The evolution of the private equity secondaries market from a niche to a mainstream investment strategy is testament to its resilience and adaptability.

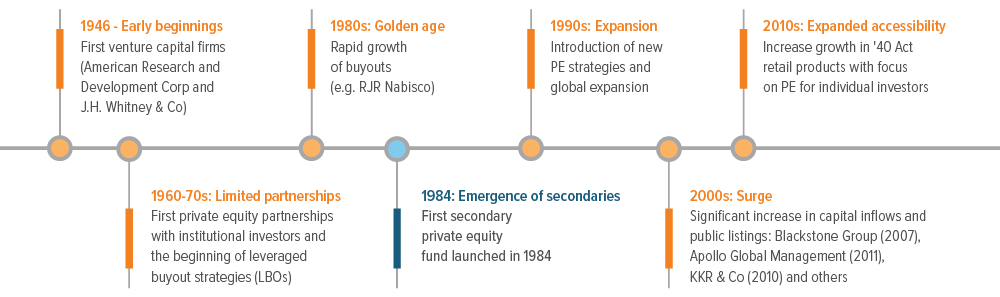

Private equity: From birth to prominence

Although private equity (PE) has been around since the 1940s, the industry has undergone decades-long maturation that has led to more prominence in investor portfolios—and the emergence of secondaries private equity.

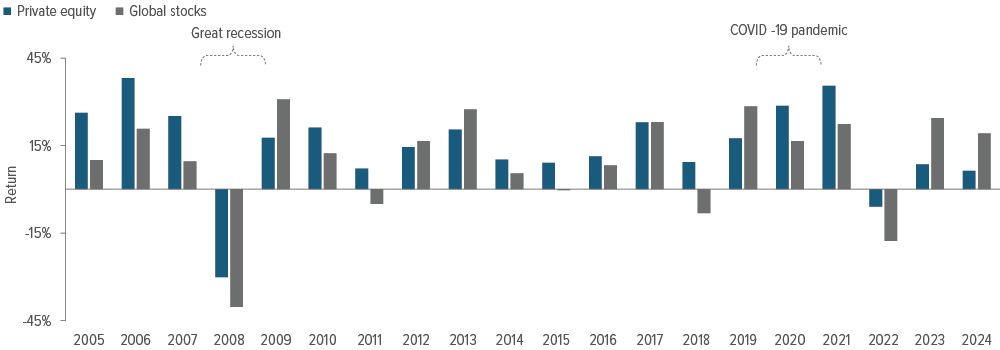

Private equity resilience captured investor attention

One of the key drivers behind the surge in private equity’s popularity has been its strong performance, both in stable and volatile markets (Exhibit 1). Over the last two decades, private equity has outperformed global stocks in 13 out of 20 years, by an average of 5%. This has sparked significant investor interest, with U.S. private equity funds raising $2.9 trillion over the last 10 years.1

As of 12/31/24. Source: Cambridge Associates, MSCI. Private equity represented by the Cambridge Private Equity Index. Global stocks represented by the MSCI World Index. See disclosures for index descriptions

Beyond the potential for higher returns, private equity opens a vast landscape of opportunities. For every public company in the U.S., there are a thousand privately owned businesses, making up roughly 99.9% of all corporate investment prospects in the U.S.2

Emergence of the secondary PE market and how it works

Private equity involves investing in companies not traded publicly, typically accessed through funds managed by a private equity firm as the general partner. Investors— known as limited partners (LPs)—commit capital for potentially long periods, making these investments “illiquid” compared to public stocks. The private equity secondaries market emerged in response to the growing demand by investors to access their capital before the fund’s investments are fully realized (i.e. sold).

Secondary fund managers buy these interests, often at a discount to net asset value, and pool them into investment vehicles, such as a registered ’40 Act fund.

Secondaries PE offer three key advantages:

1. Quicker returns than primary PE: Secondary transactions usually happen midway through a fund’s lifecycle, skipping the early investment period—when expenses incur and growth may be limited—and potentially offering shorter investment periods and accelerated returns.

2. Enhanced transparency: When investing in a new primary private equity fund, investors may not know the future holdings. However, secondary funds consist of existing assets of the underlying fund, providing better visibility into holdings and potentially enhancing downside protection compared to primary PE or global public equities. During the seven worst public market drawdowns in the past 20 years, secondary PE declined 3.6% while primary PE fell 10.4% and public equities lost 25.0%, on average.3

3. Discount opportunities: Secondary sales are often driven by an investor’s need for liquidity. Typically, the existing fund owner sells the interest at a discount to new asset value. The average market discount over the last five years was 8%,4 potentially presenting attractive opportunities for investors.

Secondaries may deliver a liquidity boost

In the initial years of a traditional primary investment, a fund will generally exhibit low or negative returns and cash flows. This is normal at this stage of a fund’s lifecycle when the private equity fund manager is making investments. Proceeds returned to investors from realized investments (typically when a company is sold) usually don’t occur until after year 5 from when the investment was made. Investing in a fund as a secondary investor, rather than a primary investor, allows the investor to buy into the fund at a later stage, potentially providing early positive liquidity.

