The UK and France both held major elections over the past few months. While the outcome in one was anticipated, the other was anyone’s guess. And the resulting market reactions reflected the dichotomous outcomes.

The UK proceeded as planned

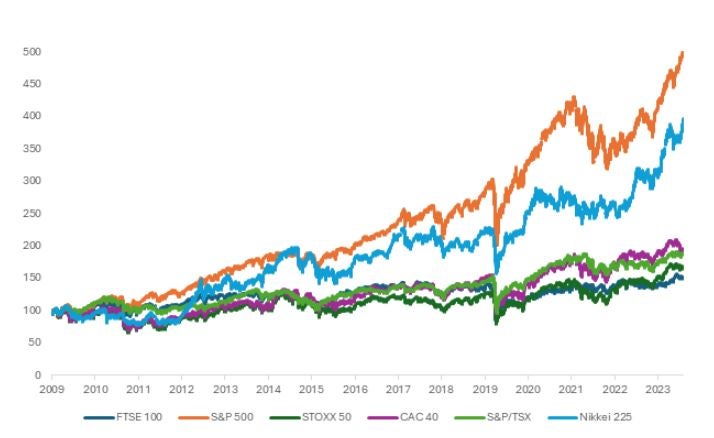

The UK elections called on May 22, 2024 by then-Prime Minister Rishi Sunak resulted in a historic victory for Sir Kier Starmer’s Labour Party, which secured a 290-seat margin. The overwhelming win followed a tumultuous period of Conservative governance marked by Brexit, low growth and Liz Truss’ controversial tax cuts that disrupted the gilt market. The UK economy, the worst-performing major economy since the global financial crisis, has seen the FTSE 100 perform correspondingly poorly.

Despite Labour’s victory, challenges loom large. The party faces economic headwinds, with the Bank of England forecasting a dismal 0.5% of GDP growth in 2024. While Starmer’s party has publicly opposed major tax hikes or spending cuts, their concrete economic plan remains unclear. As the election was broadly expected to go Labour’s direction, market reactions to it have been muted, with UK bonds and the British Pound continuing to ease higher since Sunak’s decision (Exhibit 1).

Source: Bloomberg. As of 07/09/24.

France is still up in the air

In contrast, France’s political scene has been anything but widely expected. Marine Le Pen’s National Rally (RN) Party handily beat President Emanuel Macron’s centrist alliance in early June parliamentary elections, leading the President to call for two rounds of snap elections on 6/30 and 7/7.

The RN again won more seats than Macron’s alliance in the first round, but the lack of a decisive victor in the second round has opened the risk of a hung parliament. The New Popular Front (a left-wing coalition) secured 182 seats while Macron’s alliance garnered 168 seats and the RN won 143 seats, a surprising outcome where strategic withdrawals by hundreds of candidates blocked a right-wing majority.

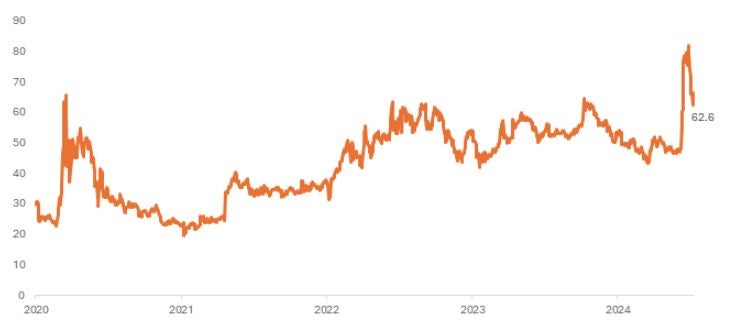

Both bond and stock markets felt uncertainty. The gap between the French-German 10-year bond spread jumped to as much as 82 bps in the runup to the election before narrowing to the current 65 bps while equities plunged nearly 10% during the period (Exhibit 2).

Source: Bloomberg. As of 07/10/24.

Going forward, investors are eyeing key risks, such as a greater than expected budget deficit (already 5.5% of GDP and facing the possibility of slower decreases), a hung parliament, or even a debt crisis. These risks add to reasons why we are not optimistic on the outlook for European equities.

Arjun Kaushik contributed to this article.