When selecting a fund to anchor your clients’ portfolios, consider its journey just as carefully as its destination.

There are probably as many approaches to core plus bond fund investing as there are core plus bond managers. But in terms of the client experience, we can broadly divide them into two categories:

A: Focus on the highest total return (the destination), with volatility considerations taking a back seat.

B: Focus on the overall investment experience (the destination and the journey). Managing volatility—especially in a slice of the portfolio designed to cushion against riskier assets—can be useful in strengthening client confidence

How does that translate into actual numbers? Let’s go to the tape. Since 2009, bond investors were put through a lot: years of near-zero rates driven by financial repression, the highest inflation in a generation, and multiple credit cycles alternating between wide spreads and (like now) historically tight spreads.

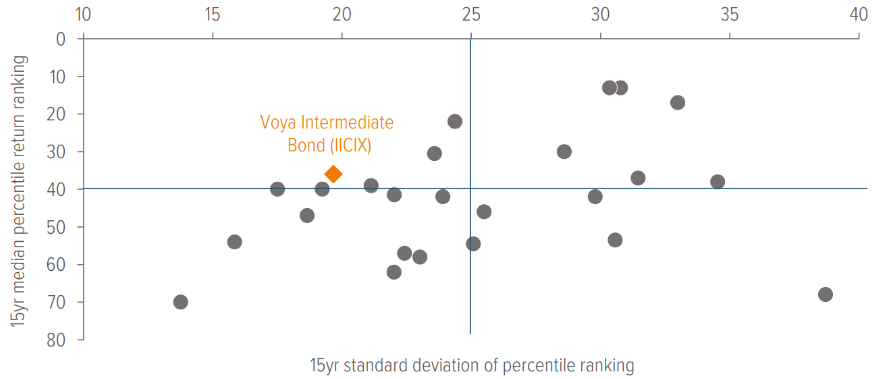

Using that time frame, we plotted the median 1-year return ranking against the volatility ranking for the 25 largest funds in the Morningstar® Intermediate Core-Plus Bond category. Expanding upon the classic Markowitz efficient frontier theory, the managers with the best combination of strong total returns and minimal volatility within that ranking are positioned in the top left quadrant of the graph.

As of 11/30/25. Source: Voya IM, Morningstar. Fund class shown is I shares.

The issue with risk

Some core plus bond managers take what we call a “long-beta” approach—loading up a portfolio with risk across all time periods and dealing with the inevitable consequences when they arise. However, such strategies may frequently get caught offsides, resulting in periods of disappointing relative returns. That’s not just a problem for quarterly statements. It can cause funds to be placed on watch lists across broker/dealer platforms, leading to difficult conversations between advisors and their clients.

Consistently good beats occasionally great

Institutional-style bond managers understand that metrics beyond total return are meaningful and can make an advisor’s job easier. A portfolio that delivers reliable performance through a variety of market conditions requires a keen eye on when to dial risk up or down, the ability to discern relative value across sectors, and careful management of liquidity.

The long-beta manager is often praised by the financial media and ratings systems for their “strong, long-term results” and “ability to generate alpha.”1 But does taking more market risk really produce alpha—that is, the portfolio’s excess return compared with its benchmark after accounting for its level of risk (as measured by beta)? What was the client’s overall experience in this fund? And what was the intangible impact on client confidence from awkward conversations with their advisor?

Your golf game, your cooking, and even your stock portfolio’s performance may be amazing every once in a while—but your core plus bond fund should be reliable above all else. At Voya, we believe a fixed income portfolio’s journey should be consistently good, rather than periodically great.

For more insights on fixed income investing, visit voyainvestments.com.

The performance quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. The investment return and principal value of an investment in the Portfolio will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month end, please visit www.voyainvestments.com.

The Adviser has contractually agreed to limit expenses of the Fund. This expense limitation agreement excludes interest, taxes, investment-related costs, leverage expenses, and extraordinary expenses and may be subject to possible recoupment. Please see the Fund’s prospectus for more information. The expense limits will continue through at least Aug 1, 2026. The Fund is operating under the contractual expense limits.

A note about risk : All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. You could lose money on your investment and any of the following risks, among others, could affect investment performance. The following principal risks are presented in alphabetical order which does not imply order of importance or likelihood: Bank Instruments; Company; Credit; Credit Default Swaps; Currency; Derivative Instruments; Environmental, Social, and Governance (Fixed Income); Floating Rate Loans; Foreign (Non U.S.) Investments/ Developing and Emerging Markets; High-Yield Securities; Interest in Loans; Interest Rate; Investment Model; Liquidity; Market; Market Capitalization; Market Disruption and Geopolitical; Mortgageand/or Asset-Backed Securities; Municipal Obligations; Other Investment Companies; Preferred Stocks; Prepayment and Extension; Securities Lending; U.S. Government Securities and Obligations. Investors should consult the Fund’s Prospectus and Statement of Additional Information for a more detailed discussion of the Fund’s risks. The strategy employs a quantitative model to execute the strategy. Data imprecision, software or other technology malfunctions, programming inaccuracies and similar circumstances may impair the performance of these systems, which may negatively affect performance. Furthermore, there can be no assurance that the quantitative models used in managing the strategy will perform as anticipated or enable the strategy to achieve its objective.