With cash yields continuing to decline, it could be time to consider shifting to a flexible, broadly diversified fixed income strategy.

Since the Federal Reserve pushed interest rates higher in 2022 to tame inflation, cash securities and money market funds have attracted investors looking to generate income and sidestep market volatility. But with cash yields off their peak (and set for a further decline with interest rate cuts expected this month and beyond), what’s the best way to continue to generate attractive income and lock in higher yields?

Moving some of that cash into a traditional bond fund consisting of government bonds and high-quality corporate debt is one idea. Another possibility—one that we think could be even more effective—is to pair a core bond strategy with a nontraditional (or unconstrained) bond fund.

Cash has been king...but bonds are ready to stage a coup!

Cash has been a great parking spot for many investors during the past few years, but this will no longer be the case when the Fed continues its rate-cutting cycle this month, with further cuts expected through year end. And when rate cuts arrive, cash returns will fall fast. Keeping a substantial portion of a long-term portfolio in cash also comes with an opportunity cost: limiting long-term growth potential by holding an asset whose yield moves in tandem with interest rates, rather than one whose yield moves in an opposite direction.

Forward-looking analysis shows that unconstrained bonds could outperform cash in many scenarios

Historically, bond yields have been good predictors of future returns.

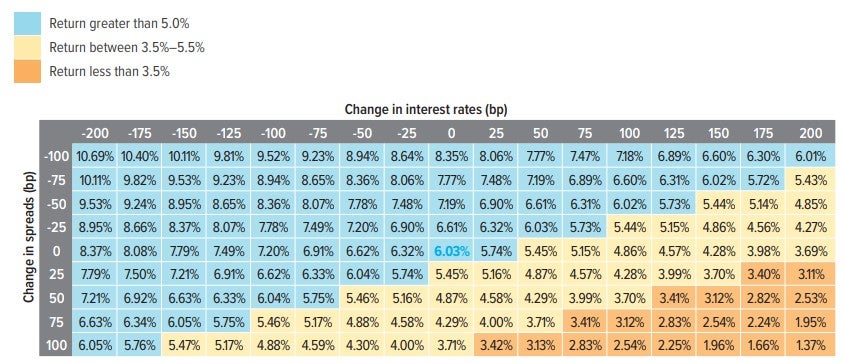

To illustrate why moving a portion of cash into an unconstrained bond fund now is worth considering, let’s look at how such a fund might perform in various interest rate and credit spread scenarios in the next 12 months. Our analysis uses a sample unconstrained bond portfolio and we’ve erred on the conservative side by assuming that cash will continue to yield 4% over the next 12 months (even though we expect the Fed to begin cutting rates this month, which would result in a decline in cash yields) (Exhibit 1).

For the scenarios shown (a +/-200 basis point [bp] change in rates and a +/-100 bp change in spreads), the sample portfolio has a median return of 6.03% over the next 12 months and outperforms cash in 81% of outcomes. Notably, if credit spreads remain unchanged, the sample portfolio could absorb up to a 150 bp increase in rates and still outperform cash.

As of 07/31/25. Source: Bloomberg Index Services Ltd., JP Morgan, Morningstar Direct, Voya IM. Sample portfolio assumes a yield-to-worst of 6.03%, interest rate duration of 2.17 years and credit spread duration of 3.32 years. Return calculations shown in table assume instantaneous moves for interest rates and/or spreads.

Unconstrained bonds can enhance fixed income portfolios

While a core or core plus bond fund is likely to be the anchor of a fixed income allocation, adding an unconstrained bond fund may help boost return potential, diversify exposure and increase the resilience of the allocation. Here’s how.

