At the precipice of a “third wave” of investing, Equity CIO Vinnie Costa explains why he believes the future of investing will be defined by the successful integration of human expertise and machine intelligence—and how Voya’s equity platform continues to evolve to meet client needs.

Spanning a history of 50+ years, the journey of Voya’s equity platform mirrors the broader evolution of markets. The first wave was fundamental investing, characterized by rigorous bottom-up research. The second wave saw the rise of quantitative strategies that leverage computational models to parse vast data sets for investment signals. The next wave isn’t coming; it’s already here.

The third wave of active equity management is human plus machine

I started my career as a quantitative investor. While quant investing is broadly accepted today (and has been for a long time), that wasn’t always the case. When quantitative techniques were first applied to investment management, there was skepticism. The same was true when the Voya Machine Intelligence team began building their models over a decade ago (which is a lifetime in the tech world).

Now, the rest of the world is finally starting to realize the power of using artificial intelligence and machine learning to combine the meticulous company-specific analysis found in fundamental investing and the broad systematic approach of traditional quantitative investing.

While we believe this represents the future of investing, one of the most critical things to understand about investing with AI is that it’s a symbiotic relationship between humans and machines. We believe our models are better because of the human expertise across our platform, and our human investment professionals are better because of the insights from our models.

Clearly defined philosophies are essential

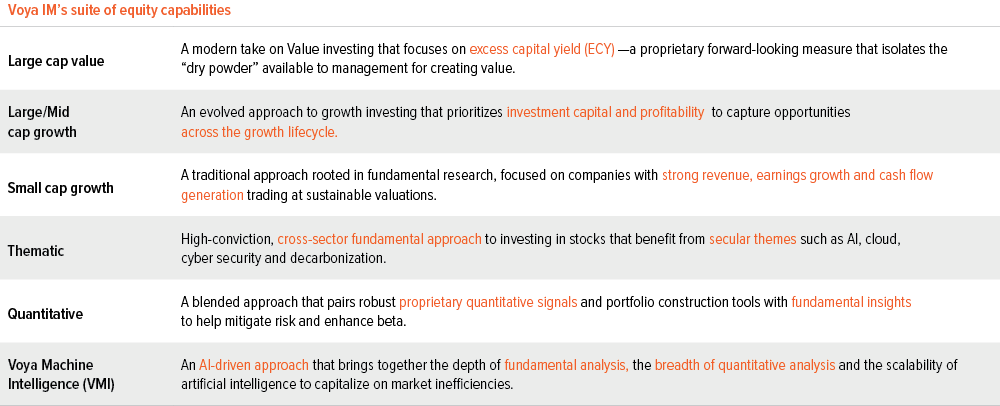

With a platform defined by a broad suite of different equity offerings, it’s critical to have very clearly defined investment philosophies. Clients rely on us to play specific roles in their portfolios and our strategies need to perform as they expect.

One thing that is shared across our platform is the desire to challenge conventional thinking. We scrutinize traditional approaches to understand how return drivers have evolved in order to design distinctive, innovative strategies.

An example of how we challenge conventional thinking is our value team’s excess capital yield framework (or “ECY”). The traditional set of metrics used to identify value stocks has essentially stayed the same for 100 years. The market has obviously changed a lot over that period.

To remain relevant, we recognized that successful value investors must evolve with the changing market environment. Over the past several years, we have enhanced our large cap value strategy from a cornerstone focus on dividends to a framework that focuses on excess capital yield, which provides a deeper, more forward looking view of the capital companies have to generate value in a variety of forms. This includes dividend growth, share repurchases, accretive mergers and acquisitions (M&A) and organic investment. ECY is a more dynamic and effective framework, as it carries a broader, more consistent and less volatile relative performance profile than more conventional valuation measures.

Similarly, our growth team has redefined its approach beyond conventional growth metrics. Across our large and mid cap growth strategies, we employ a proprietary methodology to identify the most promising companies poised for long-term expansion. By evaluating investment intensity—how extensively a company invests in future growth—alongside structural profitability—the efficiency of its existing operations—we uncover businesses that are both growing and strategically investing in that growth.

While our value and growth portfolios fit within the traditional style boxes, the thinking behind them pushes beyond conventional investment mindsets, creating more insightful and forward-looking strategies.

This mentality to think outside of the box is shared by all investment professionals and is a key pillar of our equity platform.

Better together: The power of “collaborative alpha”

Another key feature of our equity platform is our goal of generating an information advantage supported by a culture we call collaborative alpha.

At its core, collaborative alpha is intended to break down silos and encourage information sharing. We have so many different forms of expertise across our equity platform. Collaborative alpha is our way to share best practices, while respecting the individual processes that make each team unique.

For example, our large cap growth team might consider VMI’s signal and exposure to the U.S. dollar relative to other currencies. The small cap growth team runs their portfolios through VMI’s machine learning engine periodically to help identify performance outliers (both to the upside and downside) that warrant further analysis. And our VMI team added a feature to its machine learning system that is based on the large cap value team’s proprietary excess capital yield.

In addition to these enriched proprietary analytics, collaborative alpha can come in simple forms such as attending each other’s team meetings. For example, our thematic team includes centers of expertise in AI, tech and health care, creating a natural opportunity for collaboration and idea exchange with the related sector analysts on our large and small cap teams. We build on the experiences and capabilities across fundamental and systematic equity disciplines, creating a collective information advantage.

The best way to predict the future is to create it

Innovation is an idea or process that creates new value. Over the past several years, we have made deliberate and thoughtful acquisitions to modernize our equity platform in preparation for the next decade and beyond. Each of the teams acquired over the past few years offers a unique set of differentiated capabilities that align with our fundamental and quantitative heritage while uniquely positioning the platform for tomorrow.

Innovation in proprietary analytics is also vital to our ability to deliver alpha and assess risk across teams. Our teams use an array of collaborative tools that support decision making and alpha generation. Each tool broadens the mosaic of idea generation and supplements the research process across all our teams and strategies. For example, while many of our competitors are still in the research and construction phase of adding AI to the investment process, our VMI team members are pioneers in the space with a long track record of expertise both in machine learning and fundamental analysis. We also use a proprietary AI-powered “explainability” tool that translates the scores and rationale of Voya’s machine learning models for easy digestion by our fundamental and quant research teams.

These enhancements support our vision to harness the power of human intuition, quantitative insight, and machine learning to maximize alpha generation for our clients while remaining committed to our fundamental roots.

We are well positioned to deliver for clients on the road ahead

Building on over 50 years of experience delivering alpha for clients, our equity platform has innovated cutting edge tools along with a distinct, collaborative approach.

As we begin a new era of active equity management, our platform aims to bring together the benefits of fundamental and quantitative investing with one of the industry’s most experienced AI-driven investment teams to help meet our clients’ current and future needs.

A note about risk

Risks of investing: The principal risks are generally those attributable to investing in stocks and related derivative instruments. Holdings are subject to market, issuer and other risks, and their values may fluctuate. Market risk is the risk that securities or other instruments may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security or instrument may decline for reasons specific to the issuer, such as changes in its financial condition.