Thanks broadly to pressure from elevated policy uncertainty, recent weeks have brought us a sharp rout in global markets—erasing trillions in value—as well as the S&P 500’s largest one-day gain since 2008. Unsurprisingly, many pundits have been quick to report the “death of U.S. Exceptionalism.” But maybe before we declare a time of death, we should get a second opinion from our old friend macro momentum.

The main idea of the macro momentum investing style is to go long assets where fundamental macroeconomic trends are improving, and short assets where macroeconomic trends are deteriorating. And while sentiment may be shifting, underlying U.S. macro data continues to show surprising resilience.

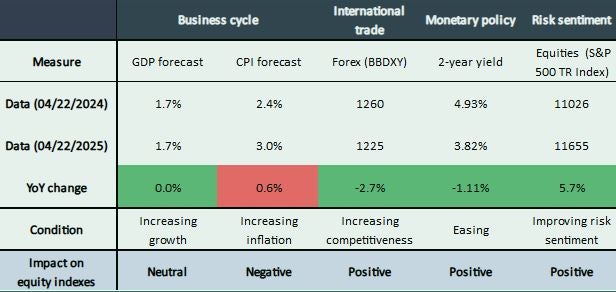

Using data reported by Bloomberg, let’s assess the macro momentum signals as of April 22, 2025:

Business cycle: ✔ GDP growth stood at +1.7% versus +1.7% 1y ago (QoQ), Δ=0% ✖ Inflation stood at +3% versus +2.4% one year ago, Δ=+0.6%

International trade: ✔ The BBDXY Index is 1225 today versus 1260 one year ago, Δ=-2.7%

Monetary policy: ✔ The two-year benchmark government bond yield is +3.82% today versus +4.93% one year ago, Δ=-1.11%

Risk sentiment: ✔ The SPXT Index is 11655 today versus 11026 one year ago, Δ=+5.7%

As of 4/22/2025.

The macro signals are mixed but tilt towards a resilient economy: GDP growth is stable but still positive, monetary policy is easing, the dollar has weakened, and risk sentiment is positive. The only negative is that the CPI forecast is higher. Of course, many of these numbers have come down from their peaks and inflation bears watching. But the broader picture points to a durable U.S. economy, especially for those willing to look past short-term volatility.

Maverick Lin contributed to this article. All data sourced from Bloomberg.