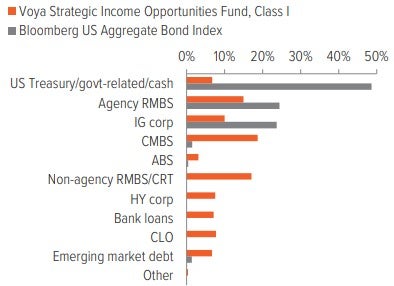

Enhanced yield opportunities without the constraints of a benchmark

Unlike a traditional bond fund, an unconstrained bond fund can seek opportunities for improving yield and mitigating risk without the confines of a benchmark. An unconstrained bond fund manager often has greater flexibility than a traditional bond fund manager to adjust exposures to a broader array of fixed income sectors, shift the portfolio’s average credit quality, modify geographical exposure, and fine-tune interest rate sensitivity based on their view of the economy.

Source: Bloomberg Index Services Ltd., Voya IM. Past performance does not guarantee future results. Investors cannot invest directly in an index.

Unconstrained bonds can enhance fixed income portfolios

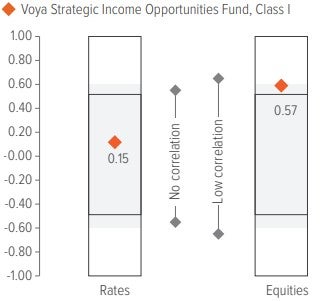

Diversification from traditional bonds and equities

Because it incorporates assets with low correlations to stocks and traditional bonds, an unconstrained bond fund is less likely to mirror broad market downturns, while increasing portfolio stability and mitigating volatility.

As of 12/31/24. Source: Bloomberg Index Services Ltd., Standard & Poor’s, Voya IM. Rates represented by Bloomberg US Treasury Index. Equities represented by S&P 500® Index.

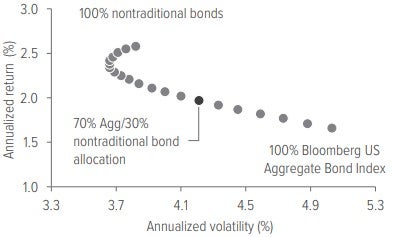

Better long-term total return potential with less risk than core bonds alone

Our research shows that combining an allocation to unconstrained bonds with an allocation to core bonds creates a more efficient portfolio—higher returns, lower risk—than a standalone allocation to either type of bond fund alone.

Source: Morningstar Direct, Bloomberg Index Services Ltd., Voya IM. Nontraditional bonds represented by the Morningstar® Nontraditional Bond category. Core bonds represented by Bloomberg US Aggregate Bond Index. Efficient frontier represented by a portfolio that blends core bonds and nontraditional bonds in 5% increments. Portfolios are rebalanced annually back to target weights at calendar year end. Past performance does not guarantee future results. Investors cannot invest directly in an index.

A note about risk

All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. You could lose money on your investment and any of the following risks, among others, could affect investment performance. The following principal risks are presented in alphabetical order which does not imply order of importance or likelihood: Bank Instruments; Company; Convertible Securities; Credit; Credit Default Swaps; Currency; Deflation; Derivative Instruments; Environmental, Social, and Governance (Fixed Income); Floating Rate Loans; Foreign (Non-U.S.) Investments/ Developing and Emerging Markets; High-Yield Securities; Inflation-Indexed Bonds; Interest in Loans; Interest Rate; Liquidity; Market; Market Capitalization; Market Disruption and Geopolitical; Mortgage- and/or Asset-Backed Securities; Other Investment Companies; Preferred Stocks; Prepayment and Extension; Securities Lending; Sovereign Debt; U.S. Government Securities and Obligations. Investors should consult the Portfolio’s Prospectus and Statement of Additional Information for a more detailed discussion of the Portfolio’s risks. The strategy employs a quantitative investment process. The process is based on a collection of proprietary computer programs, or models, that calculate expected return rankings based on variables such as earnings growth prospects, valuation, and relative strength. Data imprecision, software or other technology malfunctions, programming inaccuracies and similar circumstances may impair the performance of these systems, which may negatively affect performance. Furthermore, there can be no assurance that the quantitative models used in managing the strategy will perform as anticipated or enable the strategy to achieve its objective.