While high starting yields should provide a buffer against potential volatility, credit selection will be critical as dispersion within and across sectors increases.

Executive summary

Strong performance amid robust demand in 2024

The leveraged loan market delivered strong returns in 2024, supported by resilient economic growth, high carry and robust investor demand, with record repricing activity and CLO issuance driving borrower cost reductions and secondary price gains.

Key trends

- Performance: Loans closed the year at their highest levels since early 2022, supported by stable earnings and strong risk appetite. Single-B loans outperformed, while high yield CCC bonds saw a late-year rally in select sectors.

- Fundamentals: While leverage ratios remained stable, interest coverage ratios continued to decline due to higher rates. Defaults, largely driven by distressed exchanges, edged higher but remained within manageable levels.

- Supply and demand: Net supply growth remained subdued, with refinancing dominating issuance. CLOs and retail investors drove robust demand, supported by high yields and strong market sentiment.

2025 outlook

Looking ahead, the leveraged credit market is well positioned to deliver attractive returns, with high starting yields providing a cushion against potential volatility. Key themes for 2025 include:

- Macro and technical dynamics: A positive macro environment, easing monetary policy and supportive technicals are expected to sustain demand for leveraged credit. However, stronger net supply, fueled by a rebound in M&A activity, may soften the supply/demand imbalance.

- Default activity should stabilize: Corporate fundamentals should improve as rates decline and earnings growth rebounds.

- Corporate risk profiles are bifurcated: The market will remain split, emphasizing the importance of careful credit selection. Risks include potential inflation surprises, geopolitical tensions, and sector-specific headwinds in retail, autos, and media.

Performance outlook

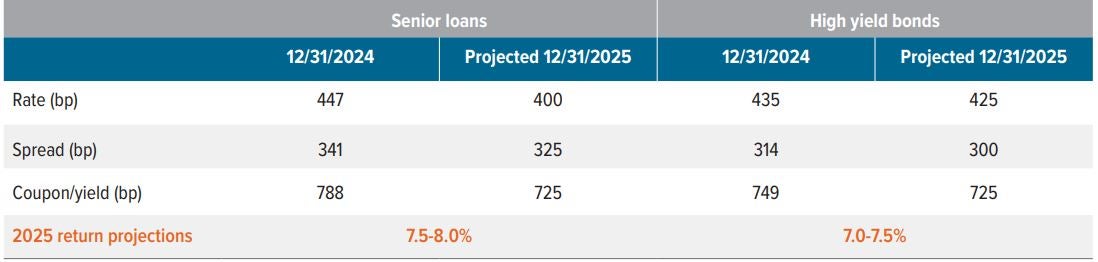

The leveraged loan market is forecast to generate a 7.5-8.0% total return in 2025, slightly outpacing high yield bonds (7.0-7.5%).1 Loans’ carry advantage will support performance in the first half of the year, but this may diminish as repricing activity and rate cuts materialize. Credit selection will be critical as dispersion within and across sectors increases.

As of 12/31/24. Source: LCD, Barclays, Bloomberg. Loans represented by the Morningstar LSTA U.S. Leveraged Loan Index. High yield bonds (HY) represented by the Bloomberg U.S. Corporate High Yield Index. Loan rate represented by a blended rate of SOFR contracts tracked by MarkIt partners; loan spread is LCD’s nominal credit spread for the loan index. HY spread is the average spread of the HY index, while the rate component backs out spread from the yield-to-worst of the HY index. Past performance is no guarantee of future results. Investors cannot invest directly in an index.

A note about risk

Principal risks for senior loans: All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield. Voya’s senior loan strategies invest primarily in below investment grade, floating rate senior loans (also known as “high yield” or “junk” instruments), which are subject to greater levels of liquidity, credit and other risks than are investment grade instruments. There is a limited secondary market for floating rate loans, which may limit a strategy’s ability to sell a loan in a timely fashion or at a favorable price. If a loan is illiquid, the value of the loan may be negatively impacted and the manager may not be able to sell the loan in order to meet redemption needs or other portfolio cash requirements. The value of loans in the portfolio could be negatively impacted by adverse economic or market conditions and by the failure of borrowers to repay principal or interest. A decrease in demand for loans may adversely affect the value of the portfolio’s investments, causing the portfolio’s net asset value to fall. Because of the limited market for floating rate senior loans, it may be difficult to value loans in the portfolio on a daily basis. The actual price the portfolio receives upon the sale of a loan could differ significantly from the value assigned to it in the portfolio. The portfolio may invest in foreign instruments, which may present increased market, liquidity, currency, interest rate, political, information and other risks. These risks may be greater in the case of emerging market loans. Although interest rates for floating rate senior loans typically reset periodically, changes in market interest rates may impact the valuation of loans in the portfolio. In the case of early prepayment of loans in the portfolio, the portfolio may realize proceeds from the repayment that are less than the valuation assigned to the loan by the portfolio. In the case of extensions of payment periods by borrowers on loans in the portfolio, the valuation of the loans may be reduced. The portfolio may also invest in other investment companies and will pay a proportional share of the expenses of the other investment company.

Principal risks for high yield bonds: All investing involves risks of fluctuating prices and the uncertainties of rates and return and yield inherent in investing. High yield securities, or “junk bonds,” are rated lower than investment grade bonds because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities. As interest rates rise, bond prices may fall, reducing the value of the portfolio’s share price. Debt securities with longer durations tend to be more sensitive to interest rate changes than debt securities with shorter durations. Other risks of the portfolio include, but are not limited to, credit risk, other investment companies risks, price volatility risk, the inability to sell securities and securities lending risks.