Key Takeaways

Don’t let economic resilience lead to overconfidence: Inflation is cooling and rates have found a plausible upper bound, but this does not mean we’re headed for a period of uninterrupted global expansion.

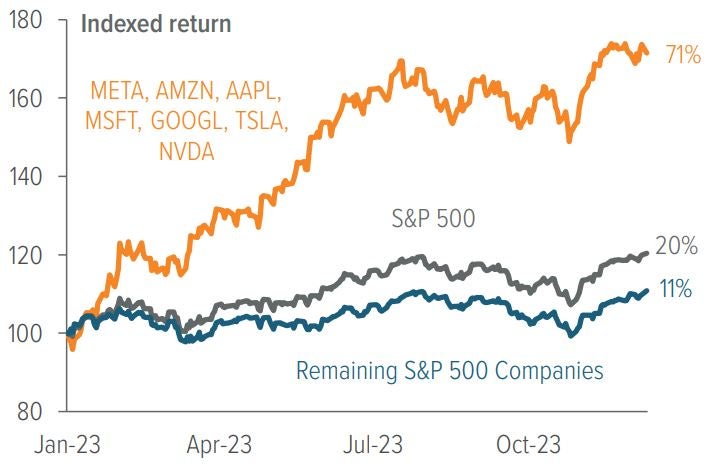

Take a closer look at recent equity performance: While the broader stock market is sitting on double-digit year-to-date returns, a closer look at recent performance reveals that valuations are being distorted by a handful of mega-cap stocks.

Quality still pays: As “good bad news” makes a comeback, the “good good news” for investors is that the higher rate structure should insulate U.S. equities and bonds in the (likely) event of an unexpected market shock.

There’s a difference between celebrating “no recession” and believing that a warmer future of uninterrupted economic growth lies ahead.

Be careful what you tether your worldview to

Bond yields are receding. The S&P 500 index appears poised to close out 2023 with a strong double-digit return. Bets on 2024 rate cuts are ramping up. The glass isn’t half full—it seems to runneth over.

How far we’ve come. Just two quarters ago (or centuries, by the standards of our 24/7 breaking news cycle), most investors were convinced the world was headed for a hard economic landing and that a recession was imminent. We didn’t think so. Looking at the broader economic picture over the course of 2023, we saw several areas of the economy that were insulated from higher rates. Borrowers had locked in long-term financing at super-low rates during Covid. Savers had begun to generate attractive yields on cash. And U.S. government spending was funding growth through borrowing and racking up persistent and sizeable deficits along the way.

With these insulating factors in place, we thought the economy would eke by and avoid a recession—the doom and gloom in early 2023 was too gloomy for us.

Standing on the precipice of 2024, too many market participants seem to be expecting economic “nirvana,” when all we really did was avoid economic disaster.

Fast-forward to today, and the market’s confidence around having hit a boundary condition of higher rates has reached a fever pitch. Insulation helped us survive a long journey through the bitter cold. But there’s a difference between celebrating “no recession” and believing that a warmer future of uninterrupted economic growth lies ahead. Insulation is not immunity. And over time, insulation wears thin.

With year-to-date S&P returns hovering near 20%, there’s a perception that equity markets love the current backdrop. Be careful what you tether your worldview to. Are equities rallying because of current economic conditions, or are valuations being distorted by a handful of mega-cap stocks?

As of December 11, 2023. Source: FactSet, Goldman Sachs, Voya Investment Management.

As Exhibit 1 shows, the U.S. stock market’s performance in 2023 has come “largely” from the so-called “magnificent 7,” which represent nearly 30% of the S&P 500 Index’s market capitalization. Said differently, the average stock hasn’t been that enthused about current market conditions and the outlook for future growth.

