Last week’s spate of U.S. economic data and revisions suggest one thing: the job market is slowing. This has significant potential implications for both the September FOMC meeting and risk asset weightings.

June U.S. jobs report showed that the economy added 206,000 jobs last month, which seems to be a decently strong figure on the surface. However, the devil is in the details: the largest drop in jobs was in temporary services, which fell by 48,900, its biggest drop since April 2021. Unemployment overall rose above 4% (to 4.1%) for the first time since November 2021.

In addition, both April and May nonfarm payroll (NFP) numbers were revised down significantly: May’s NFP was lowered to 218,000 from 272,000 and April’s from 175,000 to 108,000.

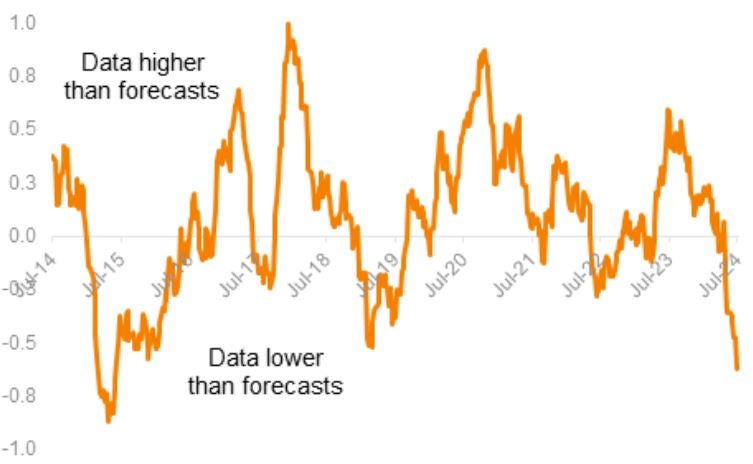

Another data point to look at is Bloomberg’s U.S. Economic Surprise Index, which calculates the difference between an economic data release and its median forecasts. The index is currently negative and has hit its lowest level since 2015, which supports the idea that US macroeconomic conditions are indeed gradually slowing.

The ongoing slowdown in hiring coupled with cooling inflation could lead the Fed to cut rates this year as soon as September—investors are currently pricing in a 74% chance of a cut at the September 17-18 FOMC meeting.

Given the recent macro backdrop, we would argue that we are probably in the later innings of the business cycle, which suggests that any overweights to risk assets should be held cautiously.

Maverick Lin contributed to this article.