The stock-bond correlation is a critical determinant of risk in traditional portfolios. What does it say right now about the implied risk of a so-called “balanced” portfolio? You might be surprised.

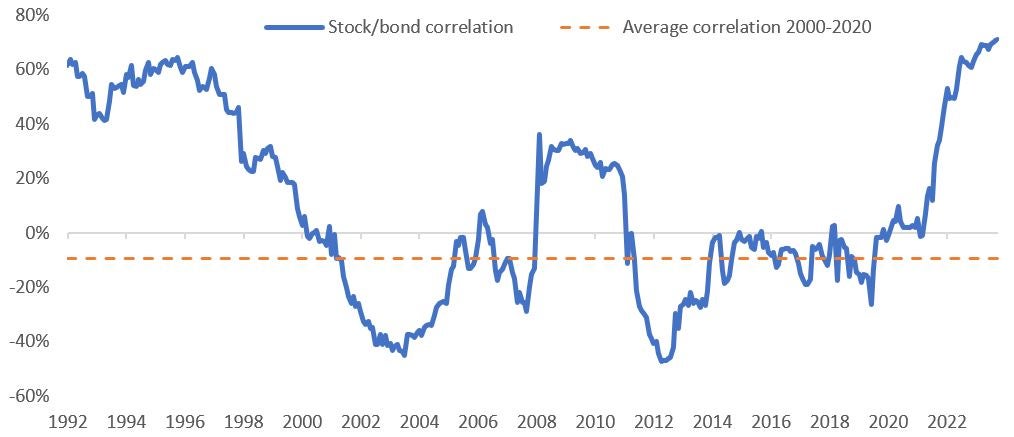

The correlation during the first two decades of the 21st century (2000–2020) was predominantly negative, which meant investors could rely on bond allocations for protection in case equities sold off. Yet recently, the rolling 3-year correlation has jumped to 30-year highs, hitting 0.7 as of June 25, 2024.

As of 06/25/24. Source: Bloomberg.

The correlation tends to become positive during periods of both higher inflation and inflation uncertainty. The recent supply chain disruptions, a tight labor market, and geopolitical tensions have all driven inflation past the Fed’s 2% target. There is precedent, however, as the 1970s to 2000s also saw a similar uptrend in correlation, driven by soaring oil prices and inflation.

The main takeaway is that while the 60/40 allocation has been a cornerstone of a traditional diversified portfolio, the current high stock/bond correlation challenges that effectiveness—and suggests that we might be in a different inflation regime. Investors might need to explore alternative asset classes and construct a multi-asset portfolio to achieve true diversification in the current market environment.

Maverick Lin contributed to this article.