A maturing market with opportunities and challenges

Challenging economic conditions and tight financing markets have slowed deal making in recent years. But it isn’t all bad news; the opportunity set in secondaries private equity is rapidly growing as primary LPs seek liquidity outside of traditional exit strategies. Active management and this need for liquidity have propelled secondaries to the fastest growing segment within the private equity industry, with deal volume rising from $2 billion in 2001 to $162 billion in 2024.5

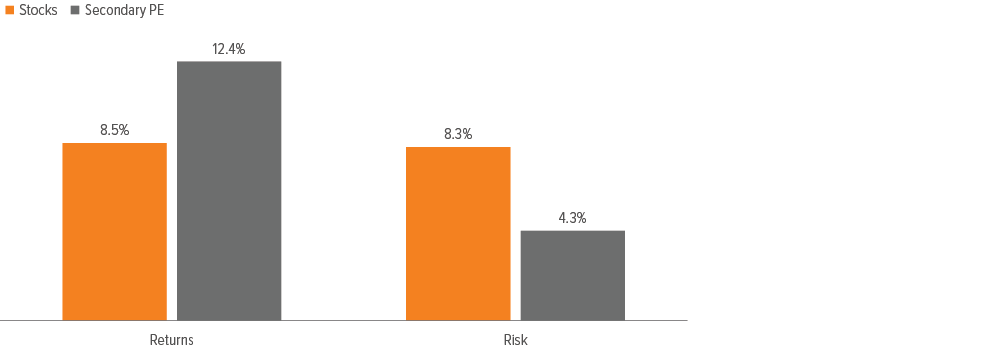

Secondaries PE historically has provided an attractive blend of higher risk-adjusted returns compared to public equities, along with a faster liquidity profile over primary private equity investments. This combination presents a strong argument for diversifying beyond the conventional 60/40 stock and bond portfolio mix by incorporating secondary funds to meet investment objectives.

As of 12/31/24. Source: MSCI, Bloomberg and Cambridge Associates. Past performance is no guarantee of future results. See disclosures for index definitions and other disclosures.

A note about risk

Investing in private equity is a risk and there is no guarantee that an investment in private equity or in a Pomona sponsored fund will be profitable. The above scenarios are for illustrative purposes only and are theoretical; there is no guarantee an investment in a Pomona-sponsored fund will exhibit any of the above characteristics or return profile.

Discussed below are the investments generally made by Investment Funds and the principal risks that the Adviser and the Fund believe are associated with those investments and with direct investments in operating companies. These risks will, in turn, have an effect on the Fund. In response to adverse market, economic or political conditions, the Fund may invest in investment grade fixed income securities, money market instruments and affiliated or unaffiliated money market funds or may hold cash or cash equivalents for liquidity or defensive purposes, pending investment in longer-term opportunities. In addition, the Fund may also make these types of investments pending the investment of assets in Investment Funds and Co-Investment Opportunities or to maintain the liquidity necessary to effect repurchases of Shares. When the Fund takes a defensive position or otherwise makes these types of investments, it may not achieve its investment objective.

The value of the Fund’s total net assets is expected to fluctuate in response to fluctuations in the value of the Investment Funds, direct investments and other assets in which the Fund invests. An investment in the Fund involves a high degree of risk, including the risk that the Shareholder’s entire investment may be lost. The Fund’s performance depends upon the Adviser’s selection of Investment Funds and direct investments in operating companies, the allocation of offering proceeds thereto, and the performance of the Investment Funds, direct investments, and other assets. The Investment Funds’ investment activities and investments in operating companies involve the risks associated with private equity investments generally. Risks include adverse changes in national or international economic conditions, adverse local market conditions, the financial conditions of portfolio companies, changes in the availability or terms of financing, changes in interest rates, exchange rates, corporate tax rates and other operating expenses, environmental laws and regulations, and other governmental rules and fiscal policies, energy prices, changes in the relative popularity of certain industries or the availability of purchasers to acquire companies, and dependence on cash flow, as well as acts of God, uninsurable losses, war, terrorism, earthquakes, hurricanes or floods and other factors which are beyond the control of the Fund or the Investment Funds. Unexpected volatility or lack of liquidity, such as the general market conditions that prevailed in 2008, could impair the Fund’s performance and result in its suffering losses. The value of the Fund’s total net assets is expected to fluctuate. To the extent that the Fund’s portfolio is concentrated in securities of a single issuer or issuers in a single sector, the investment risk may be increased. The Fund’s or an Investment Fund’s use of leverage is likely to cause the Fund’s average net assets to appreciate or depreciate at a greater rate than if leverage were not used.

The Fund is a non-diversified, closed-end management investment company with limited performance history that a Shareholder can use to evaluate the Fund’s investment performance. The Fund may be unable to raise substantial capital, which could result in the Fund being unable to structure its investment portfolio as anticipated, and the returns achieved on these investments may be reduced as a result of allocating all of the Fund’s expenses over a smaller asset base. The initial operating expenses for a new fund, including start-up costs, which may be significant, may be higher than the expenses of an established fund. The Investment Funds may, in some cases, be newly organized with limited operating histories upon which to evaluate their performance. As such, the ability of the Adviser to evaluate past performance or to validate the investment strategies of such Investment Funds will be limited. In addition, the Adviser has not previously managed the assets of a closed-end registered investment company.

Closed-End Fund; Liquidity Risks: The Fund is a non-diversified closed-end management investment company designed principally for long-term investors and is not intended to be a trading vehicle. An investor should not invest in the Fund if the investor needs a liquid investment. Closed-end funds differ from open-end management investment companies (commonly known as mutual funds) in that investors in a closed-end fund do not have the right to redeem their shares on a daily basis at a price based on net asset value.