Last week’s cooler-than-expected CPI print showed that consumer prices declined by 0.1% for the month in June (expected +0.1%) and rose by 3.0% year over year (expected +3.1%). Housing costs grew by their slowest pace since 2022, rising by just 0.2% for the month and 5.2% year over year.

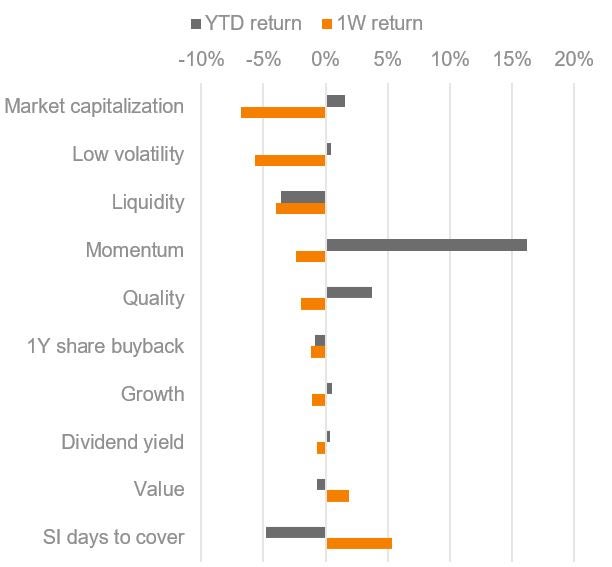

The dovish print led investors to price in a 99% chance of a September interest rate cut and sparked a significant rotation out of momentum and into market laggards, such as value and risk. The market is seemingly dispelling the higher-for-longer interest rate narrative and embracing the imminent Fed rate-cutting cycle. But will this rotation continue? We think so, provided that the trend in disinflation persists.

As of 07/17/24. Source: Bloomberg Factors to Watch (FTW), Equal-Weighted Long-Short Returns.

From a valuation standpoint, there is certainly space for the laggards to converge: looking at 12-month forward EV/EBITDA multiples, the small-cap S&P 600 is trading ~10x, the mid-cap S&P 400 ~11.4x, and the large-cap S&P 500 ~14.8x. With such significant differences in valuation multiples, we might just be at the early innings of a continued re-rating.

From a strategic perspective, U.S. large caps are likely to keep thriving from the winner-take-all markets and robust business momentum; however, the recent rotation could provide investors a tactical opportunity to capitalize on the re-rating of cheaper assets.