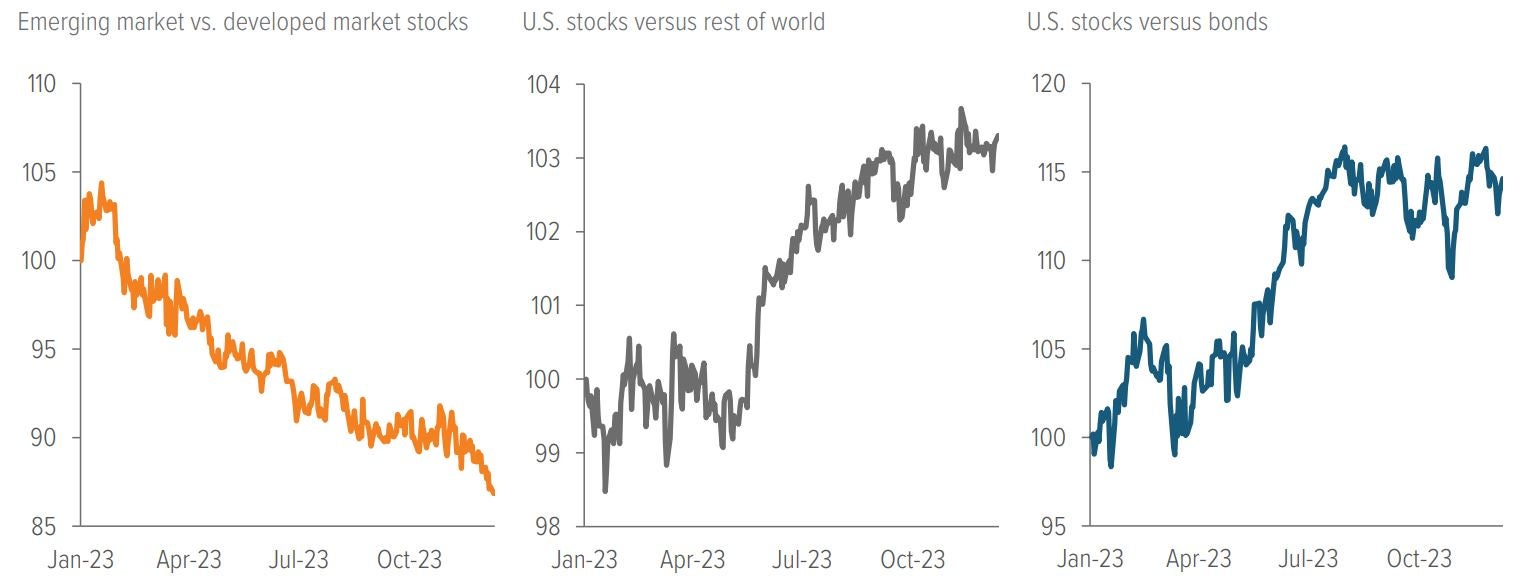

The impact of these seven stars is widespread and has created significant dispersion in the market (Exhibit 2). Small caps have lagged large caps by a sizeable margin. Value has gotten trounced by growth. The U.S. has outperformed the rest of the world, and developed markets more broadly have beaten out their emerging market counterparts.

This dispersion in performance paints a more nuanced view of the world and the outlook for economic growth. Again, there is a difference between believing inflation is cooling and rates have found a plausible upper bound ... and believing the next era of uninterrupted global expansion is already underway.

As of December 11, 2023. Source: YCharts, Voya Investment Management. Emerging markets represented by the MSCI Emerging Market Index. Developed markets and “rest of world” represented by the MSCI World Index. U.S. stocks represented by the MSCI USA Index. U.S. stocks versus bonds is a comparison of the S&P 500 Index and the ICE BofA US Corporate Index Total Return Index.

Where is insulation eroding and where is it staying strong?

Evaluating which of these market trends carries over to 2024 requires a closer look at the concept of insulation. What areas of the market still have a layer of protection, and where is it growing thin?

Looking at the U.S. consumer, resilient labor income, the cushion of accumulated wealth, and excess spending by retirees should sustain consumption. However, this insulation will be tempered as prime-age consumers seek to boost savings due to fears of labor market softening. Still, post-pandemic wage gains and falling inflation should lift real wages for lower-income workers, which will mitigate potential credit stress in the face of higher borrowing costs.

And remember, as of June 30, 2023 more than 90% of homeowners had a mortgage rate under 5%, while the current average mortgage rate is 6.82%.1 For those who did not lock in attractive long-term financing, the outlook is bleaker. For example, increased borrowing costs have significantly impacted the commercial real estate market in the United States, leading to concerns about project financing and potential defaults. The effect of high interest rates is spilling over to property sales, which started to decrease significantly in 2023 and will likely decelerate further in 2024.

