economy may be more resilient than anticipated, supported by easing inflation and rising real wages. However, further rate cuts are probably necessary to stabilize the labor market as it adjusts to the balance between supply and demand. The Fed projects that its rate-cutting cycle will conclude by the end of 2026, with its target rate settling at 2.9%.

Given our view that the U.S. will avoid a recession due to the Fed’s swift actions to support the labor market, we question whether the “neutral” rate of interest— the rate at which monetary policy neither stimulates nor constricts economic growth—will drop this low. Nonetheless, it is prudent to prepare for lower rates in the future. In an environment characterized by positive economic growth, solid employment and declining interest rates, stocks typically perform well.

As of 09/30/24. Source: Federal Reserve Bank of San Francisco, Bloomberg, U.S. Bureau of Labor Statistics, Voya IM.

Second quarter S&P 500 earnings stay positive: GP portfolios remain in base allocations

S&P 500 first-quarter earnings grew by 13.2% year-over-year, with 9 of the 11 sectors showing year-over-year increases. Technology, financials and health care sectors led the way, with earnings each rising by roughly 21%, compared with this time last year. Materials and energy sectors’ earnings all declined during the period. In aggregate, earnings came better than expectations with 79% of companies beating. With U.S. corporate earnings positive again, Global Perspectives portfolios remain in base positioning (Exhibit 4).

U.S. stocks: Strong earnings and Fed support justify valuations

We remain positive on U.S. equities, particularly large caps. The overall economic outlook is still positive, with Fed policy supporting employment and thereby consumer spending. With the election concluded and some uncertainty lifted, we expect corporate spending to resume as managers, reassured by the known political configuration, restart projects that were temporarily put on hold. Earnings have been strong and we believe this will continue. Unlike in previous quarters, earnings estimates have been revised significantly lower, which could result in larger-than-normal earnings surprises.

However, we recognize that some factors could constrain returns over the longer term. First is the incongruity of expected increases in rising profits alongside falling interest rates. Since these typically do not coincide, either 2025 earnings will come down as the economy slows, or expectations for rate cuts will need to reprice. Secondly, S&P 500 valuation ratios— such as P/E—look expensive versus history (Exhibit 5) and, to some degree, cross sectionally, contribute to our view that U.S. equity returns will be lower than they have been in the past two years.

As of 09/30/24. Source: Bloomberg, U.S. Bureau of Labor Statistics, Voya IM.

Still, we think higher valuations are partly due to the shifting composition of the S&P 500 Index. The increasing weight of the technology sector and related companies, with their capital-light business models, suggests that margins may have reached a new, higher steady state. This shift makes current valuations seem more reasonable and leads us to believe equity returns could align with earnings growth over the medium term. Therefore, we remain overweight U.S. large cap stocks, but we have gradually reduced this position in favor of mid cap stocks given their more attractive valuations and expectation that they will disproportionately benefit from lower borrowing costs.

Stocks may enjoy another boost as investors gain clarity about domestic political leadership. President-elect Trump’s proposal to extend the 2017 tax cuts could further fuel this momentum by securing lower individual tax rates, reducing corporate taxes and prolonging bonus depreciation for capital investments and research costs. While the recent uptick in rates seems to be driven by a positive growth outlook— usually a plus for equity markets—a sudden and significant increase in rates over a short period could lead to equity market turbulence.

International equities: Divergent regional trends shape investment climate

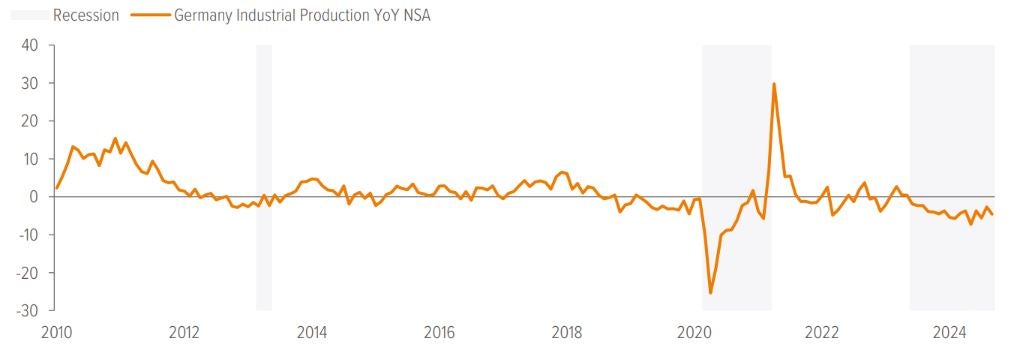

The international equity outlook presents a complex picture with regional variations. In Europe, factors such as economic stagnation, high labor costs, and political instability create a challenging investment climate, leading to a cautious stance on European stocks. The region grapples with sluggish economic activity, reduced demand from China and high real interest rates, compounded by Germany’s manufacturing slowdown (Exhibit 6) and broader geopolitical risks, resulting in subdued expectations for eurozone earnings.

As of 09/30/24. Source: Bloomberg, Eurostat accessed through Federal Reserve Bank of St. Louis.

In contrast, Japan holds a neutral outlook influenced by both economic and political dynamics. Improvements in corporate governance and earnings are tempered by currency instability and the uncertain impact of new governmental policies, though there remains potential for growth among Japanese firms. Emerging markets, particularly China, show some promise due to recent stimulus measures, but concerns about the sustainability of these efforts amidst structural and geopolitical challenges persist. Overall, these conditions reinforce a preference for domestic over non-U.S. equities in investment strategies.

Fixed income: High-quality coupon clipping

Our views on fixed income are little changed this quarter. We continue to overweight U.S. investment grade core bonds. Spreads are tight, but policy and fundamentals are supportive and carry remains attractive. Within the asset classes, lower-beta securitized assets, such as agency mortgages and consumer-oriented asset-backed securities, as well as high-quality corporates, look appealing. These sectors should benefit from solid macro conditions and favorable supply and demand dynamics.

We are underweight leveraged loans. Slower economic growth, falling interest rates, and tilted toward cyclical sectors dependent on discretionary consumer spending keep us cautious. We don’t have strong conviction on the near-term direction of rates. While we do believe the Fed will continue to reduce rates, the short end of the curve already has significant cuts priced in, and the long-end yield seems fair given our views on growth and inflation. We prefer nominal bonds as a hedge against the downside in equity returns.

Our aversion to international fixed income is based on the same factors that drive our underweights to non-U.S. equities. There are cases to be made for certain countries, but overall, foreign securities aren’t as compelling as U.S. assets, in our opinion. Furthermore, we’re not convinced that global bonds will keep benefiting from a weaker USD. However, the incoming Trump administration has openly discussed the dollar’s strength, and policy changes could potentially shift this dynamic once he takes office.

For Voya’s thoughts on the U.S. election please see “5 Investor Takeaways: Red Wave Paves the Way for Economic Protectionism.”

A note about risk

Certain of the statements contained herein are statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All investments are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Actual results, performance or events may differ materially from those in such statements due to, without limitation, (1) general economic conditions, (2) performance of financial markets, (3) interest rate levels, (4) increasing levels of loan defaults, (5) changes in laws and regulations and (6) changes in the policies of governments and/or regulatory authorities.