While high starting yields should provide a buffer against potential volatility, credit selection will be critical as dispersion within and across sectors increases.

Executive summary

2024 review

European leveraged credit markets delivered strong performance in 2024, supported by stable macroeconomic conditions, resilient corporate fundamentals and favorable technical dynamics. High yields and tightening spreads drove robust returns across both loans and high yield bonds, extending the momentum from 2023.

- Macroeconomic stability and monetary easing: The ECB lowered rates amid disinflation and modest economic growth, fostering a supportive environment for risk assets. Consumer spending benefited from wage growth and declining energy prices.

- Strong technical drivers: Demand for leveraged credit remained robust, driven by record levels of CLO issuance and increased inflows into high yield funds. Loan prices strengthened, while spreads tightened significantly.

- Resilient corporate fundamentals: Issuers maintained stable earnings, and refinancing pressures eased. Defaults remained low, with underperformance largely isolated to lower-quality credits, while stronger-rated names outperformed.

2025 outlook

The outlook for European leveraged credit remains constructive, supported by attractive yields, continued monetary easing and stable economic growth. While tighter valuations and a maturing credit cycle may temper returns, elevated carry is expected to provide income and cushion against potential volatility.

- Demand supported by high yields: Investors are likely to remain engaged in leveraged credit markets given attractive yields and sustained demand from institutional buyers such as CLO managers.

- Moderate supply growth: Refinancing activity is expected to dominate issuance in high yield, while M&A and leveraged buyout activity are expected to increase as borrowing costs decline.

- Selectivity is key: While credit fundamentals remain stable, geopolitical risks, policy uncertainty and potential sector dispersion underscore the importance of disciplined credit selection and a focus on quality.

Performance outlook

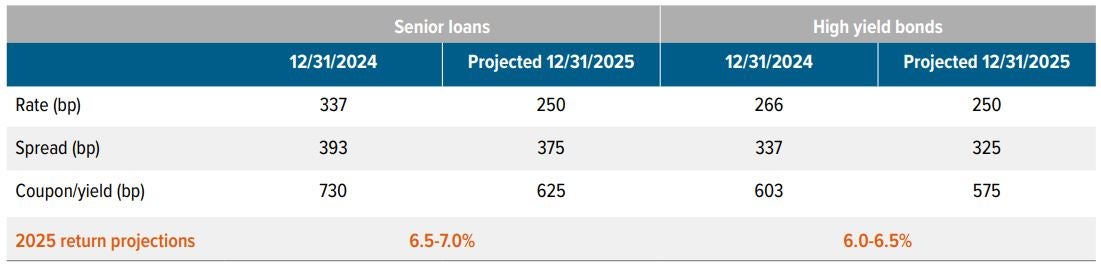

Although a range of scenarios could shift return outcomes, our base case projection is a total return range of 6.5-7.0% for European loans and 6.0-6.5% for the European high yield bond market. Broad market volatility will remain a prominent theme as the credit cycle matures. With increased bifurcation, individual credit selection will remain a key driver of performance.

As of 12/31/24. Source: LCD, Barclays, Bloomberg. Loans represented by the Morningstar European Leveraged Loan Index. High yield bonds (HY) represented by the Bloomberg Pan-European Corporate High Yield Index. Loan rate represented by a blended rate of Euribor contracts tracked by MarkIt partners; loan spread is LCD’s nominal credit spread for the loan index. HY spread is the average spread of the HY index, while the rate component backs out spread from the yield-to-worst of the HY index. Past performance is no guarantee of future results. Investors cannot invest directly in an index.

A note about risk

Principal risks for senior loans: All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield. Voya’s senior loan strategies invest primarily in below investment grade, floating rate senior loans (also known as “high yield” or “junk” instruments), which are subject to greater levels of liquidity, credit and other risks than are investment grade instruments. There is a limited secondary market for floating rate loans, which may limit a strategy’s ability to sell a loan in a timely fashion or at a favorable price. If a loan is illiquid, the value of the loan may be negatively impacted and the manager may not be able to sell the loan in order to meet redemption needs or other portfolio cash requirements. The value of loans in the portfolio could be negatively impacted by adverse economic or market conditions and by the failure of borrowers to repay principal or interest. A decrease in demand for loans may adversely affect the value of the portfolio’s investments, causing the portfolio’s net asset value to fall. Because of the limited market for floating rate senior loans, it may be difficult to value loans in the portfolio on a daily basis. The actual price the portfolio receives upon the sale of a loan could differ significantly from the value assigned to it in the portfolio. The portfolio may invest in foreign instruments, which may present increased market, liquidity, currency, interest rate, political, information and other risks. These risks may be greater in the case of emerging market loans. Although interest rates for floating rate senior loans typically reset periodically, changes in market interest rates may impact the valuation of loans in the portfolio. In the case of early prepayment of loans in the portfolio, the portfolio may realize proceeds from the repayment that are less than the valuation assigned to the loan by the portfolio. In the case of extensions of payment periods by borrowers on loans in the portfolio, the valuation of the loans may be reduced. The portfolio may also invest in other investment companies and will pay a proportional share of the expenses of the other investment company.

Principal risks for high yield bonds: All investing involves risks of fluctuating prices and the uncertainties of rates and return and yield inherent in investing. High yield securities, or “junk bonds,” are rated lower than investment grade bonds because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities. As interest rates rise, bond prices may fall, reducing the value of the portfolio’s share price. Debt securities with longer durations tend to be more sensitive to interest rate changes than debt securities with shorter durations. Other risks of the portfolio include, but are not limited to, credit risk, other investment companies risks, price volatility risk, the inability to sell securities and securities lending risks.