Insulation in China and Europe is also thin:

- China’s economic activity took a hit from the government’s stringent zero-Covid policy and the ongoing crisis in the Chinese real estate market.

- The European economy is facing several challenges that will carry over into 2024, including the ongoing war in Ukraine, high energy prices, and inflation. These factors increase the likelihood of recession in the region.

In the meantime, growing bets on 2024 rate cuts are creating a perverse dynamic in which bad news is good, because it increases the chances of a Fed cut to lower rates. But if bad news causes a rate rally, will it create a positive feedback loop for U.S. equities?

The “good good news” for investors is that the current rate structure continues to insulate U.S. equities and bonds. However, looking at the two asset classes side by side, the bond market appears to have an extra layer of insulation. If the reduction in interest rates is a response to rapidly deteriorating economic conditions, the positive impact on equity prices might be offset by broader economic challenges. Bonds, on the other hand, would likely rally.

Do deficits matter? Yes, but be careful about your time horizon.

One of the most significant factors insulating the economy has been U.S. government deficit spending. With the 2024 election cycle looming, it’s a topic we think will get increasing focus from both economists and asset allocators—and we’re already seeing some misconceptions seep into the narrative. In the near term, there is a concern that the deficit will create a self-reinforcing loop for higher interest rates, as the premium investors demand for holding U.S. government debt will increase.

Make no mistake. The deficit has reached levels that are undoubtedly concerning, surging to $1.7 trillion in fiscal year 2023, up from $1.4 trillion in 2022. This level of deficit, which equals 6.3% of the country’s GDP, is unprecedented in recent history, save for the 2008 financial crash. On its current path, the deficit is projected to reach $2.9 trillion by 2033. The growing deficit contributes to the national debt, which stood at $26.5 trillion as of October, nearly equaling the size of the United States’ annual economic output.

However, the feedback loop of the world punishing the United States for overspending is not swift. For those concerned that the deficit will cause investors to demand a higher premium in the near term, I ask a rhetorical question: Where else are investors going to go in the current environment?

Despite the country’s growing deficit, on a relative basis, U.S. Treasuries are still the world’s most attractive “flight to quality” investment.

In addition, the deficit suppresses growth and the efficiency of the economy, which actually lowers interest rates. Longer term, the risk is that the United States falls into the “Japanese trap”—a scenario of low interest rates coupled with anemic growth, potentially due to an overwhelmed financial system and reduced attractiveness for foreign capital.

If government spending continues unchecked, will the world stop using the U.S. dollar as its reserve currency? 100% yes. But the timeline to that outcome is measured in decades, not the Twitter attention span of years or quarters.

So, fear the long-term consequences, but don’t underestimate the near-term insulation benefits that fiscal spending provides.

Don’t be a hero. Quality still pays.

While the deficit does not top our list of things that could shock the market in 2024, there are plenty of things that could still go wrong. We didn’t know at the start of 2023 that there would be a bank crisis or a resurgence of conflict in the Middle East.

Rooting for “good bad news” to influence Fed policy is one thing. However, there is also the bad news that comes in the form of an unexpected shock—the “bad bad news.”

As we’ve noted in recent letters, it’s important to remember that we’ve been on a journey to a new interest rate regime. While the medicine of higher rates was an extremely hard pill to swallow, it provided us with a strong layer of insulation.

The changing whim of monetary policy is no longer the sole measuring stick for opportunities and risks, because investors do not have to reach down in quality to generate an attractive expected return.

Yields for high-quality bonds are at similar levels to the yields that junk-rated bonds paid a decade ago. With the new rate structure, higher-quality investments not only pay, but they are also better insulated from risk in the event of an unexpected market shock. Said another way, no one is paying you to be a hero in the new rate regime.

|

Risks of Investing Certain of the statements contained herein are statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All investments are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Actual results, performance or events may differ materially from those in such statements due to, without limitation, (1) general economic conditions, (2) performance of financial markets, (3) interest rate levels, (4) increasing levels of loan defaults, (5) changes in laws and regulations and (6) changes in the policies of governments and/or regulatory authorities. |